Go, Johnny, Go! Part 2

If you read my last column in Canadian MoneySaver, you learned about some historic benchmarks that typically mark when and how a bear market will end. I called that article "Go, Johnny, Go! Part 1". I featured "Johnny Dumb", who is the type of investor who seems to get his timing wrong at market tops and bottoms. This article, which is a bit more in-depth, will cover my forward view on the markets, which incorporates some of the patterns discussed in that last article. I hope it offers you some clues as to what you need to look for in your quest to trade this investment cycle profitably!

The Playbook.

It's All Been Seen Before

OK, here comes the deep stuff. I need to go over some history for you to get a handle on when Johnny Dumb's panic selling is over and done with. The fear & loathing phase discussed in the last article will afford you, the more informed investor, a magnificent opportunity to buy equities cheaply. But only when Johnny has finished upchucking his portfolio into the toilet.

To start: One of the greatest investment books I have ever read (and I've read plenty) is: The Wave Principle of Human Social Behavior and the New Science of Socionomics: Prechter, Robert R: 9781946597021: Books – Amazon.ca

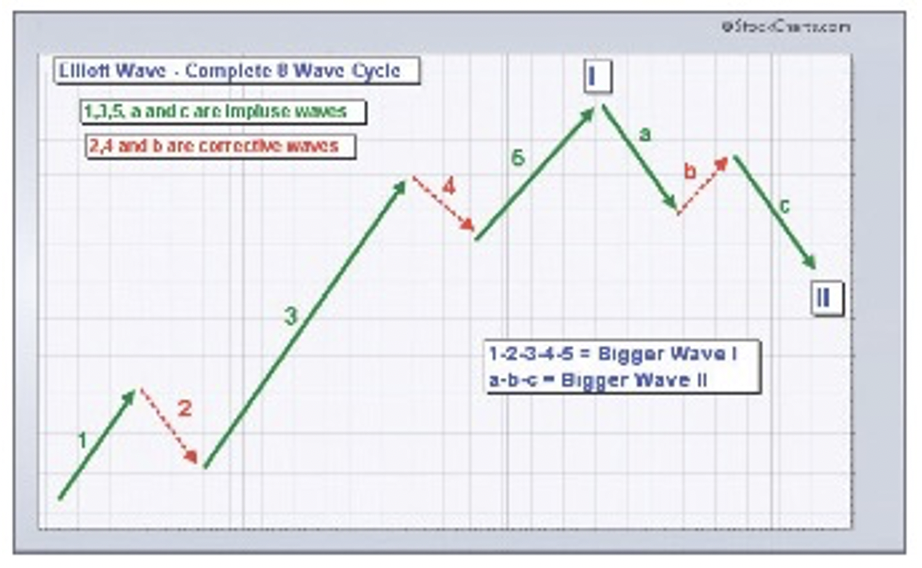

The book compares general societal mood swings with stock market movements. In a nutshell, mood and markets are correlated. Markets are a reflection of everything. We're talking: the types of movies being produced, baseball attendance, tobacco usage, alcohol consumption, and even war. Social mood, government policy, discontent & happiness are reflected in the stock market. These moods coincide with the traditional Elliott Wave phases on the market.

I'm not going to cover each wave and the socio-economic correlations described in the book right now. But I do recommend you read it; you will love the book if you are like me, a student of human behaviour. Instead of covering each wave, I am going to cover the final wave of a bear market, which is "Wave C". That, I believe, is what we are entering right now. Prechtor noted that Wave C is characterized by falling markets roughly coinciding with the following:

- War(s).

- Social unrest, fear, declining hope, discontent.

- New levels of unprecedented or abnormal government control—the crowd is allowing such controls when looking for direction and driven by fear & despondency.

- Often inflation or recession (or both).

- Finally, the bottom of Wave C, coinciding with or within the approximate timeline of a move away from the controls, fear, discontent, unrest, and war.

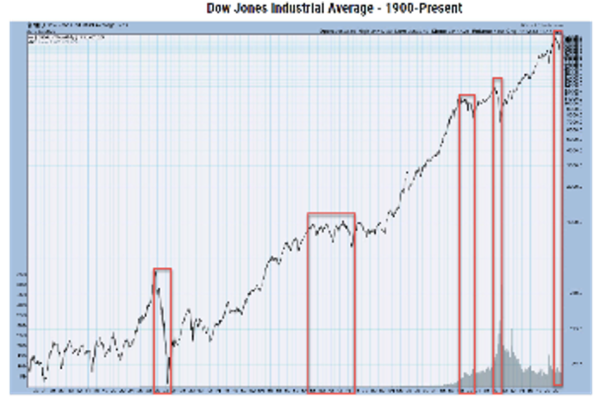

- Note the washout lows within each period.

This pattern results in "EXTRAORDINARY OPPORTUNITY', as Prechter puts it, for investors who wish to earn profits.

Let's look at Prechter's observations applied to significant bear markets over the past 100 years. The chart below is the Dow since 1900, with Bears & C-Wave washouts highlighted.

1929 – 1932 Bear

Typical Wave 3 socio-economic coincidental backdrops:

- Fear & Discontent: The Great Depression in the U.S.A.

- Massive inflation and discontent in Germany.

- Hitler's rise to power & new levels of government control—accepted as Germany looked to the new Nazi government for relief.

- Stock market bubble & pop in 1929.

- Communist party enrollment peaks in the U.S.A.

- War: WWII breaks out three years later.

1965 – 1975 Bear

Typical Wave 3 socio-economic coincidental backdrops:

- Prior setup: 1962 Cuban Missile Crisis.

- Watergate Scandal.

- New levels of government control in the budget process, personal information, and oversight of the intelligence community.

- War: U.S.A. sends troops to defend S. Vietnam.

- Russia/China send weapons & supplies to support N. Vietnam.

- Fear & Discontent: Russia / U.S.A. "Cold War" Peak.

- U.S.A.'s decade of high inflation.

- Stock market bubble & crash in 1975.

2000 – 2002 Bear

Typical Wave 3 socioeconomic coincidental backdrops:

- The terrorist attack on U.S.A soil September 11, 2001.

- Fear & Discontent: consumers are afraid to travel, shop, and go anywhere public.

- War: "War on Terrorism" & Al-Qaeda.

- Stock market "tech" bubble & crash.

- New levels of government control at U.S.A. airports, etc., as the country looked for relief to fight terrorism.

2008 – 2010 Bear

Typical Wave 3 socio-economic coincidental backdrops:

- Massive housing inflation, oil inflation.

- Sub-prime mortgage & stock market bubble & crash.

- Fear & Discontent: Real estate prices collapse, houses are abandoned, and banking collapse.

- Dodd-Frank Act: New levels of government control as the country looked for relief after traumatic banking and real estate losses.

- War: Russo-Georgian War (Russia & Rania republics).

- "Operation Scorched Earth", Yemeni offensive on Saada.

2020 Short Bear

Typical Wave 3 socio-economic coincidental backdrops:

- COVID-19 virus.

- Fear & Discontent: Stay inside.

- Unprecedented levels of government control. "Vaccine" passports & mandatory masks. Lockdowns. Travel restrictions. Civil liberties aborted. Government overreach.

- Divisive propaganda. "War" on those who questioned "the Science". Questioning medical professionals censored. Get jabbed or lose job.

- Stock market crash, then FAANG / ARK, etc., bubble (reversal!). "Stay inside" stock profits.

2022 – ? Bear

Typical Wave 3 socio-economic coincidental backdrops:

- FAANG, ARK bubble followed by a broad market crash.

- War: Russia/ Ukraine. Divided nations support each side.

- Fear, Civil unrest, Discontent worldwide: CUI (Civil Unrest Index) record highs worldwide.

- Chile, Brazil, and European government upheavals.

- Social unrest: Canada Freedom Convoy, global freedom protests (Canada, China, Sri Lanka, etc.). Dutch farmers’ protests.

- Divided political extremism.

- Extreme government control & overreach. Canada catches the world's eye with War Measures Act, bank account seizures, and abusive government rhetoric.

- Inflation, a new era of higher prices: food, gas, etc. Massive post-COVID housing boom & bust.

- The rise of Global Authoritarianism and government control: WEF "The Great Reset", WHO global mandates. Think of the cartoon "Pinky & The Brain", where The Brain wants to control the world, but he needs Pinky to buy into the vision to do so.

Part 4: Putting It All Together

Whew! That was a whack of information for you to absorb. So let me bullet point the things you need to understand from this rather deep dive into bear market history:

- Historically, bear markets coincide with some combination of socio-economic factors. Fear, social unrest, war, inflation, government control/overreach.

- This historic pattern is repeating now.

- As that socio-economic pattern reaches a crescendo, the stock market coincidingly begins a final washout.

- This washout starts with a broader acceptance of doom & gloom, aka the broad acceptance of more stock market downside to come. This attitude is now just beginning to appear.

- The bear market finale leads or coincides with pushback against the government, resolution of social unrest, and resolution or end /reduction of war activities.

- Technically, the bottom is typically signalled by extreme fear/pessimism illustrated via sentiment indicators. VIX, Put/Call, Smart/Dumb Money Studies, AAII, etc.

- It can also be spotted via extremes in longer-range momentum studies such as monthly chart RSI, MACD, ROC. See my Online Technical Analysis Course. If you haven't taken the course, now is a good time, given the circumstances.

- We are beginning to see the first signs of a Wave-3 finale. It is likely the bear market will complete Wave 3 in the coming months.

- Watch for sentiment extremes (read Smart Money/Dumb Money). Watch for momentum oscillator extremes.

- Socio-economic conditions of fear, unrest, war etc., can extend past the stock market Wave-3 trough. That's why at ValueTrend, we use Technical Analysis to determine the market washout and trend direction. We don't wait for the inevitable resolution stage of the socioeconomic stress, which is historically re-occurring backdrops that can surround a bear market bottom (before, during and after).

Conclusion:

With the backdrop presented here, you know that we are likely in, or have seen, the washout of Wave-3 in a bear market cycle, you know to wait for a trend reversal signal (a breakout past the current resistance of 4200 on the S&P 500, for example) before investing aggressively. You want to play this opportunity, but you recognize the risks. You will do so prudently and in stages without trying to time the bottom.

Good luck in 2023! Go, Johnny, go!

Keith Richards is Chief Portfolio Manager & President of ValueTrend Wealth Mgmt. He can be contacted at info@valuetrend.ca. Keith Richards may hold positions in the securities mentioned. The information provided is general in nature and does not represent investment advice. It is subject to change without notice and is based on the perspectives and opinions of the writer only. It may also contain projections or other “forward-looking statements”. There is significant risk that forward looking statements will not prove to be accurate and actual results, performance, or achievements could differ materially from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements and you will not unduly rely on such forward-looking statements. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please consult an appropriate professional regarding your particular circumstances.