Financial Red Flags: When Your Partner's Money Habits Spell Trouble

I have spent much of my professional life looking at how financial systems treat consumers. However, some of the most painful financial stories I hear don't start in a bank office or an advisor's boardroom. They start at home, with a partner whose money habits quietly undermine everything a couple is trying to build together.

When you share a life with someone, you are, in a very real sense, running a small financial enterprise together. You may not think of it that way when you first move in or get married, but the rent, the car payments, the kids' activities, and eventually retirement—all of it is tied together.

Most people do not want to snoop or interrogate their partner about money. We don't want to seem distrustful, so we ignore the little warning signs and hope they go away. In my experience, those warning signs rarely go away on their own.

According to the 2025 Financial Planning Standards Council Financial Stress Index, 44% of Canadians report that money is their number one source of stress—ranking higher than work, relationships, or health concerns. More troubling still, the Financial Consumer Agency of Canada reports that financial disagreements are cited as a contributing factor in approximately 25% of relationship breakdowns.

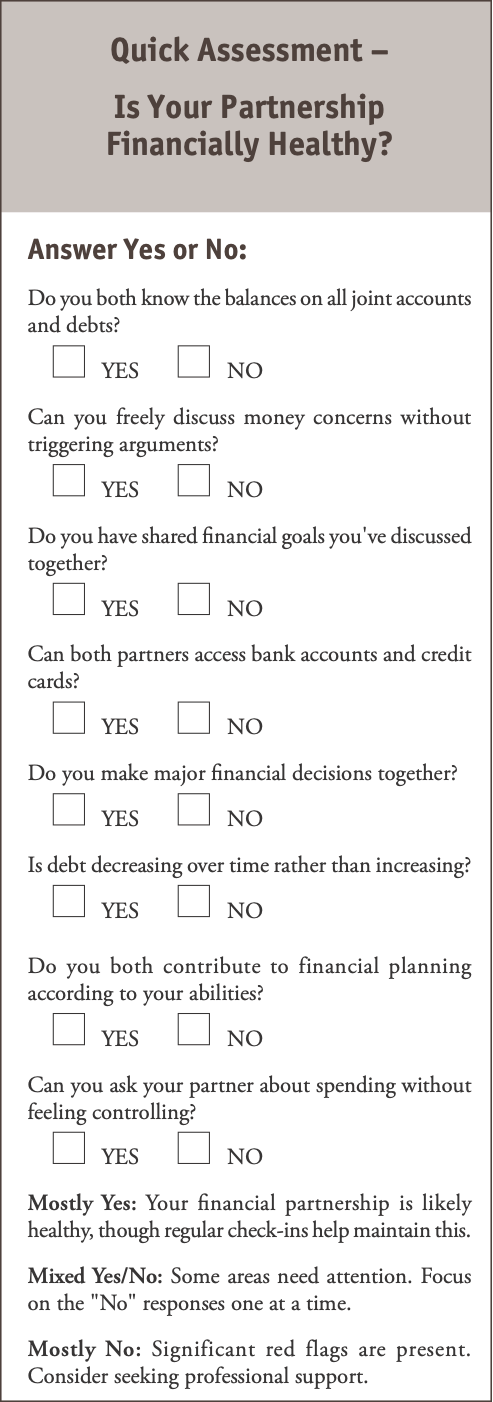

The good news is that you do not need to be a financial expert to spot serious risks. You just need to pay attention to a few recurring patterns. Here are four of the biggest red flags I see, and practical steps on how to protect yourself if things do not change.

Red Flag #1: Secrecy and "Don't Ask" Zones

I'll start with the one that worries me most: secrecy. You might hear phrases like, "Don't worry about it, I've got it covered," or "Why are you asking? Don't you trust me?"

These comments alone don't signal a crisis. But if basic questions about money always seem to hit a wall—if you never see statements or know what's on the credit cards—you have a problem. Secrecy usually stems from shame, fear of conflict, or a desire for control. None of these creates a healthy foundation for joint decisions.

Why this matters: Hidden debts tend to surface at the worst possible time, such as when applying for a mortgage or dealing with a job loss. If you are legally tied together through marriage, common-law partnership, or joint accounts, your partner's habits can directly impact your credit score and borrowing ability. In Canada, both Equifax Canada and TransUnion Canada maintain credit files that lenders review, and negative information from joint accounts or co-signed loans affects both parties.

What you can do: Ask for one "open books" conversation. Frame it as shared responsibility: "If something happened to you, I'd need to know who we owe and where the accounts are." If your partner refuses any transparency, think very carefully before taking on joint debt or co-signing loans. Consider requesting your own credit report annually (free through Equifax Canada and TransUnion Canada) to monitor for any unexpected activity on joint accounts.

Red Flag #2: Chronic Debt and "Minimum Payment" Thinking

Most of us have had periods of debt. The red flag here is chronic, rolling debt that never shrinks, combined with a partner who treats minimum payments as a long-term strategy. You'll recognize this pattern if credit cards are always near the limit or new loans are taken out to pay off older balances without a plan to stop the cycle.

Why this matters: Chronic high-interest debt is a slow leak in your financial boat. With average Canadian credit card interest rates exceeding 20%, carrying even $5,000 in credit card debt costs over $1,000 per year in interest alone. This eats into future choices like retirement savings or buying a home. Often, the responsible partner becomes the "rescuer," leading to resentment and enabling a pattern that continues indefinitely.

What you can do: Sit down and list the debts together: who you owe, how much, and the interest rate. Identify the most expensive debt and commit to one realistic step, like paying more than the minimum or freezing spending on that card. If your partner resists even this modest level of transparency and cooperation, consider whether this is truly a partnership—or a one-sided rescue operation.

Red Flag #3: No Interest in Planning

Some people are natural planners; others would rather sit through a dental procedure than talk about Wills or insurance. However, if one partner actively resists planning or shuts down whenever the topic arises, it is a significant warning sign. You may hear, "We'll figure it out later," or "I don't plan that far ahead."

Why this matters: Real life does not care whether we enjoy planning. In Canada, dying without a Will means provincial legislation determines how your assets are distributed—and it may not align with what you would have wanted. If one partner is trying to think ahead and the other resists, the planner eventually feels like a parent rather than an equal. This dynamic breeds resentment and leaves the couple vulnerable to preventable crises.

- 1. What you can do: Keep it simple. Start with three questions you can both answer:

- 2. What do we want life to look like 10–15 years from now?

- 3. What debts do we want to be rid of by then?

- 4. What would we do if one of us couldn't work for six months?

If these basic questions meet with resistance or dismissal, you're dealing with more than a planning style difference—you're facing a fundamental unwillingness to take shared responsibility for your future.

Red Flag #4: Control, Guilt and Financial "Bullying"

Sometimes, one partner uses money as a tool of control. It can start subtly with comments like, "You're bad with money; I'll handle everything," but can escalate to one person controlling all accounts and "allowing" the other an allowance.

This behaviour crosses the line from poor money management into financial abuse—a form of domestic abuse where one partner uses money to control, manipulate, or trap the other. Financial abuse includes restricting access to bank accounts, demanding receipts for all spending, sabotaging employment, or running up debt in the other person's name. The Canadian Centre for Women's Empowerment estimates that financial abuse occurs in up to 99% of abusive relationships.

Why this matters: A relationship where one person is treated like a child financially is not a partnership. If something happens to the controlling partner—illness, accident, or death—the other may be left unprepared to manage even basic transactions. Worse, financial control often serves as a means to prevent someone from leaving an unhealthy relationship.

What you can do: Maintain at least one account in your own name with some emergency funds. Ensure you know the basics: where the accounts, insurance policies, and mortgage documents are held. No one should be made to feel stupid for wanting to understand their own financial life.

If you recognize patterns of financial control or abuse, contact organizations like the Canadian Centre for Women's Empowerment or provincial victim services for confidential support and resources. Remember: financial abuse is never acceptable, regardless of who earns what income.

Raising Concerns Without Blowing Up the Relationship

Spotting red flags is one thing; talking about them is another. Money conversations rank among the most difficult discussions couples face, often triggering deep emotions about security, control, fairness, and trust.

Here are practical strategies for approaching these conversations constructively:

Choose your moment: Not during an argument, when everyone is tired, or when bills are due. Find a calm time when you can talk without interruptions.

Use "we" rather than "you": Instead of "You're terrible with money," try "I'd like us to both have a clear picture of where we stand." Frame the conversation as tackling a shared challenge together, not attacking your partner's character.

Start with feelings and goals: It is easier to respond to "I feel anxious about retirement" than accusations like "You're irresponsible." Express your concerns using "I feel" statements rather than "you are" judgments.

Focus on one issue at a time: Don't compile a list of every financial grievance. Pick one specific concern—perhaps the lack of an emergency fund or a particular debt—and work through that first.

Aim for one small step: Agree to list debts or share online access to accounts. Don't aim for a total overhaul in one conversation. Small wins build trust and momentum.

Acknowledge the emotional component: Money carries deep psychological weight connected to security, self-worth, power, and fear. Recognize that resistance may stem from shame, anxiety, or past experiences rather than malice.

Consider professional help: If conversations repeatedly stall, a fee-only financial planner or credit counsellor can provide neutral ground. Non-profit organizations like the Credit Counselling Society (available in BC, Alberta, Saskatchewan, Manitoba, Ontario, and Atlantic Canada) offer free or low-cost services to help couples develop debt repayment plans and budgets.

Protecting Yourself If Nothing Changes

If your partner refuses to change despite repeated conversations, you must protect yourself. This isn't about being unloving—it's about basic self-preservation.

Make sure joint bills are paid on time to protect your credit. Keep some finances separate—maintain your own bank account and credit card. Be very selective about co-signing new debt; remember that in Canada, co-signing makes you fully liable if your partner defaults.

Get independent advice before using your own assets to solve a partner's debt problems. Speaking confidentially with a lawyer about your rights and obligations can clarify what you're responsible for and what you're not. Provincial family law varies across Canada regarding responsibility for spousal debt, particularly in common-law relationships.

Check your credit report regularly through Equifax Canada or TransUnion Canada to ensure no unauthorized accounts or loans appear in your name.

Finally, if financial problems are symptomatic of deeper relationship dysfunction—including abuse—prioritize your safety and well-being. Organizations like provincial victim services, women's shelters, and family service agencies provide confidential support.

Love, Trust and Clear Eyes

I do not know a single person with a perfect financial history. What matters more than past mistakes is current behaviour. Love involves trust, but trust does not mean closing your eyes and hoping.

Relationships with the strongest financial foundations are those where both partners can say, "Here is the good, the bad and the ugly—and here is what we're going to do about it together."

Financial red flags don't doom a relationship; ignoring them might. The goal isn't perfection—it's partnership, transparency, and shared responsibility. When both people commit to those principles, even difficult financial situations become manageable challenges rather than relationship-ending crises.

Canadian Financial Resources

Credit Counselling:

- Credit Counselling Society: 1-888-527-8999 (BC, AB, SK, MB, ON, Atlantic Canada)

- Counselling in Credit and Debt (CICD): Programs available across Canada

Credit Reports (Free Annual Reports):

- Equifax Canada: www.equifax.ca | 1-800-465-7166

- TransUnion Canada: www.transunion.ca | 1-800-663-9980

Financial Abuse Support:

- Canadian Centre for Women's Empowerment: www.ccew.ca

- Provincial Victim Services: Contact through local police or online directory

Financial Planning:

- Financial Consumer Agency of Canada: www.canada.ca/en/financial-consumer-agency

- FP Canada (Find a Certified Financial Planner): www.fpcanada.ca

Harvey Naglie is a consumer advocate who regularly comments on the financial services sector. A former senior policy adviser with Ontario's Ministry of Finance, he brings extensive experience in financial regulation and investor protection to his advocacy work, holding an LL.M. in Securities Law and serving on the faculty at McMaster University's Directors College.