RRIF Or Annuity? Understanding The Best Choice For Your Retirement

The most frequent question I get from my retired or soon-to-be-retired clients is whether they should convert their Registered Retirement Savings Plan (RRSP) into an annuity or a Registered Retirement Income Fund (RRIF). With Canadians living longer than ever before they want to ensure that their retirement savings last a lifetime. Thus, converting an RRSP into a sustainable income stream becomes a crucial decision.

Both RRIFs and annuities offer ways to turn RRSP savings into retirement income, but they come with key differences in flexibility, security, and longevity protection. Understanding how each option works can help you make the best choice for your financial future.

Since most retirees are reluctant to pay lump sum taxes on their retirement savings plans, they usually choose to draw a monthly or annual income by converting their RRSP to a RRIF or an annuity. These two options allow them to spread out their fully-taxable RRSP retirement income every month or every year. Let’s look at both options.

Basic RRIF Rules

- RRIF investments continue to grow while sheltered from tax. The amount of RRIF withdrawn is fully taxable and taxed at your marginal tax rate.

- You will continue to decide where to invest your RRIF assets. A RRIF account can hold the same investments as your RRSP. The choices are endless.

- When you set up a RRIF account, you will have a minimum mandatory payment that must be withdrawn each year.

- Currently, RRIF rules state that in the year after you open your RRIF at age 71, you must withdraw a minimum of 5.28% of its value. The percentage withdrawal amount of your RRIF income increases as you get older.

- There is no maximum withdrawal amount. You can withdraw all of the funds in your RRIF at any time subject to tax.

Annuity Option

Simply put, an annuity is a guaranteed and steady stream of income payments you receive from an insurance company in exchange for a lump sum of cash. Compared to a RRIF, an annuity is a simple product provided by an insurance company that takes your RRSP assets and converts those assets into a retirement income for you over a fixed period or for the rest of your life. Once you choose to purchase an annuity there is no access to your capital. You are giving up your capital for a guaranteed income for life. If you’re concerned about low interest rate RRIFs, and if market volatility keeps you up at night, then consider an annuity. Annuity income is based on several factors:

- The amount of money used to purchase the annuity.

- The type of life annuity purchased.

- The current interest rates and present long-term bond rates.

- The age and gender of the annuitant.

- The expense and mortality experience of the insurance company.

Although RRIFs are more flexible than registered annuities in terms of liquidity and investment choices, an annuity provides a steady stream of guaranteed income that you can never outlive, and never decrease, with no management fees. Annuities can create personal pension plans for those without pension plans.

RRIF Versus Annuity Examples

A proper comparison between the two products requires a look at the best annuity rate on the market for a joint-life annuity. Why a joint-life annuity? If the primary annuitant dies, then the annuity income will continue to the surviving spouse. This compares well to a RRIF because when the RRIF owner dies, his spouse will receive the remaining balance of the RRIF through the tax-free spousal rollover provision. If there is no spouse, then a single life annuity should be illustrated and compared for best annuity rates.

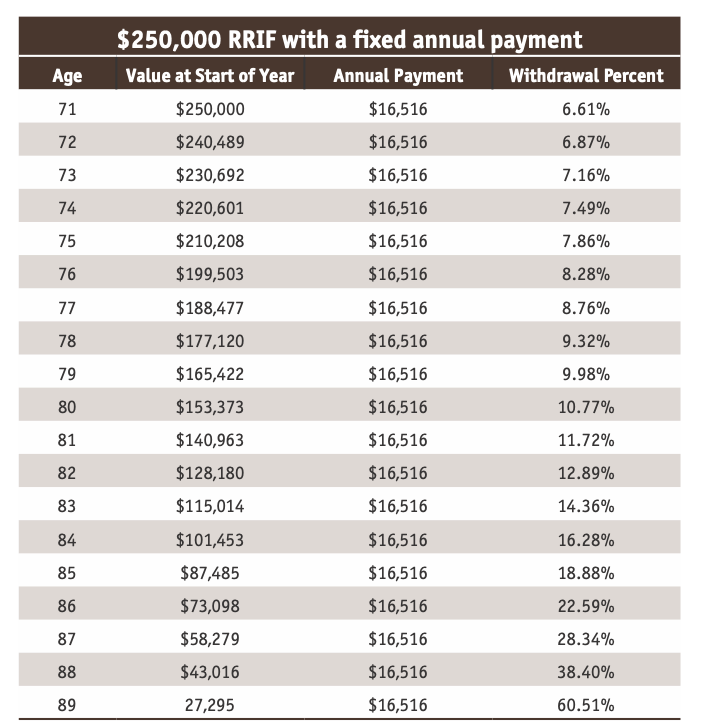

Let’s compare a RRIF income to a joint-life annuity purchased with a $250,000 RRSP. After an annuity comparison analysis, I locate the best joint-life annuity rate for a male and female age 71. Presently, a highly-rated Canadian insurance company is offering the primary annuitant (the 71-year-old male) $16,516 per year for life. One hundred per cent of the annuity income will continue to his spouse on the annuitant’s death.

Let’s look at a scenario where a RRIF was purchased and we wanted the same fixed annual income of $16,516 per year.

The fixed RRIF income will last until age 89 but not beyond if we average a 3% guaranteed rate of return.

(Note: 3% was the average rate of return for GICs at the time of writing. If we averaged a 4% rate of return the RRIF income would last until age 92. With a 5% rate of return, the RRIF income would last until age 96. Although you can obtain a higher rate of return by buying stocks, even large-cap stocks, they are not guaranteed. An annuity is a guaranteed product and a proper comparison should be with other guaranteed products).

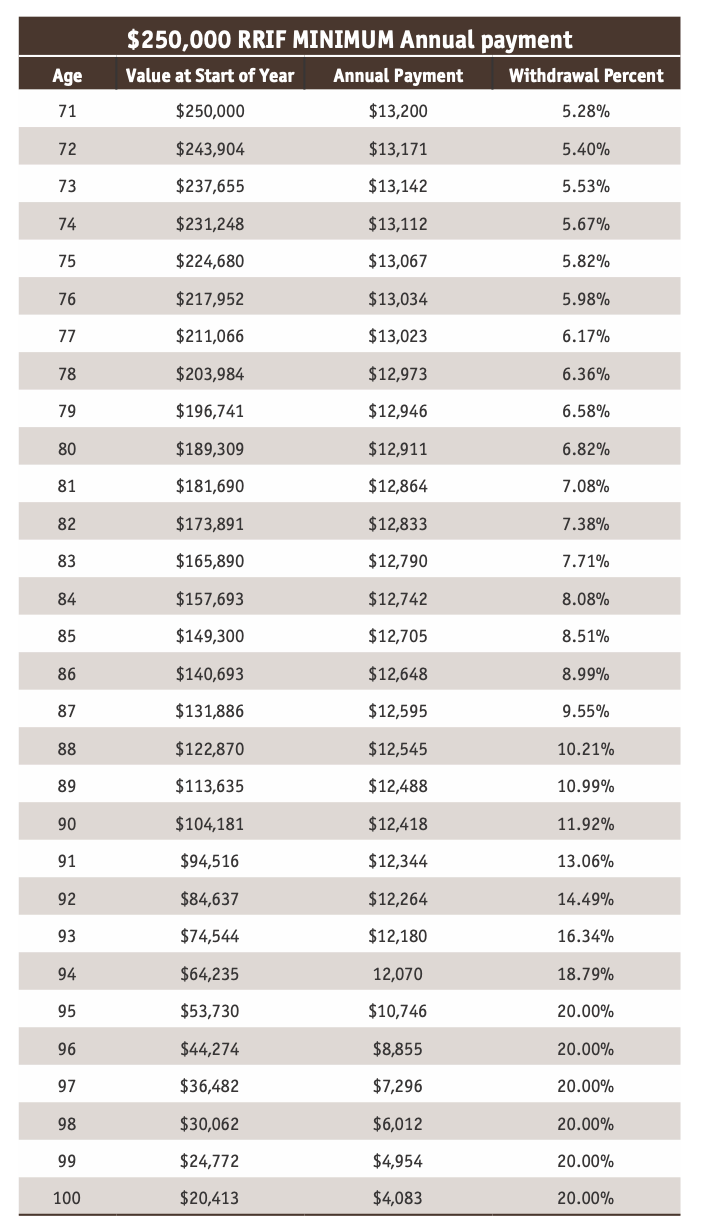

Let’s look at another chart. Below is a RRIF chart showing a $250,000 RRSP converted to a RRIF, once again earning an average 3% rate of return. Once again, using a 71-year-old male for this example, however, this time we will withdraw the minimum amount a person must withdraw out of the RRIF to meet Canada Revenue Agency RRIF rules.

This chart shows the gross RRIF annual payment of $13,200 then reduces every year until age 90 to $12,418 using the minimum withdrawal RRIF rules. After age 90, the income continues to decrease every year until it reaches $4,954 at age 99.

Which One To Choose?

Canadians are living longer. According to Statistics Canada, a 65-year-old male can expect to live to age 84, while females can expect to live to 87.1 With a growing number of Canadians living into their 90s and even past the century mark2, improved life expectancy creates a financial risk—the risk of outliving your savings. Since Canadians are living longer, they need their retirement income to last longer.

The average income from the annuity is higher than the income from the RRIF, and the annuity income never decreases. That said, this depends on your RRIF rate of return–if you’ve invested with better returns, you’ll exceed the annuity. Another important consideration is that the RRIF has greater flexibility in terms of gaining access to your capital. There is no access to your capital when you purchase an annuity. This is what you are giving up for a higher income.

If you like the higher income of an annuity but also like the flexibility of a RRIF, then you can look at combining the two retirement income options. The question becomes, “How much of my RRSP should go to an annuity and how much should go to a RRIF?” There is no general rule, but a minimum of 25% of your RRSP portfolio should be considered for an annuity since it offers you a higher guaranteed income stream. Try to cover your basic expenses at retirement with an annuity. Include in your calculation the income you are receiving from Canada Pension Plan (CPP), Old Age Security (OAS), and other guaranteed retirement income such as pension plans. This should give you a good idea of how much of your RRSP funds can be left for your RRIF in case you have an emergency and need to withdraw some of your capital.

Final Thought: My clients often tell me they are concerned about financial decision-making during their elderly years. While they are confident in managing their RRIF investments in early retirement, they worry about their risk of cognitive decline, including dementia, and becoming vulnerable to sophisticated phone scams. According to them, the steady, hands-off income from an annuity provides peace of mind, offering a sense of security and relief from financial worries as they age.

Rino Racanelli is an independent insurance advisor in Toronto, ON. Email: racanelli@sympatico.ca

1 https://www.statcan.gc.ca/en/subjects-start/older_adults_and_population_aging

2 https://www12.statcan.gc.ca/census-recensement/2021/as-sa/98-200-x/2021004/98-200-x2021004-eng.cfm