Portfolio Confidential

Q: I am a teacher, but I’m not enjoying my teaching as much as I would like. I am 57 years old, and I don’t have the passion or energy for it anymore. I’m hoping to retire around 62 or 63, and if necessary, I could continue to work part-time as a supply teacher. I am trying to imagine different scenarios for my life moving forward. One scenario is leaving my work and working on my side project; this would mean selling my home and finding a situation where I could live frugally but well. The more traditional approach would be to retire at 65 and start doing what I want with my life then. Whenever I talk to my investment people, I don’t understand a word they are saying.

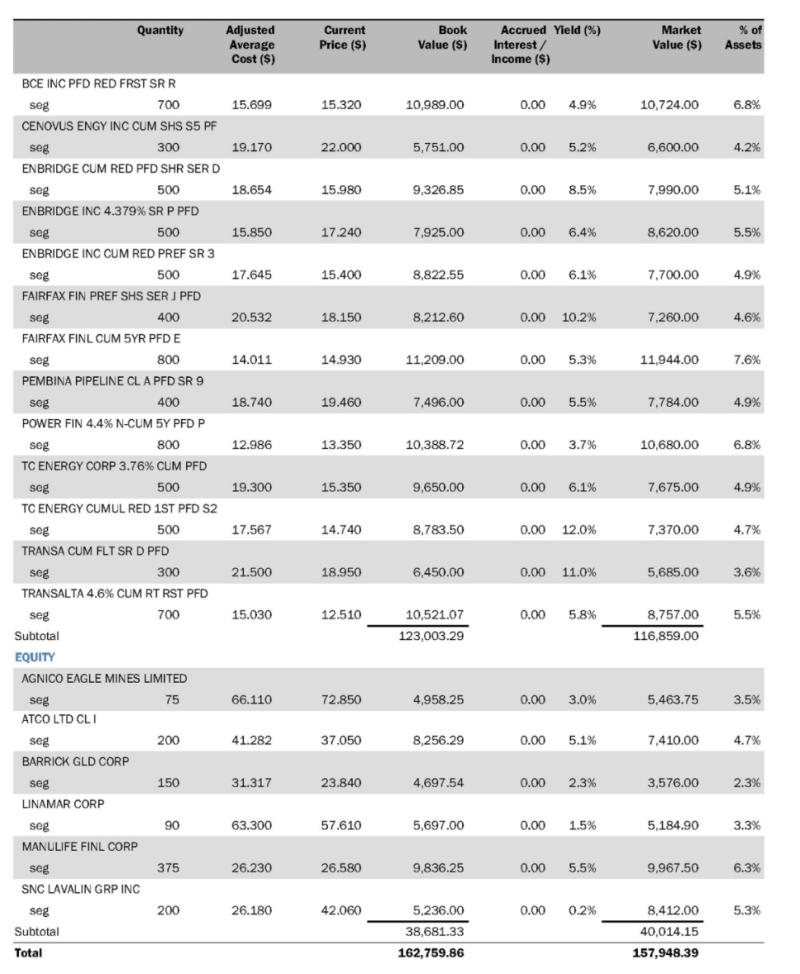

I was recently introduced to a woman advisor who was super helpful and took the time to explain things to me. She said holding so many preferred shares was unusual, especially in a Tax-Free Savings Account (TFSA). She also suggested my advisor might get paid extra on preferred shares. Another thing she pointed out was the few common shares in my account seemed like “placeholders”, stocks that were chosen without conviction. Before I think about moving my investments to her, I thought I would ask your opinion of her comments and her qualifications.

A: I think you will be better served with Mary Lacasse (name changed as requested)—I checked out her LinkedIn profile, and she has an extensive background in the industry, plus an MBA with a focus on wealth management. Her firm is reputable, and importantly, they charge a management fee but no trading commissions, so the incentive isn’t there to push certain securities over others.

Mary’s comments about the preferred shares make sense. If your objective is growth, why not common shares? And the dividend tax treatment isn’t a positive factor if they are held in tax-sheltered accounts. So, this leads me to the same conclusion—the mix of securities appears to be quite random. What are you paying for if there is no real strategy?

My advice would be to ask Mary to prepare a financial plan for you before you become a client. Her firm’s website says they do financial plans. You would need to complete a fairly extensive questionnaire, but it would be a useful process. Your input would be used to generate cash flow projections for various life scenarios. You could ask her to run the numbers for retiring at different ages, selling your house at various points in time and assuming different levels of part-time income. Seeing a range of potential outcomes would help you make some of these decisions better. And having an advisor you can actually understand will make a world of difference.

Q: My wife and I are 30-something immigrants doing well, and we have an investment advisor who we like and trust. She has told us that our equity portfolio should return between five to eight per cent per year. Some years will be better, and some years will be worse, but over a ten-year period or more, it should be in that range, and according to the financial plan she developed for us, this will allow us to achieve our objectives.

Where it gets interesting is my wife’s parents have moved from Australia to Canada to be with us (and their future grandchildren) and we recommended our investment advisor. The weird thing is that they expect 10-15% returns annually (!), and as a result, they don’t want to use our investment advisor thinking that her targets are unambitious and unreasonable. They want to find someone who can offer them returns that are more or less double what our advisor thinks are likely.

What should I say to them?

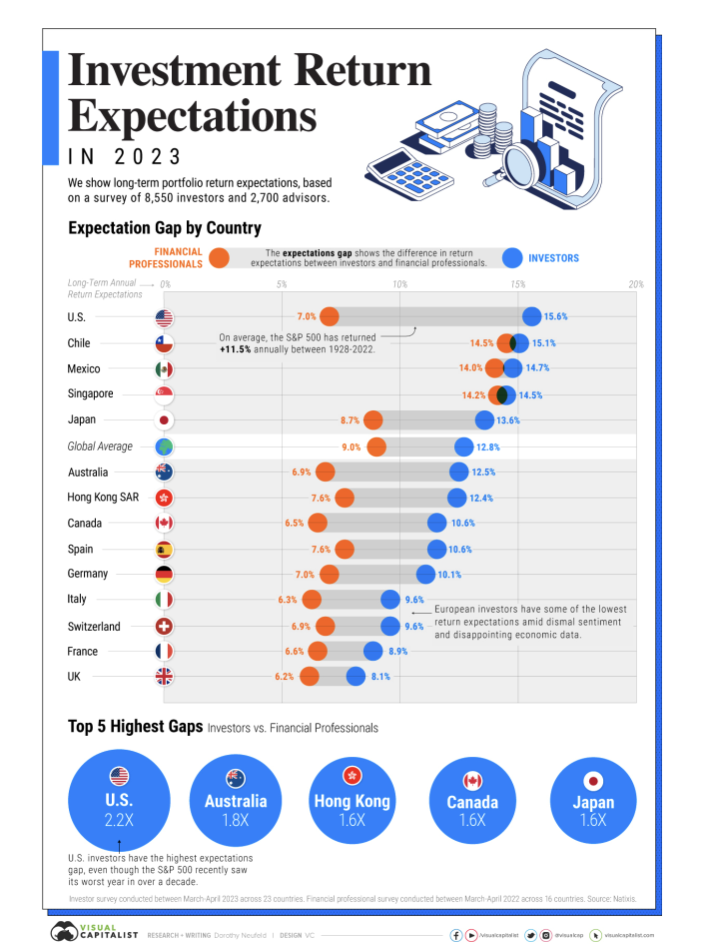

A: I’ve interviewed hundreds of investors for my global research over the years, and I can say with conviction that investor expectations vary by geography and, at times, significantly. Forecasts shift for legitimate factors such as expected inflation rates, interest rates and the potential for an economic downturn. These factors can affect return expectations for different countries, but we also see expected return variances between advisors and their clients.

The graph to the right puts this in perspective, and interestingly, Australia has the second widest gap in return expectations between investors (12.5%) and finance professionals (6.9%). I don’t know why this is the case, but if your in-laws socialize and talk about money with friends and colleagues, they may have picked up the idea that a 12.5% return expectation is a reasonable one. Their Australian advisors don’t seem to agree, and it is interesting that your Canadian advisor shares their more reasonable return expectations.

I think this graph would be a great starting point for a discussion. What matters most in the end is having realistic expectations. What are the expected returns for different asset classes over the next decade? A report by Vanguard used a quantitative model to forecast returns through 2033. For U.S. equities, it projects 4.1-6.1% in annualized returns. Global equities are forecast to have 6.4-8.4% returns, outperforming U.S. stocks over the next decade. Source: https://www.visualcapitalist.com/10-year-annualized-forecasts-for-major-asset-classes/

Do you have questions about your own investment portfolio? I have recently set up The Rich Thinking® Financial Advice Hotline. This will be a win/win: you get a free 30-minute confidential Zoom chat offering an independent, unbiased perspective on your financial situation with no sales pitch! In exchange, I get to use the anonymized data that will come from these conversations to make my Rich Thinking research even better. Email me to book your Zoom discussion: barbara@barbarastewart.ca