Insights From ETFs: It Might Be Worth Having Your Head in The Cloud

The technology sector continues to cause structural shifts impacting the way we do business in various industries. One force that is penetrating virtually all industries is the “Cloud” and never has this been more evident than in the COVID-era where the convenience of cloud computing became most apparent. Today, more and more businesses are moving much of their operations to the Cloud, rather than investing heavily in IT equipment, IT personnel and software developers. As a result, businesses (small or large) can grow much faster than before, while cutting costs. Of course, the industry behind this growth (cloud computing) is likely to see an even higher growth rate.

The technology sector continues to cause structural shifts impacting the way we do business in various industries. One force that is penetrating virtually all industries is the “Cloud” and never has this been more evident than in the COVID-era where the convenience of cloud computing became most apparent. Today, more and more businesses are moving much of their operations to the Cloud, rather than investing heavily in IT equipment, IT personnel and software developers. As a result, businesses (small or large) can grow much faster than before, while cutting costs. Of course, the industry behind this growth (cloud computing) is likely to see an even higher growth rate.

According to Gartner, the cloud computing market is expected to grow three times faster than the overall IT sector through 2022. This is what makes cloud computing an interesting space for investors. However, the cloud computing space is vast and multi-layered, involves new concepts and can be a confusing space. Knowing its structure and how it is relevant in our world today can help investors get an understanding of where the industry is going and who the players are.

The cloud computing space can be classified into three separate categories, which can be thought of as the “back-end” to “front-end” of the industry:

- Infrastructure-as-a-Service (IaaS): Companies that provide servers, storage and IT infrastructure on demand. Think Amazon Web Services (cloud storage).

- Platform-as-a-Service (PaaS): Tools and resources sold to companies and developers to build software or applications. Think Microsoft Azure.

- Software-as-a-service (SaaS): Software and applications that are sold to businesses/consumers for various uses. Think Salesforce or Google Apps.

The First Trust Cloud Computing ETF (SKYY)

The First Trust Cloud Computing ETF (SKYY) tracks the ISE CTA Cloud Computing Index. The Index is equal-weighted, which we like to see as it reflects somewhat of a strategy compared to the more arbitrary characteristic of a market-cap weighted index (such as the TSX or Dow Jones). The Index first selects companies that are considered “cloud computing” companies by the CTA and then screens according to three broad criteria. The company must have:

- A minimum market-cap of $500 million.

- A minimum free float (portion of all shares available to public investors) of 20%.

- A minimum of a three-month average daily volume of $5 million.

Equal Weighting

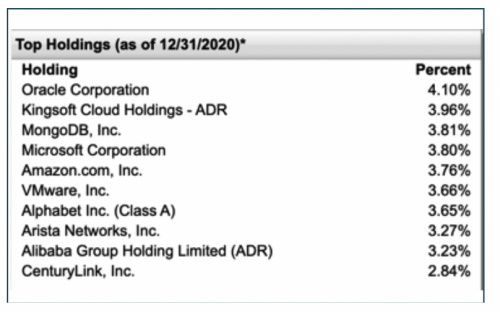

In terms of equal weighting, the Index gives each company a “Cloud Score” for each category to determine how much of a weighting a company should have in the Index. In other words, the Index ensures that you are invested in an equal amount in all three cloud computing industry categories mentioned above. However, it is important to note here that this fund does not implement the conventional equal weighting method whereby all stocks have the same weight, rather the Index focuses on an equal weighting of the three cloud computing categories. A quick glance at the holdings shows a clear bias toward large-cap companies in weighting and while this is arguably a good strategy in a growing space like this, it does not offer the small-cap growth tilt that other equal-weighted funds might have. In fairness, the fund does cap specific company weights at 4.5%, which helps to offset some of the large-cap bias. Also, the large-tech exposure to this space is arguably an advantage (see top ten holdings table below) given they have managed to exhibit outstanding growth despite their large size, while maintaining industry dominance.

Source: First Trust Portfolios

Source: First Trust Portfolios

The Index is rebalanced and reconstituted every quarter which means more frequent rebalancing and higher turnover and, in turn, more trading costs. However, given a reasonable Management Expense Ratio (MER) of 0.60%, the higher turnover has not had an overly negative impact on the fund in terms of fees.

Concentration

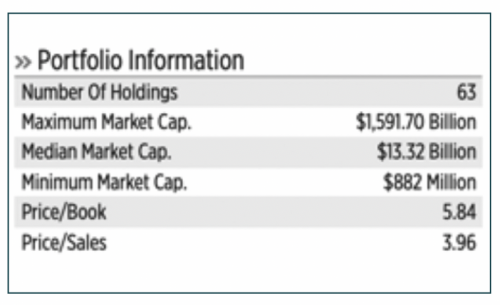

The fund currently holds 63 companies and limits the number of companies held in the fund to 80. Overall, we like this level of concentration and we think it is appropriate for a niche space.

Source: First Trust Portfolios

Source: First Trust Portfolios

Comparison with iShares NASDAQ 100 Index ETF (XQQ)

In comparing SKYY to iShares NASDAQ 100 Index ETF (XQQ), we like XQQ to get exposure to U.S. technology, however, SKYY offers a much more focused strategy for investors looking for a play in the technology sector. XQQ offers more of a generic technology exposure as well as some consumer discretionary and health care exposure and weighting based on market-cap. The screening method searches for companies with specific characteristics while applying a weighting method that helps with being diversified in the cloud computing industry and that gives SKYY an edge. Investors who are seeking more of an active approach could consider taking on SKYY instead of (or in addition to) a more arbitrary Index like the Nasdaq 100 used by XQQ. The difference in fees is also not significant considering the Index that SKYY tracks is more thought out and methodical than the Nasdaq 100.

Acquisition Play

While cloud computing is a space that is led by tech giants, it is a highly versatile space that breeds innovation and competition from smaller companies. Many smaller companies in the space (and many in this fund) can be seen as potential acquisition targets for other bigger technology companies in SKYY (e.g. Google, Microsoft, Cisco, Oracle). In the case of an acquisition that is well-received by investors, the share prices of the acquirer and target company can both see a boost. This later might be followed by a potential delisting of the target company and a new spot available in the fund when quarterly rebalancing comes around.

Performance

Since the fund’s inception date of May 27, 2011, the fund has returned an impressive 18.04% annually and has had positive returns every year thus far, even returning 6.23% in 2018 while broad markets were in the red. This could be owed partially to the growth of the industry itself, as well as the frequent rebalancing and reconstituting of the Index to maintain a certain company quality (size, trading activity, liquidity). I also think the equal-weighted method to the cloud computing ecosystem provides a sort of diversification to the space and, in some sense, lower volatility. In terms of return volatility, the fund has a three-year standard deviation that is lower than the broader S&P Composite 1500 Information Technology Index (13.68 vs 15.81) and higher on a risk-adjusted return basis compared to the broad S&P500 with a Sharpe ratio of 1.36 vs 1.10.

SKYY is the Limit

When taken into consideration the fast-paced growth the cloud industry has seen over the years (particularly in 2020), the concentration and strategy of the fund, as well as the diversified mix of cloud companies in the three industry segments, and growth record of the companies themselves, we think this fund is a good choice as part of a differentiated growth strategy. Cloud penetration into industries across the board tells us it is here to stay and COVID has arguably accelerated the existing growth trends in the space. Of course, investors may have concerns on whether this growth can continue given the sector’s awesome 2020 performance and certainly high valuations are a risk. However, I think the type of growth and adoption of cloud solutions by business seen over the last year is a signal that there will be an even bigger shift to the clouds in the coming years.

Moez Mahrez, CFA, Senior Analyst at www.5iresearch.ca.

Disclosure: Authors, directors, partners and/or officers of 5i Research have a financial or other interest in XIT and ZRE.