Three Spooky Charts

While we are typically an optimistic bunch, it is always good to think about the risks that lurk around the corner and understand the implications it may or may not have on our finances and portfolios. Being too focused on the risks can lead to someone simply hiding under the covers and ‘doing nothing’ which is a risk in and of itself, but if we are going to talk about the dangers that are out there, what better time to do it than in October where we embrace our fears and take to the streets dressed as zombies and monsters! We have curated a few spooky charts that should be on Canadian’s minds currently.

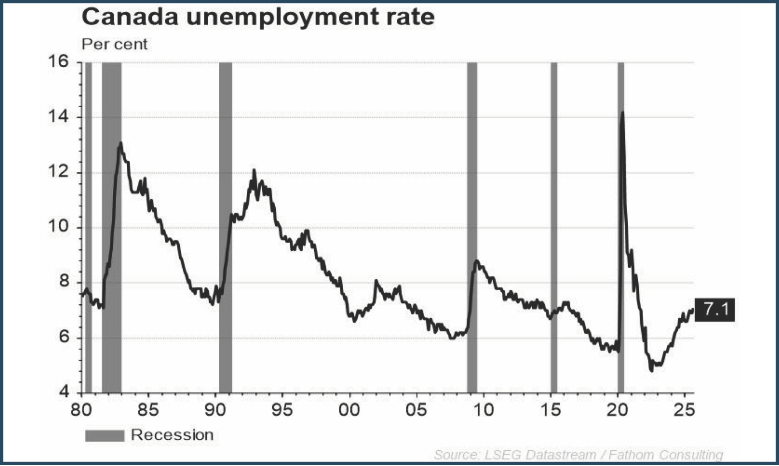

Double, Double Toil and Trouble, Fire Burn and Unemployment Bubble

The first spooky chart we have is the unemployment rate in Canada. The unemployment rate rising to 7.1% is notable on its own merit. Looking past COVID unemployment which is a bit of an outlier, Canada has not seen unemployment at this level since 2016. What might be a bit more startling here than the rate itself is the speed with which it has risen. Unemployment has gone from a low of 4.8% in July 2022 to the current levels. Typically, when you see long, prolonged rises in unemployment, it is also a sign of a recession. When you dive a bit deeper into this data, youth unemployment is particularly worrisome with 15-24 year-olds seeing over 11% unemployment and within that, 15-19 year old’s seeing over 20% unemployment.

There might be a silver lining here though. While the unemployment rate has been rising, it is rising from record low levels of unemployment, so there might be a case that this is just normalizing to regular levels. For better or worse, we will likely now in the next six months or so if this unemployment rate levels off or continues its scary trend higher.

https://refini.tv/3KgnQXZ

Screaming Valuations

Markets have certainly done well in Canada over the last year but this has also led to valuations bumping up on 20-year highs. This partially makes sense, as gold and financials have done so well and are a bigger part of the TSX, but the fact remains that TSX valuations are elevated while growth drivers at the economic and business level might be less clear or reliable. Financials, for example, still need a robust underlying economy and economic activity to be able to grow their own earnings. While gold going higher from here might help, it could also be a sign that things elsewhere are not going so well! A final point we find interesting in this chart is that the TSX tends to stick to a fairly well-defined range for its market P/E ratio. In other words, the TSX tends to revert back and forth between the well-defined 20X and 14X range. Might this time be different? Sure. But it is still a spooky chart!

A silver-lining here might be that while the TSX might be extended from a valuation perspective, trading around 20X forward earnings isn’t an overly ‘alarming’ valuation level and quite reasonable relative to other markets.

https://refini.tv/46xgQi4

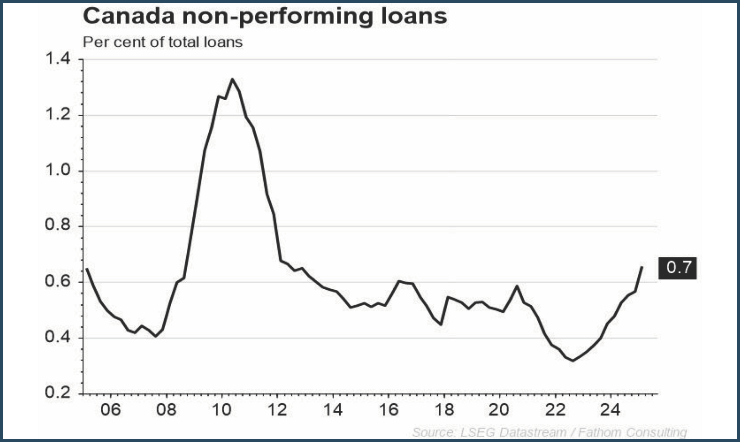

Loan Delinquency Rising From The Dead

A non-performing loan (NPL) is typically a loan where the borrower has not been able to meet their repayment obligations for at least 90 days. A rise in NPLs can be a hint that the economy is hitting a rough patch and we can see that NPLs are indeed on the rise here. What’s scarier is that we haven’t really seen this level of non-performing loans for at least 10 years and the trajectory is not comforting either. Similar to unemployment, this might just be a case of normalizing from very low levels in 2022/2023 but that rationale would be a bit more comforting without the very recent uptick we see in this chart!

https://refini.tv/47DJ77M

While these charts might be spooky, just remember, it is only three charts and we could probably find fifty charts that should make you happy and optimistic about the future. While it is prudent to be aware of and consider the risks out there, optimists tend to win over the long-term both in investing and in life, so keep smelling the roses and have a good Halloween!

Ryan Modesto,

CFA - CEO, i2i Capital Management