The Ultimate Strategy To Transfer Your Corporate Assets To Beneficiaries Tax-Free

If you’re the owner of a corporation, looking for a tax-effective way to transfer corporate assets to family, consider using your company’s capital dividend account. This is an efficient way to minimize the tax burden arising at death upon the distribution of the deceased’s assets to beneficiaries. It’s an important part of a tax reduction strategy and is only available to Canadian controlled private corporations residing in Canada.

If you’re the owner of a corporation, looking for a tax-effective way to transfer corporate assets to family, consider using your company’s capital dividend account. This is an efficient way to minimize the tax burden arising at death upon the distribution of the deceased’s assets to beneficiaries. It’s an important part of a tax reduction strategy and is only available to Canadian controlled private corporations residing in Canada.

What is a Capital Dividend Account?

The capital dividend account (CDA) is a notional account that keeps track of the tax-free amounts accumulated by a private corporation. The CDA appears on a company’s financial statement. Business owners can use the CDA to pay out tax-free income to its shareholders as a capital dividend.

Tax-Free Distribution on Death

Shares in a family-owned corporation can be a major component of a person’s estate. In many cases, the shares of the family business are left to family members involved in the company, and remaining assets are divided among family not involved in the business. If an individual continues to hold onto the corporation until his or her death, he or she will have a deemed disposition at death equal to the fair market value of the shares of the corporation. By paying proceeds to the estate via the CDA, less money is lost to taxes.

The death benefit of a corporate-owned life insurance policy is one item that can be credited to the CDA tax-free. When a private corporation is the owner and named beneficiary of a tax-exempt life insurance policy, a credit to its CDA for the amount of the death benefit proceeds received less the adjusted cost basis (book value) of the insurance policy is recorded. The insurance company would provide the specifics.

Real Life Example

Mr. and Mrs. Jones, both 65 years old, each own 50% of the shares in their holding company. The company started out as an operating company and sold its assets several years ago for proceeds of $2.5 million. From the sale, the company acquired an investment portfolio that included fixed income and equity investments.

If Mr. Jones dies first, and his will indicates that his spouse is the beneficiary of the shares of the corporation, then assets would rollover to Mrs. Jones at their adjusted cost base. In this case there wouldn’t be any tax implications to the deceased shareholder Mr. Jones or his spouse (spousal roll over pursuant to subsection 70(6) of the Income Tax Act). At the time of Mr. Jones’ death, the holding company’s portfolio had grown to a fair market value of $5.6 million.

(Note: For the sake of simplicity, it’s assumed the holding company had no other assets and no estate freeze had been previously undertaken. Dividends were paid annually to distribute fixed income earnings and recoup refundable dividend tax on hand.)

The tax grab occurs when Mrs. Jones dies. The most likely scenario is the children will receive the shares of the company at their fair market value. They will not roll over at their adjusted cost base like they did for Mrs. Jones. Instead, there would be a deemed disposition of the shares at their fair market value in the hands of the children and tax will be accessed on any gains. There’s even the possibility of double taxation. Here’s the breakdown; personal tax payable on deemed disposition on the shares, corporate tax payable on the disposition of the investments and a dividend tax if the children want to get the cash out of the corporation by selling the investments. The total tax burden, including capital gains taxes, could be close to 61% of the value of the $5.6 million in investments.

(Note: To avoid double taxation on the distribution of corporate investment assets, you have to look at post-mortem planning. It really depends on each situation and the planning done at death. With proper planning using redemption and loss carry-back as well as pipeline planning, you could have a net result of removing either the dividend or capital gains taxation at death respectively and reducing the total tax burden on the children to approx 35% instead of 61%. It is also likely that the corporation is wound up on the second death, much will depend on the type of investments held in the corporation.)

Since Mr. & Mrs. Jones wanted to leave their children the full amount of what their company was worth, they applied for a $5.6 million joint last-to-die, permanent insurance plan. This made sense for several reasons. The tax grab occurs on death of last spouse, thus the need for a last-to-die insurance plan. Premium payments would be lower since the insurance company was required to pay the death benefit only when both spouses die. The insurance and the premium payments remained the same for life.

A $5.6 million last-to-die insurance plan would cost approximately 100,000 per year for life. However, the Jones’ preferred a guaranteed limited payment plan (i.e. five or ten years payments) in case one of them lived well into their 90’s. If they were in good health and could qualify for the insurance policy, they could insure the entire $5.6 million amount for a total premium cost of $2 million.

Since the money was coming from their holding company it really didn’t cost them anything. They were simply moving money from their taxable holding company to the tax-exempt insurance plan. Once they qualified for the insurance, they decided to transfer $400,000 per year from their corporation to the insurance plan every year for five years. At that point, the plan was paid-up and no more premium payments were required. Their corporation would be the owner and beneficiary of the insurance policy otherwise taxable shareholder benefits could arise.

Results

Not only did the size of Mr. and Mrs Jones estate immediately increase, there was also a reduction in their corporation’s future taxable income, since assets are transferred to the tax-exempt insurance plan. On the second passing of the two lives insured, the death benefit of $5.6 million is paid tax-free to the corporation. The benefit payment in excess of the adjusted cost base of the policy goes to their company’s capital dividend account. The company can then distribute the funds in the capital dividend account tax-free to a shareholder or to the Jones’ estate.

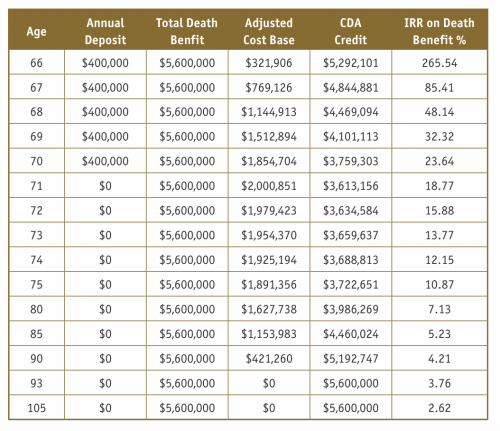

Looking at the above chart, if the surviving spouse dies at age 85, the corporation can pay a tax-free dividend equal to the capital dividend account of $4,690,024 and leave the rest inside the corporation. There is no need to take out the taxable adjusted cost base (ACB) portion of the death benefit ($1,153,985) at that moment. It should be done when it’s most advantageous for shareholders. If the children decided to release the entire adjusted cost basis amount from the corporation, they would pay a non-eligible dividend tax of $488,251 ($1,153,985 x 42.31% in Alberta) then pocket the remaining amount of $665,734.

Further down the chart, if either spouse lived to age 93, the entire death benefit of $5.6 million could be released to the children via the CDA tax-free. The Internal rate of return (IRR) compares what rate of return is required to get an after-tax amount of $5.6 million depositing $400,000 for 5 years in an alternative investment. For example, if the surviving spouse dies at age 85, they would need to earn a 5.23% guaranteed net rate of return using an alternate investment. In today’s low interest rate environment it would be highly unlikely to achieve without taking on investment risk.

Conclusion

A corporate-owned insurance plan allows a person to convert their company’s taxable surplus into non-taxable surplus, by distributing tax-free capital dividends to their family. This insurance strategy not only enhances the value of a person’s estate, it’s also a way to equally distribute the value of the company’s estate among beneficiaries.

One final thought………. In the September 2018 Canadian MoneySaver edition I wrote an article titled, “How Business Owners Can Continue to Shelter Income In Face Of New Prohibitive Tax Law.” I discussed Bill C-43, the 2017 tax legislation which reduced the amount of life insurance proceeds allowed to be distributed tax-free through the corporation’s CDA. Revenue Canada’s hunger for your corporate tax dollars suggests this could happen again. It makes sense to apply for insurance in case another CDA reduction does become law. It’s also a good idea to apply while you’re in good health. If you wait, and your health deteriorates, you may not qualify and be able to take advantage of tax-free capital dividends.

Rino Racanelli, independent annuity advisor, racanelli@sympatico.ca