Momentum As An Investment Strategy

It’s been almost 10 years since I penned my last article for Canadian MoneySaver. Since then some things have changed, I’m 10 years older, hopefully 10 years smarter, and I have recently retired from the investment business. This allows me much more time for true market research, writing and with less compliance oversight telling me what I can and can’t say. With close to 40 years of following the markets I’m figuring out what I believe works and what doesn’t. I have always tended more to follow the charts and not the opinions of other people, so hopefully I can plant some wisdom in these articles. For the last 10 years I worked as an advisor for a large bank-owned brokerage firm. The team I worked with managed accounts using individual securities and not mutual funds or similar managed products that are becoming the norm for the investment business.

It’s been almost 10 years since I penned my last article for Canadian MoneySaver. Since then some things have changed, I’m 10 years older, hopefully 10 years smarter, and I have recently retired from the investment business. This allows me much more time for true market research, writing and with less compliance oversight telling me what I can and can’t say. With close to 40 years of following the markets I’m figuring out what I believe works and what doesn’t. I have always tended more to follow the charts and not the opinions of other people, so hopefully I can plant some wisdom in these articles. For the last 10 years I worked as an advisor for a large bank-owned brokerage firm. The team I worked with managed accounts using individual securities and not mutual funds or similar managed products that are becoming the norm for the investment business.

One of the best proven strategies for investing, and one we personally used to manage client’s money was “price momentum”. Momentum, is by far, the most academically studied investment strategies when it comes to what works in the markets. It’s also one of the only strategies that stands the test of time and continues to outperform to this day. The main thesis behind momentum is taken from Isaac Newton’s first law of motion: that every object will remain at rest or in uniform motion on a straight line unless compelled to change its state by the action of an external force. To paraphrase: a body in motion will stay in motion until some force causes it to stop.

Price momentum works for most assets and asset classes so it can be used equally by conservative as well as aggressive investors. There are two common types of momentum: relative strength and absolute momentum. Relative strength is used to rank a list of stocks, funds, markets or asset classes to determine which ones are outperforming their peers. What relative strength does not tell is whether the items have a positive return. The highest-ranking asset can still have a negative return akin to the best deck chair on the Titanic. This is where absolute momentum comes in. Absolute momentum measures if there is a positive return for the asset. This is a useful macro that can tell an investor if they want to be in equities, bonds or cash. Yes, cash is an asset class and an overlooked and important one at that—kind of a safe haven in uncertain times.

One of the consistent features of momentum is that it typically is a one-year phenom. If an asset has outperformed over the last year it is likely to continue to outperform. When we start looking at performance in excess of one year, this outperformance can be less dependable. Typically, a momentum model user will look at a blended three, six and twelve-month average of price growth to determine and rank the best performers and buy the top performers. Then, at the one, three or six-month intervals the process is repeated, the list is re-ranked and the portfolio is rebalanced, selling items that have fallen down the performance ranking list and replacing them with the highest ranked performers that are not already owned. This is all relative strength.

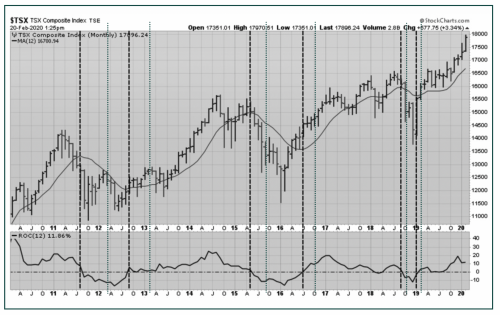

The absolute momentum indicator I personally use is looking at the twelve-month Rate of Change (ROC) of the asset. If the one-year return is negative for say the equity market, I will raise cash. This is shown on the accompanied TSX chart with the vertical dashed lines highlighting when the 1-year ROC goes negative or below zero and positive, back above zero. At the point the absolute momentum goes negative the user might look at the absolute ranking performance of stocks versus bonds or cash to determine if there is a more attractive alternative investment at that time. An equity only strategist might opt to go to cash on an absolute momentum sell signal, while a multi-asset manager might consider going to bonds if they are outperforming equities or cash. This signal on the TSX did, in fact, give a successful equity sell in September of 2018 and reversed back to a buy in January of 2019. While monthly is not the fastest signal for a trader it can save a portfolio a lot of money in a major selloff, while waiting for the market to signal a buy before re-entering.

I plan to expand on this and other investment strategies that I, and the investment community, use with real money in future articles.

John Copp CMT is an independent technical analyst and recently retired Investment Advisor from a Canadian bank owned investment dealer.