The Urgent Need For Transparency: Will CCIR Add Travel Insurance On Their Upcoming Triennial Review?

In the past few months, much attention has been focused on the upcoming removal of Ontario Health Insurance Plan’s (OHIP) meager contribution towards out-of-country medical claims. The change, which took effect January 1st, 2020 may translate in insurers hiking their rates by about 7% to absorb the loss. It is worth noting that claim processing was often slowed down when insurers had to wait six to eight weeks to coordinate payment with OHIP. Therefore, OHIP’s elimination may, in fact, reduce the claim processing time. While it is never pleasant for consumers to incur such rate increases, the more worrisome news is that two years after Canadian Council of Insurance Regulators’ (CCIR) recommendations, the majority of insurers have held onto the infamous contractual clauses, which can arbitrarily and retroactively void an insured’s policy or facilitate a claim denial: The “Misrepresentation Clause”, “The Stability Clause”, “The Change of Health Clause”, “Contractual Exclusions”. These could make consumers susceptible to personal financial devastation. Certainly, great efforts were made by some insurers to add 1“Warning Labels” synopsis in their policies, but with these deleterious clauses still embedded in policy wordings and with no sign in sight of insurers abolishing them, transparency on insurers’ claim denial stats has become urgently needed. For example, how many Canadian travellers are tripped by these clauses each year? Which population’s demographic is mostly affected? What clauses are typically invoked to deny claims, etc.? Wouldn’t it be fair for insurers to collect and release their audited data to the public on the prevalence of their claim denials including the triggering clauses? Will CCIR add this issue on their March 2020 Triennial Review?

In the past few months, much attention has been focused on the upcoming removal of Ontario Health Insurance Plan’s (OHIP) meager contribution towards out-of-country medical claims. The change, which took effect January 1st, 2020 may translate in insurers hiking their rates by about 7% to absorb the loss. It is worth noting that claim processing was often slowed down when insurers had to wait six to eight weeks to coordinate payment with OHIP. Therefore, OHIP’s elimination may, in fact, reduce the claim processing time. While it is never pleasant for consumers to incur such rate increases, the more worrisome news is that two years after Canadian Council of Insurance Regulators’ (CCIR) recommendations, the majority of insurers have held onto the infamous contractual clauses, which can arbitrarily and retroactively void an insured’s policy or facilitate a claim denial: The “Misrepresentation Clause”, “The Stability Clause”, “The Change of Health Clause”, “Contractual Exclusions”. These could make consumers susceptible to personal financial devastation. Certainly, great efforts were made by some insurers to add 1“Warning Labels” synopsis in their policies, but with these deleterious clauses still embedded in policy wordings and with no sign in sight of insurers abolishing them, transparency on insurers’ claim denial stats has become urgently needed. For example, how many Canadian travellers are tripped by these clauses each year? Which population’s demographic is mostly affected? What clauses are typically invoked to deny claims, etc.? Wouldn’t it be fair for insurers to collect and release their audited data to the public on the prevalence of their claim denials including the triggering clauses? Will CCIR add this issue on their March 2020 Triennial Review?

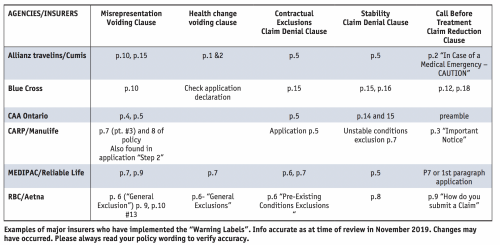

Many improvements in the travel insurance industry came about from late president Bruce Cappon’s advocacy to add this topic on CCIR’s last triennial review in 2014. In May 2017, CCIR issued their “Travel Position Paper”, which reflected many of Bruce’s recommendations, such as standardization of Questionnaires, Definitions, Terms and Exclusions. Those have been largely implemented. Most importantly, insurers are now including clear “warnings labels” (as Bruce coined it) in their applications and policy wordings, which are now made available to consumers prior to purchase. My review of major insurers’ travel insurance contracts in the last few months confirms insurers’ diligent efforts in bringing those once veiled clauses to the forefront. You can literally find the warnings in the beginning pages or well labelled throughout the policy (please refer to the following chart of major insurers).

Does this mean applicants will now avoid a claim denial if they read their policy wording? It will help, but in my opinion, it may not solve the problem entirely. Indeed, despite upfront disclosures, insurers have retained ambiguously or broadly worded questionnaires, which will muddle applicants’ ability to provide accurate answers. For example:

1) “The Time Warp” question: a confusing bundled run off sentence – “In the last five years, have you been diagnosed, treated, hospitalized…” ; 3

2) “Back to Birth” question: “Have you ever…” – With the insurer having access to medical file at claim time, it’s a risky question to answer. Forgetting a medical incident in our past is so easy to do; 3

3) “Tip of the iceberg” question: watch out for unlisted conditions concealed beneath the surface: “In the past two years have you been diagnosed, … with a chronic bowel disorder (such as but not limited to Crohn’s disease or Ulcerative colitis)”; 3

(Refer to Bruce Cappon’s article3 for more details)

It’s equivalent to warning applicants that they’re standing on a trap door which may fling open under their feet with any wrong answer to the insurers questionnaire’s “riddles”.

These convoluted questions are still being used today and may trigger the contract-voiding “Misrepresentation Clause”, which Bruce Cappon identified as one of the main culprits in post-facto claim denial. While the effect of the other clauses may be more easily circumvented by reading the “Warning Labels”, the “Misrepresentation Clause” remains very risky. How can an applicant or their doctor be sure they have properly interpreted a question? To complicate matters, insurers often give words a new “meaning” (e.g. “treatment” includes investigative tests, surgery, specialist appointment, medication, etc.). No wonder consumers continue to express anxiety over the completion of questionnaires.

What is the solution then? Certainly, I am not a proponent of dictating how a business should design a product. However, consumers should be able to view insurers’ audited data on their retroactive policy voiding and claim denials to easily assess the viability of a contract at a glance. For example, what is the specific statistic on emergency medical claim denial linked to the “Misrepresentation clause”? Which insurers have a proclivity to invoke this clause? What about denial of claims relating to the “Change of Health” clause, “Termination Clause” or “Contractual Exclusions”? Mandating the collection and publishing of audited post-facto claim denial data from the various clauses seems to be the next logical step to provide Canadian travellers with the ability to “vote with their feet” and select the most reliable plan. I suggest collecting and publishing insurers’ audited data for the past three years starting in 2016 as a starting point to compare future improvements.

As Bruce Cappon stated “it is a singular and troubling fact that most insurers neither provide nor wish to collect data on the rate of such denials.” and further suggested: “…improved practice and fairness may well occur under the influence of appropriate public scrutiny – without resorting to further regulation”. 1

Following-up on Bruce Capon’s efforts, I reached out to the CCIR on September 20th, 2019 inquiring whether they would add the collection and release of claim denial data on their upcoming review:

“It has been three years since CCIR Travel Insurance Working Group released their recommendations to the industry and the public. We definitely have seen great improvement with the addition of warning synopsis in policies. However, the majority of insurers have retained the deleterious clauses which lead to policy voiding and claim denial… We understand from your May 2017 Travel Health Insurance Products Position Paper that Mr. Cappon’s recommendation to “collect data and make it public” was not pursued. Would you be so kind as to inform us whether CCIR would be prepared to add this issue on the upcoming triennial review?”

CCIR’s Policy Manager, Tony Toy advised me via return email on October 21st, 2019 that the Travel Insurance Working Group was still actively working with the industry:

“Over the past year the CCIR Travel Insurance Working Group has been working with travel insurers to define the initial data to be collected. We wished to achieve a common understanding of what data is to be reported to CCIR members to help us monitor the success of the changes being made by industry. We are pleased to be able to report that we are expecting the first collection of this data to be done early next year.

However, based on our experience with similar data collections, it takes a few years for the data to be normalized in a consistent fashion and to build up enough base line data to provide meaningful comparisons. It would not be appropriate for CCIR to publicly release inconsistent or misleading data. Therefore we cannot say at this time when public disclosure may commence.”

I was pleased to hear that the Travel Insurance Working Group was still active and working with the industry to implement further improvements. I understand it will take time to identify and compile said information. However, I was unclear as to the type of data collection they are “defining”. Therefore, I asked for clarification on October 22nd, 2019 and did not receive any reply to date.

This would be important since we know that “Claim denial is associated with three types of policy structures: medical questionnaire, non-medical questionnaire protocols; and change of health clause.”1 Therefore, it would be relevant to focus on those specifically.

Few people are aware that whether answering a questionnaire or not, the potential for this total annihilation of coverage remains in the context of post-claim underwriting, via:

1) The “Misrepresentation Clause” if you make an honest mistake on your often ambiguously worded questionnaire;

2) Overlooking or misinterpreting policy exclusions, definitions or eligibility to coverage (when no questionnaire is required);

3) Forgetting to report a change of health (even minor) prior to departure; This is still very poorly labelled. Insurers with the “Change of Health” clause should add it to their “Warning Label”.

In addition, a change in stability prior to departure can result in claim denial for an emergency directly or indirectly related to the condition. The above clauses or exclusions may be responsible for the majority of retroactive policy termination and claim denials.

Bruce Cappon put forth some solid recommendations to CCIR regarding the type of data to be compiled:

“In the survey, categorization by demographics (age bands) would be essential”. Seniors would be expected to have a much higher denial rate due to a more complex purchase process and typically more pre-existing medical conditions... Stratification of claim denials based on: percentage of voided policies by age groups (for non-eligibility or change of health reasons); percentage of claim denied for customers’ failure to meet pre-existing stability requirements; Other reasons. … We would need to segment the number of claims denied by demographic group and the value of those claims. Insurers may pay small claims but larger ones may be more problematic. Finally, as indicated in this brief, my informal data indicate that a much higher proportion than the 18% admitted by the survey made inadvertent inaccurate responses…” The mandating of collecting and publicly releasing accurate and comparable data on travel insurance claim denials is fundamental to industry public accountability and to a properly reciprocal relationship between clients and insurers. It is our strong recommendation that insurance regulators in Canada mandate collection and publication of such data, including stratification of these data by demographic group and region, as well as insurance firm.”2

The industry has, for the most part, abided by CCIR’s recommendation to provide clear “Warning Labels” about their voiding mechanism in addition to standardized policy wording. However, the majority of insurance companies have opted to remain entrenched in the status quo of ambiguously worded questionnaires, which will continue to obfuscate applicants’ abilities to provide accurate answers. Combined with the voiding clauses, this is a recipe for disaster. Claim denials will, in my opinion, continue to occur despite applicants’ genuine efforts to follow instructions and Warning Labels. Based on Bruce Cappon’s 1assessment, the Misrepresentation is likely one of the main causes for claim denials and/or contract rescission. It is encouraging to hear that CCIR Travel Insurance Working Group continues to monitor and consult with the industry and stakeholders regarding the collection of data. Hopefully, this will include the release of data relating to the retroactive voiding of contracts categorized by contractual clauses including the Misrepresentation, Change of Health or Exclusionary Clauses. From Tony Toy’s email on October 21st, 2019, it was not clear whether information being identified or defined for collection from insurers would include these. If you wish to share your support for transparency, you can email CCIR before their next review in March 2020 at ccir-ccrra@fsrao.ca.

Isabelle Beaudoin, Travel Insurance Specialist, President, First Rate Insurance Inc., Ottawa, ON (800) 884-2126, info@firstrateinsurance.com, www.firstrateinsurance.com Isabelle has been working in the insurance industry for the past 22 years specializing in Critical Illness and Travel Insurance coverage.

References:

1 Bruce Cappon – “Travel Insurance: The Urgent Need For Improved Regulation” – A Memorandum and Submission To The Canadian Council Of Insurance Regulators - March 2014

2 Bruce Cappon – “Travel Insurance: The Urgent Need For Improved Regulation Governing Contract Voidability” – A Memorandum and Submission To The Canadian Council Of Insurance Regulators – May 2015

3 Bruce Cappon – “Beware of Policy Gremlins” – Canadian MoneySaver, June and August 2016