This ďAinítĒ Your Parentsí Retirement!

Decades ago, the idea of retirement was a fairly simple one. You save and invest in your early years, then as you get older, you begin to move increasing amounts of money over to fixed income. The fixed income (bonds) then give you confidence that your money will be there when you need it while also providing a steady income that, at least, fights inflation. If you had been in bonds for over ten years now, you might have even received the benefit of the capital itself growing as interest rates have declined. Unfortunately, this trend in interest rates has posed a real problem for new retirees and those approaching retirement.

Decades ago, the idea of retirement was a fairly simple one. You save and invest in your early years, then as you get older, you begin to move increasing amounts of money over to fixed income. The fixed income (bonds) then give you confidence that your money will be there when you need it while also providing a steady income that, at least, fights inflation. If you had been in bonds for over ten years now, you might have even received the benefit of the capital itself growing as interest rates have declined. Unfortunately, this trend in interest rates has posed a real problem for new retirees and those approaching retirement.

If you are newly or soon-to-be-retired, you have probably thought about or been given the list of trade-offs or sacrifices you need to make due to low rates. All of these options are intended to balance the fact that the “safe” portion of a portfolio now provides an income stream that is FAR lower than it has ever been. With a lower income stream to support your expenses, most individuals need to contemplate these three offsets:

1. Save more before retirement.

2. Spend less in retirement.

3. Accept more risk/volatility in your retirement portfolio.

If each option could be included with a pina colada on the beach, then it might at least help numb the pain for savers that have worked their whole life to build a nest egg only to find out they need “more” to maintain their lifestyle. What’s more, we are not even here to discuss longevity risks, where we are, on average, living longer, more active lifestyles than ever before. This means those savings also need to last longer than previously, but on a lower overall yield.

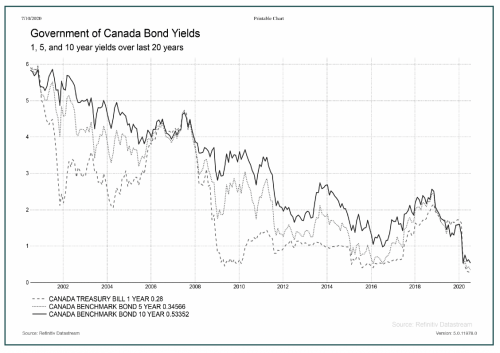

A lot of this might not be much of a surprise, but we often gloss over what this really means. The image below helps to put into context what the fall in yields looks like. We are looking at Government of Canada bonds here, but the trend is the same across the whole bond spectrum. Unfortunately, in order to get higher yields, investors need to move up in risk, which is not always a great trade-off for a retired individual.

Yes, you are reading that right. You can loan the Government of Canada money for 10 years for the privilege of earning 0.53% a year. If you put $10,000 into government bonds, they would yield you a “whopping” $530. Perhaps more interesting, you could invest in a 1-year bond at 0.28% or a 10-year at 0.53%. So, to have that $10,000 locked up for an additional nine years, you would receive an extra $502.

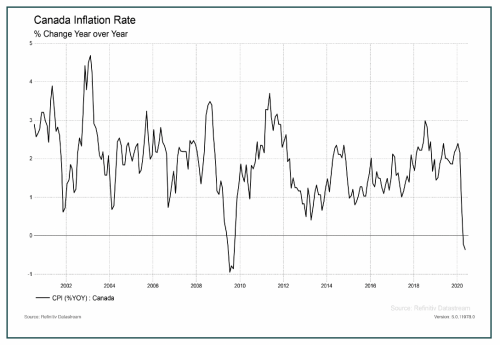

This sad story of low interest rates and bonds is not over yet. Because we have not talked about the worst enemy of bonds: inflation. Briefly, inflation represents the increased cost of goods over time. If you hold cash under the mattress, you actually lose money over the years because items get more expensive (inflation) while that cash does not grow to offset this impact. Below is what inflation has done over the same time period.

Certainly, inflation fluctuates, but most would agree it has stuck to a reliable range around two per cent over the last 20 years. Let’s bring the two together now. In a ten-year bond, an investor makes say $53 a year on a $10,000 investment. However, inflation costs $150 a year (assuming a 1.5% inflation rate). On an annual basis, an investor actually loses $97 a year. In fairness, losing $97 a year is better than losing the full $150 to inflation, but hardly an ideal outcome. We won’t even go here, but it is important to remember that all of this is before tax, so the picture is still likely worse on a net basis.

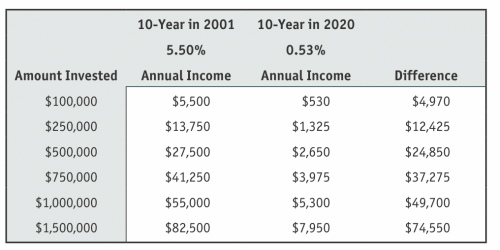

We can walk through one more table, below, to help us show how retirement is such a different beast than it was even just 20 years ago.

As the table illustrates, 20 years ago at a rate of 5.5%, a retiree could invest $500,000 worth of money for ten years, be reasonably assured that money will be there ten years from now while making $27,500 a year. With those same numbers today, a retiree would make $2,650. Think about that, some savers can spend their whole life saving a portfolio in the range of $500K and when it is all said and done, they will only be able to “safely” generate $2,650 a year from that. This certainly is not your parents’ retirement.

Twenty years ago, add in some social safety nets like Canada Pension Plan (CPP) and company pensions and you could probably live a comfortable lifestyle and have something to leave to your family without relying on the withdrawal of capital. In today’s terms, you would be almost fully reliant on safety nets to support cash flows. Taking a bit of a different angle, if we assume you need around $40,000 in retirement on an annual basis, given current 10-year bond rates, an investor needs a $7.5 million portfolio. Twenty years ago, you needed roughly a $750,000 portfolio to generate the same sort of income.

What does this all mean? Unfortunately, as hinted at earlier, it means retirees need to either accept a lower cash flow going forward, reduce their spending needs, or take on more risk in the form of equities (or some combination of the three). We do think there are two other longer-term implications that get missed here that require a bit of a divergence from the more traditional retirement mindset:

Younger investors likely need to start saving earlier (as early as possible) and take on more risk than in the past, in order to maximize their chances of building a sufficient nest egg over time. While getting started early has always been a good idea, this generally agreed upon advice will more than likely become less of a good idea and more of a necessity in the future.

Retirees might need to accept that they will have to withdraw from their actual capital in retirement. As we mentioned, this is not your parents’ retirement and the idea that you can live off the cash flows from your nest egg is becoming less and less likely in the current environment.

Finally, many individuals include or count on capital being passed down from their parents to help fund their retirements. While this will still more than likely be the case, there may need to be some adjusting of expectations within families on what a realistic amount can be expected when the sad day arrives. These conversations can be important early on for two reasons. The first is that it allows the children to act accordingly and limits any surprises. The other is that it allows the parent to not feel guilty about spending their own money that they might otherwise wish to leave to their children.

Everyone’s situation is different, but if these low yield environments persist, and in the medium-term it looks like they will, we will all need to start having conversations and making adjustments to our financial expectations/strategies. These expectations might look quite different from the traditional rules of thumb and strategies we have all been raised on for the last 50 years or so.

Ryan Modesto, CFA, is CEO at 5i Research Inc. in Kitchener, Ontario. He can be reached at ryanmodesto@5iresearch.ca