Simple Method To Outperform The Index

The primary goal for any fund and money manager is to outperform or at least equal the performance of the index. That index is usually the S&P 500. Yet very, very few managers ever achieve this objective.

The primary goal for any fund and money manager is to outperform or at least equal the performance of the index. That index is usually the S&P 500. Yet very, very few managers ever achieve this objective.

When I was a broker for a major bank in the 1980s and early 1990s, I used to go to a lot of mutual fund manager’s presentations. These demonstrations were designed to highlight the style and performance of their fund and the analysts, and why they were superior to their competition. These “dog and pony shows” were entertaining, but the one common element in all the fund manager’s presentations was that their fund’s performance was always less (sometimes considerably less) than the performance of the benchmark index. When that observation was asked by a member of the audience, the answer was that funds could not beat the index (S&P 500). In fact, over 97 percent of mutual funds cannot beat the S&P 500. The reasons are many. The investment fees are one major barrier to beating the market. Fund companies have to be paid. This ranges from the analysts to the support staff to the cost of keeping the lights on in the home office to the commissions given to the salesperson. All of this can equal as high as two percent of the fund’s value. A big chunk of the profits.

Back in the 1980s, the average investor couldn’t buy the S&P 500. But over the last 20 years, that has complexly changed. Investors can now simply buy the S&P 500 or TSX or any index through an exchange traded fund (ETF) without all of the standard overhead costs that come with mutual funds.

But this article is about how to outperform the index and not just matching its performance.

The simple method is to buy only those sector ETFs that are outperforming the index.

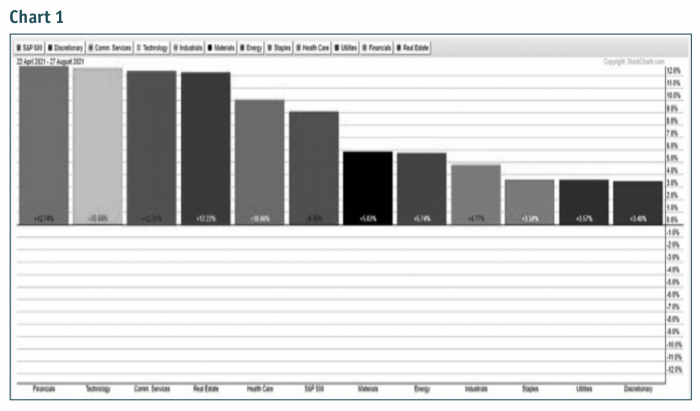

In Chart 1, taken on August 30, we see the 90-day performance picture of all the sectors in the S&P 500, including the S&P 500. In this example, only five sectors are outperforming and have greater relative strength than the benchmark index and six sectors are underperforming. In a portfolio designed to outperform the S&P 500, these are the five sectors that an investor would hold at this point. Back in late 2010, I wrote an article for Canadian MoneySaver about the importance of relative strength. This portfolio approach is an example of that application.

The investment process would be to review which sectors are outperforming the benchmark S&P 500 every 90-days. Sell those sectors that are underperforming and buy those sectors are outperforming the index.

For longer-term investors, try using a longer-term time frame.

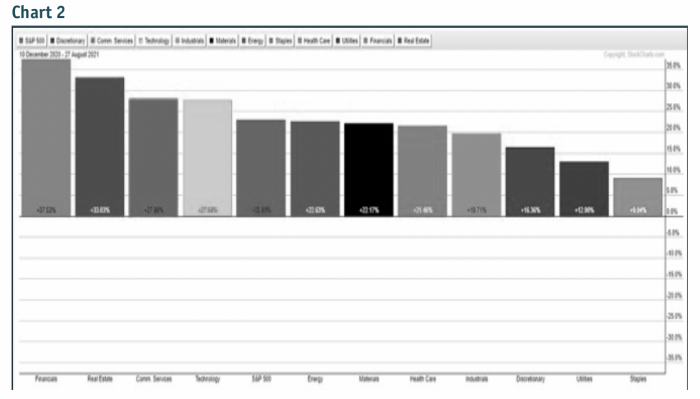

Chart 2 is of a 180-day performance picture. In this example, four sectors are outperforming the benchmark and seven sectors are underperforming. Again, the investment process would be to review and buy those sectors that are outperforming the benchmark S&P 500 every 180-days and sell those sectors that are underperforming.

My Own Portfolio: I have used this system over the last 18 years where half my portfolio is always in the benchmark S&P 500 (SPDR S&P 500 ETF - SPY) and the other half is in those sectors that are outperforming the S&P 500, based on the 180-day relative strength sector snapshot (Chart 2). My own portfolio has outperformed the S&P 500 16 of the last 18 years using this simple method. Though this article focuses on the broader S&P 500 sectors, the same method of analyses can be performed with the TSX.

The software is from www.StockCharts.com, a free website. Go to StockCharts.com, click on the Charts & Tools tab, go down to PerfCharts, click on Predefined Groups and then click on the subsection that you want to review.

Final Note: In my recent conversation with several clients who are fund managers, they have said that their portfolio holdings are slowly moving over to exchange traded funds (ETFs) versus the traditional individual stocks. The advantages of holding ETFs, I was told, are many over stocks. Clearly, for the individual investors, the ease of owning a complete sector or the whole index (S&P 500 or TSX) offers far greater performance than the traditional individual stock holding.

For additional information on this method, please contact: Donald W. Dony, FCSI, MFTA. Analyst, past instructor for the Canadian Securities Institute (CSI), editor for the www.technicalspeculator.com. At dwdony@shaw.ca, or 250-479-9463.