Pension Valuation And Asset Allocation Considerations

Recently, a member asked us for help addressing the following question:

Recently, a member asked us for help addressing the following question:

“How to value pensions into your asset allocation? Then examine your asset allocation so you have enough invested in equities to account for future inflation.”

Defined Benefit Versus Defined Contribution

To start, if you are the owner of a pension asset, particularly a defined income stream, consider yourself lucky! A pension is one of your greatest financial assets.

There are two types of company pension plans: Defined Benefit (DB) and Defined Contribution (DC). While not the focus of this article, we will provide a quick note on the key differences in order to better understand the context of the remaining article.

A DB pension means you receive a specific, known and periodic payout that is guaranteed by your employer regardless of how the pension investment performs. Your defined benefit amount depends on how much is paid into the plan and your years of service with that employer. The employer bears the investment risk and any ‘underfunded’ status.

A DC pension is entirely dependent on investment performance. The employee typically directs the asset allocation via investment fund choices. There are no guarantees about what your payout will be when you either retire or leave that employer.

Valuation And Asset Allocation Of DC Pensions

The valuation of this plan is simple: it is the market value of your investments.

Incorporating this market value into your asset allocation is easy. If your DC plan involves company stock, add this value to your equity allocation. If your DC plan uses fund investments, the fund profile will breakdown equity, fixed income and cash allocations. You can take these percentages, multiply them by the market value of the account, and add the results to your investment accounts outside of the employer.

Valuation Of DB Pensions

The traditional school of thought says you should think of the pension Commuted value (CV) as a bond, as both bonds and pensions pay predictable amounts of guaranteed income. We agree with the theory.

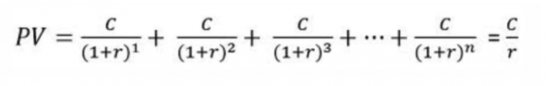

The below image dictates the value of a DB pension plan in its simplest form:

It implies that the present value (PV) (aka commuted value) of your DB pension is equal to expected annual cash flows, each discounted by some return factor. Alternatively, the function represents the money (PV) that would have to be invested today to generate monthly cash flows equivalent to the DB pension payment.

The good news is that your pension sponsor calculates the CV on a periodic basis, so you do not have to worry about valuing the income stream. The bad news is the CV tends to fluctuate year to year, as it is based on a host of dynamic factors.

However, you should be able to calculate a rough estimate of the pension’s worth using the above formula, assuming you know your entitled annual pension distribution. Assume you are entitled ‘today’ to a $40,000 per year pension and that you estimate a 25-year retirement, or life expectancy of 90. Our real interest rate is 2.0%. In the above equation, C = $40,000, r = 0.02 and n = 25. This results in a present value of $785,000. To your existing portfolio, you would add a $785,000 bond allocation.

You can make things even simpler using a favourite KISS principle (keep it simple stupid). If you have an annual pension of $40,000 and divide it by a discount rate (lets assume 4.0%), the value of that pension could be $1,000,000. The caveat here is the discount rate one uses, but the higher the number, the more conservative the resulting estimate.

The KISS illustration is simply the (C / r) term from our above formula, otherwise known as the formula for valuing a perpetuity: a constant stream of identical cash flows with no end. While you will not live forever, in the context of your life, a DB pension begins to sound a lot like a perpetuity.

Asset Allocation Of DB Pensions

Should a pension even be considered in the context of an asset allocation? This is actually a debated topic but in our opinion, the answer is “yes”. A simple example demonstrates this: Two clients visit a financial planner, each with a $1 million investible portfolio. Both will retire in one year and require $50,000 per year for living expenses. Client A has a $40,000 per year DB pension while Client B has no company pension. Chances are, the financial planner will not treat each client the same in terms of a recommended asset allocation.

Unfortunately, there exist a plethora of methodologies and/or ‘rules of thumb’ to calculate pension values. Other than using your sponsor’s CV, independent calculation of a value is very difficult. So can you build an asset allocation without knowing your pension’s true worth? Again, the answer is “yes”.

First, what is your primary concern in retirement? For the average investor, we bet it is building a portfolio that will deliver retirement cash flows to fund spending needs. In this context, it is the pension’s monthly payments that are important. The true economic worth of the pension is of limited importance.

We diverge in the need to exactly define the worth of your pension (as per our member’s query). If you have a pension income stream, you do not need to spend your retirement years calculating present values!

Through our portfolio review service at 5i Research Inc., we partner with clients to build asset allocations. In the presence of a DB pension, we primarily analyze this asset on the basis of its cash flow vs. retirement spending needs. Depending on the size of the resulting surplus/shortfall, an asset allocation can then be built to best address the variance.

Put another way, the DB pension cash flow (and not present value) is a critical input for determining the client’s ability to take equity risk. Just as important is the willingness to take equity risk. Once you have these factors qualitatively ranked along some sort of ‘high-medium-low’ spectrum, you can then build an appropriate asset allocation. Let us take a look at this process in action.

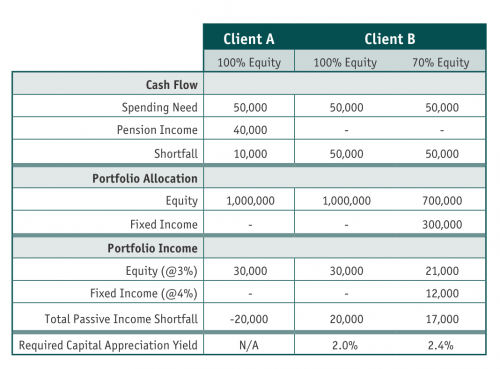

We first look at the DB pension’s impact on a client’s ability to take equity risk. In retirement this is a function of income reliability vs. your spending needs. We will use the below table as context for our discussion:

If Client A has a retirement spending need of $50,000 but pension of $40,000, she only requires the $1,000,000 portfolio to generate $10,000 in return, or 1.0%. Client A has a high ability to accept equity risk. Client A has the ability to go 100.0% equity in theory (though likely not prudent in practice).

If broad equity dividends yield 3.0%, then the portfolio generates an additional $30,000 per year, or a $20,000 per year surplus. Client A could have an ‘unlimited’ ability to take equity risk with personal savings, as a market crash would have no meaningful impact on the majority of cash flows.

If Client B went 100% equity, he would generate $30,000 per year in dividends but still generate a shortfall of $20,000 per year. This would require a 2.0% capital appreciation yield from the equity portfolio. In our view, Client B has less ability to take equity risk and should have more fixed income in the portfolio.

We may suggest to Client B a 70/30 equity/fixed income portfolio. This is additional “passive income” of $3,000 per year vs. the 100% equity portfolio. It does bump up the required capital appreciation on the equity portfolio to 2.4% but this drawback is superseded by the enhanced reliability surrounding cash flows.

And what if markets have an awful year? Client B would cringe at the thought of withdrawing from equity losses. Again, fixed income makes sense here as its low correlation with equities means Client B could have a source of capital that at least maintains its value in poor equity markets, which he could rely on first before withdrawing from equity principal.

What is important to notice about the above is we have addressed what a beginning asset allocation could look like without knowing the true value of the pension. Instead, one should evaluate total pension income sources (DB, CPP, OAS) against the retirement spending need, and then build the asset allocation in the context of any spending shortfall or surplus.

Refining the asset allocation comes down to weighing the willingness to take risk.

Our introductory member question was concerned with keeping pace with inflation. If this is the primary concern, then the willingness to take equity risk might be low and he/she could simply invest in a GIC ladder and accomplish the objective. If our member is Client A, then the 100% equity allocation described via the ability to take equity risk looks less reasonable now.

If Client B walks into the financial planners office with a 100% equity portfolio, he has a high willingness. However, the ability to take risk in his scenario is lower, so a mixed mandate continues to make sense.

A final point regarding the ability and willingness to take equity risk: If the two diverge, the lower risk function takes most importance and drives the asset allocation. So, if there exists a high willingness to take equity risk but the ability is low (i.e. large spending shortfall, small investable portfolio), then the ability drives the need for more conservative asset allocations like government bonds and vice versa.

Concluding Thoughts

Valuing a DB pension income stream is inherently difficult and any estimate will be volatile with a small change in the assumption inputs.

Fortunately, we think understanding the annual cash flows provided by the pension is the most important element in building an asset allocation vs. knowing the pension’s economic worth. The former is what is needed to determine how much income your retirement portfolio will need to generate, and this then drives the asset allocation.

A pension that provides more than your spending needs means equity market volatility really has no impact on your cash flow planning. If there is a high willingness to take equity risk, this situating could lend itself to a more aggressive portfolio. However, if a large spending gap exists after, then income reliability from the portfolio is a priority. This necessitates a mixture of conservative equity dividends and diversified bond yields.

Beyond ability and willingness to take equity risk, do not forget a simple ‘reality check’ and evaluate your need to take risk. In our illustration, Client A needs to generate $10,000 from a $1,000,000 portfolio, or 1.0%. She could invest the entire portfolio in GICs and be fine. While Client A has the ability to be 100% equity, the need proves that she is taking excess risk beyond what is required. It may be prudent to tone back the equity allocation.

Client B has a need to generate $50,000 per year on a $1 million portfolio, or a 5.0% total return, which would be achievable with a mixture of equity and bonds. A Client with a need of 10.0% would likely have to reconsider spending needs as few portfolios could meet this target sustainably, without drawing on principal.

Michael Southern is an Analyst with 5i Research in Kitchener, Ontario.