The Role of High-Interest Savings ETFs in a Diverse Portfolio Navigating Rising Rates, Beating Inflation, and Funding Big Dreams

A diversified portfolio typically includes a cash component, and this cash holding provides an investor with liquidity and convenience. Traditional portfolio theory suggests that investors should carry some static percentage of their portfolio in cash to act as a diversifier against volatility in a portfolio, for liquidity purposes to add to existing bond or equity positions, or to fund new purchases. However, alongside the Bank of Canada’s recent interest rate increases, cash is beginning to yield attractive rates.

With the rapid rise in interest rates, Canadian investors are increasingly looking for ways to earn yield in their investment portfolios and generate a stable source of return. High interest savings (HISA) Exchange-Traded Funds (ETFs) may meet this demand for some investors. There are many benefits to these new high-interest savings ETFs, including low to no volatility. This is a great quality to have in an investment portfolio, as investors can avoid day-to-day fluctuations common in investments in the stock market. In a period where stock market returns have been muted, and volatility has been high, these products offer investors a way to safeguard their money and earn a strong yield.

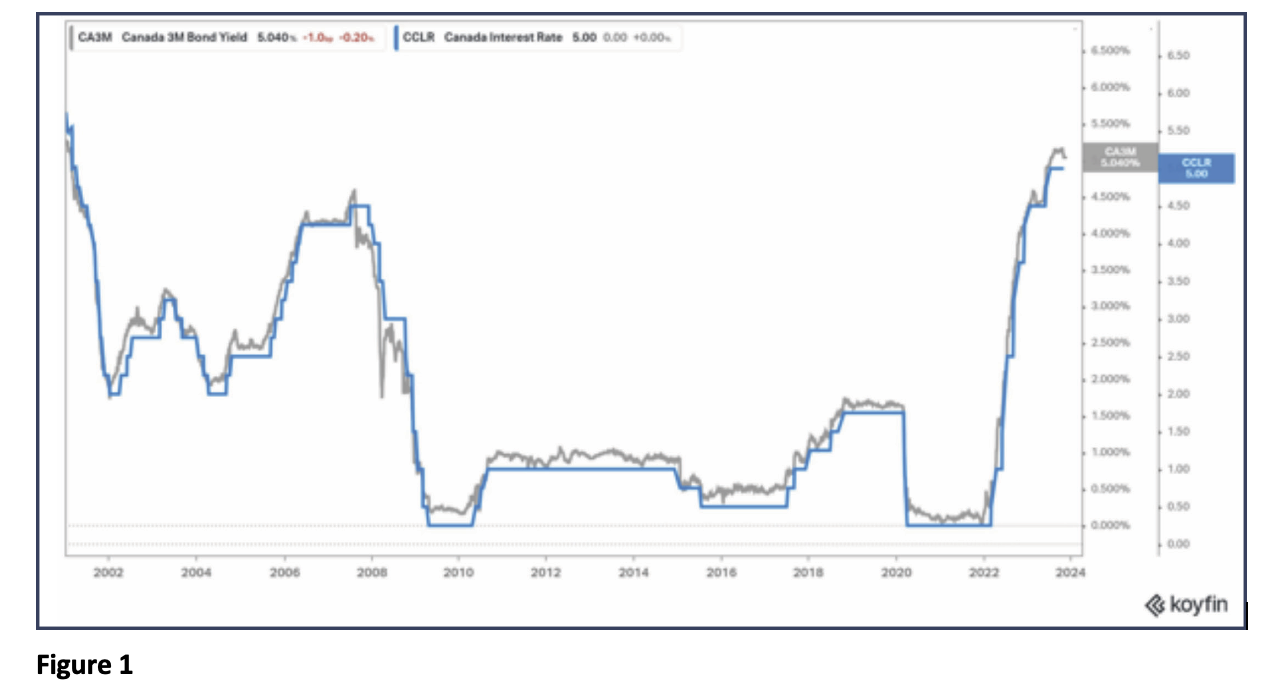

In Figure 1, we demonstrate Canadian interest rates and short-term Canadian bond yields (3-month yields) over the past 20 years. Investors can see the substantial rise in rates since 2020, as well as the relative attractiveness of these yields against prior years.

Another benefit of the high-interest savings ETFs is they can be used as a method to beat inflation. With the annual inflation rate dropping near the two per cent target, a five per cent + yield on a stable ETF helps investors increase their purchasing power.

These ETFs can also be a great savings vehicle for Canadian investors. Investors who are planning to make a big ticket purchase in the near future (car, downpayment on a house, engagement ring) can use these ETFs as a method of savings without a large risk of volatility or selloffs.

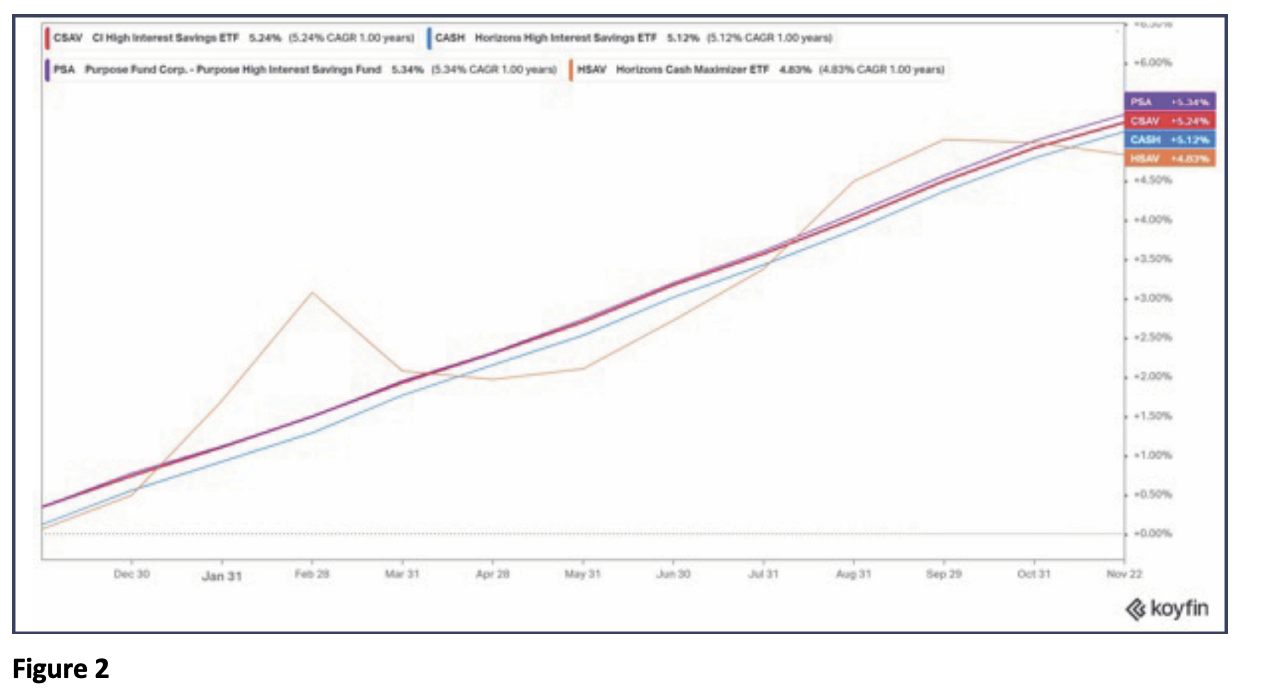

In Figure 2, we look at the annual performance (including distributions) of these ETFs over the past one-year period. We can see that HSAV has shown a slightly different performance than the other ETFs, and this is mainly due to its distribution method and other conditions.

An Overview of The Different High-Interest Savings ETFs Available to Canadian Investors

We have identified four high-interest savings ETFs that we feel have good price stability, yield, liquidity, and diversification. They are:

- CI High-Interest Savings ETF (CSAV)

- Purpose High-Interest Savings ETF (PSA)

- Horizons High-Interest Savings ETF (CASH)

- Horizons Cash Maximizer ETF (HSAV)

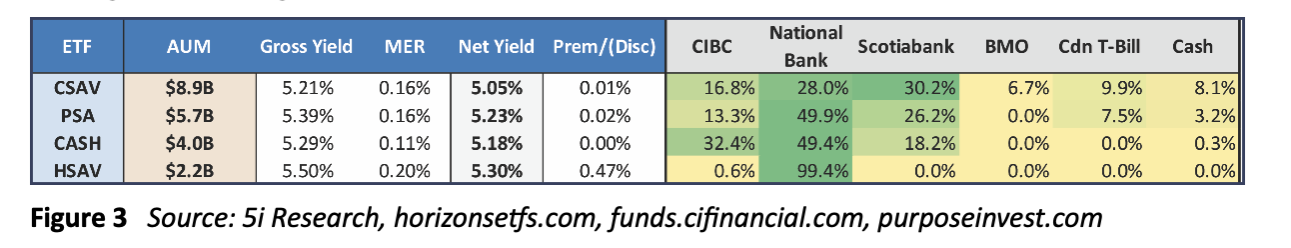

In Figure 3, you will find fund information for each ETF, outlining Assets Under Management (AUM), gross yield, Management Expense Ratio (MER), net yield, premium/(discount) to Net Asset Value (NAV), and holdings with the large Canadian banks.

We have filtered the list from highest to lowest liquidity levels (AUM). The ETFs with the highest net yield include HSAV and PSA, although the caveat is that HSAV trades at a premium to its NAV, and thus, if this premium shrinks, investors can expect their annual net yield to decline. After taking into consideration the premium to NAV, PSA and CASH currently offer the highest net yield after premium/(discounts) to NAV. CSAV has the widest distribution of holdings across the various large banks, and we feel this might offer certain investors more comfort.

CI High-Interest Savings ETF (CSAV)

CSAV aims to provide investors with monthly income and invests in high-interest savings accounts with National Bank, CIBC, Scotiabank, BMO, Canadian Treasury Bills, and cash. This ETF has the highest AUM of all the ETFs listed ($8.9 billion), but it also has the lowest net yield of 5.05%.

Purpose High-Interest Savings ETF (PSA)

This ETFís goal is to provide investors with monthly income while preserving capital and liquidity. It has a high AUM of $5.7 billion, a strong net yield of 5.23%, and most of its assets are deposited with National Bank, Scotiabank, and CIBC.

Horizons High-Interest Savings ETF (CASH)

This ETF by Horizons provides investors with monthly income while maintaining price stability by investing primarily in high-interest deposit accounts with large Canadian banks. It has a strong net yield of 5.18%, an AUM of roughly $4.0 billion, and an attractive MER of 0.11%.

Horizons Cash Maximizer ETF (HSAV)

The HSAV ETF differs from the other high-interest savings ETFs, as it does not issue distributions to investors but rather offers capital appreciation through its share price. HSAV provides daily liquidity and invests in high-interest deposit accounts with Tier 1 Canadian Banks just as CASH does, although the interest it earns from high-interest savings accounts is reinvested into its NAV for modest capital growth.

This can be advantageous for investors as it does not make taxable distributions, which can enhance the after-tax performance relative to other yield-generating products. While investors may not see a monthly cash distribution like the other ETFs, its market price can accrue value daily from the interest it earns.

Risks and Considerations

While these high-interest savings ETFs have low volatility, there are certain risks associated with these products. The Office of the Superintendent of Financial Institutions (OSFI) recently announced that it is changing certain rules imposed by Canadian banks, and therefore, this will slightly reduce the rates offered through HISA ETFs. It is estimated that the yields can drop by 0.5%, and further restrictions like these can impose risks for Canadian investors.

If the Bank of Canada reduces interest rates, these HISA ETFs will also see their rates decline. Lastly, while the current yields on these products are attractive, particularly for short-term or intermediate-term savings, there is an opportunity cost associated with these products. With the U.S. and Canadian markets being depressed for a few years now, if the markets continue to recover, investors may be losing out on better opportunities in the traditional equities markets.

The Bottom Line for High-Interest Savings ETFs

High-interest savings ETFs can be an effective method of attaining high yield with low volatility in an investorís portfolio. These are products that can enable Canadians to save for near-term big-ticket purchases or even long-term spending goals. Overall, we think the entrance of high-interest savings ETFs into the Canadian space is a net positive for investors, and choosing the right one can involve a balance between liquidity, net yield, and diversification across the banks.

*Sign up for ETF Update here to receive more articles like this on a monthly basis. https://etffundupdate.ca

Disclosure: Authors, directors, partners and/or officers of 5i Research have a financial or other interest in XIT and ZRE.