Insights From ETFs: What is Quality?

There is lots investors can learn by studying ETFs. Even passive index ETFs with no particular strategy that simply reflect broad market-cap weighted indices like the TSX or S&P500 can serve as a good idea generator for individual stocks. However, factor ETFs that implement screening strategies based on certain criteria can offer an even more refined list of companies as well as lessons in investment strategies from their screening methodologies that we can implement ourselves.

There is lots investors can learn by studying ETFs. Even passive index ETFs with no particular strategy that simply reflect broad market-cap weighted indices like the TSX or S&P500 can serve as a good idea generator for individual stocks. However, factor ETFs that implement screening strategies based on certain criteria can offer an even more refined list of companies as well as lessons in investment strategies from their screening methodologies that we can implement ourselves.

What is a quality company?

In the investing world, we often hear about the concept of investing in “quality companies”. The word “quality” is often used quite loosely and in fairness, quality in itself is a subjective concept. However, there are certainly some agreed upon characteristics in the investment industry as to what constitutes a quality stock. One way to get an idea of what investment professionals and fund managers view as quality is to turn to factor ETFs with a quality tilt and understand their screening methodologies.

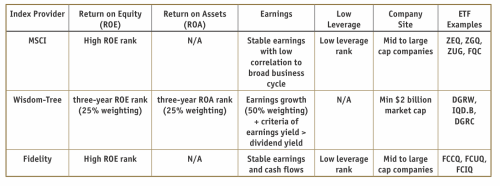

Most ETFs available in Canada with a quality tilt use an underlying index created by either MSCI, Fidelity or Wisdom-tree. Regardless of the exposure offered by each ETF (ex. Canada, US, International), there were common criteria that each of the index providers used, which represented in the column headers in the table below.

While the three index providers use slightly different criteria to measure quality, common themes are certainly high ROE, stable earnings, low leverage and company size. Interestingly, from these quantitative measures one can infer certain qualitative characteristics such as good company management (ROE), lower volatility in share price (stable earnings), lower bankruptcy risk (low leverage) and an adequate market share or presence (company size).

Qualitative factors in quality investing

Another aspect we find common within quality-focused ETFs is the qualitative objective to invest in companies with wide economic moats, sustainable competitive advantages and an ability to perform in all market conditions. Though these are characteristics related to qualitative concepts such as branding, customer loyalty, industry structures and business models, it is often the case that high ROE, earnings stability and low leverage result in companies with strong economic moats and sustainable competitive advantages. In turn, you often end up with companies that have relatively consistent profit margins and high ROE. Perhaps a unique way of measuring effective management in addition to high ROE is Wisdom Tree’s earnings yield to dividend yield measure, which makes sure that companies are being prudent about how much of their dividend is being paid out relative to their earnings.

What individual stock investors can learn from quality ETFs

The answer is straightforward, looking for the same characteristics that these quality ETFs screen for can be a great way for investors to find quality companies for their individual portfolios. Of course, quality does not need to be limited to the characteristics discussed above. Just as the index providers have differences in the criteria, an individual investor can impose his/her own criteria. As examples, one can add in a more specified debt to equity threshold of 25% or a current ratio (current assets to current liabilities) of 1.5. One can even add in a growth twist by requiring a minimum earnings growth rate of X% over the last five years. That said, if one is more of a passive investor, quality ETFs are certainly a good and easy option for quick diversification, but for someone who is looking to be more selective, using criteria like the one’s discussed above are a good starting point.

Moez Mahrez, CFA, Analyst at 5i Research.

Disclosure: Authors, directors, partners and/or officers of 5i Research have a financial or other interest in XIT and ZRE.