CDIC 101 – Everything you should know.

Are you aware that in Canada, your deposits may be protected if your financial institution were to fail? Do you know the coverage limits, how much is protected, and how? Let’s dive into the corporation that was established by the government of Canada to keep your deposits safe and secure, CDIC.

About CDIC

The CDIC (Canada Deposit Insurance Corporation) was established by the government of Canada in 1967. While originally mandated to protect depositors against the risk of losses from a failure, the Corporation is now the resolution authority for Canada’s largest financial institutions and contributes to the stability of Canada’s financial system. CDIC has over 80-member financial institutions, which include banks, federally regulated credit unions, as well as loan and trust companies. You can check if your financial institution is a member using their member list. Financial institutions that are members will also have the CDIC logo on the local branch doors, in the footer of their websites, as well as in their banking applications.

Since its creation in 1967, CDIC has handled over 43 bank failures and closures, affecting over 2 million depositors – no depositor has lost any funds that were protected by CDIC.

Although CDIC is a Crown corporation, it is not publicly funded. Funding for the corporation is provided by the premiums paid by member financial institutions. CDIC coverage is free and automatic for all depositors.

What’s Covered, What’s Not?

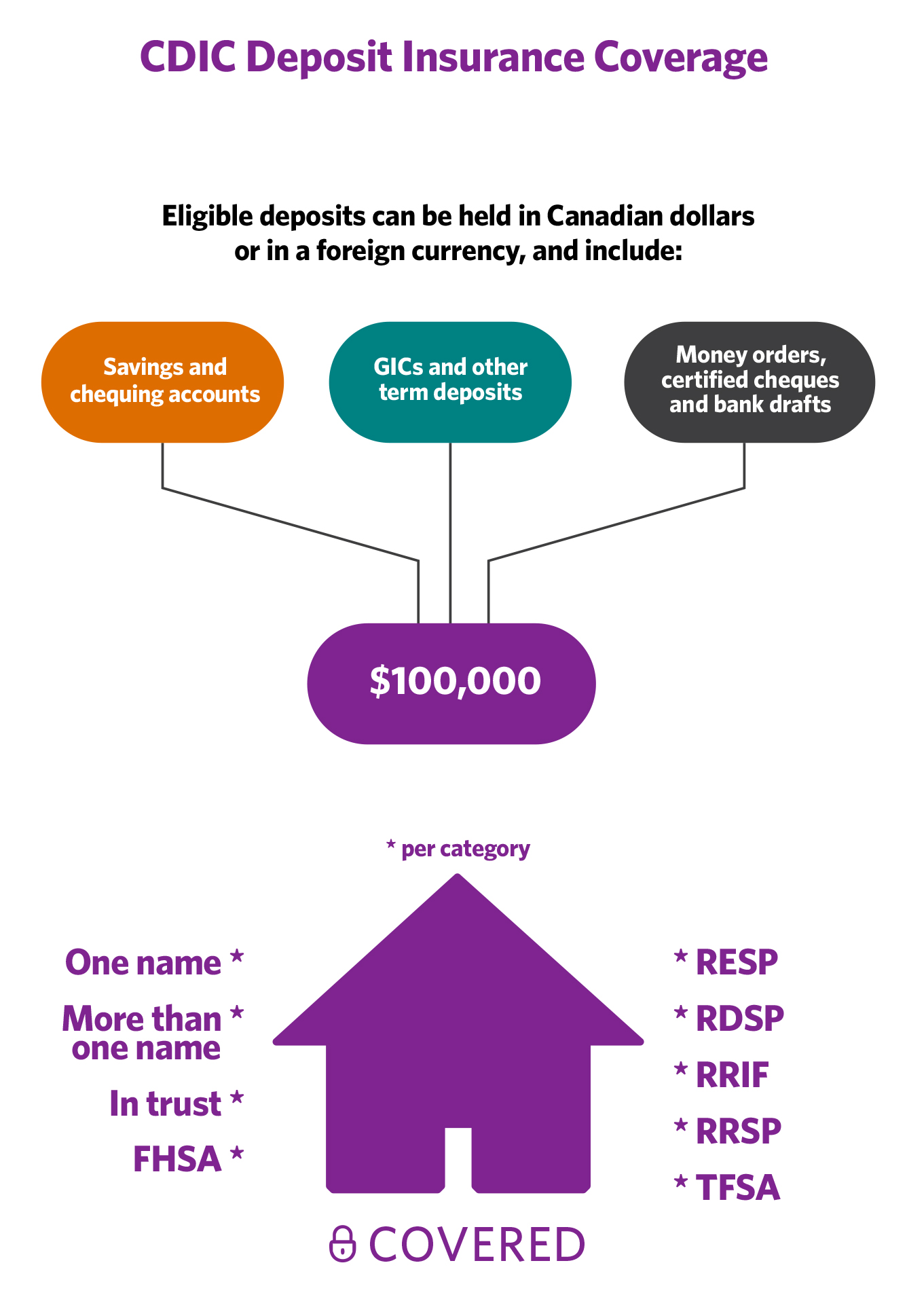

CDIC coverage is broken down into nine different eligible deposit categories. Eligible deposits are insured in each category up to $100,000 at each member institution. The categories include:

· Deposits held in one name

· Joint deposits (accounts held in more than one name)

· Deposits held in trust for another person

· Deposits held in Registered Retirement Savings Plans (RRSPs)

· Deposits held in Registered Retirement Income Funds (RRIFs)

· Deposits held in Tax-Free Savings Accounts (TFSAs)

· Deposits held in a First Home Savings Account (FHSA)

· Deposits held in a Registered Education Savings Plan (RESP)

· Deposits held in a Registered Disability Savings Plan (RDSP)

Each depositor receives up to $100,000 in coverage per category, per member institution.

The following accounts are not protected by the CDIC:

· Mutual funds, stocks, and bonds

· Exchange Traded Funds (ETFs)

· Cryptocurrencies

Note: (For investment protection in Canada, you may be covered by CIPF).

Coverage example:

Anne-Marie has recently graduated from university and is planning a backpacking trip. To achieve her savings goals, she’s put money aside. She banks with two financial institutions, member institution A and member institution B.

This is what Anne-Marie has in one name at two CDIC member institutions. Here is what does (✓) and does not (✗) qualify for coverage:

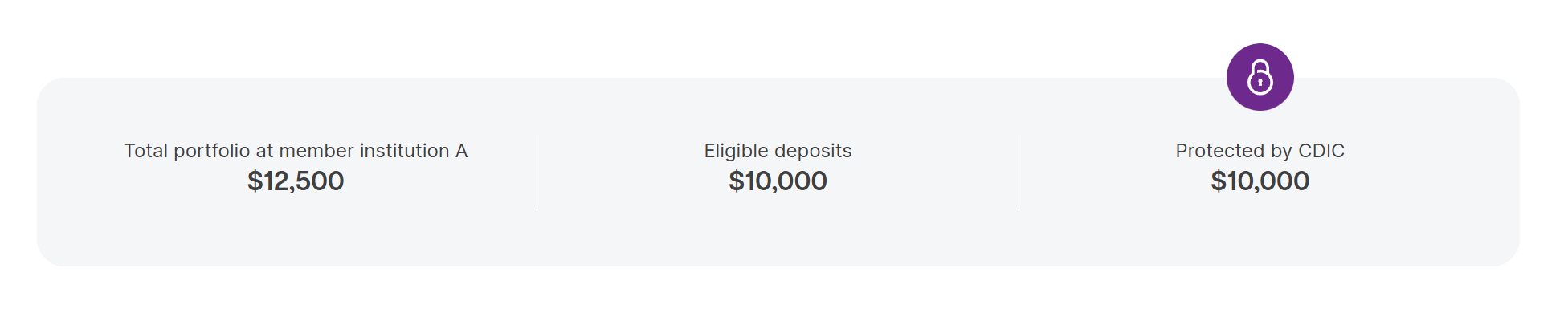

Here is what Anne-Marie holds at CDIC member institution A:

- $5,000 in a high-interest savings account ✓

- $2,000 in a GIC ✓

- $3,000 in a chequing account ✓

- $1,500 in stocks and bonds ✗

- $1,000 in mutual funds ✗

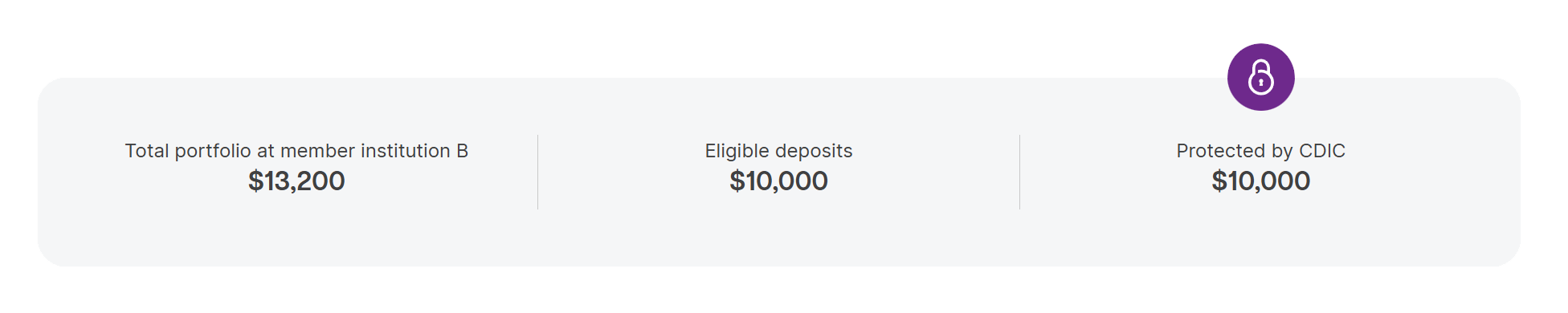

Here is what Anne-Marie holds at member institution B:

- $3,000 in a GIC ✓

- $1,500 in a chequing account ✓

- $5,500 in a savings account ✓

- $2,200 in stocks and bonds ✗

- $1,000 in mutual funds ✗

Anne-Marie’s eligible deposits are protected up to $100,000 at member institution A and B separately. So, in this example, she has $20,000 total in eligible deposits at both member institution A and B.

Looking for more coverage examples? Visit the “what’s covered” section of the CDIC website here. You can also use the CDIC deposit insurance calculator to enter your current deposits, your financial institution, and the amounts to see if your deposits are fully covered.

What happens if a member institution fails?

Canadian financial institutions must meet robust prudential standards to maintain their safety and soundness, but like all businesses, they can fail at some point. If a bank does fail, CDIC has tools to resolve them while protecting depositors and contributing to the stability of the financial system. Resolution is the process by which financial institutions that are failing or likely to fail are restructured or closed.

In Canada, CDIC is the resolution authority for all its members – from the smallest to the largest. This means CDIC takes the lead when any of its members reaches the point when it is no longer viable.

CDIC’s objectives in resolution are to:

- Protect eligible deposits

- Maintain the flow of critical financial services

- Protect our economy

- Minimize risk to taxpayers

CDIC has a range of tools it can use to resolve member institutions. These are not confined to closing an institution and reimbursing insured deposits. They include powers to support: a sale of shares or assets; amalgamation with another institution; recapitalization; restructuring or other private solutions. For more information on the resolution process, see here.

Financial Literacy

Improving the financial literacy of depositors is always top of mind for CDIC. Increased financial literacy contributes to lowering the risk of depositors running in the rare event that a bank does fail. Visit the CDIC financial literacy hub to learn more about deposit insurance and how to ensure your money is protected. You can also play their financial literacy game to learn more about CDIC, navigate real-world financial scenarios, and learn essential skills for points. With interactive challenges and practical tips, the game equips players with the knowledge and confidence to make informed decisions.