Portfolio Confidential

I have most of my holdings in large-cap Exchange-Traded Funds (ETFs) such as the S&P 500 and the Nasdaq. But I have a small 5 to 10% holding in the Russell 2000, on the theory that after a decade of lagging small and mid-cap performance, they are due for outperformance any day now. However, the mega cap strength, led by the Magnificent Seven, is making me wonder if small and mid-caps will ever outperform again.

I realize that kind of throwing in the towel or capitulation is normally a sign that the asset class is about to outperform! Any views on small-cap versus large-cap?

I reached out to my former colleague Levon Barker, Portfolio Manager, U.S. Equities, Cumberland Private Wealth Management Inc. for his views on this topic:

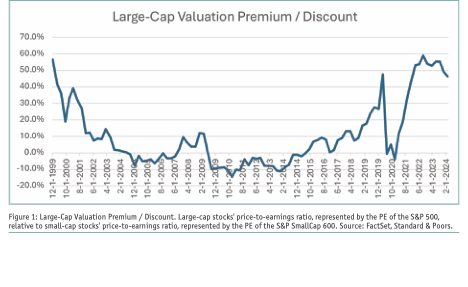

“Waiting for small-caps to outperform has felt like waiting for a pot of water to boil when you forgot to turn the burner on. Small-caps haven’t outperformed the large-cap indices since the early 2000s after the dot com bubble burst and the U.S. was coming out of a mild recession. Back then, U.S. large-cap stocks had peaked at almost a 60% valuation premium to small-cap stocks (as measured by forward Price/Earnings (PE).) Recently, the markets have reached the same level of valuation disconnect. An argument can be made that the large-cap trade is maturing.

Valuation alone, however, isn’t enough to reverse the trend. Like the cold pot of water, small-cap stocks will need a catalyst to gain steam. In the early 2000s, the catalyst was earnings growth. From the end of 2000 to the end of 2007, small-cap stocks grew earnings 156% versus only 11% for their large-cap peers. And during that time, small-cap stocks advanced 70% while large-cap stocks were up only 22%. Since emerging from COVID, at the end of 2021, large-caps have grown earnings by 8.4%, while small-cap earnings have declined by 15.9%. It’s no wonder investors are pursuing larger companies which are better capitalized and usually have structural competitive advantages.

What could cause small-cap earnings to start to outperform? Falling interest rates. Small-cap companies tend to carry more debt than their large-cap peers which are often flush with cash. Further, the cost of debt for small-caps has risen ~200bps from 2021 to the end of 2023, but only ~100bps for the S&P 500 . Because of this, small-caps have a higher proportion of expenses related to interest expenses. Assuming the economy holds up, moderating interest rates combined with the excessive valuation discount could help small-cap stocks find their boiling point.

An allocation to small-cap stocks can be a good diversification tool. Small-cap indices, like the Russell 2000 are less concentrated than the large-cap indices. The top 10 stocks in the S&P 500 make up almost one third of the index, where the top 10 stocks of the Russell 2000 account for less than 6% of the total index. The less concentrated nature of small-cap indices creates greater potential to add alpha through in-depth research and active management.

My daughter is thinking about becoming an investment advisor. She is great with numbers but she is quite introverted and she struggles with socializing at times. How much socializing is needed to be a successful advisor?

In my 30+ years of experience working in the investment industry, I’ve seen a wide variety of personality types succeed as investment advisors. My #1 piece of advice is always to be yourself! In your daughter’s case, she could take advantage of a typical introvert personality strength: one-to-one relationships. When it comes to advisor/client relationships, “like attracts like” so if she sticks with her most comfortable way of working, she will be best positioned to meet clients that are a good fit for her personality.

I am also quite introverted so as an investment advisor I would spend the bare minimum amount of time attending large noisy client events. However, I successfully cultivated deeper relationships via one-on-one meetings. Where can an introvert advisor excel? I can think of three proven strategies:

Focus on education. Advisors that position themselves as the “go-to” person for information will be rewarded in spades. Welcome any and all questions without judgment and make it easy to learn about investing.

Help people with their life picture. A big part of an advisor’s job is to facilitate networking. Ask people “How can I help you?” and “Who do you need or want to meet?” Follow through and make it happen.

Be a problem solver. Managing investments for high-net-worth clients means you will be asked to solve just about every kind of problem. You will hear deep dark secrets before anyone else does—including family members. Over the years, I have received phone calls on the weekend or late at night about: "I'm thinking of leaving my wife. My business partner had a car accident and I want to buy him out. My daughter has cancer. I have been packaged out of my job as an executive. My husband is an alcoholic."

How much socializing is needed to be an investment advisor? If we define socializing in the conventional sense, according to the Oxford Dictionary “the action or practice of participating in social activities or mixing socially with others”, I don’t think it is way up there on the list of what universally works to make advisors a success.

Many good advisors prefer to limit socializing to one-on-one coffee chats or lunches. And many good advisors broaden the definition of socializing to include the three proven strategies outlined above.

Do you have questions about your own investment portfolio? Consider calling The Rich Thinking® Financial Advice Hotline. This will be a win/win: you get a free 30-minute confidential Zoom chat offering an independent, unbiased perspective on your financial situation with no sales pitch! In exchange, I get to use the anonymized data that will come from these conversations to make my Rich Thinking research even better. Email me to book your Zoom discussion: barbara@barbarastewart.ca