Insuring Your Children’s Future

Setting aside money for your children or grandchildren’s future is smart planning. With a countless number of choices available, it can be hard to determine the most appropriate savings plan to meet their needs. Several key requirements for a child’s savings plan should include tax deferred growth, stability, security, and access to money when it is needed.

This article will explore a popular children’s product that has all of these key requirements, but is a less talked about alternative—participating juvenile life insurance.

Participating life insurance for children provides permanent life insurance protection with a cash value component that can grow tax-advantaged inside the policy. The cash values can be accessed once or several times during a child’s life and can be used for any purpose.

More Than Just Insurance Coverage

Participating insurance for children has little to do with immediate insurance needs and more to do with providing a start for their future savings plan and part of their overall financial security plan. The best time to invest in one of these plans is when the children are at a very young age. My first participating insurance plan was purchased for me at the tender age of fifteen days. Fifteen days was the earliest age at which you could purchase a permanent insurance plan.

Benefits include:

- No income-tax payable on the growth of the cash values while it remains in the policy;

- The product has excellent long-term cash value growth and can be contractually paid up after 20 years. There’s also the potential to end out-of-pocket payments even sooner through a premium offset option;

- The children can also have life insurance coverage to last their lifetime;

- If your child were to develop health problems, it could jeopardize their ability to get insurance coverage in the future. There is a guaranteed insurability benefit (GIB) to allow for increases in coverage as life insurance needs increase, even though the child may be uninsurable in the future;

- Current tax laws allow for a tax-free rollover (transfer of ownership) of the policy between the policyholder (parent) and the insured child without tax implications, regardless of who is paying premiums and how much cash value is in the plan.

- After ownership transfer, and if the plan is cashed out or a partial payment received, the tax, if any, will be attributed back to the insured child (new owner) and not attributed to the parent or grandparent who started and paid for the plan.

When I made the decision to go to university, my parents transferred the ownership on my insurance policy to me. By signing the policy over, future tax implications on any cash value withdrawals would be my responsibility. I decided to cash out my insurance policy at age 21 (in hindsight I should have just cashed out the dividends and kept the plan going, a mistake I have regretted to this day). At that time there was enough money in the plan to pay for my first year of university (although I could have used the cash value for anything I wanted). The following year Revenue Canada sent me a T3 capital gain income of $648.00 to be included in my personal tax return. This had no effect on my personal tax rate whatsoever, since I was a full-time student and only a part-time worker.

Participating Insurance, A Great Complement To RESPs

RESPs (registered education savings plans) have become a popular choice for funding a child’s post-secondary education. The main reason Canadians buy RESPs is the 20% government grant available to contributors of the plan.

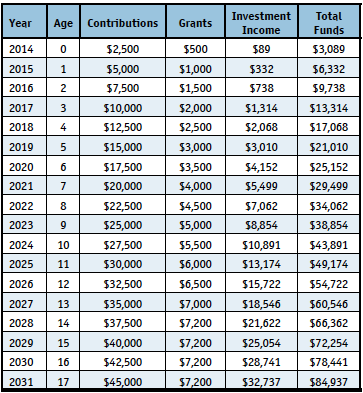

Below is an RESP illustration for a newborn child, using an average rate of return of 5%. For this illustration I have applied some basic rules to RESP investing. $2,500 will be invested every year to receive the maximum annual government grant of $500 per year. A lifetime maximum of $50,000 can be invested in an RESP per child with a maximum lifetime government grant of $7,200.

The chart shows a total amount of $45,000 invested on the child’s behalf until they reach the age of 17. At age 14 the maximum government grant of $7,200 has been achieved. Beyond age 14, grants end. After 17 years your child will have $84,937 in their RESP which can be used for post-secondary education purposes only. When the accumulated income is withdrawn, not the contribution

portion, it is taxable to your child.

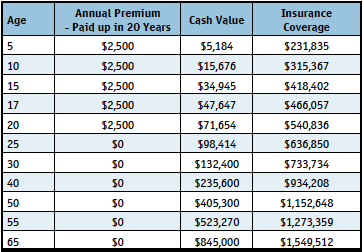

Let’s use the same amount of $2,500 per year and invest that in a participating juvenile insurance plan for a maximum of 20 years and see what happens.

After 17 years, the total cash value reached $47,647, and the insurance coverage has grown to $466,057. After 20 years, the plan is paid up and continues to grow every year. The rate of growth with participating insurance is impressive even when the plan is paid up. At age 25 the total cash value grows to $98,414.

Chart assumptions: Juvenile male insured, age 15 days, standard risk, Estate Achiever max 20 policy, paid-up additions with maximum additional deposit option for 20 years, annual premium $2,500 initial death benefit.

The cash and death benefit values include values dependant on dividends, which aren’t guaranteed. Values shown are based on Canada Life’s 2014 dividend scale. Actual results will vary up or down from those illustrated, based upon the actual dividend experience of the policy.

In conclusion, RESPs are a good choice to fund your child’s post-secondary education, but you need to ask whether they will be enough, and whether they provide enough flexibility.

Participating life insurance is a great complement to RESPs because it provides extra cash and more flexibility in determining what key life event the money will be used for:

- Four-year undergrad in university and/or studying abroad

- A trip in the summer to Europe

- Starting their first job

- Getting married

- Down payment on a car

- Down payment on their first home

- Retirement income.

Whatever the key event, it’s good to know you have the flexibility to determine when to withdraw the cash and give your child a helping hand.

Rino Racanelli, B.Sc., Independent Insurance Advisor,

MRH Financial Services, Oakville, ON (416) 880-8552,

racanelli@sympatico.ca