Currency Connections: The Loonie’s Role In Your Portfolio

Canadian MoneySaver asked me to write an article on the outlook for the Canadian dollar. I do feel there are some encouraging positives for the Loonie that could see our currency rise in the near term. However, while I am bearish on the U.S. dollar versus global currencies, it is my opinion that the Canadian dollar will continue its relative weakness against both global and U.S. currencies in the longer term. Please don’t get me wrong. The longer-term downside influences on our dollar that I present below could very well change positively. We must be cognisant of the current conditions, while allowing new data to change our outlook in the future. This article covers the fundamental and technical evidence behind my near-term optimism on the Loonie. It also covers my longer-term caution on our dollar. At the end of the article, I present some strategies for investors to hedge against the potential of a longer-term falling Loonie.

On The Positive Side

I see five reasons for optimism in the coming months for the Loonie. Keep in mind that these developments should be considered Canadian-dollar-positive in the near term but have yet to prove if they are sustainable.

- With Canadian inflation still sticky, the Bank of Canada (BoC) easing cycle could be done, while the U.S. Federal Reserve (Fed) is preparing for additional cuts. This should be expected to strengthen the Canadian dollar against the U.S. dollar in the coming months.

- Upward revisions to Canadian Gross Domestic Product (GDP) suggest a smaller output gap, and productivity growth is now supporting a stronger Loonie. The unemployment rate looks to have peaked (now at a sixteen-month low of 6.5% from the summertime high of 7.1%),

- Global investors are ploughing more money into the Canadian economy and the markets. The bleeding from years of net direct investment outflows has not only stopped but reversed. In fact, since the second quarter of 2024, the prior massive outflows have swung to a cumulative net inflow of C$11 billion. Over that same time frame, global investors have emerged as net buyers of Canadian securities (stocks, bonds, money market paper) to the tune of nearly C$230 billion.

- The net speculative short position in the Canadian dollar in the Chicago Mercantiles Market (CME) futures and options pits recently totalled 145k bearish contracts — only 1.5% of the time have the traders been this short. This is a contrarian signal – the short Loonie is a crowded trade. If shorts cover, the flow-of-funds impact would be so large that we could see a sizeable positive impact on the Canadian dollar.

- With fiscal and regulatory policy turning more supportive, the long-term growth outlook is brighter. The fact that the old Liberal cabinet is being shuffled out is encouraging, and Prime Minister Carney’s effort to negotiate with Alberta Premier Danielle Smith could be bullish news for the highly important oil and gas industry, assuming the West Coast interest groups see the reality of its importance of allowing the pipelines and shipping of the product, particularly in the face of the U.S. tariffs. This would not be happening under the prior Trudeau government.

Technical Trend And Targets

The longer-term technical picture is bearish for the Loonie, despite my near-term optimism. The 5-year chart below illustrates the downtrend of the Canadian dollar vs. the USD.

Long-Term Downside Potential

On this chart, you will note that $0.68 CAD /USD has been tested three times since 2015, implying that level as a likely target. However, we may see a lower level. This, considering the fundamental factors affecting the Loonie, as I describe below. In 2002, the Loonie hit $0.62! Such a low target would be the extreme case, but we shouldn’t discount it.

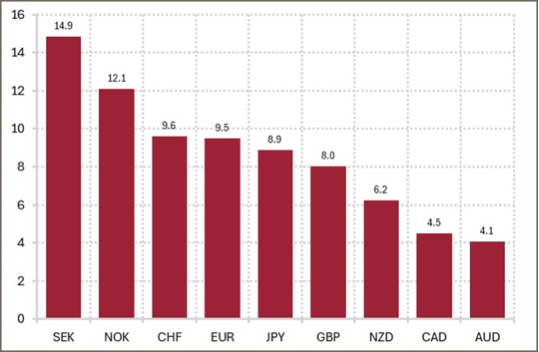

A global perspective reveals the Canadian dollar to be the second-worst performer of G-10 currencies against the greenback — getting a modest lift for the year-to-date (+4.5%), even in the face of the de-dollarization trade (USD declining). Only the Australian dollar (+4.1%) has advanced by less.

Let’s now discuss two of the primary factors behind the longer-term trend of a declining Canadian dollar.

1. Business Migration

A half trillion dollars more Canadian investments go south than there have been American investments come north since 2015. And now, large corporations (eg, Nutrien, Kimberly- Clark, Diageo amongst others) are leaving or re-deploying divisions to the USA. Some firms, while not leaving entirely, are reducing production in Canada (eg, General Motors and Stellantis pulled production out).

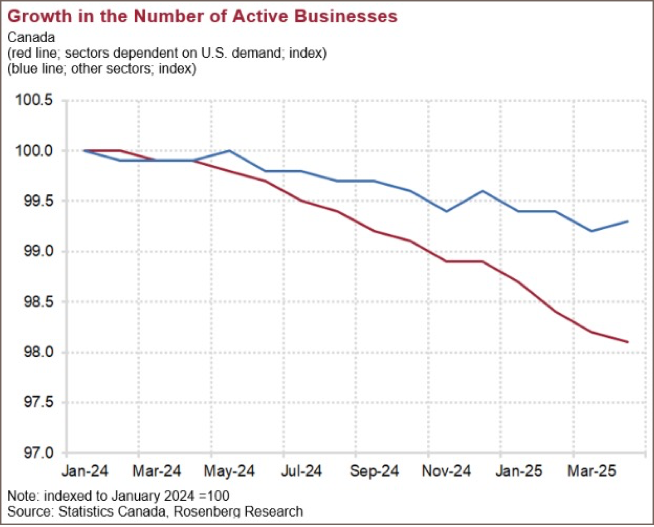

Understand that migration of businesses is not limited to large corporations.

2. Canadian Economy

Question: Isn’t the Canadian economy improving?

Canada is in a precarious position after the recent Federal budget, a slowing economy, and its high debt load (which will increase by 20% by 2030 via the recent budget deficit plan). While printing money and drastically increasing debt, as happened over the Trudeau era, can be termed stimulative (adding to my short-term optimism on the Loonie), it will pressure our longer-term stability and inflation pressures. To wit: On 6 November 2025, Fitch, which already lowered Canada's Credit Rating this year, warned of yet another potential new downgrade for Canadian bonds over the medium term. This, based on “persistent fiscal expansion and growing debt burden”.

“The Canadian economy is in 30th place out of 38 major industrial countries. Canadian productivity rose +0.9% in Q3, annualizing to +3.7% and nearly doubling consensus expectations, but this still fails to recoup Q2 losses and leaves the YoY trend below +1.0%. The long-term 10-year trend remains weak at +0.6% versus +1.7% in the U.S., and productivity levels are still below early-2020 values, highlighting secular stagnation.”

– Rosenberg Research

Summary of longer-term facts affecting the Canadian dollar

Fitch issued a warning that Canada's new government's fiscal platform and "spending promises" pose a "material risk" to Canada's credit rating.

The Canadian independent Parliamentary Budget Officer (PBO) recently called the most recent budget “unsustainable” and “stupefying”

- Fitch also warns that Canada has experienced rapid fiscal deterioration and a sharply weaker economic outlook.

- The cost of the Canadian federal government is up 73% in less than a decade, according to Statistics Canada.

- The Canadian private sector has seen a contraction (loss) in private sector jobs.

- Canada saw a +20% population boom in the past decade, with no per capita real GDP growth to show for it.

- Despite foreign capital inflow into our equity markets (noted under my near-term upside viewpoints), net new business creation has dried up these past two years. Net foreign direct business investment outflows have totalled C$430 billion this past decade.

- The long-term technical trend for the Loonie has been bearish with no signs of basing.

- Canada is among the only countries NOT holding gold, a classic currency hedge for countries.

Five suggestions to profit from a near-term strong, and longer-term weak Canadian dollar

- In the near term, take advantage of buying global and U.S. currencies if my shorter positive outlook for the Loonie proves true.

- Focus on hard assets and commodity producers (Canadian or global). Commodities are traded in USD. This protects your portfolio from stock risk (if any) and a potential decline in the CAD.

- Diversify into international securities and/or Exchange-Traded Funds (ETFs) that are not hedged in their country's currency back to the Canadian dollar.

- Buy USD-denominated securities or currency when you see rallies on the Loonie.

- The Global X U.S. Dollar Currency ETF (DLR.TO) offers an opportunity for investors to capture the positive performance of the U.S. dollar versus the Canadian dollar.

Conclusion

I'm cautious against buying into any narrative of sustainable Loonie strength. A weakening Canadian economy and our alarming debt levels will further undercut the sustainability of strength in the Canadian Loonie. This, despite the US Fed restarting its easing cycle (which pressures its own currency).

Any lingering strength or upside move by the Loonie on the back of U.S. dollar weakness should be questioned until the economy proves to be longer-term stable. Our government must reverse the fiscal debt direction it has become so addicted to over the past decade. I recommend we stay cognisant of the current conditions, while allowing new data to change our outlook in the future. Things can change!

Keith Richards is Chief Portfolio Manager & President of ValueTrend Wealth Mgmt. He can be contacted at info@valuetrend.ca.

Keith Richards may hold positions in the securities mentioned. The information provided is general in nature and does not represent investment advice. It is subject to change without notice and is based on the perspectives and opinions of the writer only. It may also contain projections or other “forward-looking statements”. There is a significant risk that forward-looking statements will not prove to be accurate, and actual results, performance, or achievements could differ materially from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements, and you will not unduly rely on such forward-looking statements. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please consult an appropriate professional regarding your particular circumstances.