Insights From ETFs: What can ETFs tell us about the ‘Growth-to-Value’ Rotation

There has been a lot of talk about the market sentiment shifting from growth to value. This may give off the perception that investors now prefer companies with low price-to-earnings (P/E) ratios over companies with high (P/E). While this is a fair observation, it is a bit of an over-simplification.

There has been a lot of talk about the market sentiment shifting from growth to value. This may give off the perception that investors now prefer companies with low price-to-earnings (P/E) ratios over companies with high (P/E). While this is a fair observation, it is a bit of an over-simplification.

There may be more to what we are currently seeing in the markets than just a ‘rotation’ from growth to value. There are other things to consider including the degree to which sectors were affected by the pandemic, their sizes and the fact that we are coming out of pandemic, the likes of which we have never experienced before.

The charts below represent the cumulative performance of value and growth ETFs and a combination with different market caps relative to the S&P500, which we will consider as ‘Core equity’.

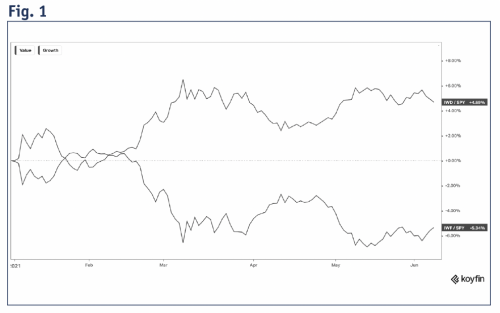

Using the help of the ETFs IWD (iShares Russell 1000 Value) and IWO (iShares Russell 2000 Growth) let’s take a look at how value and growth as a whole have performed: (Fig. 1)

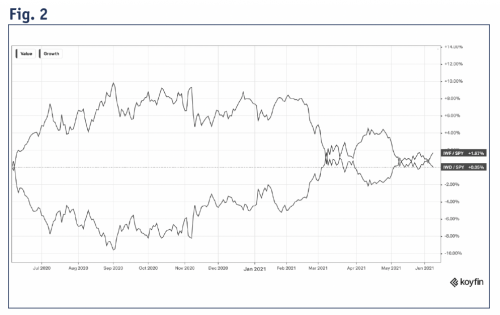

On a YTD basis, the ‘rotation’ seems clear. However, zooming out over the last year this rotation seems a bit less obvious with value and growth crossing over each other a few times (chart below). This makes sense given the strange market we have seen over the last year due to COVID. With such a steep run-up in growth and tech stocks during the pandemic, a sharp short-term correction is not surprising. Many value stocks are also cyclical which typically do well in an economic recovery and are expected to bounce back even more coming out of the pandemic. All of this has likely further exasperated the rotation from growth to value. (Fig. 2)

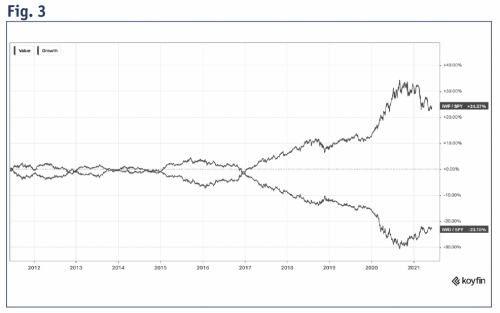

Like many other comparisons in investing, under/outperformance depends on what point in time you start measuring. The further back we go with growth and value, the less clear it becomes how ‘real’ this rotation is. Zooming out even further to 10 years we see that there have been other instances when growth and value cross over, taking turns being the ‘outperformer’ compared to the S&P500, particularly from 2011-2017, with growth vastly outperforming thereafter. (Fig. 3)

A question that comes to mind here is: How much does growth need to correct, and value need to appreciate for this to be considered a real rotation?

Growth still seems to be the overall winner in the long run. However, in fairness, it can be argued that plain vanilla ‘value’ ETFs and indexes often simply look for companies that are trading at a P/E below average market level. A low P/E is not necessarily a sole metric to go by when looking for companies with strong return potential. In fact, many companies have low P/E’s, because of weaker fundamentals and slow growth. So, it would not be unreasonable to attribute some of the underperformance of value to ‘value-traps’. On the other hand, an index that tracks companies with growth characteristics is arguably a more reliable indicator for long-term capital growth.

Does size matter?

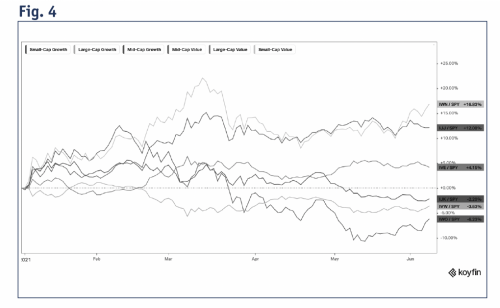

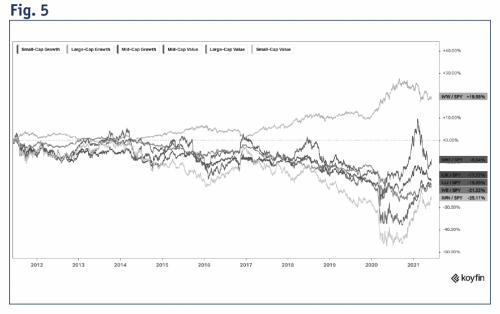

To gain better insight as where the rotation is happening and what it could mean, it helps to break things down in terms of market size as well. Below we have charted value and growth ETFs of different market caps. (Fig. 4)

We can clearly see that value has outperformed so far this year, and in particular, small-cap and mid-cap value compared to large-cap value. Here we almost see a mirror image with small and mid-cap value being the best performing ‘styles’ and small-cap growth being the worst performer, on a YTD basis. This could be explained by investors adjusting their risk to reward outlook by moving away from unprofitable small growth stocks viewing them as too risky, especially given concerns over interest rates and inflation. On the other hand, small caps tend to outperform in an economic recovery, giving ‘undervalued’ small-cap stocks a more interesting risk/reward set up. Put differently, small caps with low P/E’s might present less downside risk than their higher P/E growth counterparts, while also providing upside potential associated with an economic recovery. (Fig. 5)

Zooming out to a 10-year time frame, it is also worth noting here that both small-cap and large-cap growth have done very well over longer time frames compared to the rest. Large-cap growth stands out, in particular, showing far less volatility than small-cap growth and outperformed it by about 30% on a cumulative basis over 10 years.

Differences in sectors

It is also worth noting here the differences in sectors. For example, the top sectors in the small-cap growth index are technology, health care, industrials and consumer discretionary, all of which saw strong rallies during the pandemic and are now seeing a correction. This is in contrast to small-cap value whose top sectors consist of those that will likely benefit from an economic recovery like financials, industrials, consumer discretionary and real estate. While industrials and consumer discretionary are common to both small-cap value and growth as top sectors, they contain different subsectors that will likely react differently to the reopening of the economy. For example, industrial companies can be both renewable energy equipment companies (strong rally in 2020) or construction companies (to benefit in post-pandemic). Consumer discretionary companies can be e-commerce companies or physical retail stores etc.

What does this mean for investors?

We think it is important for investors to differentiate between the general market sentiment and risk appetite and the negative performance of an individual stock based on its fundamentals. As always, we are reluctant to make conclusions based on the short-term movements in stocks. Additionally, investors should keep in mind that more volatility should generally be expected when investing in growth stocks compared to value. Will value begin to outperform growth going forward? Based on historical trends, we think it is far too early to make that call. Growth still holds the upper hand when looking out over longer time periods, but ‘value’ indexes do not necessarily reflect a true value strategy. The recent shift from growth to value may also highlight the role ‘style diversification’ can play in reducing overall portfolio volatility in the near term.

Finally, regardless of whether one takes more of a growth or value approach to investing, we think focusing on fundamentals will continue to be the key to long-term success.

Disclosure: Authors, directors, partners and/or officers of 5i Research have a financial or other interest in XIT and ZRE.