GIC Risk

When GIC investors have the information necessary to compare the safety and return of a GIC with the safety and return of a welldiversified conservative portfolio (WDCP), they usually choose the WDCP.

When GIC investors have the information necessary to compare the safety and return of a GIC with the safety and return of a welldiversified conservative portfolio (WDCP), they usually choose the WDCP.

The main reason is safety—and by safety I mean safety against stock market risk, inflation, and income tax. Simplicity and liquidity are the additional benefits of a WDCP. Of course, if you are comparing a GIC to speculative stocks, a conservative investor should always choose the GIC because speculative stocks can lose all of their value.

But if you compare a GIC with a WDCP (say 60% fixed income and 40% equities) over a 10-year period, the WDCP has been more beneficial to the investor. For example, over the past 10 years the WDCP earned about 23% more (after tax) and although in 2008 it dropped 10% in value, at no time did the WDCP fall below the value of the comparable GIC.

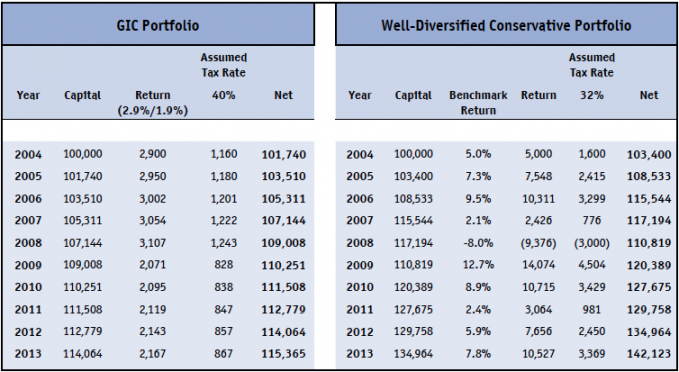

To illustrate this point (see chart below), assume that in June 2004 you invested $100,000 in a 5-year GIC earning the going rate at that time of 2.9%. When it matured in 2009, you bought another 5-year GIC earning the going rate at that time of 1.9% maturing in June 2014. During this period, after reinvesting the interest (but deducting an amount equal to the tax that would have to be paid on the accrued interest) you would have about $115,000. With the WDCP (invested in an ETF portfolio) you would have about $142,000. Granted, in 2008 the WDCP did drop in value by 10%—but it fully recovered its value in two quarters. If you used ‘best in class’ managers, your return would have been significantly better than the reported benchmark return.

Most investors save for long term goals – such as retirement. For this objective, it’s the value of the portfolio at the date of retirement that is important. Short-term drops in value are unimportant and when a disciplined process is being followed a drop in value can be an opportunity to rebalance. There is no sense in avoiding volatility over the next 30 years (before you need the money) – if a more volatile portfolio will give you more when you do need it.

Some investors like GICs because they never drop in value on the monthly statement. This is a bit of an illusion—the reason the value is the same each month is because it can’t be sold prior to maturity. Some GICs are cashable but these investments offer a lower interest rate compared to non-cashable GICs with the same maturity date. If, instead, you own a government bond, you will see a drop in value if interest rates rise and that is because the statement reflects the true value of the bond. If the GIC could be sold at any time, the statement would reflect its true value (rather than the maturity value) and in this case there would be no noticeable difference between the GIC value and the bond value.

But what if shortly after making a $100,000 investment in a WDCP we have a 1929 style stock market crash? Well, this event would likely be accompanied by a drop in long-term interest rates so the 60% in bonds might increase in value to $70,000 while your equities might be worth only $10,000. But you do have liquidity and a $20,000 income tax loss, and in five years when your GIC matured there might not be much difference between the value of your GIC and the value of your WDCP.

If one is holding off on investing in a WDCP because he or she believes that a severe crash is imminent, a better way to protect oneself and make a decent return would be to buy long-term government bonds. Compared to GICs this would offer liquidity, guaranteed maturity values, higher returns and capital gains (as interest rates moved lower as they would be expected to in a 1929-style crash). I do not recommend trying to time the market because while some investors can get out at the right time and some investors can get in at the right time, no investors have been able to consistently get in and get out at the right time. I believe the best strategy is a WDCP, which is rebalanced in a disciplined manner to lock in profits when markets rise and to buy when securities are less expensive during market corrections.

At the beginning, if investors take care to get into an asset mix that is consistent with their rate of return requirements and their level of comfort with volatility and if they rebalance in a disciplined manner, they will always be in the right asset mix and they never need to worry about where the markets are going.

Another option for investors who really want simplicity, guarantees and tax sheltering would be to place a portion of the portfolio in a prescribed life annuity where with payments are guaranteed for a minimum of ten years. This investment would deliver a higher return than a GIC as well as significant income tax advantages. Individuals who want simplicity, guarantees and tax advantages, and who also want to maintain capital for their heirs could combine an annuity and a tax-exempt life insurance policy. While this would provide a lower income than a simple annuity, it would preserve the estate

for one’s heirs.

Bottom line: the simple GIC represents one of the banks’ most profitable lines of business. For this reason, informed investors will take a pass on the GIC offerings and will instead invest in a way that offers the potential for a higher return, liquidity, income tax efficiency, and that addresses the risk of inflation.

Warren MacKenzie, CPA,CA, is the founder of Weigh House Investor Services and a Stewardship Counsellor with HighView Financial Group.

Email: warren.mackenzie@weighhouse.com

Tel. (416) 640 - 0550