A Stand Against Capital Punishment – Ways To Minimize Your Capital Gains Tax Bill Part 2 – Advanced Strategies

In my first article in this series (September 2019), I have hopefully whetted your appetite for ways to have your cake and eat it, too. In other words, how to best combine large capital gains with small tax bills. Today’s missive is about putting the principles laid out in that earlier article into action.

In my first article in this series (September 2019), I have hopefully whetted your appetite for ways to have your cake and eat it, too. In other words, how to best combine large capital gains with small tax bills. Today’s missive is about putting the principles laid out in that earlier article into action.

Advanced Strategies

The following suggestions will apply some of the points noted above, and, as the cherry on top, I’ll throw a few more crumbs on the table as we go that can result in even more savings:

Realize Gains in Your Non-Registered Accounts Strategically

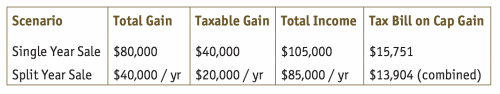

Although it can be dangerous to hold onto your investments too long in some cases, as years’ worth of gains can sometimes collapse like a hot souffle in a cold kitchen when a good stock goes bad, waiting to sell when in the right tax bracket can also save a lot of tax dollars if the stars and Wall Street both align. For clients holding rental properties or large equity positions, that might mean waiting to sell until retirement or during a sabbatical year when in lower tax brackets. My example from the first article in this series illustrates the potential savings of selling when in a lower tax bracket. You might also sell off only part of an asset in a single tax year. Assume an investor receiving full OAS who typically earns $65,000 in other income wants to liquidate a stock with an $80,000 capital gain. The following shows her tax bill if she sells it all at the end of 2019 or if she sells 50% on the last trading day of the year and the remainder on the first trading day of 2020, assuming the price and tax rates don’t change. As tax brackets are indexed, this investor might actually save a bit more by using this strategy than the example below illustrates.

By waiting one trading day to sell the remaining 50% of her shares, this investor could save as much as $1,847, including the OAS clawback amount. Some investors might even stagger the sale over 3 years to have more of the gains taxed in even lower brackets. Just keep in mind my souffle metaphor from earlier when trying to get too clever about picking the time to sell – I don’t want you getting egg on your face by holding the stock just a little bit too long and watching your capital gain turn into a capital pain.

Realize your Company’s Capital Gains Strategically, Too

To begin, consider whether your company’s total taxable passive income for that year will exceed $50,000 (remember – only 50% of capital gains are included as passive income, which means you can earn twice as many cap gains than interest and investment dividends inside your company for this calculation) and by how much. The federal government and most provinces give a preferred tax rate on the first $500,000 of active business income per year, with this threshold reduced by $5 for every $1 your company’s passive income from the previous year exceeds $50,000. After estimating that year’s taxable investment income, then determine how much business income you expect to make and keep in the company next year. If you don’t plan on keeping any excess earnings in the corporation or if that money would still qualify for the small business rate, then no big deal. On the other hand, if triggering too many gains might impact your company’s active business tax bill in the year to come, then decide whether or not it still makes sense to sell or see if there are any capital losses you can apply or create to reduce the taxable gain.

Conversely, if you will have already lost your small business rate next year (i.e. you’re going to have more than $150,000 in passive income this year regardless of what you do), consider turning lemons into lemon tarts by triggering additional capital gains now. By gorging yourself on capital gains this year, you might find it easier to stay under the $50,000 threshold in the future. This works best if you have a legitimate need to re-balance your portfolio anyway or where planning on realizing the gains over the next year or two in any event, as triggering tax bills earlier than necessary means having less money to compound going forward. You would have to compare the future tax savings to the lost growth and income on the money you’re paying to the government ahead of schedule in taxes. Ultimately, since there are a lot of factors to consider, including how much realizing extra gains now might impact your personal income, the decision when to trigger corporate capital gains is usually best made with the help of your accountant or an experienced financial planner.

Consider Investing for Capital Gains Corporately to Protect an Active Company’s Small Business Tax Rate

My last bullet explains how too much passive income inside one of your companies can increase the tax rate you pay on active business income the following year and leave you with that queasy feeling that often follows dinner at a smorgasbord. In addition to strategically realizing gains and losses inside your company, consider whether it makes sense to focus on capital gains investments inside your company in the first place if the passive income rules are cramping your lifestyle, as well as your stomach. Only 50% of the gains are included in the passive income calculations and you can control when you trigger those tax bills when you own individual stocks or sell ETFs or funds (although you still might receive some gains from funds and ETFs along the way.) This might work even better with investments like corporate class mutual funds (if you can stomach the fees and they still work for you after the recent tax changes that can impact their tax efficiency) that are designed to minimize taxable distributions or REITs (real estate income trusts) that generally pay tax-free return of capital in full or in part up until the time of sale. As an added bonus, your company can pay you the 50% of the total gain that wasn’t corporately taxed to you as a tax-free corporate dividend, which gets more money in your pocket without having to flow out more taxable income to you.

Use Your RRSP Room Strategically

If you’re normally in a lower tax bracket but are expecting a super big gulp-sized capital gains in the future that will push you to the tax bracket stratosphere, consider stockpiling your unused RRSP room and using it when it is time to sell. As only 50% of any gains are included as income, $50,000,000 of unused RRSP room can offset $100,000 of realized capital gains. Also, keep in mind that your RRSP contribution doesn’t have to be a long-term commitment – you can pull a bunch of the money out during the next tax year when in a lower tax bracket if you want. Have a spouse in a lower tax bracket or who might be in the future, such as if you retire in different years? Consider making the contribution a spousal one, although keep in mind that the money needs to stay in your spouse’s RRSP for at least three December 31’s before withdrawals can be taxed in your spouse’s hands.

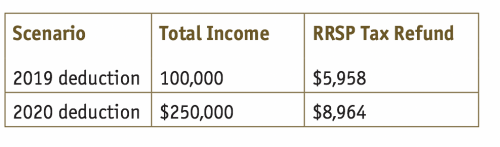

Here is an example to show some of the potential savings. Assume you earn $100,000 per year net of all other deductions and make an $18,000 RRSP contribution by the end of February 2020. You have the choice of deducting your contribution for the 2019 tax year or deducting it for the 2020 year (or later, if you really wanted), as you are expecting to sell rental property with $300,000 in unrealized capital gains ($150,000 of which will be taxed) in the near future. Although you will have to wait an extra year to get your refund, here are the potential tax savings you might reap by practicing delayed gratification.

By waiting a year to apply her RRSP deduction, this investor saved about $3,000. Although she did lose the use of her refund dollars for 365 days, she would have needed to get an after-tax return of over 50% if getting the smaller refund sooner to make it worth her while. This investor would also definitely want to make her regular RRSP contribution in 2020, as she would have earned about $18,000 more in new room based on her 2019 income, as this additional deduction would produce a similar tax refund.

Consider Delaying your OAS Pension if Triggering Gains in your Late 60ís

Consider delaying your CPP as well. At this point, if your taxable income exceeds about $76,000 and you are on OAS pension, you will lose fifteen cents per dollar your taxable income exceeds this amount. Since only 50% of capital gains are taxed, think of any capital gain that takes you into the clawback zone as costing you seven and a half cents instead. Actually, it will cost you less than that as well, since you would have had to pay tax on those lost pennies and dollars in OAS pension anyway. Since you can control when you start your government pensions and are rewarded for waiting by getting an increased pension, consider delaying at least your OAS pension if you are planning on triggering a big capital gain in your late 60’s until the year after the dust has settled. This gain may have cost you your entire OAS pension for the year of sale anyway, so you really haven’t lost anything by waiting, and you still get the benefits of waiting – a larger monthly OAS pension for life. It’s like passing on cake today when you’re already too stuffed to eat it anyway in exchange for two slices tomorrow.

Consider Claiming a Capital Gains Reserve When Selling Real Estate

It’s a lot easier to spread out the capital gains hit when selling RBC shares rather than a studio apartment on Howe Street. On the other hand, there is a special rule that applies if you don’t receive your real estate or business sales proceeds in single year. In fact, if you defer enough of your gain, you can spread the tax hit out over up to five years. It usually means taking back a mortgage when you sell, which is admittedly something that doesn’t work for a lot of us. If selling in December, at least consider structuring the deal so that the gain is spread over 2 years rather than just one by delaying payment of part of your sales proceeds until January. If you and a spouse own real estate jointly and you don’t plan on selling for a few years, it might even be possible use this strategy between spouses before selling to an outsider. One spouse sells his interest to the other but gets paid (and taxed) over the next 5 years in 20% increments, charging his spouse interest at the minimum allowable rate during the interim. Although the buying spouse still has to pay tax on her gain plus the increase in value on the portion she acquired from her husband, the total tax bill might still be a lot less than if the selling spouse had to also include his part of the gain in a single tax year. This is another strategy to discuss with a tax or planning pro in advance, as there are a few moving parts involved.

Conclusion

Hopefully, some of the ideas described in this article have provided you with plenty of food for thought. If so, stay tuned until next time when I serve up the final course.

Colin S. Ritchie, BA.H. LL.B., CFP, CLU, TEP and FMA is a Vancouver-based fee-for-service lawyer and financial planner who does not sell investment or insurance, just advice. To find out more, visit his website at www.colinsritchie.com.