Beating The TSX Annual Update 2023/2024

It’s that time of year when Christmas decorations are put away and one more row is added to my Beating the TSX Results spreadsheet. It’s like writing a story, one sentence every year. This narrative began back in 1987, the first year David Stanley started tracking the results of this simple but powerful investment strategy. Since then, there have been ups and downs, twists and turns, doubts and exuberance. Over 36 years, a story has emerged: individual investors can outperform professionally managed funds.

The secret lies in the words of the world’s most quotable investor, Charlie Munger:

“You don’t have to be brilliant, only a little bit wiser than the other guys, on average, for a long, long time.” - Charlie Munger

This is the key to successful investing and the key to Beating the TSX. Counterintuitively, brilliance can be a hindrance because it often leads to over-confidence. If you want to be a little bit smarter than other investors for a long, long time, my suggestion is to arm yourself with an investment plan that is easy to understand and simple to execute. You don’t have to be smart as long as your plan is.

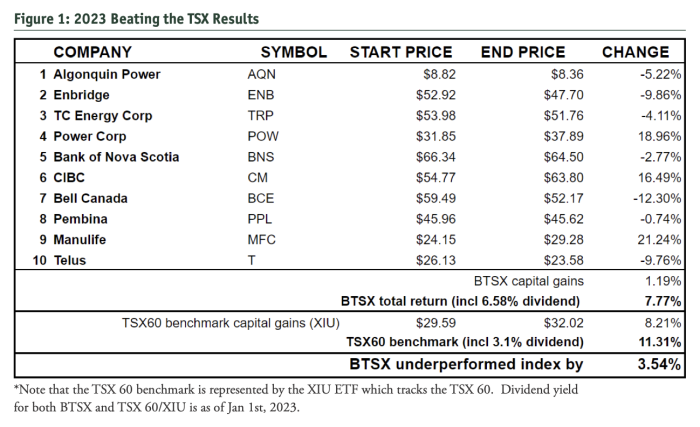

Beating the TSX is a simple method of selecting Canadian dividend-paying stocks that rarely offers spectacular short-term returns. In fact, in 2023 it lagged the index by about 3.5%. But, on average, it’s been a little better than the index by a few percentage points - and, as Munger says, that’s what matters in investing.

Beating The TSX: How It Works

Created by David Stanley in the 1990s, BTSX is a simple method that anyone can use to identify Canadian blue-chip dividend-paying stocks that might be worthy additions to your portfolio. I’ve been using the method personally since 2008 and writing about it since 2018. There are just three steps:

1. List the stocks on the TSX60 by dividend yield.

2. Purchase the top 10 yielding stocks in equal dollar amounts.

3. Hold for a year and repeat.

The method usually results in a portfolio of stocks with several appealing characteristics:

- They are large and usually stable companies with low volatility.

- They have a high dividend yield.

- Most have a long history of stable and growing dividends.

- They are often purchased when their stock prices are depressed.Every good investment strategy will have periods of underperformance. After two years of beating the index, the recent weakness in dividend-paying stocks has caused BTSX to lag the TSX 60 by 3.54% with a total return (price + dividends) of 7.77% vs. 11.31% for the benchmark.

Thirty-six Years Of BTSX Returns

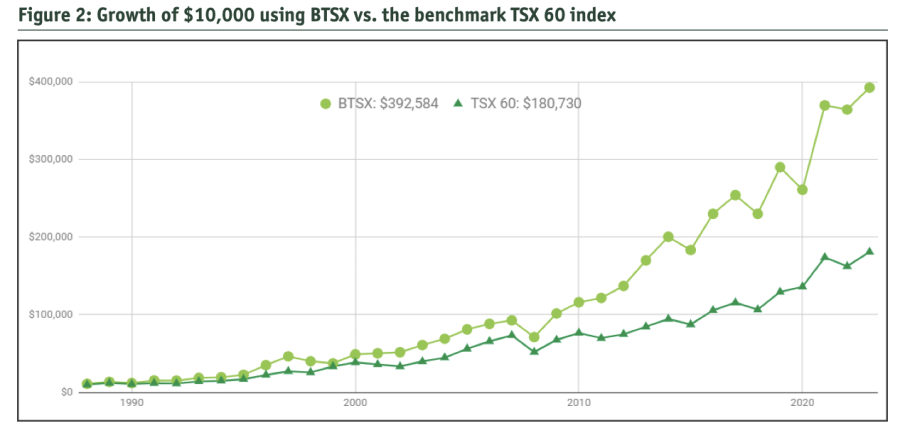

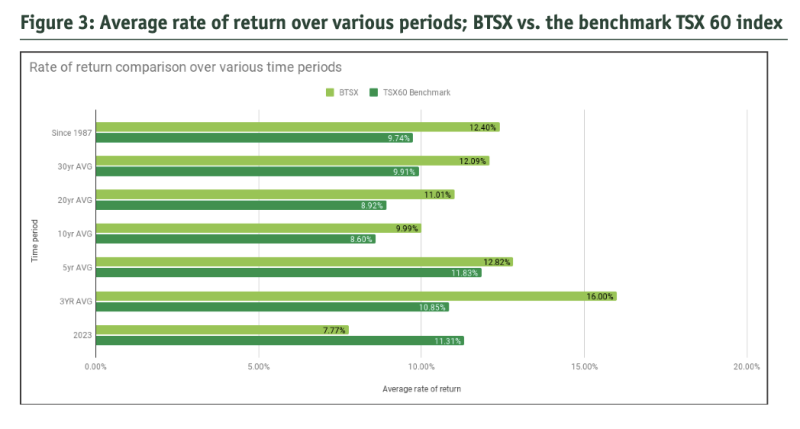

If you’re tempted to dismiss Beating the TSX based on this year’s returns alone, let’s put them in context. In investing, it’s decades that matter, not years. Over the last 36 years, BTSX has displayed an average annual outperformance of 2.66% over the TSX 60. This means that, if you had invested $10,000 in BTSX stocks 36 years ago, you would now have $392,584 – over double what a TSX60 index investor would have (in both cases total returns re-invested).

What about periods less than 36 years? Even though Beating the TSX fell behind the index last year, it has beaten the benchmark over the last 3, 5, 10, 20, and 30-year periods. How many mutual funds do you know of with a track record like this?

BTSX: Strengths and Weaknesses

Results are always compelling but performance is just one factor that investors must consider. Beating the TSX stocks offer many advantages including:

- They tend to be large, stable, profitable companies.

- They are purchased at attractive valuations.

- They provide high dividend yields.

- They tend to raise their dividends over time.

But BTSX has limitations as well, including:

- The possibility of dividend cuts.

- Suboptimal sector diversification.

- Not all BTSX stocks will be winners.

- The BTSX portfolio doesn’t always beat the benchmark.

If you’re going to use Beating the TSX successfully, you need to be aware of these limitations. Have a plan for dividend cuts, to achieve adequate diversification, and understand there will always be individual stocks and individual years that will take some of the shine off the method. If the goal of any investment strategy is to be a little better than average over long periods, it's important to prepare yourself for temporary underperformance.

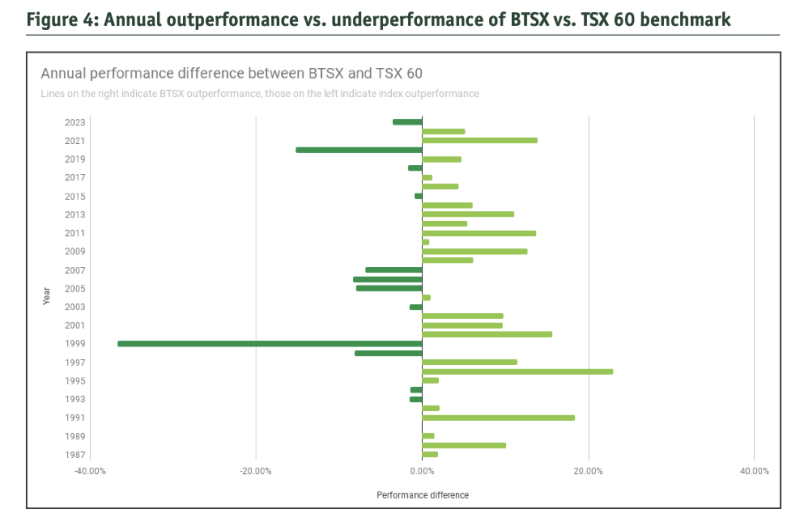

Figure 4 will help you understand the ups and downs of BTSX’s performance over time. It shows how BTSX has performed relative to the TSX60 index year by year; 2023 is at the top and 1987 is at the bottom.

The finance author Morgan Housel explains wealth generation as “investment returns to the power of time”. Time is the exponent. Time is the multiplier. Beating the TSX has had years far worse than 2023 but it is a long-term strategy. Committed investors who have held through the down years have been handsomely rewarded.

BTSX Dividend Income

Many investors are attracted to Beating the TSX because of the dividend income. Not only are dividend-paying stocks less volatile than non-dividend-paying stocks, but investing for income makes sticking to your investment plan more likely. Even though the market may be down and the headlines full of doom and gloom, dividend investors are incentivized to hold rather than sell. In fact, as prices fall, reliable dividend payers get even more attractive because their yields go up.

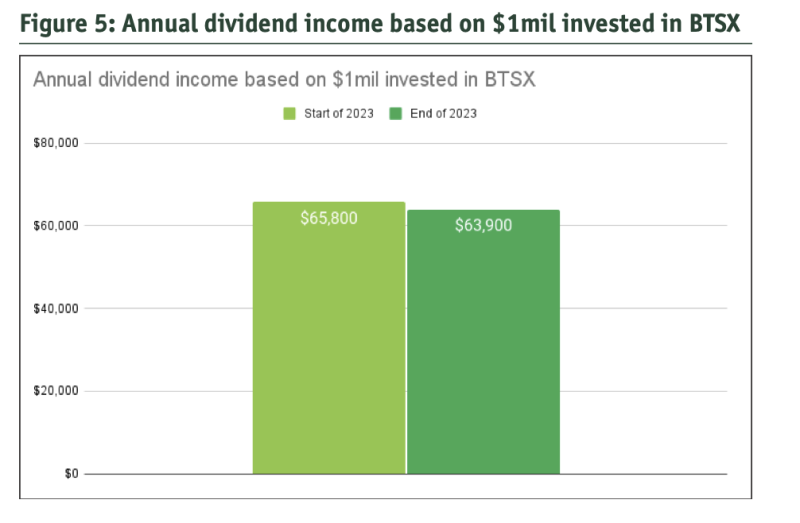

BTSX started 2023 with a very juicy average dividend yield of 6.58%. Since then, every stock on the list raised its dividend with the exception of AQN which, predictably, cut its dividend. But even with that 40% dividend cut, the total dividend yield for the portfolio remained at a very respectable 6.39%. What this means in real dollars is that if you had $1mil invested in the ten BTSX stocks, your annual dividend income would have gone from $65,800 at the beginning of the year to $63,900 at the end. (See Figure 5.)

Beating The TSX 2024

Investing can get very complicated very quickly. Some of us find the details interesting, but the fact is that complex investment strategies are associated with worse returns, not better. The best thing about BTSX is its simplicity. DIY investors have been able to access exceptional returns - no special skill required.

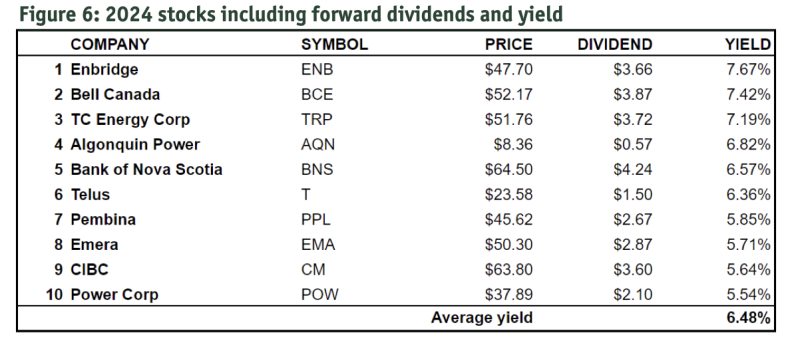

The chart below shows the list of stocks for 2024 including their forward dividends and yield.

As always, this post is for information purposes and is not investment advice. Beating the TSX can be a powerful tool to identify potential investments but should always be used in the context of a complete financial plan.

Wishing you all the best in 2024!

Matt Poyner is a DIY investor, flat-fee financial planner, and author of the blog DividendStrategy.ca. He can be reached at contact@dividendstrategy.ca