Annuities: Good Income Option For Retirees Despite New Tax Rules

In the January 2016 Canadian Money Saver edition, I wrote an article titled An Easy Way to Save Money on a Prescribed Annuity. I discussed how the new tax legislation (Bill C-43 effective January 2017), would change the exemption test on annuities. Bill C-43 will now use a new mortality table to calculate the taxable portion on prescribed annuities, resulting in a higher tax payable for non-registered prescribed annuities. Despite the recent tax changes, annuities continue to be an important part of a retirement plan?

In the January 2016 Canadian Money Saver edition, I wrote an article titled An Easy Way to Save Money on a Prescribed Annuity. I discussed how the new tax legislation (Bill C-43 effective January 2017), would change the exemption test on annuities. Bill C-43 will now use a new mortality table to calculate the taxable portion on prescribed annuities, resulting in a higher tax payable for non-registered prescribed annuities. Despite the recent tax changes, annuities continue to be an important part of a retirement plan?

Quick Recap: What Is A Prescribed Annuity?

An annuity is a guaranteed and steady stream of income payments you receive from a life insurance company in exchange for a lump sum of cash. A prescribed annuity is an annuity purchased with non-registered funds that has distinct tax advantages (an annuity can also be purchased with registered funds such as RRSPs, and RRIFs, but are fully taxable).

An annuity purchased with non-registered funds is taxed using either an accrual or prescribed methodology. The accrual method is based solely on interest earned. Since the principal is high in the early years, the interest portion of the annuity will also be high. This means higher taxes being paid in the early income years. Alternatively, non-registered annuities can be taxed on a prescribed basis where income payments are a blend of interest and principal over the life of the contract. This spreads out the tax payable evenly every year.

What Qualifies As A Prescribed Annuity?

An annuity contract must qualify for prescribed tax treatment and is defined in Regulation 304(1) of the Income Tax Act. It can be exempt of accrual taxation if the following conditions are met:

- The policyholder must also be the annuitant. An annuitant is the person whose life the contract is based on.

- A joint life annuity is permitted subject to certain variables. Joint life usually refers to husband and wife to receive income payments, but there are other combinations available.

- The annuity must be non-commutable and non-transferable--this means it is a permanent contract for the life of the individual and can not be cashed in or transferred to another party, either as a gift or for consideration.

- Annuity payments must start by December 31 of the year following the purchase date.

- Annuity payments must be equal, made regularly, at least annually, and cannot be inflation protected (indexed).

- Annuity payments can be for life or a certain term (term certain) as long as the term does not exceed the annuitant's 91st birthday.

- The policyholder can also be a testamentary or spousal trust.

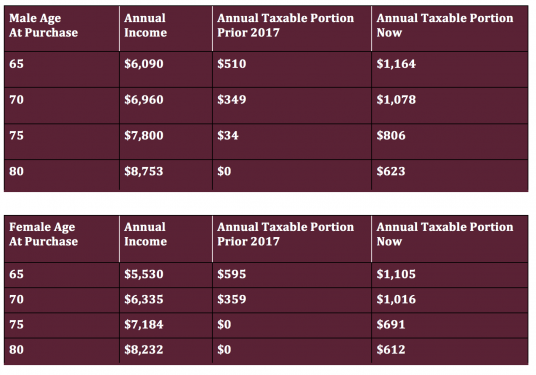

Now that the new law took effect, we can compare the difference in tax for a $100,000 10-year guarantee prescribed annuity with an income start date of April 2017. The two tables below show a higher amount of tax for both male and female under the new rules.

Annuity Tax Rates Last Year Versus Annuity Tax Rates This Year

Annuity income values were obtained from highly rated Canadian insurers and are for illustration purposes only. The exact income and tax rate will apply when the annuity contract is issued. Different annuities will result in taxable portions that may not vary from old to new in the same proportion.

Are Annuities Still A Good Retirement Income Option?

Selecting retirement income options is one of the most important financial decisions a retiree or soon to be retiree will make. Government sources such as Canada Pension Plan, Old Age Security, and the Quebec Pension Plan may not provide adequate income to cover basic expenses. Some of the major challenges seniors face today include; outliving their retirement savings, market downturns, and low interest rate returns on GICs and other guaranteed investment products. Annuities can provide a higher income stream than most guaranteed products and continue to have a distinct tax advantage if purchased with non-registered money.

By purchasing an annuity you give up some liquidity and flexibility, therefore it should be an important component of a larger investment plan. Depending on your age (a good age range for an annuity is generally between age 60 to 80), and net worth, 25% to 30% of your assets can be used to purchase an annuity. You should always have enough cash on hand for emergencies and other investment opportunities. Annuity products have become more innovative with numerous options available and continue to be one of the safest investments around.

How Safe Is An Annuity?

Annuities are among the safest investments around because they are financially backed by Canada's insurance companies, which in turn are backed by an organization called Assuris (www.assuris.ca). Assuris is the not for profit organization that protects Canadian policyholders in the event that their member life insurance company should fail.

Assuris' has a monthly income protection for annuities. If your life insurance company fails, your payout annuity policy will be transferred to a solvent company. On transfer, Assuris guarantees that you will retain up to $2,000 per month or 85% of the promised monthly income benefit, whichever is higher. Assuris is funded by the life insurance industry and endorsed by the Canadian government.

Rino Racanelli is an independent insurance advisor in Toronto, ON. He can be reached by phone 416-880-8552 and by email racanelli@sympatico.ca. Or you can visit his website www.BackToBackAnnuities.com.