The ABCs Of ESG Investing Part 2: Investing Choices For The ESG-Conscious

In the first part of this three-part series, we examined the basics of ESG investing. To reiterate, the E in ESG stands for environmental issues such as pollution and climate change, while the S represents a company’s social attitudes as in how it treats its employees, its customers, and its investors. Finally, the G for governance looks at issues such as boardroom diversity, executive compensation, conflicts of interest and shareholder rights. Corporations perceived as having an indifferent attitude toward ESG risk alienating investors, including powerful institutional shareholders that may refuse to hold stakes in companies that don’t conform to the investing institution’s ESG policies.

Socially responsible investing, or SRI, is a subset of ESG in which investors apply their own values to decide whether to invest. For example, a socially responsible investor, whether individual or institutional, may refuse to invest in companies that make weapons or cigarettes or may shun companies with poor environmental records. A subset of SRI is impact investing, which involves directing money to businesses, non-profit organizations and charities that are visibly and actively working to improve the world.

This article looks at mutual funds, Exchange-Traded Funds (ETFs) and individual companies suited for ESG-conscious investors. The third and final part will examine alternative energy investments.

The mutual fund and ETF industries have launched an array of ESG-focused funds, most of which are so new they have no measurable track record. Last summer, Morningstar’s Ian Tam noted that of 76 sustainable Exchange-Traded Funds (ETFs) from Canadian fund families, fully 72 had been launched no earlier than 2019.

ESG-conscious funds fall into two broad categories: negative funds that avoid companies and industries that have poor environmental, social or governance records, and positive funds with portfolios made up of clean energy companies or those with other solid ESG characteristics.

Most funds that advertise themselves as being ESG-conscious focus on the environmental aspect of ESG, and most of these follow the negative route by simply shunning any sort of resource company. Some other ESG funds hold energy and mining companies that have taken steps to reduce their carbon emissions, while other funds hold shares of royalty companies that collect payments from energy or mining firms without doing any drilling or digging themselves. Some positive fund portfolios are made up of battery makers and solar and wind energy companies, while a few focus on companies that have diversified boards and senior management. Regardless of what they hold, almost all funds feature the words “ESG,” “social”, “sustainable”, or “clean” in their names.

Some fund companies, such as North Growth, offer only ESG-focused products in their stable of funds.

Balance sheets, income statements and other financial information reveal nothing about a corporation’s attitude toward ESG, which can only be properly measured through complex analysis. Sites that collect and disseminate this data charge fees that only institutional investors can afford, but the funds that use the data often end up with what appear to be obvious holdings. For example, ESG-focused funds have come under fire in the United States for simply being overpriced collections of giant technology companies. Many such funds own stakes in Apple, Alphabet (Google), Meta (Facebook), Amazon.com and Microsoft, which have all made what for them are relatively easy promises to not pollute, to hire more people from traditionally underrepresented groups, to install solar panels on their roofs and so on. A recent article in Bloomberg Green (bloomberg.com/green) stated the funds that hold these stocks behave like broad technology funds but with higher fees and more volatile performance.

In Canada, fund managers may use complex analysis to avoid companies and industries likely to run into ESG problems. However, the resulting portfolio often simply looks like the S&P/TSX 60 Composite Index minus the energy and mining stocks. The resulting ESG-focused funds are usually filled with banks and insurers, the two railways and a smattering of giant retailers and manufacturers, creating what looks like an expensive Canadian large-cap fund without any resource names.

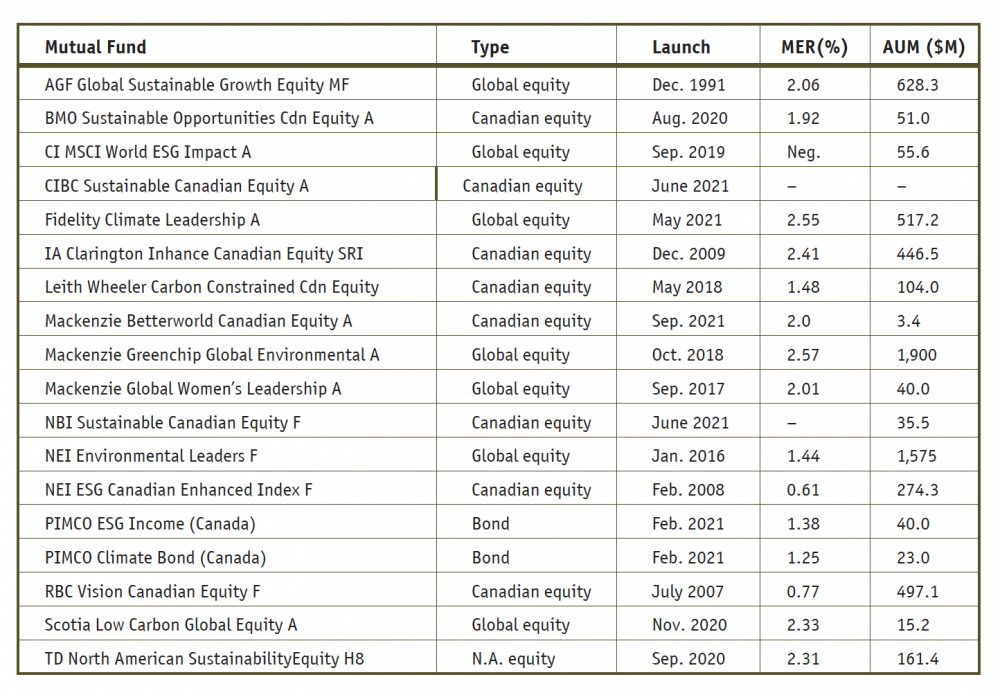

ESG/SRI Focused Mutual Funds

The mutual funds listed below are samples only. Each issuer offers many different versions, and space does not permit the complete listing of all series, which vary depending on minimum initial amounts invested, advisor type, management expense ratio (MER) and so on. Many ESG-focused funds are so new they have yet to set an MER and have less than $1 million in assets under management (AUM).

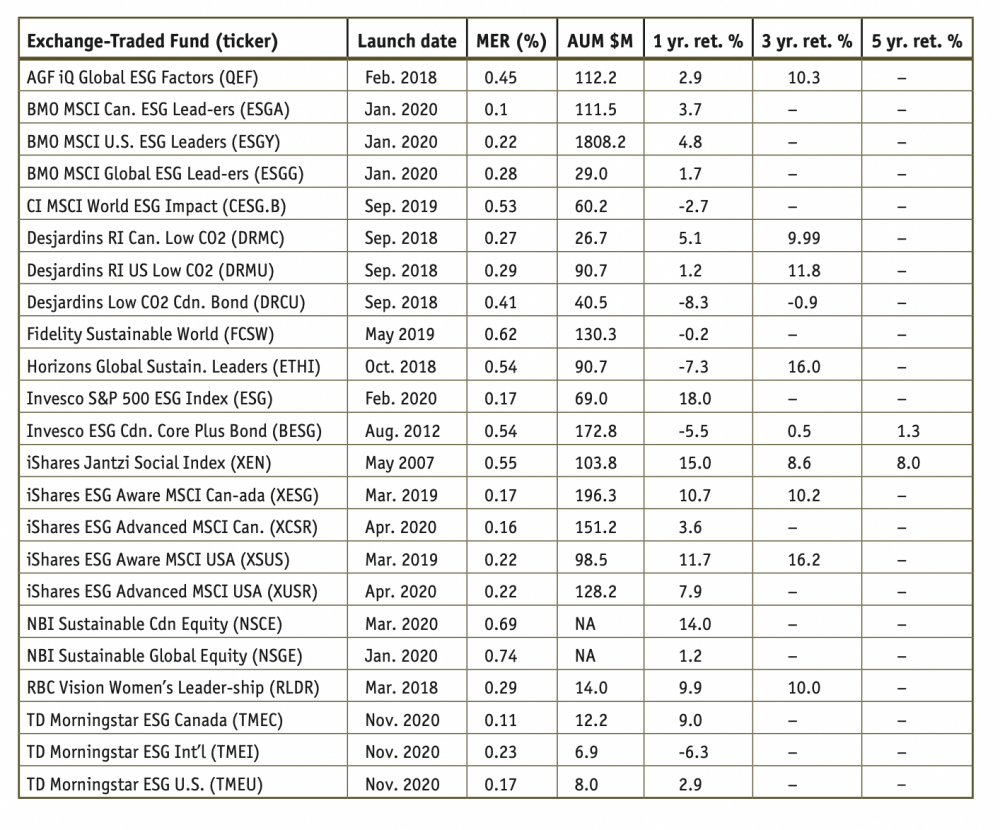

Canadian ESG/SRI Focused ETFs

The table below is made up of ETFs that are at least two years old. Among funds too new for the list,Wealthsimple launched two SRI funds and CIBC launched a family of sustainable ETFs last year, and Scotiabank followed with a suite of funds this year. Many Canadian ESG-focused funds are so new they have yet to set an MER and have less than $1 million in assets.

Individual Corporations

Most sites that collect and disseminate corporate ESG data are too expensive for individual investors. Among the affordable sites is Morningstar’s Sustainalytics, which offers free access to its ESG risk ratings page (sustainalytics.com/esg-ratings) that ranks more than 9,000 companies around the world. Sustainalytics’ ESG risk ratings range from negligible (a score of 0 to 10) through low, medium, high and severe (40+). The site lists 181 companies with negligible ESG risk—obvious candidates for ESG-conscious investors. Among Canadian companies that Sustainalytics regards as having negligible ESG risk: Altus Group Ltd. (AIF), Celestica Inc. (CLS), Franco-Nevada Corp. (FNV), LifeWorks Inc. (LWRK), Metalla Royalty & Streaming Ltd. (MTA), PrairieSky Royalty Ltd. (PSK), Thomson Reuters Corp. (TRI) and Wheaton Precious Metals Corp. (WPM).

The data can be filtered by industry and risk rating group but not by country, and the results appear only in alphabetical order, necessitating further research. By providing Sustainalytics with their contact information, users can access more detailed reports, a company spokesperson said.

Another Canadian source of ESG ratings is Toronto-based Corporate Knights, a quarterly magazine that sells for $22 a year and also appears as an insert in The Globe & Mail. The publication features rankings such as the Best 50 Corporate Citizens in Canada and the Global 100 Most Sustainable Corporations.

In the United States, Berkeley, California based As You Sow (asyousow.org) has been advocating for ESG on behalf of shareholders since 1992. The site covers a variety of ESG issues, including reports and scorecards on zero emissions, CEO pay, clean energy, greenwashing (false claims that products or services are environmentally friendly), racial justice, pesticides and plastics.

This year’s edition of As You Sow’s free Clean200 list of environmentally conscious companies, created in conjunction with Corporate Knights, is made up of 200 giant corporations culled from a pool of 8,480 global firms.

The Clean200 excludes fossil fuel companies such as oil, gas and coal producers, utilities that generate less than 50% of their power from green sources, weapons manufacturers, and companies it regards as contributing to deforestation: those that make palm oil, paper/pulp, rubber, timber, beef and soy. As well, companies using child or forced labour and those that engage in negative climate lobbying are not included. The United States dominated the 2022 list, with 52 companies on the Clean200, while Canada had the second largest share with 18 names, shown below.

Richard Morrison, CIM, is a former editor and investment columnist at the Financial Post. richarddmorrison@yahoo.ca

Comments

Login to post a comment.