Insights From ETFs: Does a low-volatility strategy work in COVID uncertainty?

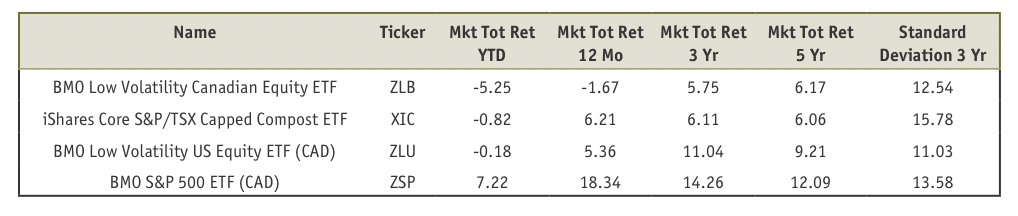

Low-volatility strategies can sound “boring”, but some have shown comparable performance, and at times, outperformed broad market indices. However, the real questions are: have these strategies stood the test of volatility in this year of uncertainty? Will they continue to be a good way to lower portfolio risk? To gain some insight let’s compare the performance and components of low-volatility Exchange-Traded Funds (ETFs) BMO Low Volatility CAD Equity ETF (ZLB) and BMO Low Volatility U.S. Equity ETF (ZLU), to their broad market counter parts iShares Core S&P/TSX Capped Composite Index ETF (XIC) and BMO S&P 500 Index ETF (ZSP). In the table below you can see the performance for different time periods and three-year standard deviations (a measure of return volatility).

Low-volatility strategies can sound “boring”, but some have shown comparable performance, and at times, outperformed broad market indices. However, the real questions are: have these strategies stood the test of volatility in this year of uncertainty? Will they continue to be a good way to lower portfolio risk? To gain some insight let’s compare the performance and components of low-volatility Exchange-Traded Funds (ETFs) BMO Low Volatility CAD Equity ETF (ZLB) and BMO Low Volatility U.S. Equity ETF (ZLU), to their broad market counter parts iShares Core S&P/TSX Capped Composite Index ETF (XIC) and BMO S&P 500 Index ETF (ZSP). In the table below you can see the performance for different time periods and three-year standard deviations (a measure of return volatility).

ZLB has clearly underperformed XIC this year so far, and this may seem discouraging at face value for low-volatility investors. However, a closer look at a year-to-date performance chart will reveal that ZLB held up slightly better in March 2020 and April 2020 when we saw the most of volatility this year. ZLB had also outperformed XIC throughout most of the first half of 2020. From June 2020 onward, various sectors in the TSX began to pick up strength, explaining XIC’s outperformance compared to ZLB year-to-date.

However, the low-volatility strategy of ZLB provides more sector diversification and has been comparable to the broad XIC ETF over three and five years, with a lower standard deviation over three years, making ZLB a more attractive option compared to XIC. ZLU has underperformed its U.S. counterpart over the same time periods, and this is justifiable given the higher weighting in technology and other cyclical sectors in ZSP. However, ZLU has provided solid annual returns on a three- and five-year basis while providing the lowest standard deviation on this list. This is a fair trade-off for investors seeking lower portfolio volatility.

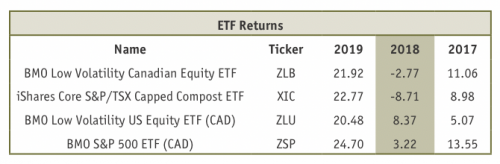

Low-volatility ETFs during “normal” market declines:

Low-volatility ETFs significantly outperformed their broad market counterparts in 2018, a year in which markets had arguably more “normal” fears about a general economic slowdown (particularly related to trade tensions). The potential consequences of virus outbreak were certainly not factored into the low-volatility strategies of these ETFs. However, it will be interesting to see how something like a virus outbreak will be factored into low-volatility assumptions in the future.

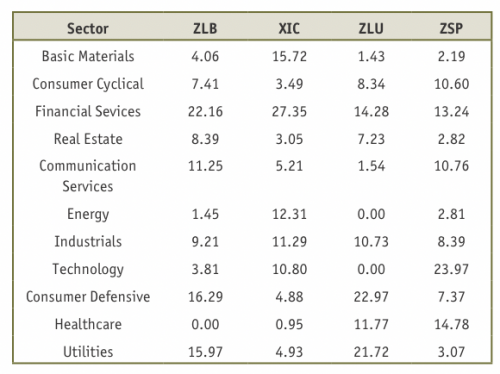

Sector

The table above shows the sector breakdowns of each ETF. Though ZLB has a seemingly superior sector set-up for a recessionary environment, XIC has outperformed ZLB this year, which may have left investors wondering why. We first need to keep in mind that low-volatility is not meant to outperform, as much as it is meant to provide lower volatility. Secondly, XIC likely benefited from the 30% rally seen in the basic materials sector primarily from the run up in gold prices (due to economic uncertainty) and precious metal prices this year. Basic materials are nearly 16% of XIC compared to 4% in ZLB. This is one explanation of the difference in year-to-date performance, but due to the commodity price risk, we still would not consider the materials sector to be a reliable “hedge” to downside risk, and would rather turn to utilities and consumer defensive sectors that ZLB offers for low-volatility.

When comparing ZLU and ZSP, a similar tilt can be seen towards sectors like consumer defensives and utilities in ZLU, and 0% weighting in technology compared to ZSP at 24%, which puts ZLU at a disadvantage compared to ZSP this year. The unique “new normal” caused by COVID-19 has resulted in a bias in performance towards technology, health care and mining stocks which have little to no weighting in the low-volatility ETFs we are discussing. In this environment, we could argue that technology companies that are already equipped to operate remotely are the new “low-volatility” play. If not technology companies, perhaps the ability to operate remotely will be a low-volatility criterion for any type of business for future strategies.

The outperformance of broad markets compared to low-volatility ETFs is partly related to the disproportionate effects this pandemic has had on specific sectors, adding to what may seem obvious—this year has been one unlike any other in our lifetimes. It is also important to consider the geography that a low-volatility ETF covers. In Canada, the volatility strategy of ZLB has worked favourably compared to investing in the broad TSX. Finally, it is always important to remember the purpose of low-volatility ETFs and not fall into the trap of comparing apples to oranges. Low-volatility is meant to provide lower volatility of returns and ETFs like ZLB and ZLU have done quite a decent job of doing just that.

Disclosure: Authors, directors, partners and/or officers of 5i Research have a financial or other interest in XIT and ZRE.

Moez Mahrez, CFA, Analyst at 5iResearch.ca.