Double Happiness: Financial Perks For Couples

“Faster alone, further together.”

-Brad Pitt

Let’s face it. The world is set up for couples. From Noah’s Ark to Bumble, it’s all about pairing up. Sure, there are benefits to staying single, like sleeping on whatever side of the bed you fancy, but added financial security isn’t one of them. For singletons, few things are as annoying as “smug marrieds.” Not only do these couples flaunt their cozy togetherness, but they get access to financial perks only available to twosomes.

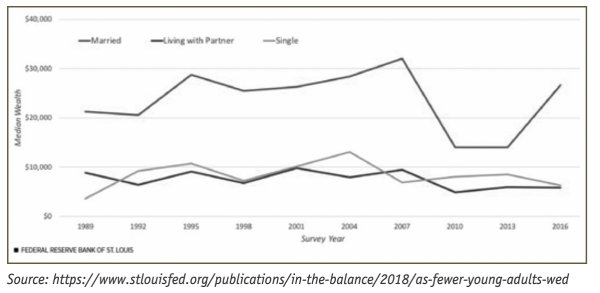

What’s the financial upside to being in a couple? According to a study conducted by the Federal Reserve Bank of St. Louis from 1989 to 2016, young marrieds had three times the median net worth compared to live-together or single households primarily due to a higher concentration of housing wealth and less debt. In Canada, based on a report from Statistics Canada, couples with children under 18 had a median net worth of $435,700 compared to lone-parent families with $83,100. (2019)

Even before including the special tax breaks for couples, a twosome can shore up their balance sheet much faster. Erin Lowry, a personal finance author and the creator of the Broke Millennial blog, wrote in Bloomberg it only took 16 months after they married to pay off her husband’s student loans, something she admits would have been impossible for him to do on his own. She and her husband took turns picking up the household chores when the other person hit a busy patch which meant they saved money by not having to outsource cooking and cleaning. As a self-employed worker, Lowry benefits from the high-quality medical benefits provided by her husband’s employer. Both could direct surplus funds to pay down his loan quickly and begin building their nest eggs. Lowry also says retirement planning will be less stressful, knowing there will be double the earnings and benefits to cover potential shortfalls.

A Threesome: You + Spouse + The Government

While personal tax rates don’t change because you’re married or in a common-law relationship (as defined for tax purposes), the amount of federal tax paid can be lowered through sharing unused non-refundable tax credits, spousal plans, and spousal rollovers. Here are some of the ways couples can benefit:

Spousal Registered Retirement Savings Plan (RRSP)

Particularly advantageous for couples where there is a wide disparity between earned income, a spousal RRSP allows the higher-earning spouse to use their RRSP contribution room to contribute to a spousal RRSP in their partner’s name (called the “annuitant”) and still receive the tax deduction. The higher-earning spouse gets the bigger tax refund (since they are in a higher marginal tax rate). When the money is withdrawn, it is usually done at the annuitant’s lower tax rate. After age 71, no further RRSP contributions may be made. However, if one has a younger spouse and RRSP contribution room, contributions may be made to a spousal RRSP until the younger spouse turns 71.

Canada Pension Plan (CPP) And/Or Quebec Pension Plan (QPP) Sharing

When both partners who live together have contributed to CPP or QPP, they can elect to share pensions. The amount shared is based on the number of months they have lived together while contributing to their pension plans. This can reduce the amount of income tax paid if one partner is in a lower tax bracket.

Pension Income Splitting

After 65, one spouse can transfer up to half of an eligible pension income from an employer-based pension fund, an RRSP, annuity payments, or Registered Retirement Income Fund (RRIF) to the partner’s tax return to lower their tax liability. (CPP, OAS, and certain foreign pensions are not eligible.)

Home Buyers’ Plan

The Plan allows first-time home buyers to use up to $35,000 of RRSP savings to help finance the down payment on a home, provided the funds have been in the account for at least 90 days. For a couple, each may contribute $35,000 for a total of $70,000.

Spousal Tax Credit

If one partner earns less than the Basic Personal Amount (BPA), which is $15,000 for 2023, the higher-earning spouse can claim the difference between the two amounts (BPA minus spouse’s earned income) on their tax return to receive the spousal tax credit.

Dividend Income Splitting

Couples can divide investment income. One spouse lends money at the prescribed rate to the spouse in the lower tax bracket, who then invests the funds to generate dividends. The income generated would be taxed at a lower rate and reduce the couple’s total tax bill.

Charitable Donation Credit

To gain a higher tax credit, a couple could pool their individual donations to registered Canadian charities and claim them on the lower-earning spouse’s tax return. Donations over $200 are eligible for up to a 29% tax credit.

Pooled Medical Expenses

Couples can combine some medical expenses. The spouse with the lower income would claim the amount on their tax return to maximize tax credits.

Sharing Is Caring

Additional non-refundable credits eligible for spousal transfers to reduce tax include age amount, Canada caregiver amount for infirm children under 18, pension income amount, disability amount, and tuition amount.

Spousal Rollovers*

When a spouse dies, their property, stocks, bonds, and other non-registered assets can pass to the Canadian-resident spouse or common-law partner on a tax-deferred basis. No capital gains tax is paid until the assets are sold at a future date, or the surviving spouse dies, whichever comes first.

For registered accounts such as RRSPs, RRIFs, and Tax-Free Savings Accounts (TFSAs), the surviving spouse may transfer the assets to their own registered plans on a tax-deferred basis at the tax cost amount. Anyone can be named a beneficiary to these accounts, but only spouses or common-law partners can be named successor annuitants/holders on RRIFs and TFSAs. Naming a spouse the successor annuitant/holder is more advantageous than naming them a beneficiary since it allows them to take ownership of the accounts without the requirement to transfer funds out.

For RRIFs, the successor annuitant could transfer the RRIF assets to their own RRIF account and continue to receive the deceased RRIF payments. Alternatively, if the surviving spouse has an RRSP, the RRIF investments can be rolled into that account without affecting the surviving spouse’s RRSP contribution room.

For TFSAs, the successor holder would take over ownership of the TFSA, and their own contribution room would not be affected. Income earned in the deceased TFSA account would not be taxed. On the other hand, if the spouse is named the beneficiary of the TFSA, they can make an “exempt contribution” to their own TFSA, but income earned after death would be subject to tax.

Love And Money

Tax breaks and estate planning issues aside, coupling is good for other reasons, too. In the 2020 Canadian Community Health Survey, Canadians were polled on how they felt about their lives. Those who were married or in a common-law relationship reported higher life satisfaction than those who either never married were separated, widowed, or divorced. People who lived with other people were happier than those who lived alone. The ties that bind also bring us happiness. And if these relationships happen to come with a few tax breaks, well, it’s icing on the cake. Happy Valentine’s Day!

*Note: Quebec legislation requires beneficiaries, successor holders or annuitants on registered accounts to be named in a Will, not in the accounts themselves.

Rita Silvan, CIM is a finance journalist specializing in women and investing. She is the former editor-in-chief of ELLE Canada and Golden Girl Finance. Rita produces content for leading financial institutions and wealth advisors and has appeared on BNN Bloomberg, CBC Newsworld, and other media outlets. She can be reached at rita@ellesworth.ca