Why Dividend Growth Investing Stands The Test of Time

Dividend investing is a suitable investing strategy for anyone who wants to generate income from their investment portfolio. Unfortunately, there is a widespread belief that dividend investing sacrifices growth. In other words, many investors believe that dividend investing and growth investing have no point of intersection.

Dividend investing is a suitable investing strategy for anyone who wants to generate income from their investment portfolio. Unfortunately, there is a widespread belief that dividend investing sacrifices growth. In other words, many investors believe that dividend investing and growth investing have no point of intersection.

We believe that this isn’t the case. In fact, there are plenty of merits to investing in dividend growth stocks – companies that pay dividends, and have a strong track record of consistently increasing these dividends over time. This article will describe the merits of implementing a dividend growth investing strategy and why we believe this strategy will stand the test of time.

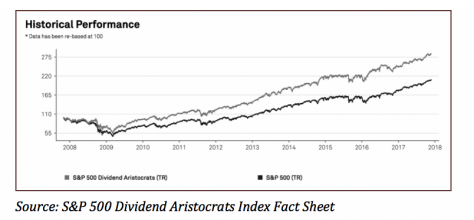

The first, and perhaps most important, reason why investors should consider investing in dividend growth stocks is there is empirical evidence that shows dividend growth stocks tend to outperform the broader stock market over time. There is no better example of this than the Dividend Aristocrats – an exclusive group of dividend stocks with 25+ years of consecutive dividend increases. The performance of the Dividend Aristocrats is compared to the broader stock market in the following chart:

As of October 31, 2017, the S&P 500 Dividend Aristocrats Index – which is an equal weight index of all 51 S&P 500 stocks with 25+ years of consecutive dividend increases – has delivered annualized returns of 10.85% over the trailing 10-year period. For context, the broader S&P 500 Index has returned 7.51% during the same time period. The Dividend Aristocrats have outperformed the world’s most important stock market index by more than 3% per year for ten years.

This outperformance is even more remarkable when you consider the risk profile of the Dividend Aristocrats. Conventional academic finance suggests more returns can only be generated by incurring additional volatility. The Dividend Aristocrats show that this isn’t always the case in practice, as they’ve outperformed the market while generating considerably less volatility.

Here’s what the numbers look like. Over the 10-year period discussed previously, the Dividend Aristocrats Index had a price standard deviation of 14.06% while the S&P 500 Index had a price standard deviation of 15.15%. This combination of higher returns and lower volatility make for excellent risk-adjusted returns when measured by financial metrics like the Sharpe Ratio or the Sortino Ratio.

This is no fluke. There are fundamental, common-sense reasons why dividend growth stocks have outperformed the market over time (and should continue to do so). We believe these appealing qualitative characteristics can be broadly divided into three categories.

First, companies that pay rising dividends need to be generating actual earnings and cash flow to support said dividend. This is particularly true for companies that have very long dividend histories. For investors, the unintended benefit of this is it eliminates pre-earnings startups and companies that are experiencing financial difficulties or bankruptcies – in other words, the riskiest investments in the stock market. Over a large enough time period, dividend growth stocks need to actually experience growth in their underlying businesses.

The second reason why dividend growth stocks outperform is because of the lesser amount of retained earnings available to the corporate managers of these companies. This means that the company’s capital allocators must be extremely selective in the growth opportunities that it takes on, which likely enhances the quality of a company’s capital allocation decision-making in the long run.

Lastly, steadily rising dividend payments are indicative of a shareholder-friendly management culture. This likely extends to other areas of the company, including insider ownership and stock dilution policies. Indeed, we’ve studied the insider ownership tendencies of Dividend Kings (an even more exclusive group of dividend growth stocks with 50+ years of consecutive dividend increases) and their insider ownership is well above average, with most corporate executives owning millions of dollars of company stock.

The title of this article suggests that dividend growth investing will stand the test of time. Indeed, there are many characteristics of dividend growth investing that suggest it’s a worthwhile strategy for the conservative, long-term investor.

The first reason why dividend growth investing is here to stay is related to the fundamental, business-level characteristics of dividend growth stocks. Many of the most well-known and successful dividend growth stocks are market leaders in slow-changing industries with considerable barriers to entry. Unsurprisingly, the Dividend Aristocrats are very underweight sectors that are prone to disruption (like information technology) and highly overweight sectors that remain relatively unchanged over time (like healthcare, consumer staples, and industrials).

Two prime examples of the slow-changing nature of dividend growth stocks are Coca-Cola (KO) and Pepsi (PEP). These companies, which are both Dividend Aristocrats, were founded in 1892 and 1898, respectively, and are the undisputed market leaders in the beverage industry. Pepsi also has a large market share of packaged foods thanks to its acquisition of Frito-Lay. It is unlikely that a small startup will create a beverage that is more popular than Coca-Cola or Pepsi, and the sheer scale required to compete with these heavyweights make this even less likely. This makes the competitive positioning of these Dividend Aristocrats extremely powerful.

For investors, the security level implication of this is dividend growth stocks with long histories of dividend increases have a much higher probability of continuing to increase their dividends than dividend growth stocks with shorter dividend increases. In the past, we’ve analyzed the probability of a dividend cut for Dividend Aristocrats (stocks with 25+ years of consecutive increases) when compared to dividend stocks with shorter (10-24 year) dividend increase streaks. Unsurprisingly, the companies with longer histories of steadily rising dividends had a far lower chance of reducing their dividends in the sample period we analyzed.

Another piece of evidence to suggest dividend growth investing will stand the test of time is the successful practice of this investing strategy for decades by highly influential and prominent investors. While Benjamin Graham is most well-known as the father of value investing, he was also discussing dividend growth investing at least as early as 1934, when the original edition of his seminal book Security Analysis was published. In the book, he wrote: “The prime purpose of a business corporation is to pay dividends regularly and, presumably, to increase the rate as time goes on.” Warren Buffett’s investment portfolio is also full of high-quality dividend growth stocks. Dividend growth investing worked in 1934, and it still works today. We remain convinced that this strategy will continue generating market-beating returns for the foreseeable future.

For self-directed investors, the actionable way to apply the knowledge this article has shared about dividend growth investing is by buying high-quality dividend growth stocks trading at fair or better prices and holding them for the long run. For investors that are averse to buying individual stocks, you can also participate in the benefits of dividend growth investing through passive investing products like the Dividend Aristocrats ETF (NOBL).

This article was contributed by Nick McCullum of Sure Dividend, an investment newsletter provider aimed at helping people invest better through taking low-cost, long-term positions in individual stocks.