How To Take A Retirement Income From Your Corporation Using A Corporate Annuity

If you’re the owner of a Canadian-controlled private corporation and have reached retirement age, this could be the time to use some of your corporate savings for a retirement income. If your corporation has built up significant retained earnings over the years and most of your investment capital is tied up in the company, ask yourself: Should I start using some of my business assets as retirement income, or wait and leave the money inside the corporation?

If you’re the owner of a Canadian-controlled private corporation and have reached retirement age, this could be the time to use some of your corporate savings for a retirement income. If your corporation has built up significant retained earnings over the years and most of your investment capital is tied up in the company, ask yourself: Should I start using some of my business assets as retirement income, or wait and leave the money inside the corporation?

Deciding when to retire and when to start taking an income from your business is not always an easy decision. A host of factors will weigh on your decision including, your current financial situation (savings and personal income), health, family needs and estate plans.

I have come across several business owners with large portions of cash sitting in corporate accounts, invested in traditional fixed-income investments such as Guaranteed Investment Certificates (GICs) and bonds.

This is a common investment strategy, since most business owners near retirement age have investments in a more conservative portfolio. Income received from these types of investments is considered income to the corporation and taxed at the highest marginal tax rate (50.17% in Ontario).

With such a high tax rate on interest-bearing vehicles, business owners should be looking for an alternative investment to help them reduce taxes, while increasing their net after-tax retirement income. A simple retirement product created by insurance companies to do just that is the corporate annuity.

A corporate annuity offers a lifetime retirement income stream while reducing tax payable. Shareholders of private corporations who want to take income from their corporation and prefer conservative type investments, should consider a corporate annuity.

How It Works

When a corporation purchases an annuity, the corporation will be the owner and beneficiary of the contract. The annuitant typically will be the shareholder of the corporation (annuitant is the person whose life the contract is based on). Annuity payments will be based on the life (or joint lives) of the shareholder(s) and would be paid into the corporation.

The taxable portion of the annuity is taxed as interest income. In Ontario it will also be taxable at a rate of 50.67% of which 30.67% of this tax is refundable when a taxable dividend is paid to a shareholder.

Now, to get income into the shareholder’s hands, the corporation would then turn around and pay a dividend to the shareholder as an ineligible dividend. The individual would pay personal tax on the received dividend at their marginal tax rate. The actual rate of tax on the dividend will depend on personal income level (46.84% in Ontario if a shareholder is in the top tax bracket). I often use taxtips.ca when running these kinds of scenarios to get an idea of an individual’s tax liability when paying dividends out of their corporation. https://www.taxtips.ca/taxrates/on.htm

Lastly, since the annuity is purchased with non-registered funds (non-RRSP or RRIF), the taxation will be either accrual or prescribed. The accrual method is based solely on interest earned. Because the principal is high in the early years, the interest portion of the annuity will also be high; therefore, a higher taxable portion is payable in the beginning. As the amount of the annuity principal goes down with each payment received, the interest and the tax payable decrease.

Alternatively annuities can be taxed on a prescribed basis. Annuity payments will be a blend of interest and principal over the life of the contract. This spreads out the tax payable evenly every year. An annuity contract must qualify for prescribed tax treatment and is defined in Regulation 304(1) of the Income Tax Act. It can be exempt from accrual taxation if the following conditions are met:

- The policyholder must also be the annuitant. An annuitant is the person whose life the contract is based on.

- A joint-life annuity is permitted subject to certain variables. Joint-life usually refers to husband and wife who receive income payments, but there are other combinations.

- The annuity must be non-commutable and non-transferable i.e. it is a permanent contract for the life of the individual and cannot be cashed or transferred to another party, either as a gift or for consideration.

- Annuity payments must start by December 31 of the year following the purchase date.

- Annuity payments must be equal, made regularly, at least annually, and cannot be inflation protected.

- Annuity payments can be for life or a certain term as long as the term does not exceed the annuitant’s 91st birthday.

- The policyholder can also be a testamentary or spousal trust.

Since the owner is the corporation and not the annuitant, a corporate annuity would not qualify for prescribed taxation. It would be taxed on an accrual basis.

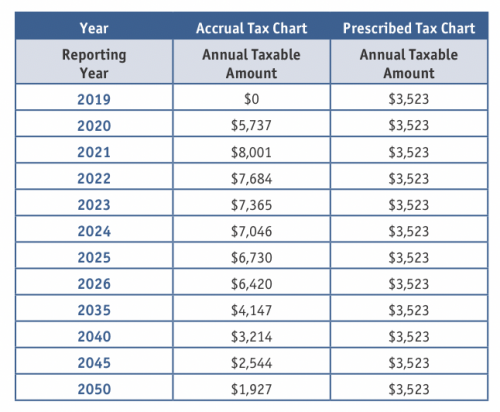

The table above shows the two taxable methods for a 70 year old male who purchased a $250,000 single life annuity. The annuity income payments would start at the end of 2018. The highest paying life annuity at time of article was $18,240 per year.

Accrual Versus Prescribed Taxation

The prescribed method of taxation shows an equal annual amount tax payable each year, while the accrual method of taxation will vary from year-to-year. Although the taxable portion of the annuity is taxed as interest income, 50.67% in Ontario, the corporation could have access to a tax refund of 30.67% Refundable Dividend Tax On Hand on the taxable portion of the annuity when a dividend is paid to the shareholder. Each $2.61 of dividend paid to the shareholder will result in a tax refund of $1 in the corporation.

Rino Racanelli is an independent insurance advisor

in Toronto, ON. Email: racanelli@sympatico.ca.