Docked Or Destined To Soar: A Look At Propel Holdings (PRL)

While you're sitting on the dock, lounging in your garden, or just taking a well-earned break from the daily grind, your mind might wander to your portfolio, and whether it's time to welcome a new name aboard. One company that’s been making quiet waves in the financial sector is Propel Holdings. With a focus on alternative lending and a growing digital presence, Propel has caught the attention of investors looking for an innovative company with a side of growth potential. Let’s dive in and take a closer look:

Overview:

- Stock: Propel Holdings (PRL)

- Sector and Industry: Financials - Consumer Finance

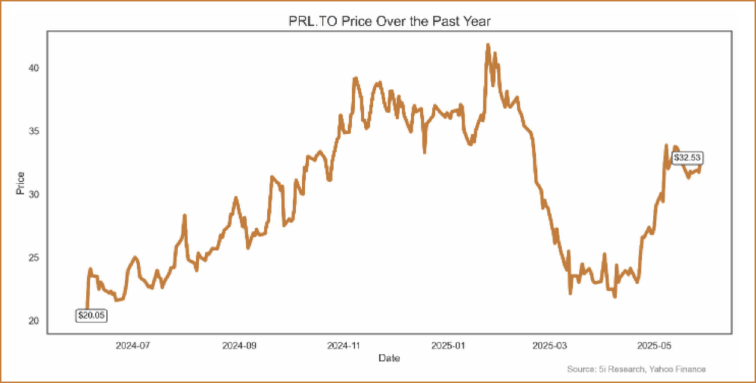

- Stock Price: $31.81 (as of 29 May 2025)

- Market Cap: $1.26 billion

- Dividend Yield: 2.2%

- 52-Week High: $43.36.

Business Overview

Propel Holdings (PRL) is a Canadian fintech company that helps people in the U.S., Canada, and the U.K. access loans. It caters particularly to those that have trouble getting loans from traditional banks. It operates under three brands: MoneyKey and CreditFresh in the U.S., QuidMarket in the U.K., and Fora in Canada. PRL uses its technology and AI tools to assess borrowers in a different way than traditional credit scores. This helps more people qualify for loans who might otherwise be overlooked. PRL has served over 1 million consumers, has over 19 million applications per year, 3 operations centres, and is 100% online. Its operations fit neatly in between traditional lenders that can be inaccessible to certain consumers and offer higher quality loans than higher APR alternatives like payday loans and lease-to-own institutions.

Growth Story

PRL facilitates access to loans through two credit products: instalment loans and lines of credit. PRL generates sales through interest and fees on the consumer loans it facilitates. It does not hold the loans on its books, but instead, banks or credit funds that it partners with fund the loans to the borrower, and PRL earns the fees and a cut of the net interest spread. A few key ways that PRL earns sales include: loan finance fees and the net interest spread on instalment loans and lines of credit, loan servicing and ancillary fees, and data services where PRL licenses part of its AI credit-scoring platform to its partners.

The underlying secular trend of consumers seeking digital lending is poised to help drive growth for PRL, as well as its continued focus on expanding its geographic presence across new states, provinces, and countries. As an example of PRLs dedication to growing geographically, in late 2024, PRL acquired QuidMarket for USD$71 million, a fast-growing consumer lender in the U.K. PRL aims to grow by also serving lower-risk markets, and instead of only serving subprime or high-risk consumers, it is now trying to target lower-risk or near-prime borrowers. PRL also offers graduation programs for its existing customers, where they can graduate to lower rates and higher loan amounts as their creditworthiness improves with PRL.

Financial Snapshot

In its most recent quarterly earnings for Q1 2025, PRL reported earnings per share (EPS) of $0.58, missing estimates of $0.59 and sales of $138.9 million which beat estimates of $137.2 million. Revenues grew by 44% from the prior year, and its loans rose by 40%. Its QuidMarket segment, the U.K.-based lender, performed better than expected, supported by a positive macro backdrop in the U.K. PRL continues to demonstrate profitable growth, particularly during what is usually a slow quarter for the company. Under the surface, PRL continues to see strong demand from consumers as individuals are left out of the traditional lending markets and turn to platforms like Propel. A general tightening of loan underwriting conditions from traditional lenders is benefiting PRL, and its consumers are proving resilient, with a reduction in its provision for loan losses from 44% in the prior year to 42% in the recent quarter. Top-line growth, operating leverage, effective cost management, and lower loss provisions helped to grow its net profits year-over-year, and its net profit margin increased to 17% for the quarter.

Profitability and Efficiency

PRL has demonstrated strong operating leverage and efficiency as its profit margins have expanded nicely over the years. Over the past 12 months, PRL saw a 42% year-over-year growth rate in its sales, but earnings grew more than 50%, demonstrating strong operating leverage.

In Figure 1, we demonstrate how PRL’s profit margins are at both the high end of its 10-year historical averages, and as compared to Canadian financial stocks. For example, its earnings before interest, taxes, depreciation, and amortization (EBITDA) margin of 22.6% is quite high relative to its 10-year historical average, and its return on equity (ROE) of 32.93% is just above average for its long-term average, but higher than most Canadian financial stocks.

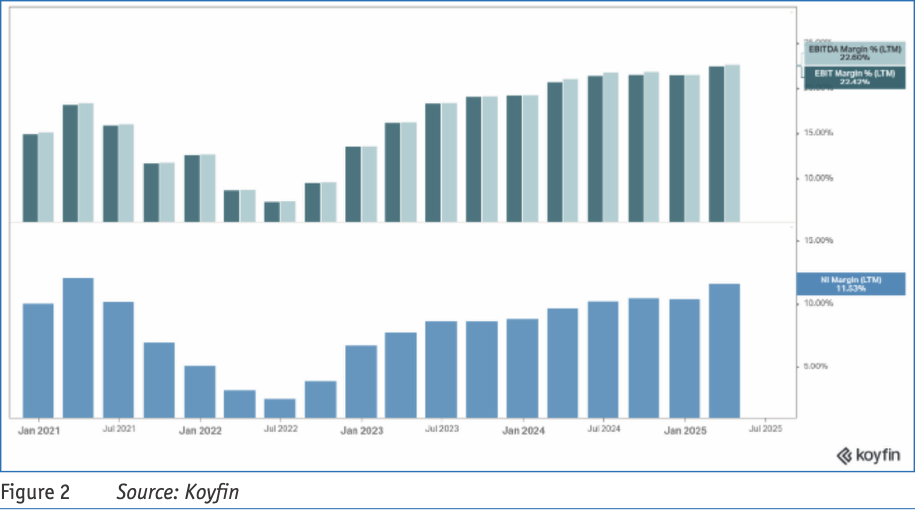

In Figure 2, we showcase how PRL’s profit margins have been expanding nicely since mid-2022. In the top pane, we show its EBITDA and earnings before interest and taxes (EBIT) margins, rising in tandem, and its net income margin showing good acceleration in its recent quarter.

Valuation

PRL trades at a relatively cheap valuation compared to its peers, which include Goeasy (GSY) and OppFi (OPFI). On a forward price/earnings (P/E) basis, PRL trades at 8.9X, a roughly 6% discount to the average of its peers, and a 1.3X forward sales multiple, a premium to OPFI, but in line with GSY. Compared to its historical averages, PRL trades at a 29% discount to its long-term P/E average, and at a slight premium relative to its historical average sales multiple.

The company’s recently added service, Lending-as-a-Service, is a capital-light and high-margin revenue stream that management believes will continue contributing to an increased ROE, and its operating leverage should also lead to expanding margins going forward.

Due to its continuous business development, rollout of new products and services, expansion into new geographies, and strong historical growth rates, we feel that its forward valuation of 8.9X P/E helps to support our thesis for price appreciation in the coming years. If the company can continue to execute on adding new business lines, expanding its partnerships and markets, and growing its top and bottom lines at these high rates, we feel that its current valuation represents an attractive opportunity.

Risks to Consider

Since PRL is a consumer lending platform, it faces credit risk, the risk of a customer or counterparty defaulting on their contractual obligations. PRL also is exposed to industry risks, as the company operates in several states across the U.S., many provinces in Canada, and now the U.K., any changes in the laws and regulations in these areas can negatively impact PRL’s results. Interest rate risk is considerable for PRL, as it has benefited from the rising interest rate environment, as consumers pushed out of the traditional financial system have sought loans with PRL. However, we feel this risk is slightly offset by a net benefit whereby PRL can see margin expansion due to its credit facilities mostly being on a floating rate basis.

Bottom Line

While PRL is a relatively new name to the TSX and it does not have too many years of operating experience, it has witnessed rapid growth in its product and service offerings across both Canada and the U.S., and it is demonstrating it can expand into new geographies with its latest acquisition of QuidMarket. Its growth rates are impressive, and the nature of its capital-light business model enables high operating leverage, which should increase its margins in the coming years. PRL trades at a reasonable valuation relative to both its peers and its historical average and given its expansion in margins as its operating leverage takes hold, we feel that it has a long runway ahead of it. Overall, this is becoming a high-quality name that has the potential for high future growth rates and continued margin expansion.

Learn More

5i Research provides easy-to-understand research reports on over 50 Canadian growth and dividend stocks, including PRL. For more, or to try 5i Research for free, visit www.5iresearch.ca

Chris White, CFA, Head of Research for 5i Research Inc.

Disclaimer And Disclosure: The opinions expressed in this article are the opinions of the analyst about this company and industry. Neither the analyst nor any employee of 5i Research own any shares of the subject company and does not offer shares for sale of the subject company. No fees were paid by the subject company to 5i Research for the production of this article. The analysts who produced this article are required not to trade in any individual Canadian security.