Types of Debt and How to Use them Effectively

In this article we are going to explore some of the main types of debt that are offered to consumers and what the best uses of debt can be. We are often trained to believe that debt is bad and that, if possible, we should have zero debt. While having zero debt allows for peace of mind and an easier lifestyle, it is not necessarily attainable for most, and the reality is that not all debt is bad. Obtaining debt is much like gaining trust, it starts off small and incrementally gets larger as time progresses and more trust is built. One of the first debt instruments that most of us obtain is a credit card, and usually it is at a low limit as the financial institution is just beginning to build trust. As the financial institution begins to see that the individual can pay off their debt on the credit card, the cardholder is awarded a credit score, and this provides a reference point to other institutions on the trustworthiness of this borrower.

Not all debt is bad, and in fact, some debt can help us to advance our level of financial freedom, and this all starts with understanding the different instruments of debt and how they can be used effectively.

Classifying Debt Instruments

There are two primary distinctions when obtaining different types of debt: revolving loans and term loans.

Revolving Loan

A revolving loan is a type of loan where the total amount available for use is replenished as the debt amount is paid back. The total amount, partial amount, or no amount can be withdrawn from the loan, and paid back on the borrower’s own schedule. As the borrower pays back the loan amount, it is once again available to be drawdown. Interest payments are typically required monthly, and if no payment is made, then the interest amount gets added to the total debt amount. An example of a revolving loan is a credit card or a line of credit.

Term Loan

A term loan is a loan which usually has a fixed repayment schedule, with a set number of years that the loan must be paid back in. The total loan amount is provided upfront to the borrower and a predetermined payment amount is required weekly or monthly. Unlike a revolving loan, the loan amount is not made available for use as the borrower pays down the debt. At the end of the term, the full loan is paid off and the loan amount cannot be used again. An example of a term loan is a mortgage or a car loan.

Credit Cards

A credit card is a revolving loan which is available to many Canadians at or above the age of 18. Typically, a financial institution will start the borrower off with a small loan amount at an interest rate of roughly 20%. Many individuals use credit cards for larger purchases to collect points or cash-back, and others use it as their primary payment method. If the credit card balances are being paid off on time, we believe using a credit card frequently or infrequently is a smart method to easily build up one’s credit score. Allowing the financial institution to see that one is responsible enough to take on debt and pay it back on time allows them to gain and build trust. Improper use of a credit card would be to finance unnecessary purchases that one cannot immediately afford, as the interest payments can become unmanageable for most.

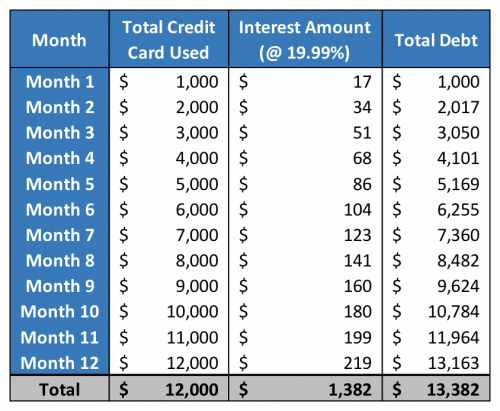

Below is an example of how credit card debt, having one of the highest interest rates of all types of debt, can easily get out of hand. In this scenario, the borrower is adding $1,000 in credit card purchases to their credit card per month, at an annual 19.99% interest rate, and is not making any payments per month. At the end of the year, $12,000 of the credit card has been used and $1,382 of interest has been accrued. As the interest balance grows bigger it adds to the total balance and creates a ripple effect for larger and larger interest payments.

Line of Credit

A line of credit is a revolving loan which has a maximum loan amount and usually the interest rate is variable (meaning that it can increase or decrease). A line of credit typically offers higher amounts and lower interest rates than a credit card, although it does not provide the borrower with points (like with a credit card) and is usually only available to people that have an established credit score. A line of credit can be used like cash, like a chequing account.

A line of credit can be used improperly to make unnecessary purchases or purchases that the borrower cannot afford; however, it can also be used as a tool of leverage for the borrower. For example, an individual that is looking to sell their house but requires a bathroom to be updated first can use the line of credit to renovate their bathroom, sell the house, and use the proceeds from the sale of the house to pay back the line of credit. In some circumstances this can be quite an effective use of the line of credit to receive the highest amount possible on the sale of one’s house.

Mortgage

A mortgage is a term loan available to borrowers to finance the purchase of a house. The amortization period is often twenty to thirty years and a fixed or a variable rate can be chosen. It is often five years that the fixed or variable rate is set for, and interest rates are often quite competitive as the loan is backed by the property being purchased. A down payment amount is required as the financial institution will not provide financing without a down payment.

A mortgage can be used improperly if one takes on a larger amount than they can afford or if they can no longer afford the monthly payments. Mortgages can be very useful and provide one with the ability to own property that they would otherwise not be able to purchase outright.

The value proposition for owning a home via a mortgage is that part of the monthly payments includes repaying the debt (principal payments) and this gets added to an individuals’ equity position. On the other hand, renting allows for more flexibility and fewer additional payments (renovations, etc.), however, the rent payment does not add to an individuals’ equity.

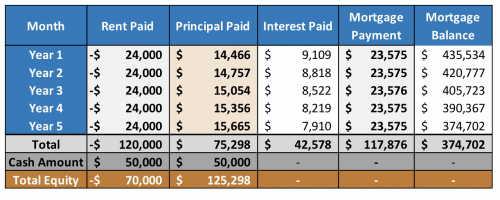

As an example, we will compare an individual that is currently renting a home for $2,000 a month against an individual that is purchasing a home with a mortgage. In this example, the individual is purchasing a $500,000 home, with a 25-year amortization period, a 5-year fixed term of 2.0% interest rates, and a 10% down payment (being $50,000). This would represent a $450,000 mortgage amount ($500,000 less the $50,000 down payment) and the monthly mortgage payments would be $1,965.

In the table below we see the annual rent payments made for the individual renting is $24,000, and the annual mortgage payments are $23,575. The principal portion of the mortgage payments reduce the overall mortgage balance and increase the individuals’ equity position. The individual renting pays $120,000 in rent over five years but gets to retain $50,000 that was not put towards a down payment, therefore having a net equity position of ($70,000). The individual that purchased via a mortgage put $75,298 towards their principal and retained their $50,000, leaving them with a positive $125,298 equity position. This is the capability that using debt effectively can have. Of course, it must all be within one’s comfort level and affordability. The rent vs. buy debate is an ongoing one and there are pros and cons on all sides here. For example, the extra $50,000 in this example could be used for investing or other means. A lot also comes down to the differences between mortgage and rental rates that prevail. This is one of many scenarios one could encounter!

Conclusion

In this article we’ve explored various types of debt, the different uses of each type of debt, and how to use debt properly and effectively to one’s advantage. As always, one needs to assess what is within their affordability and comfortability levels, but the key takeaway is that debt can be used as a tool of leverage to improve one’s financial situation.

Research for today, invest for tomorrow

Research for today, invest for tomorrow

Chris White, CFA

Analyst for 5i Research Inc.

Comments

Login to post a comment.