Secular Trends And Investing Robotics

The Trend

The Trend

While browsing the internet, you may have seen the following meme that depicts a sign on the wall displaying the text: Warning! Due to the shortage of robots, some of our staff are human and may act unpredictably when rushed or abused.

In its amusing way, this cautionary statement goes to the heart of what makes robotics such an intriguing area of science, technology, ethics and indeed investing. We humans are prone to error and fatigue and do not always behave as one might expect (or wish). Robots, by contrast, are designed to perform tasks, activities, processes or functions with little to no error, without boredom and without emotion.

Robotics can be defined as: “A branch of engineering that involves the conception, design, manufacture, and operation of robots. This field overlaps with electronics, computer science, artificial intelligence, mechatronics, nanotechnology and bioengineering.”1

The use of robotics is becoming ever-more widespread and worthy of a look as investors.

Some Facts

The use of robotics is not without significant ethical controversy but the focus of this article is on investing in this relatively young, growing and arguably inevitable trend.2,3,4

According to International Data Corporation (IDC), a research firm, the global market for robotics will grow from $91.5B US in 2016 to over $188B US by 2020 (that’s a 105% increase in four years). The rapid growth is reportedly fueled by technological improvements, expanded uses and greater market acceptance.5

According to The Robot Report, 2016 was the best year yet for start-up funding in global robotics. Reportedly $1.95B US was invested in early stage companies worldwide, up 50% from 2015.6

So far, robotics has made major inroads where tasks are predictable (e.g., welding) vs. where they are less predictable (e.g., management). According to McKinsey, some of the sectors facing the highest growth in robotics and automation include: accommodations and food services, manufacturing, agriculture, transportation and warehousing, retailing, mining, financial services and health care.7

Two highly beneficial areas of robotics use include precision surgery8,9, and bomb disposal.10 Precision surgery can help with cardiology and lead to minimally invasive surgical practices through miniaturization that allow patients to heal much faster than with traditional methods. Bomb and mine disposal can be conducted much more safely by robots than by humans. In both cases, while not totally automated, these uses of robotics extend the capabilities of the human expert who controls the equipment.

Home farming is an area where robotics is making intriguing strides as well. Imagine using a robot to grow fresh food in your own back yard. The robot handles seed planting, scheduled watering and weeding and the home farmer controls everything using an app.11

Another emerging area of robotics is called collaborative robotics.12 The “cobots” used in this type of application also involve closely integrating human and robotic activity together. For example, a human could “teach” a robot to work on an assembly line and be there to make corrections and retrain the robot as the workplace needs change (e.g., changing a product line). This allows the human to focus on the intelligent activities and the robot to be focused on the repetitive tasks. Re-think Robotics is a leader in this space.13

There are countless examples of robotics use, current and emerging, from hairdressing and security to weaponry and space exploration, with no doubt many more to come.14

Risks

As with any area of emerging endeavour, there are risks for investors. Growth forecasts can be notoriously inaccurate and things like politics (e.g., trade wars), recessions (e.g., reduced consumption, less capital investment) and regulation (e.g., new taxes, tax credits or anti-trust activities) can all impact a promising investment theme.

Valuations in the robotics space are also quite high which may suggest lower future returns should be expected. Using the exchange traded fund (ETF) ROBO as a proxy for the robotics theme, the weighted average price/earnings (P/E) ratio is 25.98. By comparison, the Dow Jones Industrial Average ETF DIA has a weighted average P/E of 19.81.

Robotics hasn’t always been a profitable area to invest and history may repeat. Again, using the ETF ROBO as a proxy, the period between October 2013 and February 2016 witnessed a 21% drawdown in the fund’s return (since then it has climbed by 71%).

So perhaps this is not an area of investment suited for the faint of heart or it may simply be better to “chip away at” investing in robotics over time.

Ideas For Further Research

For those who are interested, there are two main ways to invest in the robotics theme: ETFs and individual stocks.

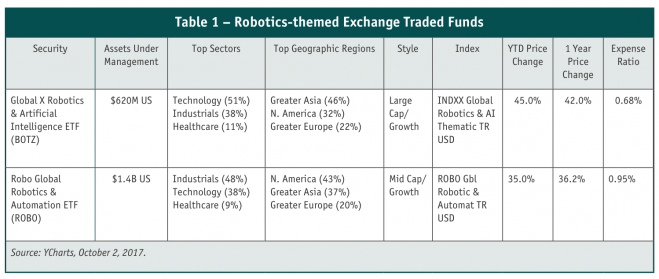

There are two major robotics-themed ETFs available, both listed in the US (no Canadian equivalent is available): BOTZ and ROBO (see Table 1).

BOTZ is smaller with $620M US in assets compared to ROBO’s $1.4B US (both are seeing fund inflows grow rapidly in 2017). BOTZ is a bit more technology-focused, has a higher percentage of holdings in Asia and is more large-cap oriented. ROBO has a greater emphasis on industrials, has more holdings in the US, and is more mid-cap oriented. Returns year-to-date show BOTZ at 45% and ROBO at 35%. ROBO is more diversified, with 89 holdings and the top 10 holdings representing about 20% of the fund. BOTZ, by contrast, has 33 holdings with the top 10 making up about 65% of the fund. Finally, BOTZ has a lower expense ratio at 0.68% compared to the more-pricey ROBO at 0.95%. Neither is overly cheap in that regard as is often the case with specialty ETFs.

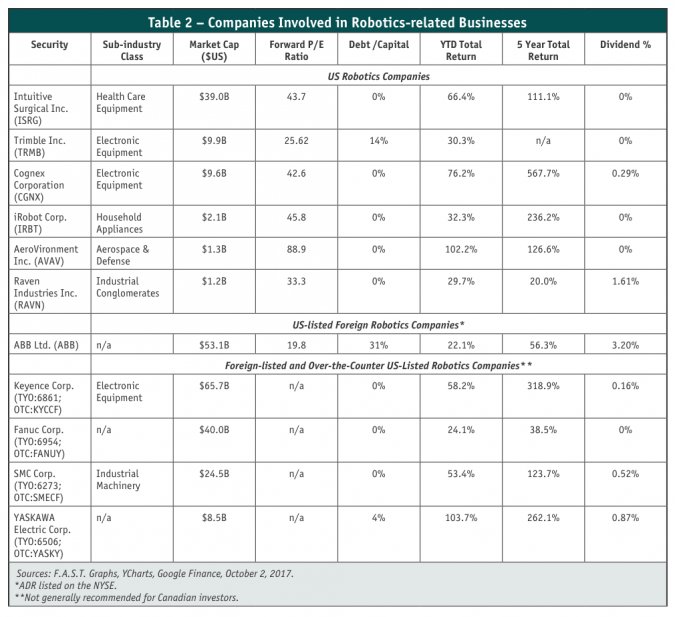

Many leading robotics firms are of course found in the two funds. Companies in the robotics space include Intuitive Surgical, Trimble, Cognex, iRobot, Raven Industries, AeroVironment and ABB to name a few. Several leading robotics companies are listed abroad, and some are listed in the US over-the-counter. These will be harder, more-costly or even ill-advised for most Canadian investors to purchase directly. More on these and other companies can be found in Table 2.

There do not appear to be any pure-play, publicly-listed Canadian robotics companies available to investors. Privately held Canadian companies, that may one day go public, include Clearpath Robotics of Kitchener, ON, Robotiq of St-Nicolas, QC, and Kinova Robotics of Boisbriand, QC.15

How To Invest In The Robotics Trend

Given how widespread the growth in robotics is becoming, and how many sectors of the economy are touched by it, there is a good case for investing in an ETF. ETFs spread risk across numerous companies and sectors and eliminate the need to try to pick the winners. It also helps Canadian investors buy ownership in foreign-listed companies that may otherwise be unavailable to them. This can lead to a more “average” return on investment compared to buying just the star performers in the fund (if they can be picked of course). There are also fees to consider when buying an ETF.

Alternatively, if one has conviction about a specific company and its product line, a direct equity stake allows for a more concentrated holding based on company fundamentals and potential. Fees are also generally low (unless purchasing foreign-listed stocks).

Either approach could offer a reasonable risk/return trade-off for some investors and it really comes down to personal preference and perhaps how much foreign exposure one wants.

Concluding Remarks

Like it or not, there is little doubt the use of robotics is here to stay – and grow. The theme’s momentum applies to companies in many sectors, but for now, especially to industry, technology and healthcare. Investors may be well-advised to view the theme as having above average risk while also offering potentially greater than average long-run returns.

Michael Patenaude, BA, MA, is an avid personal finance enthusiast living in Ottawa. He publishes his blog and portfolio along with content from the Ottawa Share Club at money4retirement.ca. He is co-founder of the McMurtryInvestmentReport.ca. Email: mrpatenaude@gmail.com. This article is not intended as investment advice, a product endorsement nor is it a solicitation to purchase securities. Michael owns shares in ROBO.

- http://whatis.techtarget.com/definition/robotics

- https://www.weforum.org/agenda/2016/10/top-10-ethical-issues-in-artificial-intelligence/

- https://medium.freecodecamp.org/bill-gates-and-elon-musk-just-warned-us-about-the-one-thing-politicians-are-too-scared-to-talk-8db9815fd398#.mz3oa2bnc

- http://www.visualcapitalist.com/visualizing-jobs-lost-automation/

- https://www.idc.com/getdoc.jsp?containerId=prUS42213817

- https://www.therobotreport.com/news/2016-was-best-year-ever-for-funding-robotics-startup-companies

- http://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/where-machines-could-replace-humans-and-where-they-cant-yet

- https://www.medgadget.com/2016/12/axsis-new-robot-precision-surgical-applications.html

- http://www.davincisurgery.com/da-vinci-surgery/da-vinci-surgical-system/

- http://www.bbc.com/future/story/20160714-what-does-a-bomb-disposal-robot-actually-do

- https://www.youtube.com/watch?v=uI7aHhy8tyU&list=PLxzJmNzonMVPhx58tQQmP-UloFEZwxMk6#action=share

- https://www.ted.com/talks/rodney_brooks_why_we_will_rely_on_robots

- http://www.rethinkrobotics.com

- http://www.techworld.com/picture-gallery/apps-wearables/uses-of-robotics-in-business-how-will-robots-be-used-in-future-3649782/

- http://www.design-engineering.com/canadian-firms-listed-among-top-50-robotics-companies-to-watch-133954/