Beating the TSX: The One-Fund Solution

Regular readers of Canadian MoneySaver will be intimately familiar with the venerable “Beating the TSX” investment approach first pioneered by David Stanley in 1996. Adapted from the Dogs Of The Dow strategy developed by Michael O’Higgins in the early 90’s, “Beating the TSX” (BTSX) boasts a 25-year track record of historical outperformance relative to the benchmark index and has been successful back-tested to 1987. Importantly, this isn’t a case of simply cherry-picking historical investment returns to arrive at a market-beating approach after the fact. Real-world Canadian investors have been handily “beating” the TSX for decades now following this simple yet effective approach.

Regular readers of Canadian MoneySaver will be intimately familiar with the venerable “Beating the TSX” investment approach first pioneered by David Stanley in 1996. Adapted from the Dogs Of The Dow strategy developed by Michael O’Higgins in the early 90’s, “Beating the TSX” (BTSX) boasts a 25-year track record of historical outperformance relative to the benchmark index and has been successful back-tested to 1987. Importantly, this isn’t a case of simply cherry-picking historical investment returns to arrive at a market-beating approach after the fact. Real-world Canadian investors have been handily “beating” the TSX for decades now following this simple yet effective approach.

The BTSX strategy, of course, is an incredibly simple investment approach by design. Developed specifically for do-it-yourself Canadian investors looking to break free from the shackles of the high-fee mutual fund industry, it relies on a simple, mechanical, rules-driven approach that is remarkably easy to both implement and maintain for the generalist Canadian investor. BTSX simply selects the ten highest yielding stocks from the Canadian large-cap universe and purchases them in equal amounts. These stocks are held for the duration of the year, after which another ten high-yielding stocks are selected and the process begins anew.

Since 1987, the BTSX strategy has handily outperformed the Canadian broad stock market, delivering a 9.73% annual compounded return versus 7.56% for the TSX composite index . This level of outperformance would have resulted in the BTSX strategy near-doubling the TSX over the entire 34-year period. Enough ink has been spilled over the years extolling the virtues of BTSX, so we won’t rehash the points here, but for those interested in a more detailed historical analysis of this strategy, please refer to Matt Poyner’s coverage of BTSX at www.dividendstrategy.ca.

While BTSX is a stunningly simple strategy, many investors would undoubtedly find a one-fund “buy-and-forget” option that could achieve similar results as the BTSX approach to be extremely convenient. Unfortunately, no such BTSX fund presently exists, although our analysis of available dividend Exchange-Traded Funds (ETFs) suggests that there is one extremely effective proxy currently available to Canadian investors that delivers remarkably similar returns as BTSX. This would be the iShares Canadian Quality Dividend Index ETF, which trades as XDIV on the TSX.

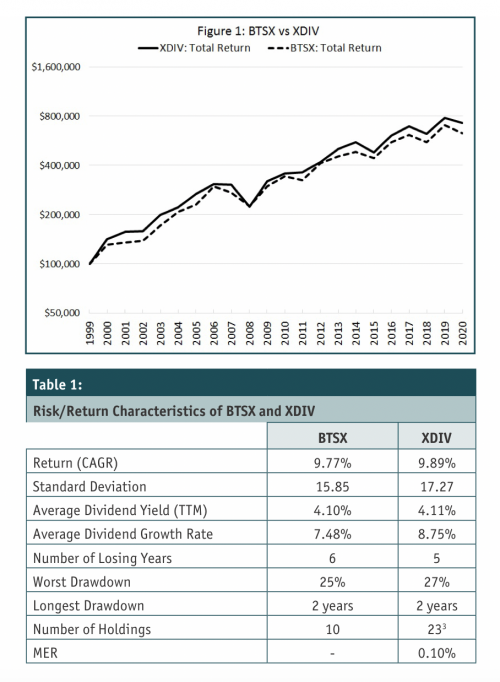

XDIV, of course, is a relatively new fund with a limited historical track record, which will undoubtedly cause some of our readers to question the assertion that XDIV serves as a proxy for BTSX. While it is true that XDIV has only a three-year track record as an investable ETF in Canada, it is based on the MSCI Canada High Dividend Yield 10% Security Capped Index of which MSCI provides historical data as far back as 1999. In order to compare these two investments, the total return of a $100,000 investment in both the BTSX and XDIV is shown in Figure 1. Note that the graph is presented in log scale for easier comparison, such that each increment on the Y-axis represents a doubling of the investment. Returns also do not account for taxes or fees.

We can see from Figure 1 that XDIV tracks the BTSX portfolio extremely well, delivering a 20-year annual compound return of 9.89% for XDIV versus 9.77% for BTSX. Fortunately for the sake of this comparison, MSCI also provides us with both total return data and ex-dividend price data (returns which exclude dividend reinvestment), allowing us to approximate dividend payments and yields from 1999-2020. Table 1 compares a selection of key metrics with respect to investment returns, dividends, and risk for both XDIV and BTSX.

While BTSX and XDIV will certainly perform differently over the course of any given year, over the long run their risk/return profiles have proven to be remarkably similar. Of course, the point of this comparison isn’t to make the case that XDIV’s long-run outperformance relative to BTSX is set to continue going forward, only to point out that the two investments share enough in common to confidently say that XDIV provides similar performance to BTSX and is a close enough proxy to be used as “buy-and-forget” substitute for Canadian investors.

Of course, given that XDIV’s benchmark isn’t based on the BTSX methodology, this begs the question as to how XDIV and BTSX share such similar risk/return profiles in the first place. Ultimately, the BTSX approach boils down to a large-cap value strategy which uses the dividend yield as a value measure. By selecting stocks from the largest companies in Canada, BTSX hopes to capture safe and mature companies that have very little chance of failure due to their relatively wide economic moats (think the big five banks). These companies have stable and steady dividends that are relatively persistent and will continue to pay out even if the price is temporarily beaten down. Thus, selecting high-yield captures temporary declines in price relative to underlying fundamentals (ie. the dividend), and selecting large-cap provides a measure of stability and low volatility.

By contrast, XDIV’s methodology is comparatively complex, although it ultimately ends up being driven by many of the same factors as BTSX. With respect to the specific methodology, XDIV begins with the entire Canadian equity universe and removes Real Estate Investment Trusts (REIT’s), non-dividend payers, and stocks with extremely high payout ratios. It further removes stocks without a five-year track record of persistent dividends and screens out stocks with poor “quality” metrics such as return-on-equity and debt-to-equity. Once this list is derived, XDIV will then select all stocks with a dividend yield 30% or higher than the broad market, and then cap-weights these stocks up to a 10% maximum weighting per stock. Thus, not only does XDIV end up with significant value exposure based on price-to-dividend, but by screening for quality dividend-paying stocks with a track record of persistent dividends and then weighting by market-capitalization, it tends to end up with overweight exposure to large-cap as well.

XDIV seems to be driven by similar factor exposures as BTSX, which has likely resulted in comparable risk and return characteristics between the two investments over the last 20 years. For those investors who have been tempted to follow BTSX yet have been holding off due to the added management overhead and high single-stock concentration, XDIV can be thought of as a more diversified and easier to manage solution. Of course, you pay a relatively small 0.1% MER for the convenience, but in the grand scheme of things this strikes us as money well spent for a “set-and-forget” one-fund solution.

Brian Chang is the author of the finance blog Crusoe Economics (https://crusoeeconomics.com). He resides in Vancouver and can be contacted by email at info@crusoeeconomics.com or on twitter @CrusoeEconomics.

Disclosure: The author has an investment position in XDIV.

1 BTSX annual returns prior to 2015 are only available from May to May of the following year. Beginning in 2015, returns are available on a calendar year basis. TSX composite returns have therefore been computed from May to May prior to 2015, and for the calendar year thereafter.

2 https://www.msci.com/msci-indexes-for-canadian-investors

3. As of June 23, 2021