Are You Rich Yet? Redefining Wealth Today

In terms of net worth, what does it take to be considered rich today? In the HBO series Succession, loosely based on the Murdoch family, naïve Cousin Greg boasts that he expects to inherit $5 million from his grandfather’s will, and he’ll be “golden”. “You can’t do anything with five million,” a wealthy relative tells him. “Five is a nightmare. Can’t retire. Not worth it to work. It will drive someone ‘un poco loco.’”.

According to the UBS 2025 Global Wealth Report, more people are encountering this “nightmare”. The number of “everyday millionaires”–EMILLIs—those with a net worth between US$1 million and US$5 million has quadrupled since 2000. The “Poorest Rich Person’s Club” is getting crowded with over 52 million people globally. In 2024, the world added 680,000 new USD millionaires, an increase of 1.2% from the year prior.

EMILLIs may be rich on paper, but can they spend like the truly rich without jeopardizing future finances?

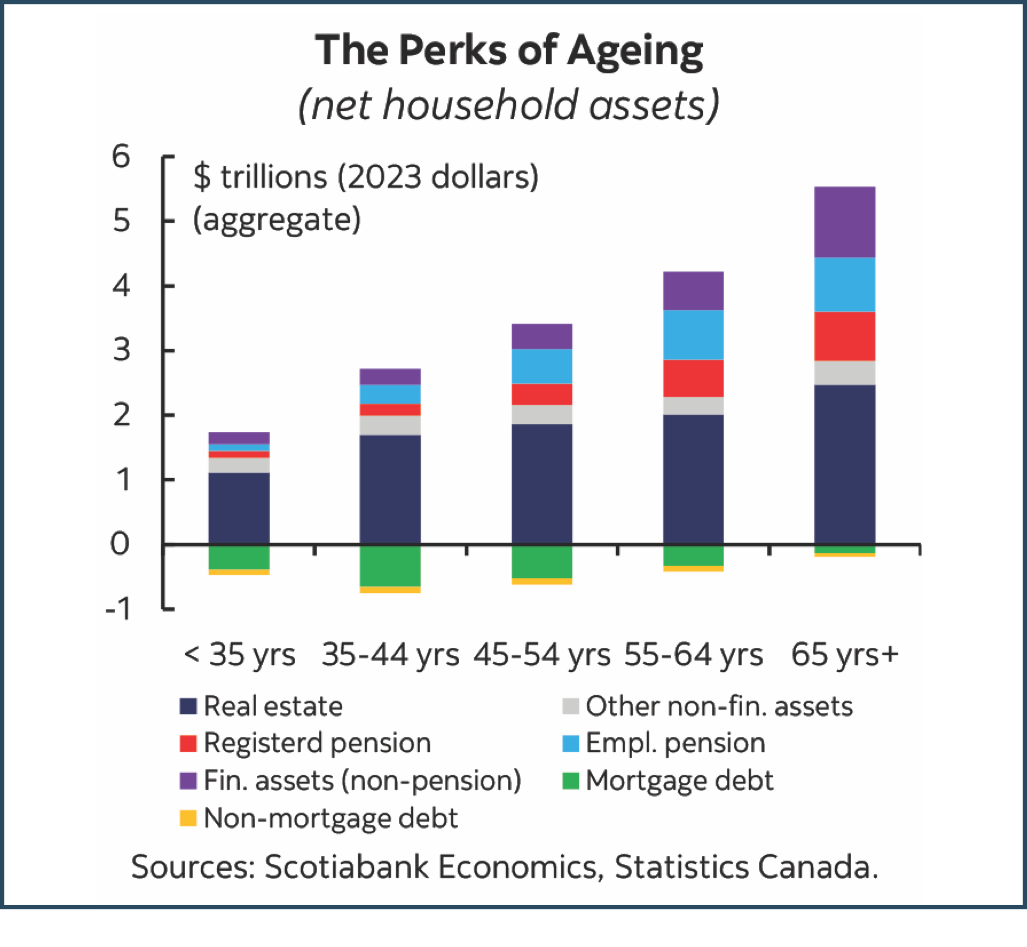

Rising stock, real estate, and even Bitcoin prices, along with inheritances from affluent Boomer parents and grandparents, have pushed some ordinary middle-class Canadian households into the coveted high-net-worth (HNW) group, which represents approximately 4.4% of worldwide millionaires. In mid-2024, net assets across all Canadian households were over $17 trillion, an astounding gain of nearly 25% since 2019. Not surprisingly, real estate represents nearly half of this amount. Pension and non-pension assets place a distant second and third.

There is a lot of daylight between the lifestyles of EMILLIs whose wealth is largely tied up in real estate and those in the very-high-net-worth (VHNW) (USD$5m-$30m), and Ultra-high-net-worth (UHNW) (US$30m+) groups. It is the UHNW, which represents just 1.1% but controls 32% of the HNW cohort. Going back to 2004, the percentage of wealth held by UHNW has remained between 32-35%. This group is 20% larger than it was five years ago, and its collective wealth of over US$49 trillion is more than the combined GDP of the U.S. and Chinese economies. These folks are not booking their vacations on Expedia!

Tapping into their net worth without harming their long-term financial health is the issue facing EMILLIs. Here’s a closer look at some of the sources of EMILLI’s wealth.

Home Base

Since nearly half of household wealth in Canada is tied up in the principal residence, subtracting it would cause a significant drop in median net worth. This would be a drag psychologically, but the new, lower amount would better reflect the day-to-day realities of funding expenses through typical sources of cashflow such as employment, dividend, and interest income. Wealth management firms typically segment clients based on the value of their investable assets minus real estate.

However, for the individual, a case can be made for including real estate in the net-worth calculation. It is a substantial asset that can be monetized to fund lifestyle expenses. It can be sold to raise cash, leased to generate rental income (short/long term lease or home sharing), and it provides cashflow through a home-equity-line-of-credit (HELOC) or a reverse mortgage.

Owning a home is still one of the best ways to boost lifetime wealth. According to Statistics Canada, households with a primary residence (and an employer-sponsored pension plan) had a median net worth of $1.4 million compared to $11,900 for those who do not own real estate.

However, it’s risky to depend entirely on rising real estate values to support lifestyle expenses. Real estate is a fixed asset, making it costly and time-consuming to convert into liquid wealth. Selling a home to fund lifestyle expenses may mean downsizing to a less desirable location or property and away from established social connections and amenities. Further, selling comes with hefty transaction costs.

Products such as reverse mortgages are costly to set up and come with high interest charges, which compound over time, eroding the value of the home equity. For those who plan to leave an estate to beneficiaries, this could substantially reduce the value of the inheritance.

Owning a home is a double-edged sword: while it strongly contributes to total net worth, it is tricky to monetize without making sacrifices. Owning multiple properties, such as a principal and a recreational residence, or a rental property, makes it easier to raise cash to fund lifestyle expenses.

Divine Dividends

Dividends are a boon for those who want to elevate their lifestyle spending without drawing on their current asset base. Those in the highest income groups rely on dividends as a major source of income. According to Statistics Canada, the top 1% of tax filers in 2022 reported an average dividend income of $97,000; the top 0.1% had $480,000, and the top 0.01% had an average reported dividend income of $2,179,000. All groups saw dividend increases from the year prior.

High-quality Canadian dividend-paying companies are a not-so-secret means to compounding wealth over the long term. Research shows that a basket of these stocks outperformed indices such as the TSX and the S&P 500 over the past 60 years because they provide superior returns to Guaranteed Investment Certificates (GICs) and government bonds. For retirees, even accounting for a small Old Age Security (OAS) clawback, dividends provide superior after-tax returns in non-registered accounts. As a bonus, rising dividends are congruent with rising share prices over the long term, which generate capital gains when sold. Data over a 50-year period showed that the annualized return of dividend payers (S&P500) was more than double (9.2% vs.4.3%) that of non-payers and with less volatility along the way.

Author Charles Ellis, investment consultant and author of the bestselling Winning the Loser’s Game, recommends tilting the portfolio toward dividend-paying equities. He points out that most people have more exposure to fixed income than they realize if they also receive pension and annuity income. Having an over-allocation to fixed income and bonds depresses total long-term returns. If you receive or plan to receive Canada Pension Plan/Québec Pension Plan (CPP/QPP), OAS, employer-sponsored pension, or annuity income, these should be added to the fixed income ledger when determining your ideal asset allocation. If the asset base is substantial enough, annual dividend income from quality high-yield companies with a history of raising dividends annually could provide a healthy, inflation-protected spending budget in retirement without the need to significantly encroach on the capital.

Live Longer to Prosper

Sticking around is another way to become wealthier. According to a Scotiabank survey, Canadians 65+ had an aggregate of nearly $6 trillion 2023 dollars, compared to slightly over $3 trillion for those aged 45-54. A common source of anxiety is running out of money later in life. In fact, many retirees underspend and leave significant estates with 43% worth over $250,000.

Net-net-net

Imagine you could choose a contract that would guarantee you a risk-free return for the next half century, and, at the same time, provide for your current spending needs. Jason Zweig, a columnist at The Wall Street Journal, posed this question recently. He named this target rate “net-net-net”—a rate of return free of risks, inflation, and fees. Knowing the lowest riskless rate of return you would accept, it helps you select how much additional risk you would be willing to accept for a potentially higher return.

At the time of writing, Royal Bank of Canada sells a 1-year non-redeemable GIC with an annual return of 2.55%. (For simplicity, let’s assume a desired 2.5% net-net-net return.)

The pre-tax, nominal return needed to achieve 2.5% is calculated as follows: Real return (desired net-net-net) = (1 + Nominal return) / (1 + Inflation rate) – 1. If the combined tax rate is 30%, inflation is 3% and the desired net-net-net is 2.5%, then R is approximately 7.96%.

The average annualized return for a balanced portfolio of 60% Canadian equities and 40% Canadian bonds (1983-2022) was 8.5%. But keep in mind this was during a period when the yields on government paper fell from mid-teens to near-zero, boosting total bond returns. Today, with asset prices near historical highs, the likelihood of similar outsized returns in the future is diminished. Investors counting on double-digit returns to fund retirement spending are likely to be disappointed. Net-net-net return goals may have to be adjusted downward. (You can run various net-net-net scenarios on ChatGPT or other Artificial Intelligence (AI) apps.)

Final Thoughts

Today, the lifestyle excesses of the ultra-wealthy stream nonstop into our social feeds like a toxic rain. This has a corrosive effect on our ability to experience gratitude and to appreciate what we have accomplished financially. It’s easy to feel dissatisfied, which can lead to taking bigger investment swings than we need to. A Financial Post survey asked readers what threshold of net worth defined being rich. Nearly 48% said “between $5-$20 million”. What does rich mean to you? A final thought from American writer Henry David Thoreau: “I was rich, if not in money, in sunny hours and summer days.”

Rita Silvan, CIM is a finance journalist specializing in women and investing. She is the former editor-in-chief of ELLE Canada and Golden Girl Finance. Rita produces content for leading financial institutions and wealth advisors and has appeared on BNN Bloomberg, CBC Newsworld, and other media outlets. She can be reached at rita@ellesworth.ca.