Crypto Crash Course With Chris; Part #1 – Crypto Networks

Crypto's Volatility And Recent Events

The crypto space is highly volatile, to say the least, and recently there has been a lot of negative press and exposed bad actors in that space. Despite its volatility and prolific share of scams, there is a highly motivated subset of builders and programmers that continue to move aspects of the space forward into a more productive future. I am sure we have all heard of the various three-letter acronyms of FTX, SBX, 3AC, and others that have made waves in the news cycles and represent the more nefarious side of crypto. While these players had hidden agendas and motivations of their own, beneath the news cycle surface, there is an extremely vibrant and active community aside from those bad actors that are passionate about how crypto can revolutionize and disrupt modern-day industries.

Addressing Common Misconceptions About “Crypto”

Crypto is a short form for cryptocurrencies, which is a slight misnomer in that while these “coins” can be used as currency, or a medium of exchange, their makeup is really that of a network. As of writing, there are roughly 12,425 cryptocurrencies in existence, and arguably less than the top 100 have true utility and fundamental use cases. For this article, we are going to ignore the multitude of crypto coins that have emerged for no other purpose than pure speculation. For those uninvolved with crypto, it is easy to only view crypto as just coins, but when we peel back the layers behind viewing them as just tokens, these are protocols and networks with functionalities well beyond simply a medium of exchange.

What the Crypto Landscape Looks Like Today

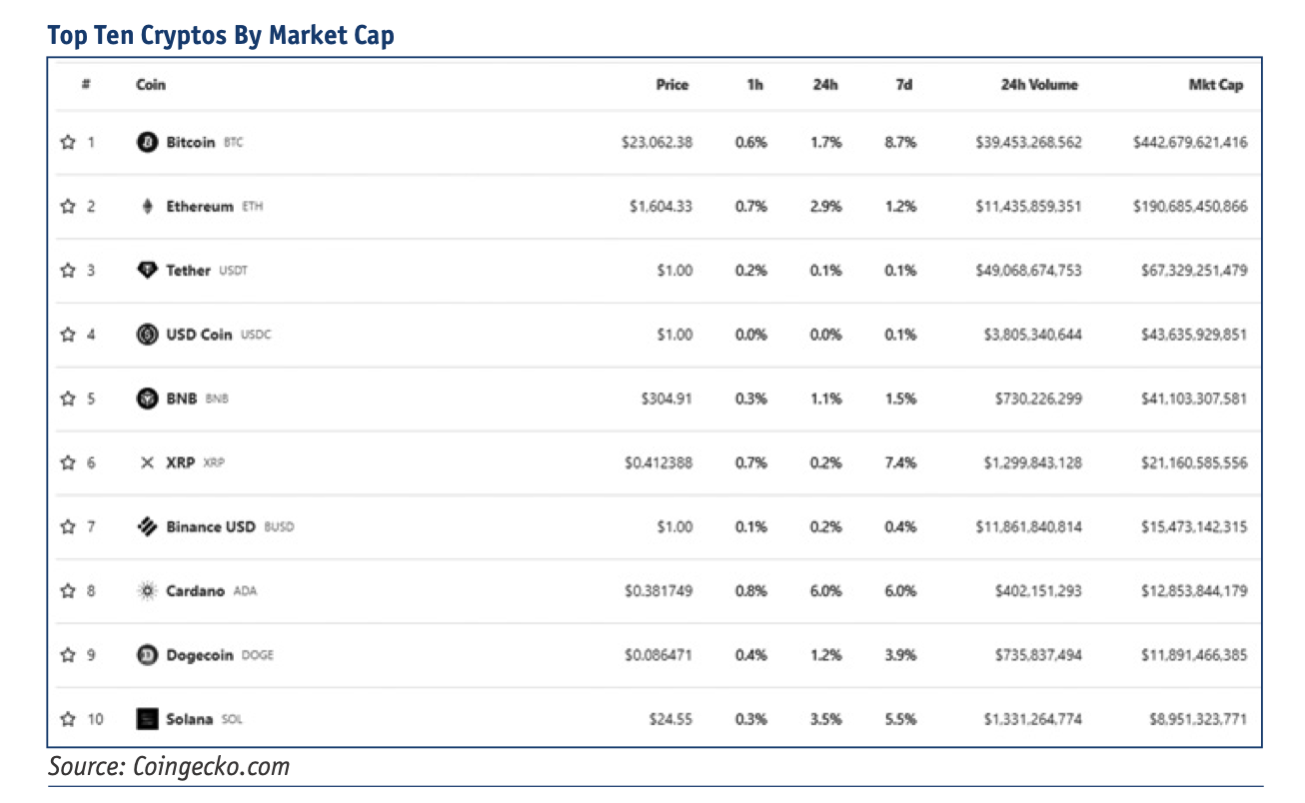

There are a few well-known and recognizable cryptos that exist today, and then there are a plethora of coins that no one has really heard of. For this article, let's take a look at and focus on the top ten cryptos by market cap.

Bitcoin ranks number one, with the largest market cap of all 12,425 coins at $442.7 billion as of writing. Ethereum (ETH) stands second at a $190.7 billion market cap, and Tether, USD Coin, and Binance USD are all “stablecoins”, which are pegged 1:1 with the US dollar. BNB, Solana, and Cardano are smart-contract platforms similar to Ethereum, XRP attempts to solve international money transfers, and I'm sure we have all heard of Dogecoin. Bitcoin and Ethereum clearly stand out against their competitors in size, and the activity on these platforms clearly validates this.

The Crypto Framework And Basis Behind Their Networks

In this section, we are going to go through the framework behind most cryptocurrencies and, along with it, some of the popular buzzwords.

Blockchain

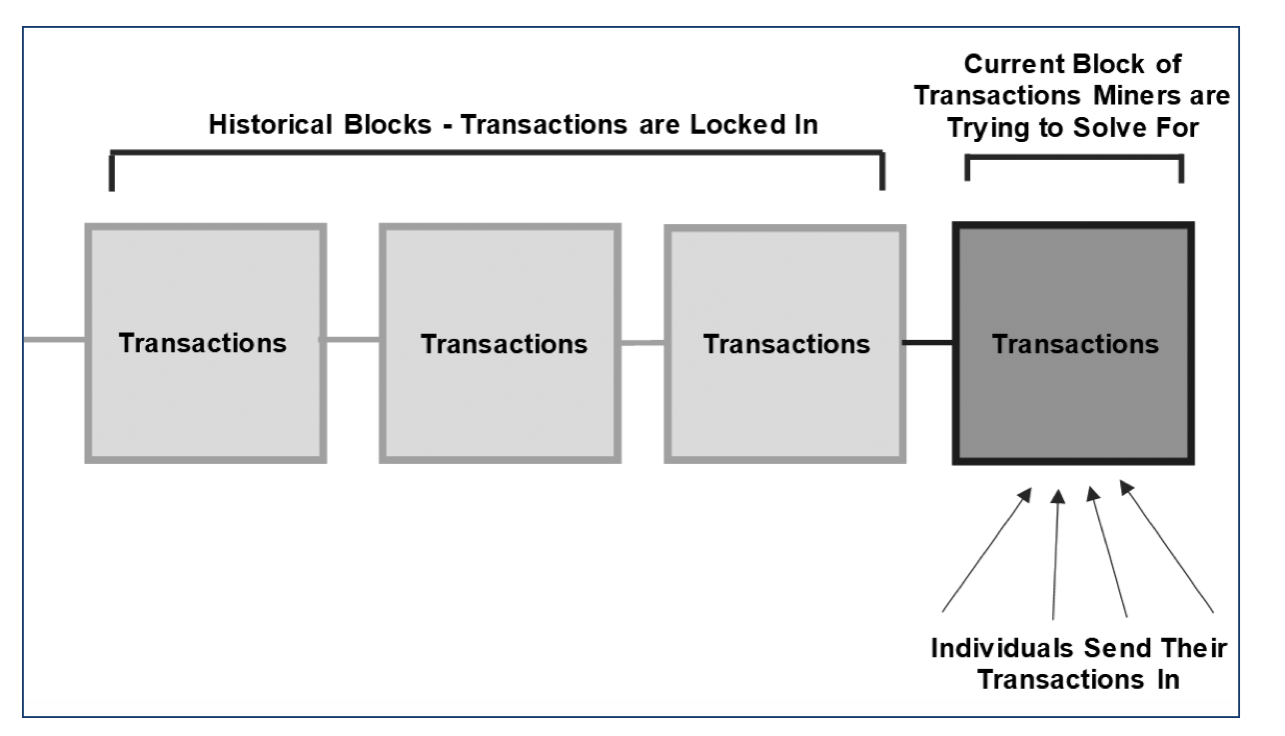

All cryptos are underpinned by the “blockchain” technology. This is the technology that enables crypto to be a public ledger of transactions. When we think of the banking system, it operates as a centralized private ledger of transactions. Transactions are sent to a bank, which is owned and operated by a corporation in a specific location, and its systems record and approve transactions in a private (not visible to the public) ledger. On the other hand, blockchain technology operates with a public digital ledger that can be verified by anyone in the world, where transactions are sent to the network, bundled into what is known as “blocks”, and these blocks are approved and recorded by miners. The term blockchain becomes much less intimidating when we visualize that it is a chain of blocks (bundles of transactions). Only one block of transactions can be verified at a time, and as blocks are verified by miners, they are sealed and locked into the blockchain's history forever and cannot be altered.

Miners

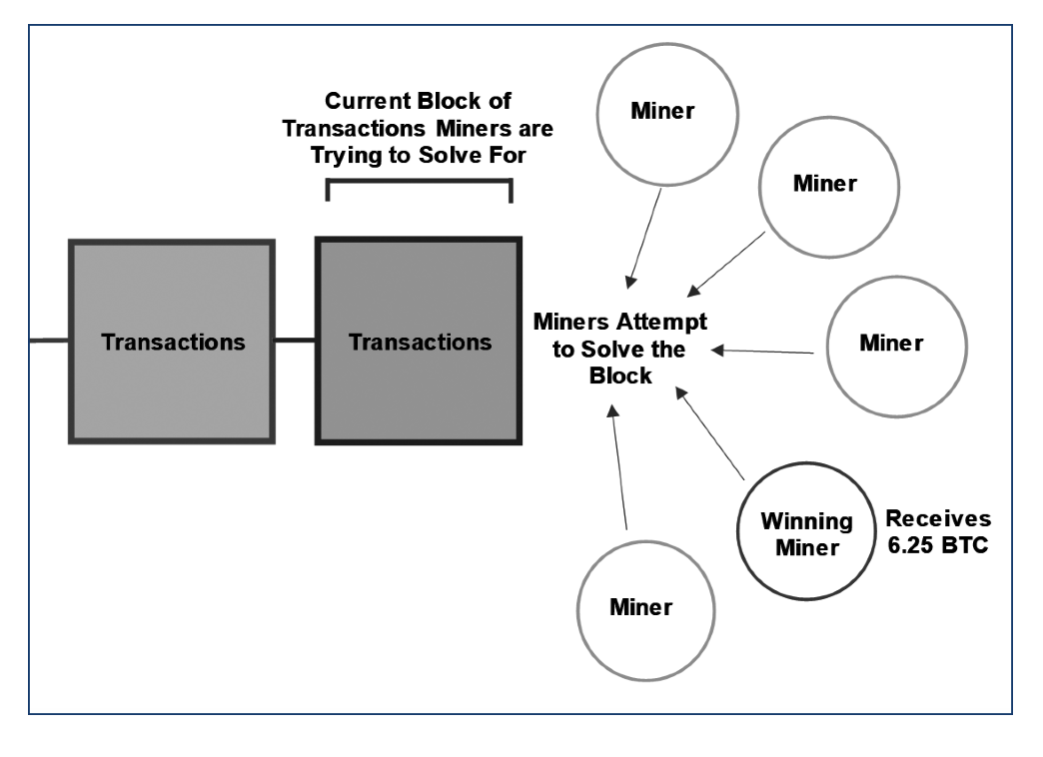

Crypto miners are essentially the security of the network. Crypto miners compete against each other to complete a complex math problem that will solve the current block of transactions. Once that block is solved, the winning miner is rewarded in crypto (for the bitcoin network, they receive bitcoin, etc.). This is how crypto networks are secured. Crypto miners are incentivized to be honest in approving transactions on the network and are rewarded for that honesty, similar to how a bank employee is honest in verifying transactions and is rewarded by their salary. The difference is that crypto miners operate across the world, are not employed or have any contractions to the network, and largely they do not know each others' identities.

Decentralization

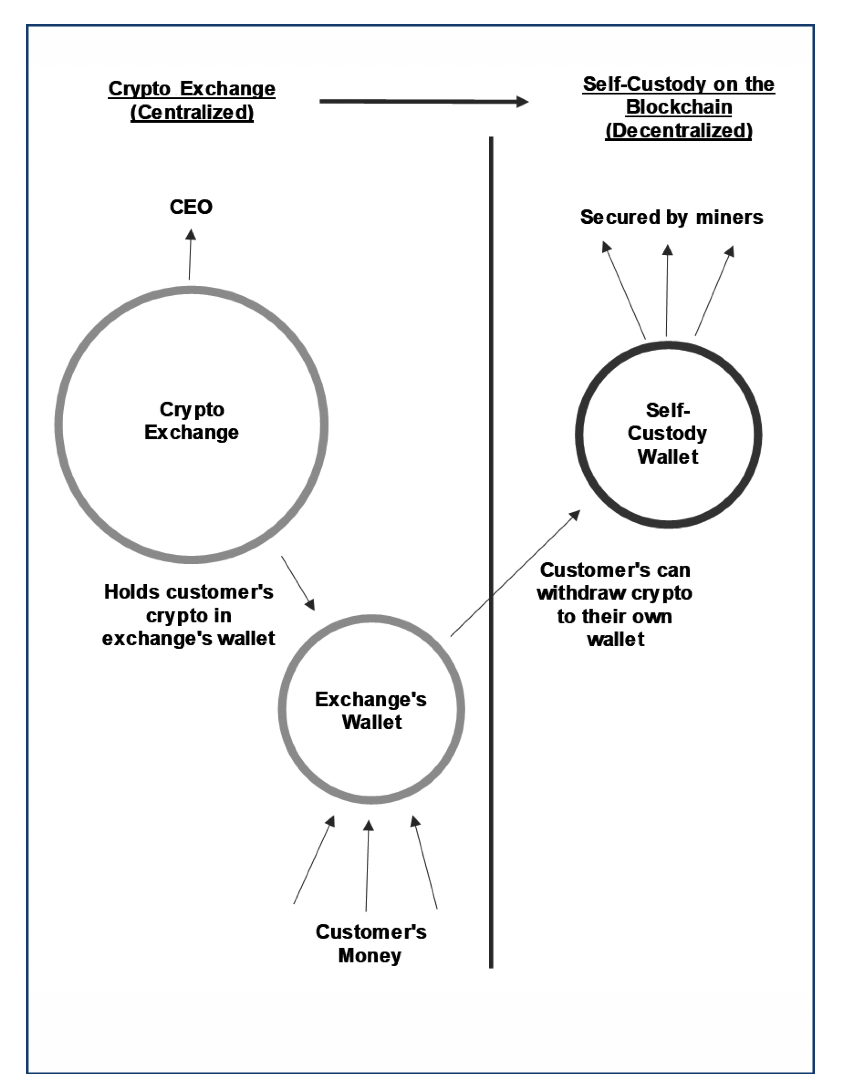

The combination of blockchain technology and miners being incentivized by the network’s coin (BTC, ETH, etc.) is what allows crypto networks to be referred to as “decentralized”. There is no central authority, no CEO, no headquarters, and no single entity in charge—it is a network of individuals using the crypto protocol to send and receive coins and miners that validate the network, which have no ties or connections to each other and are incentivized to act fairly and truthfully.

Crypto Exchanges

Crypto exchanges are often what cause individuals to conflate the security, robustness, and integrity of a decentralized blockchain and the actions performed by some of the bad actors of centralized crypto exchanges. Crypto networks operate as a layer on top of the internet, with their own decentralized qualities. The problem is that there are only two ways to acquire crypto: by being a miner and being rewarded for solving blocks or by transferring fiat currency to a centralized exchange and purchasing crypto. The only way to convert fiat currency into crypto is through an exchange, and exchanges, unlike crypto networks, are centralized. Crypto exchanges have a CEO, headquarters, employees, dedicated servers, and so forth, and this makes them vulnerable to attacks, malfeasance, and fraud. The silver lining is that once individuals have exchanged fiat currency for crypto using an exchange, they can then transfer that crypto off the exchange and into their own self-custodial wallet.

Crypto Wallet

Crypto wallets are self-explanatory—they are a wallet created on a crypto network designed to hold cryptocurrencies. If an individual transfers crypto off-exchange and into their own crypto wallet, this is known as self-custody since no other individual, corporation, or entity has access to that wallet. It is solely in the hands of the individual. This is an excellent feature of crypto networks to ensure that the individual has sole ownership, and no other entity can take that from them, but it also places the onus of responsibility entirely on the individual. If the password is lost, stolen, or given away, the cryptocurrencies in that wallet are at risk.

Permissionless

Aside from the centralized nature and regulations of crypto exchanges, crypto networks can be used by anyone in the world. No sign-up is required to use crypto networks. It is non-partisan. There are no special treatments or preferences between users. All users are treated equally by the network, and it does not adjust fees up or down depending on who uses the network or where it is being used.

What Makes the Top Crypto Have Value?

Each crypto network is unique and offers its own utility, but we feel most of these differences can be seen between the top two networks: Bitcoin and Ethereum.

The Bitcoin network's value proposition is that it is currently the largest crypto network, which is arguably the most decentralized (most number of miners) and has first-mover advantages. Bitcoin's unique feature is that there will only be 21 million bitcoin available. There is a hard-cap supply of 21 million that is expected to be achieved sometime 100 years from now, and currently, there are roughly 19 million in existence. This may sound like a lot, but considering the supply will never go beyond 21 million, that means only roughly 0.003 bitcoin per person on the planet or 0.37 bitcoin per millionaire on the planet.

Ethereum also operates on blockchain technology like Bitcoin. However, its supply is not capped like Bitcoin’s is, but rather its unique feature is in the applications that can be built on top of the network. Applications include Decentralized Finance (DeFi), NFTs, decentralized games and social applications.

The Conclusion is Not So Cryptic

Once we understand the premise and underlying principles behind crypto networks, the idea becomes much less arcane. These are networks that use the coins issued on their platforms to incentivize miners to act in good faith and secure transactions performed between individuals. Crypto networks are ledgers of financial transactions, just like a traditional bank. However, its key distinctions are that the transactions are fully public and transparent, the network is secured by many individuals (miners) and cannot be altered by one single entity, and anyone can use the network without restrictions.

Chris White, CFA, Analyst for 5i Research Inc.

Disclosure: The presenter has a financial or other interest in Bitcoin and Ethereum