Vice Squad: Investing In Sin Stocks

What constitutes sin varies widely these days. For some it’s drugs, gambling, and guns, for others it’s leaf blowers or vaccines. In the Before Times, swearing was frowned upon while the virtues of cigarettes were endorsed by medical doctors. In its infancy, Facebook, now Meta, was once considered a fun and fresh way to keep in touch with family and friends until it became Hatebook and the poster child for inciting violence, teenage self-loathing, and the destruction of democracy.

“The times they are a-changin’”, sang Bob Dylan. Now, in the dawn of a new, virtuous age, it seems déclassé to point out the financial benefits of investing in sin. The growing appetite for responsible investing, one focusing on environmental, social, and governance factors (ESG), has seen a massive influx of capital, both retail and institutional, which continues apace. Investors are seeking well-run, profitable companies at the forefront of positive change that are poised to take advantage of new and sustainable opportunities. Investment behemoths, such as BlackRock which manages over US$6 trillion in assets, has vowed to publicly disclose what proportion of its Exchange-Traded Funds (ETFs) have exposure to sin stocks, as well as how they score on ESG measures.1

Where does this leave the legacy vice stocks, which include tobacco, alcohol, gaming, drugs, and weapons? Sitting pretty, actually. Studies show this group provide excess risk-adjusted returns, are more profitable and less wasteful than the average corporation, tend to exhibit lower volatility, be more defensive, and score higher on the value metric. In fact, not investing in sin stocks is correlated with underperformance. So, moral issues aside, what’s not to like?

Why Do Sin Stocks Outperform?

Amid the growing concern about the excess concentration of uber-popular technology stocks in the major indices, sin stocks are the proverbial wallflowers, shunned by many. Sin stocks are the opposite of a crowded trade where investors eagerly bid up prices. On the contrary, investors tend to avoid sin stocks for rational reasons such as the perception of taking on increased reputational risk from litigation and regulation, or because these businesses conflict with their personal values. Institutional portfolio managers may be further restricted from holding these kinds of investments by mandated guidelines. Fewer bids mean lower valuations which are correlated with higher expected returns and a margin of safety during market downturns. For example, sin Initial Public Offerings (IPOs) are typically under-priced by over 22 per cent compared to non-sin IPOs.2

Investors who are willing to buy sin stocks expect to earn a premium as compensation for taking on reputational risk. Bad news events tend not to rattle the share price of sin stocks as much as good news boosts prices. Paradoxically, investing in sin stocks is appealing for the risk averse since so much of the bad news is already baked into the price.3

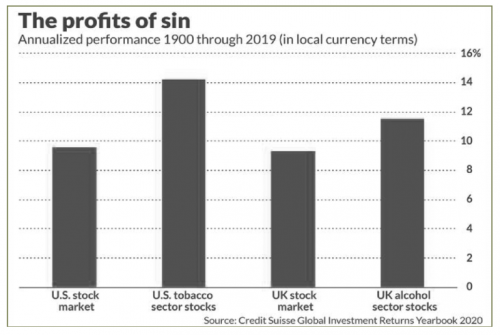

A research study conducted by Cambridge University and London Business School reviewed the past 120 years of performance for alcohol and tobacco stocks. In the U.S., these two categories outperformed the market by 4.6 per cent annualized. If an investor put only one dollar in U.S. tobacco companies in 1900 and reinvested the dividends, by 2020, the initial investment would have grown to U.S.$6.28m. (To be enjoyed by someone’s heirs, no doubt.)4

As only one example, from 1969 to 2017, Altria (domestic maker of the Marlboro brand) was the best-performing stock. Including dividends, its average annualized return was 20 per cent during this period based on a recipe of marketing a highly addictive, recession-proof product served with lashings of rich dividends on the side. (For the record, Altria also has exposure to alcohol, with a 9.5 per cent stake in Anheuser-Busch InBev and cannabis with a 45 per cent ownership stake in Canada’s Cronos Group.) Altria has rewarded its shareholders by raising its dividend 54 times during the past 50 years, with a current yield over eight per cent and a target payout ratio of 80 per cent of earnings per share.5,6

Risky Business: Sin Stocks In The Crosshairs

But all is not rosy in vice land as new studies question their purported outperformance and the cultural 1mood shifts. In a survey of 106 firms in four “sinny” industries (alcohol, tobacco, gambling, defense), published in The Journal of Investing in 2020, the sin portfolio posted higher overall returns, higher Sharpe ratios, and lower beta compared to the general market represented by the S&P.7

However, to better understand what drives sin stock outperformance, researchers at Robeco Asset Management and EDHEC Business School debunked the usual explanation which is under-pricing. Instead, once they factored in other proven drivers of return—size, value, and momentum—the market beating advantage of sin stocks disappeared.8

ESG factors are on investors’ minds and a recent study of 79 sin stocks vs. comparable firms as a control group by HEC Montreal and School of Business, Aalto University, Finland found sin stocks rate poorly on all three measures, particularly regarding managing water stress, chemical safety, and business ethics. To add insult to injury, they concluded, not only are sin companies exposed to more extreme ESG issues, but they also lack the management processes to mitigate these problems.9

Still, for those investors whose definition of diversification means including some exposure to less than savoury businesses and are also looking for one-stop shopping, there is ETF VICE launched in 2017 (ticker: VICE; tagline: “Invest in the vices people love”), and B.A.D (betting, alcohol, drugs), a forthcoming fund.4 Despite the fact sin stocks show better financial disclosure and higher expected return, changing social norms may finally reverse their historical outperformance. To quote an investor truism, “maybe it really is different this time”.

Rita Silvan, CIM is a finance journalist specializing in women and investing. She is the former editor-in-chief of ELLE Canada and Golden Girl Finance. Rita produces content for leading financial institutions and wealth advisors and has appeared on BNN Bloomberg, CBC Newsworld, and other media outlets. She can be reached at rita@ellesworth.ca

Sources:

1 https://www.ft.com/content/915fc5b9-745c-3b06-b21f-682ee62d0c4f

2 https://alphaarchitect.com/2021/07/29/the-benefits-of-sin-stocks/

4 https://www.ft.com/content/78609b84-b147-11e4-831b-00144feab7de

6 https://www.fool.com/investing/stock-market/market-sectors/consumer-staples/tobacco-stocks/

7 https://alphaarchitect.com/2021/07/29/the-benefits-of-sin-stocks/

8 https://www.ft.com/content/f70e45d2-91ab-11e9-8ff4-699df1c62544

9 https://www.mdpi.com/2071-1050/13/17/9556/htm