Business Cycle 101

In past articles for Canadian MoneySaver, I have tried to offer different approaches to portfolio design and analysis. Articles such as “Simple Method to Outperform the Index” (2021-10), ‘Beyond Fundamentals” (2014 -02), “Index Investing” (2009-07), “The Easiest Method” (2008-08), “New concepts in Portfolio Design” (2007-05).

The last article that I wrote about investing with the business cycle was ten years ago, back in 2013. It is time for an update.

The business cycle provides unique information to the investor that can not be obtained through any other methodology. It can offer evidence of what stage (Recovery, Expansion, Peak, Slowdown, Recession) the economy and the stock market are in. Also, by identifying the stage or phase of the business cycle, sector selection can be greatly narrowed. Certain industry groups outperform, and others underperform during specific stages of the business cycle.

What Is The Business Cycle?

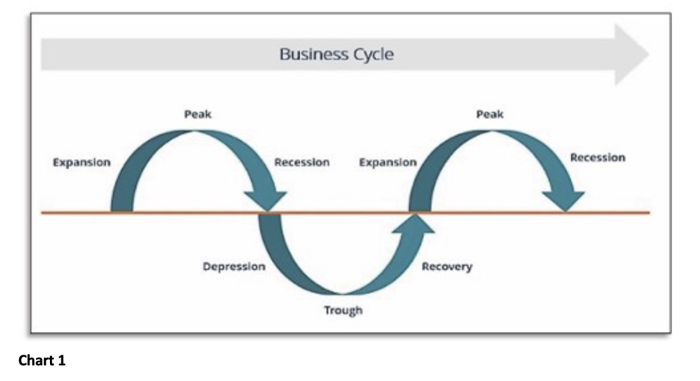

The business cycles are the phases of expansion and contraction in economic activity. That economic activity is represented by not only Gross Domestic Product (GDP) but also the measures of industrial production, employment, income, and sales, which are the key economic indicators used for the determination of U.S. business cycle peak and trough dates (Chart 1).

For most investors, being in the market during the expansion stage is the most profitable. But how do you know what phase the market is in now? We know the stock market has been advancing for about 14 years. The average duration of a bull market since the 1930s has been about 18 years. This would suggest that the current stock market is mature. Business cycles are often much shorter than stock market cycles, averaging about seven years, but can range from two to ten years (source: Wikipedia).

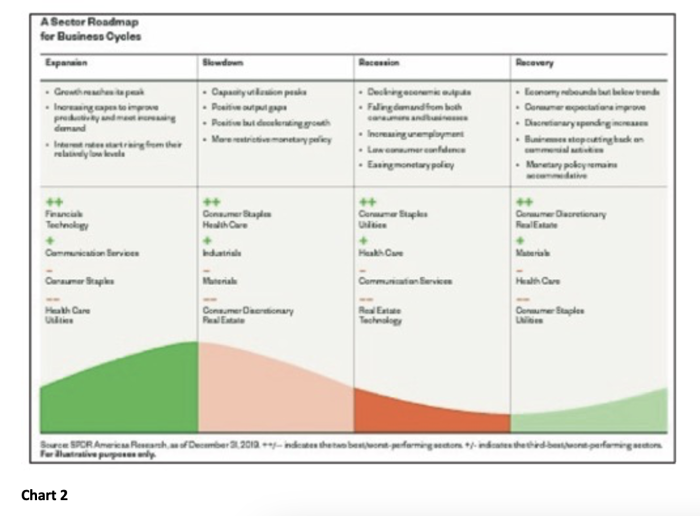

Within the context of a mature market, a review of sector strength can provide a roadmap for the Business Cycles and its location within that cycle (Chart 2).

Economic elements that correspond to the expansion stage are GDP growth reaching its peak (This action appears to have happened in June 2021 for the U.S. and Canada). Increasing capital expenditure (capex) to improve productivity and meet increasing demand (this action is still ongoing). Interest rates start rising from relatively low levels (rates began to rise in early 2022 in the U.S. and in Canada).

There are elements that cross over the Slowdown phase of the business cycle. Capacity utilization peaked in 2021, there is positive but decelerating GDP growth, and there is a more restrictive monetary policy. The sectors that typically outperform during the expansion phase are Financials, Technology and Communication Services, and industry groups that normally underperform during this stage are Consumer Staples, Health Care and Utilities. The safe havens.

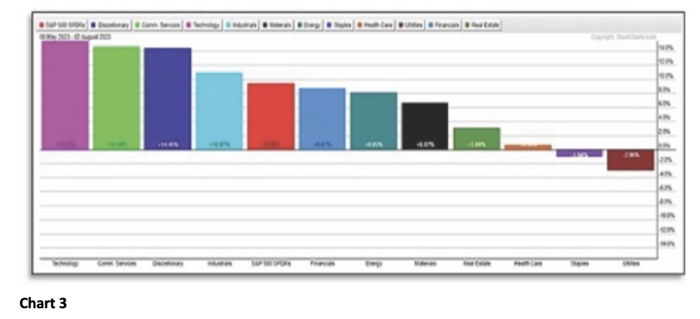

A 60-day sector performance chart shows four industry groups outperforming the S&P 500. They are Technology, Communication Services, Consumer Discretionary and Industrials. The lowest-performing sectors are Consumer Staples, Healthcare, and Utilities; all these sectors are considered safe havens. This mix closely matches the model for the expansion phase in Chart 2 (Chart 3). Sector performance that matches the Slowdown stage of the business cycle has not started yet.

What Does This All Mean To Investors?

The stock market has been advancing for about 14 years. By historical standards, this timeframe represents a mature market. In the business cycle, an equal number of economic elements are present from both the Slowdown phase and the Expansion phase. Sector performance, however, closely matches the expected models of the Expansion phase.

Investors should recognize that during each phase of the business cycle, certain sectors outperform, and others underperform. The business cycle appears to be in a transition stage between Expansion and Slowdown. Investors may wish to start slowly transitioning their portfolios into a Slowdown model.

Donald W. Dony, FCSI, MFTA, is an analyst with over 35 years of financial market experience, past instructor for the Canadian Securities Institute, and editor at www.technicalspeculator.com.