Maximizing Your Savings: Why Contributing to Your Registered Retirement Savings Plan (RRSP) Isn't Enough, Don't Forget About Your Tax-Free Savings Account (TFSA)

Saving for your future (including retirement or any large purchases) is an important financial goal which requires discipline and includes tax strategies. Two of the most popular ways to save for retirement in Canada are the Registered Retirement Savings Plan (RRSP) and the Tax-Free Savings Account (TFSA). Popularity among Canadians for RRSP is higher given that it is a great way to reduce taxable income and save for retirement, while TFSAs often take a back seat. While each has their advantages and limitations, both can be used to maximize savings and compound tax benefits.

RRSP vs TFSA

The RRSP is a tax-deferred savings plan, where the investment earnings on the money you contribute grows tax-free, but when you withdraw it in retirement (or before), it is taxed as income at the taxpayer’s marginal tax rate. The idea is to contribute to the RRSP in your highest earnings years to pay lower taxes, and then withdraw the funds during retirement, when your income is typically lower and so is your marginal tax rate.

For an RRSP, your contributions are tax-deductible, reducing your taxable income and possibly resulting in a tax refund. Any withdrawals from an RRSP are considered income and are fully taxable at your marginal tax rate, which, depending on the size of the withdrawal and your other sources of income, could bump you into a higher tax bracket. While there is tax withheld when you withdraw funds from an RRSP, it is rarely enough to cover the full tax hit.

For 2023, the RRSP contribution limit is 18% of earned income you reported on your tax return in the previous year, up to a maximum of $31,560, plus any unused RRSP contribution room from previous years. However, that amount is reduced by contributions made on your behalf to an employer-sponsored pension plan. Your RRSP contribution limit will be shown on your Notice of Assessment from your previous year’s income tax form, you can find it online on your personal My Account with Canada Revenue Agency (CRA) or you can call them.

The TFSA, on the other hand, is a Tax-Free Savings Account that allows you to contribute a maximum amount each year, and the investment earnings in the account grow tax-free. Contributions made to a TFSA are from after-tax income, so you do not receive a tax receipt that would reduce your income or taxes owing. However, any investment earnings are tax-sheltered, and when you do withdraw the funds, they do not need to be included in your income.

Both an RRSP and TFSA are considered “registered accounts”, and as such, they do not have implications for capital gains or losses.

Do I pick one or the other?

Both the RRSP and TFSA have unique efficiencies, benefits, and limitations, but contributing to both can help you maximize your savings. Contributions to an RRSP can reduce your income, and potentially reduce your tax bill. Investment earnings in both the RRSP and TFSA are tax-sheltered, eliminating any taxes owing on capital gains or dividends.

It's important to know what your contribution limit is for each account because there are stiff penalties if you over-contribute.

Let’s look at how RRSP contributions can provide potential tax savings.

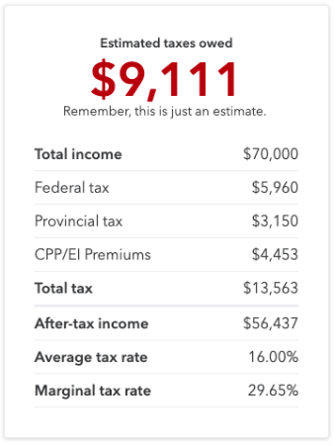

With a salary of $70,000 without an RRSP contribution, this is what the estimated taxes look like: (Source: Intuit Tax Calculator)

Putting 18% into an RRSP or $12,600, the taxes paid look like this:

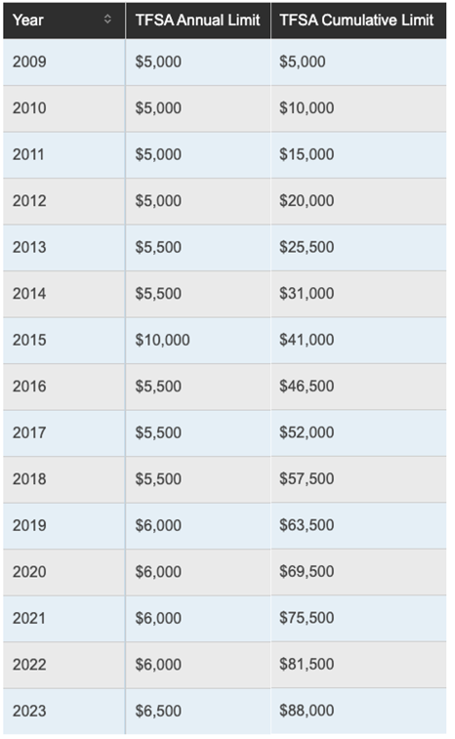

A TFSA has a yearly limit, and the new TFSA room becomes available on January 1. The investment vehicle was created in 2009 and allowed for a cumulative contribution limit. Your TFSA contribution limit is available online on your CRA “My Account”, or you can call them. It is not longer included on your Notice of Assessment.

Source: MoneySense.ca

Let’s compare an investment in a TFSA and a non-registered account. Assume an investor opens a TFSA account and invests $6,500, and let’s compare it to a $6,500 investment in an unregistered account. Assume an investor earned 7% on each account annually. Over a year, $456 is earned. In a TFSA, the $456+$6,500 (initial contribution) can be withdrawn with no strings attached. The $456+$6,500 in the unregistered account, if withdrawn, is taxed as part of your annual income. Assuming a marginal annual tax rate of 29%, the after-tax earnings in the unregistered account would be cut to $323.76.

The numbers might not seem significant over one year. However, keeping in mind future contributions and compounded growth, tax savings from a TFSA can quickly add up. Additionally, the TFSA contribution limit changes periodically to reflect inflation and, as seen in the table above, increases over the years.

RRSPs are to be used for retirement, are TFSAs also just for retirement?

No, a TFSA is a versatile savings tool that anyone aged 18 and over can open to save for various reasons, whether it’s your first car, a wedding, a down payment for your first home, an emergency fund, renovation, vacation, a child’s education, or supplement income during retirement. Even if you have maxed out your RRSP contributions, the TFSA can still be used to continue saving for retirement or as a tax-sheltered way to continue saving for the future.

Withdrawals

Funds from the TFSA can be withdrawn at any time and withdrawals amounts from your TFSA will be added back to your TFSA contribution room at the beginning of the following year.

TFSA withdrawals are not considered taxable income and therefore do not affect federal income-tested benefits or tax credits you may be otherwise eligible for, including CCB (Canada Child-Care Benefit), CWB (Canada Workers Benefit), or GST credit. It also does not reduce income-level-based benefits such as EI (Employment Insurance) or OAS (Old Age Security) and Guaranteed Income Supplement (GIS).

In contrast, RRSP withdrawals are added to your income, and can have an impact on income-tested benefits. You also do not get RRSP contribution room back.

While your RRSP contributions are a great way to reduce taxable income and pay fewer taxes while saving for retirement, it is important not to forget about your TFSA. Contributing to both accounts can help maximize savings potential for retirement and other life goals. The earlier your start, the more time you’ll have to take advantage of TFSA and tax-free earnings.

Comments

Login to post a comment.