Alternative Asset Funds: Must-Have Or Most Hyped?

Like every consumer industry, investment tastes change to reflect the times. The utilitarian 60/40 portfolio is now deemed passé and poorly suited for these tumultuous times. Alts (a.k.a. ‘alternative investment strategies’) are roaring down the product pipeline. Once the exclusive domain of institutional investors, family offices, and high-net-worth individuals, these often pricey and opaque strategies, such as private equity, private credit, and venture capital, are now being pitched to the hoi polloi. But are they “a must-have”—or “a most hyped”?

The backdrop for the alts pitch could not be any better. After the strong returns of the past several years, the landscape has changed. Rising political and economic uncertainty amidst high market valuations is making investors jittery. Enter alternative strategies which promise to provide growth, income, capital preservation and diversification. Investors are listening: According to Prequin1, the global alternatives industry is expected to reach nearly $30 trillion in assets under management (AUM) by 2030, representing an annualized growth rate of 9.7%. Currently, alternative assets such as real assets, private equity (PE) and private debt, make up around 15%2 of global AUM.

The ALT SHOPPE

Alternatives can include real assets such as real estate, infrastructure, natural resources, and even art, vintage wine, designer handbags, and other collectables. However, actively managed alternative fund strategies fall into these seven categories3: private equity, venture capital, private debt/credit, hedge funds, real estate, infrastructure, and natural resources. Private equity has the leading share (67%) of the $15.1 trillion private markets assets class4.

- Private equity strategies invest in non-publicly listed businesses. PE firms may be part or full owners of the companies or own shares in them. A liquidity event (such as a sale to another PE firm, an IPO, or an acquisition by another firm) generates capital gains to investors.

- Venture capital funds invest in start-ups with expected high growth rates.

- Hedge funds aim to hedge out market (beta) risk with long/short strategies, merger arbitrage or investments in assets whose value growth is not market dependent.

- Private Debt/Credit funds provide loans to businesses.

- Real estate funds acquire, finance and own either residential, commercial, or industrial properties. They may also invest in funds or firms that invest in these properties.

- Infrastructure funds invest in services and facilities in essential areas such as utilities, telecoms, transportation, waste management, bridges, tolls, energy, etc.

- Natural resources funds may invest in timberland, water, metals, agriculture, and energy.

Why Invest in Alts?

Recent regulatory changes have made some of these strategies available to regular (non-accredited) investors in the form of “liquid alternative” mutual funds which can be traded easily.

As global markets become increasingly correlated5, there is a case for adding alternatives as diversifiers. Historically, stocks and bonds are negatively correlated to growth volatility but positively correlated to inflation volatility, something bond investors experienced in 2022. Hedge funds may use leverage and long/short strategies which aim to provide a positive absolute return regardless of market direction.

Private markets are less efficient than large, publicly traded markets. Experienced managers may be able to exploit attractive opportunities in mispriced assets to generate superior returns.

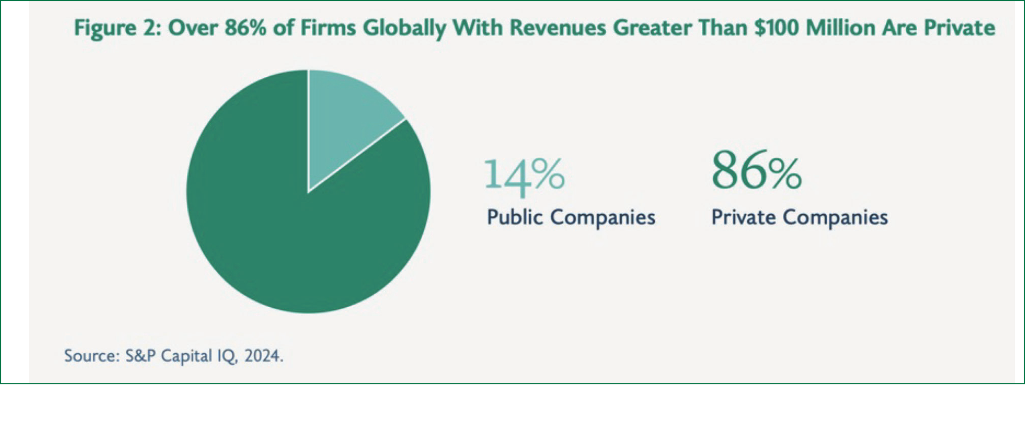

A growing number of leading companies, such as Open AI, SpaceX, ByteDance, and Stripe are choosing to remain private for longer. Supplied by PE investors, they may not need an IPO to raise funds and thus avoid the regulations, compliance and reporting requirements and the scrutiny of being publicly traded. PE funds can help investors access a wider investable universe. For example, globally, 85% of companies6 with revenues over $100 million are privately owned. By 2024, there were 2.5 times7 more companies backed by private equity compared to public companies.

Investors generally prefer lower price volatility. Because private assets are typically priced mark-to-model, they display less visible price volatility than publicly traded equities. Many leading private companies are “capital light”, with the value comprised of the intellectual capital and software systems, not buildings and machinery. This makes active manager expertise paramount to assess the intrinsic value of the company.

Why To Not Invest In Alts?

Compared to public markets where price discovery is easy, private markets are opaque, with less regulatory obligation to disclose financial information such as earnings and revenues, and compensation and incentive pay packages. Liquid alternative mutual funds and ETFs are subject to similar disclosure requirements as conventional funds, however private assets, by their very nature, make full transparency challenging.

Private asset prices are mark-to-model. This may give investors the illusion of lower volatility in private assets, but this is only because the current market value of the asset is not verified. There could be a meaningful gap between expected and actual asset values. The asymmetry of access to information between what the seller (fund manager) and buyer (investor) knows reduces market efficiency and could mislead investors into owning poor quality or “zombie” companies.

Alternative asset funds are more illiquid than publicly traded funds. There may be hard or soft lock-up periods, making them a poor fit for investors who need access to their capital. The new class of liquid alternative funds address this challenge by being easily tradeable, and by keeping some of their holdings in short-term paper. However, the need for greater liquidity may come at the cost of lower total returns.

With the dominance of low-cost passive funds, the investment industry must find other ways to generate fees. Funds specializing in actively managed alternative strategies are priced at a premium, and charge performance fees which can erode returns over the long term. High fees may also incentivize some managers to take bigger risks to defend the fee structure.

Control + ALT: Is There An Alternative To Alts?

Cash: Returns on cash will not blow the roof off, but neither will they rip your face off. Cash is non-correlated to other asset classes. Those near or in retirement, or with impending costs, or who have employment uncertainty, or who prefer, like Warren Buffett, to have a significant war chest for future buying opportunities, or who simply prefer to sleep well at night, should consider holding a slug of cash. Your financial advisor may not encourage this (low to no fees) but cash serves as a diversifier of returns, in other words, a “no-frills alt”.

Real Estate: Do you own a home, a cottage and/or investment properties? Eureka! Real estate and land are alternative assets and should be added to the “alts” column of your investment portfolio.

Pension/Insurance: Canada Pension Plan CPP (and Quebec Pension Plan (QPP) have significant allocations to alternatives including global private equity (33%), private credit (approximately 13%), and infrastructure (9%), based on the 2023 CPP Annual Report. For example, CPP Investments8 has over $700 billion AUM divided between Base CPP and Additional CPP, two funds with different asset allocations. Municipal, provincial, and private sector pension funds, as well as insurance companies, hold alternative assets.

BAM+: An affordable way to gain additional alt exposure is to buy shares in Brookfield Asset Management (BAM). Brookfield Corp (BN): trophy real estate, insurance, infrastructure and 73% ownership in BAM; BAM: purest private equity/alternative asset manager in North America with over $1 trillion AUM; Brookfield Infrastructure Partners L.P. (BIP): owners and operators of critical global infrastructure networks; Brookfield Renewable Partners LP (BEP): renewable power and decarbonization solutions in five continents. You get the alts' strategies and the dividend, and you only pay trading commissions.

Twosies: Finally, a word from legendary distressed debt investor Howard Marks9 on asset allocation, who posits there are only two asset classes: ownership and debt. To participate in the financial side of a business, an investor can either own part of it (equity) or make a loan to it (debt). Ownership involves higher risk with the potential for higher returns, while debt, by its contractual nature, involves lower risk and typically lower potential returns. Every investor must decide for themselves, based on income needs, investment horizon, financial position, goals, aspirations, responsibilities, and temperament, what the optimal asset mix should be. Do not let the current fashion for alts—or whatever the next trend will be—distract from investing fundamentals.

Rita Silvan, CIM is a finance journalist specializing in women and investing. She is the former editor-in-chief of ELLE Canada and Golden Girl Finance. Rita produces content for leading financial institutions and wealth advisors and has appeared on BNN Bloomberg, CBC Newsworld, and other media outlets. She can be reached at rita@ellesworth.ca.

1 https://www.globenewswire.com/news-release/2024/09/18/2948056/0/en/Global-alternatives-markets-on-course-to-exceed-30tn-by-2030-Preqin-forecasts.html

2 https://www.pwc.com/ng/en/press-room/global-assets-under-management-set-to-rise.html

3 https://www.preqin.com/academy/lesson-1-alternative-assets/what-are-alternative-assets

4 https://www.brookfieldoaktree.com/insight/alts-quarterly-trends-watch-2025

5 https://www.aqr.com/Insights/Research/Journal-Article/A-Changing-Stock-Bond-Correlation

6 https://www.brookfieldoaktree.com/insight/alts-quarterly-trends-watch-2025

7 https://www.visualcapitalist.com/sp/public-vs-privately-held-companies-the-shifting-landscape/

8 https://www.newswire.ca/news-releases/cpp-investments-net-assets-total-646-8-billion-at-first-quarter-fiscal-2025-891440681.html

9 https://www.brookfieldoaktree.com/sites/default/files/2024-10/ruminating-on-asset-allocation.pdf