Toromont: A Heavyweight Worth Hauling In?

Maybe the stock market isn’t the first thing on your mind as you soak up the sun this summer, but that doesn’t mean opportunities aren’t out there. If you're looking for something solid and steady with a history of performance, Toromont Industries Ltd. (TIH) might be worth a closer look. Known for its dominance in heavy equipment and industrial solutions, especially as a leading Caterpillar heavy equipment dealer in Canada, TIH combines operational resilience with long-term growth potential. Read on to learn more:

Overview:

- Stock: Toromont Industries (TIH)

- Sector and Industry: Industrials - Specialized Equipment Rental

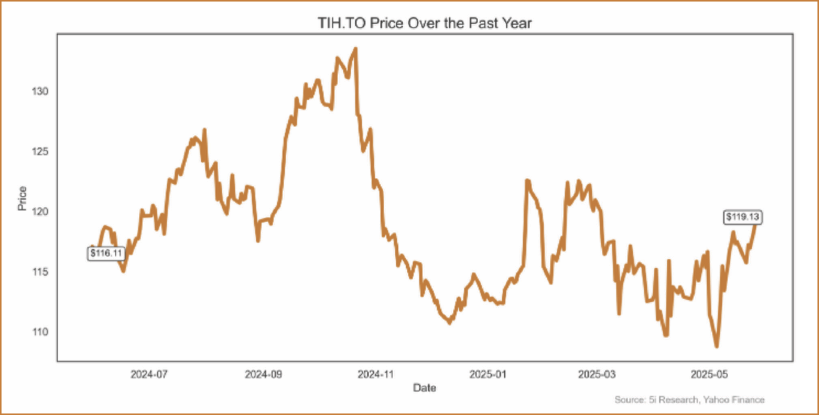

- Stock Price: $120.2 (as of May 29, 2025)

- Market Cap: $9.77 billion

- Dividend Yield: 1.7%

- 52-Week High: $134.88

Business Overview

TIH is one of the leaders in providing specialized equipment rental services in Canada. The company has an exclusive partnership with Caterpillar, which helped TIH maintain a favourable market share in some of the key regions in Canada over the years, including Ontario and Quebec. TIH competes with international and national distributors of similar specialized equipment with industry-leading market share.

TIH’s specialized types of equipment are widely used in a variety of industries, including residential and commercial construction, mining, road building and other infrastructure-related activities. The company also served the industrial market by designing and installing refrigeration systems under the brand CIMCO, which was a successful acquisition for TIH a few years ago.

TIH’s share price has been under pressure recently due to the expected cyclical industry downturn, which negatively affected the company’s profitability for some quarters. However, over the long term, TIH has possessed a superior track record of creating shareholder value with a 55-year dividend record and 34 years of consecutive dividend growth.

In addition, over the last 30 years, through multiple economic recessions, industry cyclical downturns and the pandemic, TIH has been one of the best-performing stocks in the Canadian market. TIH managed to compound shareholder capital at around 17% per year on average (dividend included).

Growth Story

Despite operating in a tough competitive landscape which depends on a variety of factors, including distribution capabilities, range and quality of products, and reputation of the distributors, the company maintained a stable market share over the years, along with a strong sense of creating shareholder value through profitable organic growth.

Here are the company’s initiatives to allocate capital and drive organic growth over time:

1. Strengthen Product Support: Target a more balanced revenue mix with a focus on product support (currently 43%) such as driving after-market strategies and delivering customer solutions. This can offset some of the cyclicality from equipment delivery due to the recurring nature of the service offering.

2. Broaden product offering: deliver specialized capital equipment to a diverse range of customers and industries and expand customer base by increasing the product lines and capabilities.

3. Maintain a strong financial position with healthy liquidity and solid return on capital invested over the business cycle.

4. Offer a progressive dividend policy along with an opportunistic approach to share buyback.

5. Focus mainly on driving organic revenue growth while occasionally opportunistically making large-size acquisitions.

Financial Snapshot

TIH operates in a cyclical industry, as demand for its products is sensitive to the macro environment and economic activities. However, in recent years, TIH’s management has stabilized the company’s revenue by growing other streams of recurring revenue, such as service, spare parts and support.

For the most recent fiscal year ended 31 December 2024, the company mainly generated revenue through three key services, including

- Equipment sales/rental (59.1%)

- Product support services, including the sale of parts and performance of service work on equipment (40.7%)

- Power generation (0.2%)

TIH possesses a large diversified customer base by geography and industry without any significant concentration of revenue with any individual customer. In terms of operating divisions, TIH has two main segments: The Equipment Group focuses on the construction and infrastructure-related market, while CIMCO serves customers in industrial sectors through services like engineering, installation and production support for refrigeration systems. The company generated 90.8% of total revenues from the Equipment Group and 9.2% from the CIMCO segment.

Geographically, TIH has a main presence in North America, most sales came from Canada at 97%, and 3% from the U.S. The company completed the acquisition of Tri-City Equipment Rentals for a total of $77.5 million, a leader in heavy equipment rentals with operations in Southwestern Ontario. The acquisition is expected to expand the company’s heavy equipment rental business through additional market presence and new customers.

Profitability And Efficiency

For the most recent quarter ended 31 March 2025, the company reported total revenues of $1.089 billion, a year-over-year increase of 7.0% from $1.016 billion, mostly driven by decent sales growth across two operating segments of Equipment Group and CIMCO, which grew by 7% and 9%, respectively. Operating income declined by 8% to $98.5 million from $106.6 million in the same period last year due to lower gross margins and slightly higher expenses. Operating margin was 9.0% compared to 10.5% in 1-2024.

TIH’s return on equity (ROE) declined to 18.5% on a trailing twelve-month basis, which was a drop from the previous year of around 22%, indicating room for improvement here, given that the company is currently in a cyclical downturn and in the process of integrating a large acquisition.

Despite a difficult operating environment, TIH possesses a strong culture of operational efficiency. Revenue per employee grew from $548 thousand in 2020 to around $698 thousand in 2024, which indicates a solid culture of disciplined cost control.

Management’s financial objective is to achieve consistent double-digit growth in earnings per share (EPS) and, at the same time, maintain at least an 18% return on equity (ROE) over the business cycle. TIH has consistently done well under those metrics.

Valuations

TIH is perceived as a high-quality industrial name due to its great track record of operational efficiency and value creation. TIH has mostly traded at a premium relative to its peers. TIH is currently trading at a meaningful premium of Forward P/E of 20.1x, compared to its direct competitors in the international market, such as Finning International (FTT), which only trades at 12x. However, TIH’s premium valuation makes sense given its superior operating metrics including organic growth and return on equity.

Compared to historical averages, TIH’s valuation is on par with its valuation multiples over the last ten years. Long-term investors in TIH could do quite well with expected annualized total returns (dividend included) in the range of 12%-15% in a low-risk manner.

Risks To Consider

TIH faces an inherent risk of cyclicality in the demand for its products and services, which are sensitive to the macro environment and economic activities. For instance, the company currently faces a headwind in terms of booking growth and profitability due to the industry’s cyclical downturn. Management is trying to address this by focusing on growing more recurring revenue sources, such as product support services. Secondly, the company pursues growth through a combination of acquisitions and capital investment, which raises the risks of both overpaying for deals and high operational leverage. Given the cyclicality of the business, the high operating leverage could negatively impact its profitability in the downturn when sales decline. Lastly, the company is dependent on the exclusive relationship between the company and Caterpillar. A deterioration in the acceptance of Caterpillar products and the partnership between the two companies could seriously affect TIH’s prospects. However, TIH is one of the world’s largest dealerships of Caterpillar by revenue and geographic territory, so it is unlikely that both parties would do something that could damage the relationship between the two.

Bottom Line

The recent industry downturn has lasted longer than expected, and has put pressure on the company’s margin and return on equity. It is understandable, given the cyclicality of the business, that earnings would be sensitive to economic activities. In addition, TIH possesses a solid track record of value creation through acquisitions and is in the process of integrating the newest acquisition. We think the recent fluctuation in operating results is normal, and we do not see any meaningful change in the company’s fundamentals yet. TIH continues to be a high-quality industrial name with a shareholder-friendly policy through a combination of progressive dividend history and occasional share buyback. TIH managed to compound shareholder capital at around 17% per year on average (dividend included) over the last 30 years, which indicates the longevity and sustainability of the business model. TIH is trading at a fair valuation, which should do well in the next industry cyclical upturn.

Learn More

5i Research provides easy-to-understand research reports on over 50 Canadian growth and dividend stocks, including TIH. For more, or to try 5i Research for free, visit www.5iresearch.ca.

Disclaimer And Disclosure:

The opinions expressed in this article are the opinions of the analyst about this company and industry. Neither the analyst nor any employee of 5i Research own any shares of the subject company and does not offer shares for sale of the subject company. No fees were paid by the subject company to 5i Research for the production of this article. The analysts who produced this article are required not to trade in any individual Canadian security.