Investing 101

Investing 101

Basic Terminology

WHAT ARE STOCKS?

- Securities representing a share or ownership stake in a company. Stocks are usually accessible to the public. For example, you can buy shares in Microsoft (ticker: MSFT) to benefit from the dividends the company pays and growth of the share price as the business grows.

What are Bonds?

- Interest-bearing debt obligations. Bond investors (buyers) receive interest payments from bond issuers (borrowers) until a specified maturity date. They do not involve direct ownership of an asset/project.

What is an ETF?

- Exchange-Traded Funds (ETFs) can be bought like stocks on exchanges throughout the day. They represent a basket of securities or stocks and give investors broad exposure to certain themes/industries/strategies. ETFs often track a passive index of stocks or commodities like gold and oil.

What are REITs

- A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating properties. REITs pool money from investors and make it possible for individual investors to earn dividends/rental income from real estate investments—without having to buy, manage, or finance any properties themselves.

What is a Mutual Fund?

- Also baskets of stocks or securities, but are usually actively managed and charge higher fees than ETFs. Not all are available on exchanges and can only be bought/sold at the closing price at the end of a business day.

What are Cryptocurrencies (aka “Cryptos”)?

- Digital or virtual currencies secured by cryptography, making it nearly impossible to counterfeit. Most enable secure online transactions through blockchain technology. Cryptocurrencies like Bitcoin and Ethereum are thought to be “currencies of the future”. As per many experts, cryptos are expected to disrupt the fields of finance and law.

Capital gains - Increase in the value of an investment.

Dividends - Distribution of profits by a company to its shareholders.

Equity - Another word for stocks or shares.

Discount brokerage - A platform that allows you to buy and sell stocks.

Margin - Borrowing money to invest.

Ticker symbol - Combination of letters representing a stock (eg. MSFT).

Securities - Financial investments with a monetary value (eg. stocks, ETFs).

Index - Measures the performance of a basket of securities.

Portfolio - Collection of investments meant to serve a strategy/purpose.

Dividend yield - Annual dividend return to expect based on stock price.

Bull market - When the stock market rises for a sustained period of time.

Bear market - When the stock market falls for a sustained period of time.

Options - Give the buyer the right to buy or sell a stock at a specified price.

Futures - Agreement to buy or sell something at a predetermined price at a specified time in the future.

Initial Public Offering (IPO) - When shares of a company become available to the public for investment.

Sector - A part of the economy, usually broader than an industry.

Volatility - How much the value of an investment fluctuates.

Beta - Measures the volatility of a security compared to the market.

Alpha - Excess return gained compared to the market.

Diversification - Allocating capital in a way that reduces exposure to any one particular asset or risk.

Liquidity – How quickly you can get in and out of an investment.

Long position - Owning a security to gain from increase of its value over time.

Short-selling - Selling shares you do not own to gain from decline in price.

Fundamental analysis - Analysis of a business' financial statements, financial health, growth, profitability, competitors, and markets.

Technical analysis - Analysis of price data/patterns to identify trends and make predictions for where the price of an asset will go.

Commodities - Natural resources or agricultural goods (gold, oil, wheat).

Blockchain - A digital record of transactions, linked in a single list (chain).

5 Steps For Beginners to Stocks:

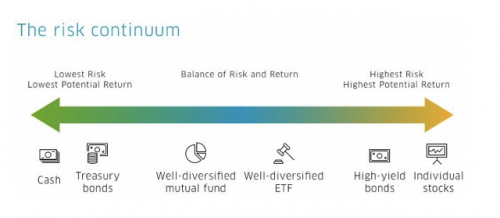

1. Before you even start, think about the risks!

- Understand that all investments can move any given day.

- There is almost always a risk/return tradeoff. More return potential means more risks, which means you investments will move more wildly up AND DOWN.

- Make sure you are in a position where you can invest comfortably. What this is comes down to a personal decision but we have a rule of thumb that might help: In investing, corrections (a 10% decline) can happen almost annually. So when, investing, we suggest investor go in with the expectation that they could lose 10% 'tomorrow'. Does this change anything?

- If just starting out, don't be afraid to just dip your toe in the water. Get a feel for things, and how the market and your brokerage works! Remember, this is a marathon, not a sprint.

- Beware margin and options - These are high risk strategies. While they can make sense for some investors, we often suggest one first becomes comfortable with investing and volatility before venturing into this area.

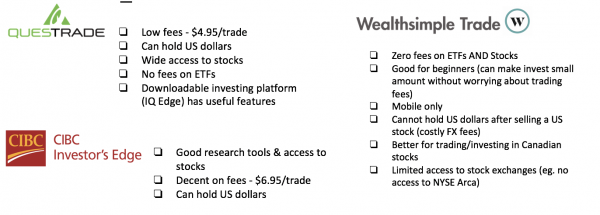

2. Open a Discount Brokerage

- A self-directed investment account is what you use to buy and sell stocks on your own.

- Below are some popular examples of discount broker platforms iCanada one can use to open an account:

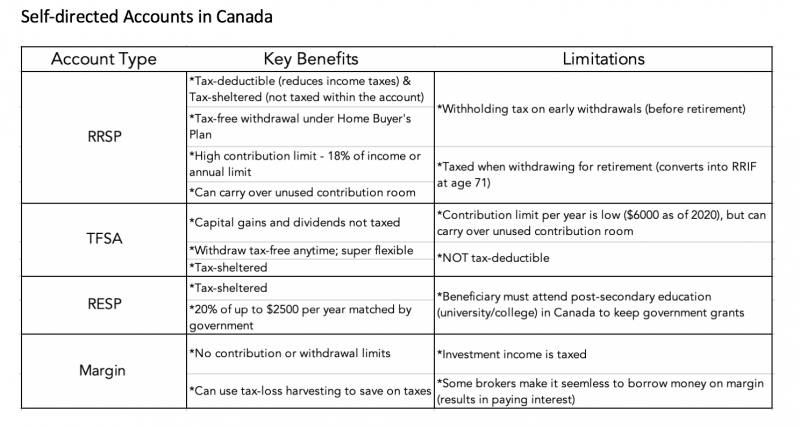

3. Decide which investment account type(s) to use

Taxable accounts

- AKA “margin” or “non-registered” accounts.

- Standard, “plain-vanilla” account type.

- Many allow you to borrow 3-4x your money on interest to invest - we would exert caution here as borrowing to invest is a risky practice.

- Investment income from capital gains or dividends is taxable.

- One can reduce capital gains tax by selling investments at a loss (sometimes a good idea).

- No contribution or withdrawal limits (greater flexibility).

Tax-sheltered accounts

- For most people, these are a good idea to take advantage of BEFORE using a margin account as gains and dividends can grow without getting taxed!

- Registered Retirement Savings Plan (RRSP): Capital gains and dividends are tax-free when selling a stock within the account. Save on taxes when contributing (tax-deduction), but taxed on withdrawals.

- Tax-Free Savings Account (TFSA): Capital gains and dividends are completely tax-free. Provides the most flexibility as both contributions and withdrawals are not taxed or tax-deductible. Has contribution limits.

- Registered Education Savings Plan (RESP): Used for beneficiary's (child) post-secondary education. Government provides 20% match incentive that can be reinvested. Incentives must be used for education upon withdrawal.

4. Understand what kind of investor you are

- Passive.

- Primarily diversified ETFs/Mutual Funds.

- May only need to rebalance semi-annually or annually.

- Lower risk/return due to diversification.

- Active.

- Buying individual stocks (sometimes ETFs for niche exposures).

- Higher concentration and company specific risk.

- Requires more time commitment, monitoring, research and decision making.

- Rebalancing more frequent but does not need to be daily or weekly.

Core & Explore

- A mix of passive and active.

- A few funds/ETFs for larger portion of portfolio as ‘Core’ to reduce overall portfolio risk.

- Taking more concentrated ‘bets’ with individual stocks as satellite holdings.

- Great approach for learning.

- Can transition into more individual stocks as one gets more comfortable.

5. Buy a few ETFs as core positions

There are many different asset classes and subcategories but generally speaking, the two main asset classes in investing to balance portfolio risk are:

Equity ETFs

- Suggested position size for beginner: 25-50% of portfolio.

- As one gets more comfortable with individual stocks (higher return potential/risk), one can gradually reduce their position sizes of these ETFs and move more into picking their own stocks.

Examples:

- Canada: iShares Core S&P/TSX Capped Composite Index ETF (ticker: XIC)

- US: BMO S&P 500 Index ETF (ticker: ZSP)

- International Developed: iShares Core MSCI EAFE IMI Index ETF (ticker: XEF)

- Emerging Markets: BMO MSCI Emerging Markets Index ETF (ticker: ZEM)

- Provide low volatility/low return, portfolio diversification, low correlation to stocks.

- How much of your portfolio this takes up depends on your investor type (more on this below).

- As part of Bond portion, one can keep 5-10% of portfolio in Cash for short-term opportunities.

- Examples:Canada: BMO Aggregate Bond ETF (ticker: ZAG)

- US: iShares Core U.S. Aggregate Bond ETF (ticker: AGG)

6. Research individual stocks to add for more concentration

- Stock Market News: Yahoo Finance, MarketWatch, CNBC

- Market Data and Stock Analysis: Koyfin.com, Yahoo Finance

- Investment Terms and Jargon: Investopedia

- Analyst Reports: Available through many discount brokers

- Online Articles: Seeking Alpha, Stockchase, 5iResearch

- Get ideas from stock holdings of ETFs you find interesting.

- Take note of companies you see in your everyday life - find out if the parent company is publicly traded, then research them! eg. Logos on buildings, appliances, food labels, electronics, internet tools etc.).

- Pay attention to trends (eg. changes in technology, consumer preferences etc.) Use your expertise in your field of work/education to gain insight on publicly traded companies.

- Use stock screeners like Finviz to filter by all sorts of financial metrics and industries Look up the screening criteria of famous investors like Warren Buffett, James P. O’Shaughnessy and Peter Lynch for a starting point on what to screen for.

Investing Strategies:

- Value: Invest in companies that are believed to be undervalued based on the quality and cash flows of their business.

- Growth: Focuses on companies that will grow at a fast pace. Investors should generally expect to pay a premium for high growth.

- Momentum: Takes advantage of upwards momentum in stock price and upwards revision in earnings and revenue.

- Dividend/Income Investing: Buying companies to benefit from their stable dividends. This is often used as a form of passive income.

- Have emergency savings of at least SIX months of living expenses that you do not invest.

- If you need the money within 1-2 years, keep it in cash/savings and don’t invest it.

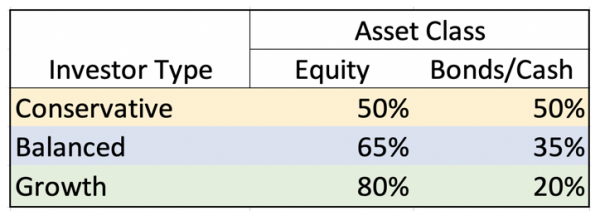

- Growth: Priority is to grow capital, average to above average risk tolerance typically with long time horizon (10 years +).

- Balanced: Wants a mix of growth and capital preservation; typically medium risk tolerance with medium to long-term time horizon (5-10 years).

- Conservative: Typically prioritizes capital preservation and income generation. Risk tolerance is low and appropriate for investors with shorter time horizons before withdrawing funds.

- Investor types are just guidelines, don’t let them limit your strategy!

- Know that the learning never stops, and that’s the beauty of it!

- Don’t be afraid to make mistakes, but calculate your risks.

- The best way to learn is by investing your own money (paper trading learning is limited).

- Aim to save/invest 15-20% of your paycheck or income.

- Always keep a long-term time horizon in mind when buying a stock.

- Buy a stock as if you are buying an entire business (Warren Buffett wisdom).

- Invest in companies that you think will likely do well in the future and show good trends in their financials/profits/cash flows.

- It’s okay to ‘dabble’ in high risk/high reward stocks, but with smaller amounts relative to portfolio.

- It makes sense to allocate higher weight to companies that one has higher conviction in.

- Invest in different sectors and stay diversified...but you don’t have to own everything!

- 20-30 stocks is usually enough to make a well-diversified portfolio.

- Fewer than 15 stocks can work, but creates a higher risk/more concentrated portfolio - make sure you know those companies well!

Comments

Login to post a comment.