Taking Note Of The Possibilities: Autocallable Contingent Income Notes

I have a confession to make—I’m fussy about surprises. I’d much rather save them for birthdays and major holidays than when reviewing my investments. Admittedly, volatility can sometimes be an investor’s best friend, such as when a penny stock is suddenly worth dollars, however, these happy surprises are outweighed by the times things go the other way, which leaves me feeling like I’ve just found out that Christmas was cancelled while sitting on a piece of birthday cake. And, for investors who are on track for a comfortable retirement, and who are tired of getting motion sickness when tracking the ups and downs of their stock portfolio or are already in retirement and can’t afford to get it wrong, they should feel the same way.

I’ve previously written about how volatility when you have your good vs. bad investment years (your “sequence of returns”) can have a profound effect on the eventual size of your portfolio, particularly during retirement when you might have to “sell low” to pay for golf and groceries. On the other hand, I’ve not written nearly enough about some of the other risks investors have when saving for retirement, such as running out of money due to not taking enough investment risk. Guaranteed Investment Certificate (GIC) investors, this might mean you! If your money needs to last you through 30-plus years of retirement, settling for investment returns that might not even keep up with inflation after including taxes potentially means tough times if you live into your 90s (or 100s if some of those alleged medical advances actually pay out) unless you’ve got other assets that pick up the slack or either have or will later inherit a healthy nest egg.

Although I love the regular income that GICs can produce and appreciate the peace of mind that comes with the typically complete capital protection, I’m willing to take a bit more risk to hopefully reap a lot more reward. Although there is no silver bullet perfect for every occasion and every market, I’ve found a few tools that can produce a significantly higher income without dramatically increasing the risk of getting birthday cake on my snazzy new pants. In other words, while I’m taking on more investment risk than a GIC, I’m also giving my portfolio a chance to at least keep up with inflation to combat longevity risk, otherwise known as the possibility of having to survive entirely on bologna sandwiches later in life. Today’s offering talks about one of these tools designed to thread the needle between investments that are too unpredictable and those that are too stingy: autocallable contingent income notes, a subclass of a class of investments known as structured notes.

Structured Notes: What Are They?

In general, structured notes are investment products created by banks that track the performance of underlying investments and pay investors according to how that specific underlying basket of investments performs. The banks issue a bunch of different notes with different potential returns based on different underlying investments, ranging from the performance of the entire TSX, a basket of a few stocks, such as the big five banks, or even the performance of a single stock, such as Tesla.

In many ways, structured notes are like betting on sports, although with typically far less risk than overzealous Leafs fans may have experienced over the years. The banks offer an ever-changing array of notes, each with different potential outcomes and levels of risk, depending on current market conditions. Investors investigate the different notes and place their bets based on their assessment of risk and return. Like any good bookie, the banks cover their risk by purchasing options or zero-coupon bonds in the investment market that match the terms of the notes on offer, so they are not out of pocket if the investors win. In fact, both the banks and the investors have something to celebrate if this happens, since someone else will ultimately be financing the investors’ profits, while the bankers are still smiling because they got to use the investors’ money along the way, minus the cost purchasing the protection, to do bank-like things, like lending it to other clients or investing it for their own profits.

Although there is a wide variety of notes on the market, I want to talk about one type: autocallable contingent income notes, a name obviously not chosen by an advertising professional. This product provides a regular income stream provided that the underlying investments don’t drop below a predetermined limit. It is typically considered a hybrid of both stocks and bonds—the returns are based on the performance of a stock, but investors don’t participate in the growth of the underlying investments (although there are other structured notes that offer this feature if you’re so inclined.) Instead, investors get a constant payout for each specified period (such as monthly, quarterly or annually), much like a bond, unless the underlying investment has dropped more than a preset amount as of a specific day. Also, unlike stocks, any proceeds from notes are almost always taxed as interest.

The Value Proposition And An Example

The best way to describe this class of notes is by way of example. Although I’ll recklessly throw some investment jargon your way, keep reading, and hopefully, all will soon become clear. A typical note issued in today’s high-interest and uncertain times might offer 12% annual income paid monthly (each payment is called a “coupon”) based on the underlying performance of a basket of Canadian banks with a 30% barrier and a 30% partial maturity guarantee when the note matures in seven years (although five- and three-year maximum lifespans are also common) with a 110% autocall feature. Translating into English, this means that so long as your basket of bank stocks hasn’t declined in value more than 30% from the date the note was issued on a preset day each month, you earn that month’s interest coupon. If, instead, financial Armageddon hits and your basket of banks is down 35% on the day in question, you miss that month’s payment. The next month, however, if the banks have rebounded even slightly to 71% of their original price, you earn that month’s income, although last month’s lost interest remains lost and gone forever most of the time.

This monthly calculation continues until one of two things happens—either the underlying basket appreciates by more than 10% of its original value (the “autocall” price), or seven years have passed, and the note “matures.” In the first scenario, investors get their final interest payment, plus all their original investment back as of the month the basket hits its target growth rate. In the second situation, it all depends on the value of the basket at the time of maturity plus the amount and type of downside protection purchased. In the example I’ve given, which is a 30% “barrier,” at maturity, if the basket is worth at least 71% of the original value at that time, then the investor gets a full refund of the original purchase price and their final interest payment. On the other hand, if the investment is only 69% of the original value, then they would only receive $69 of the original note. Put another way, this investor gets all their money back so long as the underlying bank bundle hasn’t declined by more than 30%, but if it has, they are on the hook for the entire loss.

If the latter outcome is too risky for your blood, you might purchase a note with a “buffer” instead. While a barrier provides protection if the loss is within a certain range, buffer notes offer protection even if the loss exceeds the preset threshold. Using my previous example, if you owned a 30% buffer instead of a 30% barrier and the basket was worth $69 at maturity, you’d still get back almost all your original investment, although your monthly interest payments would likely have been less than those offered through a barrier note. As you’d expect, you pay for this extra protection by accepting a lower yield since the bank must buy more expensive protection to cover the potential loss.

Other Ways To Protect Yourself

Although buying a buffer dramatically reduces downside risk, that is not the only way to increase your odds of a positive outcome. Here are some other tactics to increase the chances of a happy ending:

- Increasing the size of the buffer or barrier. Is 30% not enough protection to protect the quality of your nightly slumber? Consider buying 40% downside protection instead, both to protect your regular income and how much you’ll get back if the note isn’t redeemed until maturity.

- Purchase notes with a memory feature. Although being underwater on the observation date typically means losing that period’s payment forever, notes with a memory feature allow you to play catchup. When the note is once more above its barrier or buffer on a future observation date, the investor gets both their regular payment plus any payments they may have missed in the past.

- Buy notes that go low. There are occasionally notes that calculate the initial value of the note for future observation date purposes based on the lowest value of the underlying bundle within the first observation period. For example, a note with a semi-annual coupon based on the TSX with a 30% barrier with this additional feature would pay that half-year’s coupon so long as the value on each observation date was at least 70% of the value of the TSX at its low point during the first six months after the note was issued rather than the bundle’s original value at the time the note was issued.

- Opt for monthly coupons. If there is a precipitous decline in the value of the underlying investment on an observation date, it’s far better if you only miss one month’s coupon payment instead of perhaps an entire year’s worth. Different notes offer different payout periods, such as monthly, quarterly, semi-annually or yearly. Since a really bad day in the market on the observation date means not getting paid, picking the monthly coupon option means only missing one month’s worth of income if the investment world is far less dire a month later. Although picking shorter payment periods can cost you the occasional payment if the bundle is underwater for a month or two but rights itself by the end of the quarter or year, I’d much rather accept this risk than chance risking an entire year’s worth of income by selecting a note with longer gaps between payments.

- Picking a boring bundle. Hedge your bets by picking a note based on an underlying investment you think is conservative or which you view as already significantly discounted. As a bonus, because of this recent volatility, notes based on investments with a recent decline generally offer higher coupon payments. Some clients recently purchased notes based on Canadian banks for these reasons, for example. It is even possible to purchase a note based on an entire index like the TSX rather than a specific sector if you feel that this is a safer bet.

- Pushing out the lifespan of the note. The duration of the structured notes can also vary. One school of thought suggests that the further out in time before a note matures, the smaller the chance that the underlying basket will be less than the protection purchased at that time. If you believe that the market ultimately wins in the end, increasing the distance between purchase and the maturity date plays into this philosophy. Moreover, since notes can also be sold on the secondary market, notes with a longer maturity period aren’t as volatile if you need/want to cut bait and sell along the way.

- Selecting the autocall carefully. Most notes do not make it to maturity. In fact, the majority are redeemed within a couple of years of issue. Sometimes, this is a good thing and sometimes, not so much. If you love the interest rate and the underlying basket, look for a higher autocall threshold, such as 110% of the original bundle value vs. 105%, so you can keep raking in the cash for a bit longer. On the other hand, perhaps you just want to park your money in a note until you feel better about the market and/or don’t love current note rates. If you have an autocall feature where you’re redeemed when the investment climbs by only five per cent vs 10%, you will be bought out potentially far sooner if the investment performs, at which time you can redeploy your capital into either another type of investment or perhaps another note with more favourable terms.

- Purchase a note with the right initial observation date. Even if you have a monthly autocall feature, your note will have a minimum initial waiting period before the autocall feature kicks in. If you love your current note, picking perhaps a 1-year initial observation date vs. six months may help keep the good times rolling that much longer.

- Buy a bundle of bundles. Rather than just purchasing a single note based on a single bundle, spread out your risk by purchasing several different notes based on different underlying investments. In fact, structured note Exchange-Traded Funds (ETFs) have recently come onto the market in Canada. Although the one I investigated is too new and has only 20% barrier protection, who knows what will be on offer in a couple of years or how existing products have performed.

- Pick a note that matches your ultimate time horizon. Although most autocall notes are redeemed within a couple of years, and there is a secondary market should you wish to sell, consider matching the ultimate duration of your notes to when you need the money. For example, if investing in a Tax-Free Savings Account (TFSA) to purchase a home in five years, a note with a seven-year maturity period might not be the one for you. As stated earlier, however, if you really need the cash, there is a way out. In fact, structured notes may be cheaper to unload in some situations than non-cashable GICs, depending on how your note is priced in the secondary market.

- Don’t be a one-trick pony. No matter how much you like this type of investment, continue to diversify your portfolio with different types of investments. For GIC fans, this might mean combining structured notes with a few GICs as well to further reduce your risk. Ditto for those investors who are big on bonds, preferred shares, or perhaps other investments like Mortgage Investment Funds, which I see as the main competitors, although each has its own pros and cons.

More Note Planning Tips

In no particular order, here are some more tips to consider when looking into purchasing notes:

- Shop around. Not all banks offer the same rates at the same time. If your broker is linked with one of the big banks, make sure that (s)he also looks at what the competitors are selling.

- Realize that notes pay interest and plan accordingly. Although notes are based on an underlying bundle of stocks, all distributions are taxed as interest income. Accordingly, they are best owned in registered plans, family trusts with low-income beneficiaries or by low-income individuals not worried about things like the Guaranteed Income Supplement (GIS) clawback.

- Focus on the big picture when assessing risk. When choosing between this type of product vs. alternatives like GICs, preferred shares and bonds, consider the risk of a note being redeemed for less than full value at maturity but also the extra income you may have received along the way vs. some of these alternatives. It could be that the extra cash received before then from a higher yield, particularly if you have buffer protection that absorbs most of the loss, still leaves you better off than something like a GIC with 100% principal protection but a much lower yield. Do a similar analysis if deciding how to allocate money among investments like notes, bonds and preferred shares, although you’ll also have to factor in the chance of those other options producing capital gains or losses (although this could also arise if trading structured notes on the secondary market.)

- Get your broker to custom fit a note. Like a good bookie, banks are typically willing to create tailor-made notes for the right client if worth their while ($1 million seems to be the minimum note size.) Accordingly, if you can’t find the exact note of your dreams, see if your broker or portfolio manager is willing to work with a bank to create a custom fit. It’s not like you’d have to purchase the whole thing—my own portfolio manager is currently working to create one that a bunch of his clients will share, plus whatever other investors may snap up.

Performance Notes

The following stats, plus many useful tweaks and suggestions, were provided to me by two portfolio manager friends at Aligned Capital, Thomas Tsiaras and Wail Wong. A big thank you to both for their expert advice.

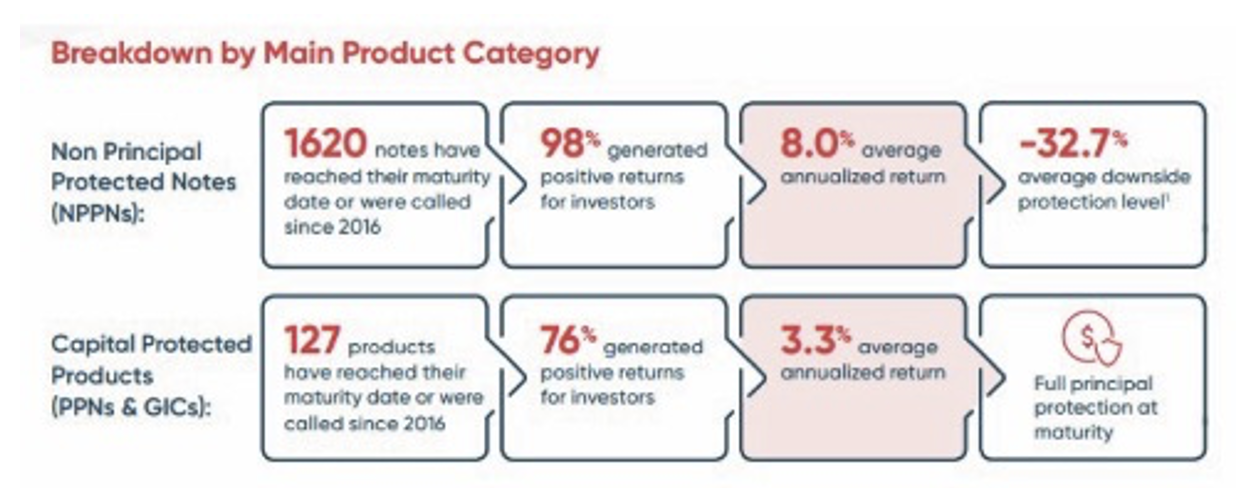

The following chart pertains to National Bank products from 2016-2022. Our notes of choice, autocallable contingent income notes, are included as part of the “Non-Principal Protected Notes” family, as opposed to the “Principal Protected Notes.” The first category covers notes that include only partial protection (an average of 32.7% downside coverage), while the second cluster fully guarantees that investors will not lose money.

While the fully protected notes, including market-linked GICs (which are not to be confused with your guardian variety fixed income GICs), did ensure that no one lost money, they only produced an average annual return of 3.3%. In contrast, notes with partial protection averaged an annual return of eight per cent, even after factoring in losses. Moreover, the partially protected notes failed to make a profit only two per cent of the time, versus 24% for notes with full coverage. In other words, in exchange for taking on this extra risk, which only resulted in neutral or negative outcomes two per cent of the time, the investors earned more than twice as much as their more conservative friends, with a higher chance of making money.

Fee Classes

Notes are either sold as “A” or “F” class, just like many other types of investments, either with an embedded commission for the advisor (A Class) or with that commission stripped out, with advisors charging their clients an advisory fee directly (F Class.) As you would expect, F Class notes offer a higher yield.

Some advisors may offer clients the choice of purchasing either class of notes—those with a one-time fee embedded into the product but with a yield that is adjusted to cover these costs or those with the commission stripped out but with ongoing advisory fees paid directly, although this will likely require clients who purchase both versions from the same advisor to hold them in different accounts, one managed by the advisor and the other self-directed. In some cases, choosing the Class A notes can even be a win-win for both client and advisor—the lower A class yield may be less than what the advisor charges in management fees, but the advisor still makes a healthy one-time commission, particularly if the note is sold or autocalled within a couple of years and the clients reinvest the proceeds with that advisor.

Conclusion

Although they have been around for a while, autocallable contingent income notes are currently one of the trendiest investment options for clients looking for higher yields with some extra protection. Although they may have more moving parts than a caper movie, don’t let that scare you off from putting in the work to see if they have a place in your own investment portfolio. The retirement you save might just be your own.

Colin S. Ritchie, BA.H. LL.B., CFP, CLU, TEP and FMA is a Vancouver-based fee-for-service lawyer and financial planner who does not sell investment or insurance, just advice. To find out more, visit his website at www.colinsritchie.com.