Looking Ahead – 2017-2018

In the November/December 2015 issue of Canadian Moneysaver (CMS), I penned an article titled, Wither Deflation, Inflation, Interest Rates and the Stock Market. The purpose of today’s article (written December 29th, 2016) is to update last year’s article. I chuckle at my opening comments last year that “It is difficult to remember a time when investors have been buffeted (no pun intended) by so many economic, geo-political and global financial cross currents”. I chuckle because if anything, during this past year, uncertainty has become greater and the cross currents very much stronger. Today I would re-title the article to read “Inflation, the US dollar, Interest Rates and the Stock Market”. I think that given recent trends, one can safely for now, put aside any worries about Deflation and its impact. That thought is explained below.

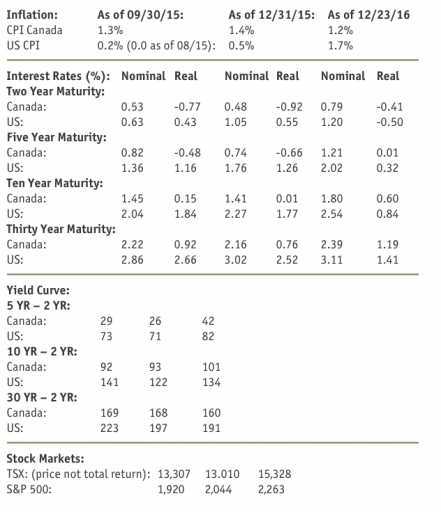

Let’s look at what has happened since September 30th, 2015, the data used in last year’s article, until December 23rd, 2016.

Commentary

Inflation:

While I am obviously interested in reported Canadian CPI, my focus is on the US, the trends in reported CPI and its key components. As shown above, reported US CPI increased from 0.0% in August 2015 to 1.7% as of November 2016. (Bureau of Labor Statistics – December 15th report). Looking at the key components, Energy (CPI weighting of 7.1%) increased 1.1% year over year (“YOY”), Medical Commodities (1.9% weighting) 4.3%, Medical Services (6.7% weighting) 3.9% and Shelter (33.5% weighting) 3.6%. Therefore, we currently have 42.1% of the US CPI increasing at YOY rates in excess of 3.5% and another 7.1% increasing YOY at a rate in excess of 1.0%. I don’t expect the growth of Shelter or Medical Commodities and Services to slow down although admittedly the latter two have shown some recent weakness. In my view, if oil prices can hold above $50.00 West Texas Intermediate (WTI) for a sustained period, that will put further upward pressure on CPI which was reported at +1.7% ex energy. In summary, I stick to last year’s forecast of 2.5% or closer to 3.0% sometime in the next 24 months.

Interest Rates:

If my inflation scenario unfolds along the lines I suggest, then one would have to expect nominal rates to rise further. The key is to what levels and how quickly? Clearly at some point, rates will reach a level which would negatively impact the US economy i.e. auto sales and housing (and impact stock markets). In trying to guess what that level might be depends on the inflation experience, the $US relative to other global currencies, US interest rates relative to other major countries rates and the shape of the yield curve. As of today, as reported in the 12/29 Wall Street Journal, yields for global government bonds with a ten year maturity were: US Treasuries 2.51%, German Bunds: 0.20%, France: 0.68%, UK: 1.15% and Japan: 0.06%. For investors looking for safety, they would automatically be drawn to the US Treasury Bonds. This would put continuing upward pressure on the $US and downward pressure on US corporations’ foreign earnings. I think it is fair to suggest that the major upward move in the $US from about 80 to 100.50 as measured by the US Dollar Index (DX/Y index) from about September 2014 until January 2015 was partially because of the interest rate differential and a flight to safety. It has just recently had another move from 97.50 (after a sell-off from the 100.50 level) to about 103.20. It has now pulled back to about 102.68. If the dollar remains strong, aside from the negative impacts mentioned, the US Fed could regard it as a defacto tightening and become less aggressive about implementing the current consensus of three Fed Fund rate increases in 2017.

Where does that leave us in terms of trying to forecast rates? I don’t think it is helpful to CMS readers to engage in what could be construed as nothing more than wild guesses. Nevertheless, at this point I will try to show one possible scenario. I think it is clear that rates will continue to rise if my inflation forecast comes to pass and the economy continues on its current growth track. In trying to cobble together a forecast I make two assumptions. The first is that the Fed will keep a sharp eye on the interest sensitive components of the economy and will become less aggressive if it appears short-term rates (2 – 5 years) are starting to impact the economy. The second is that at some point, bond investors will demand a return to historical “real return” levels. (A real return is a bond’s nominal yield minus the current rate of inflation). Historically, real rates for the two to five year government bond maturities were about 1.0%, ten years at least 2.0% and for a thirty year bond 2.50%. For reasons mentioned, I think the Fed will keep a sharp eye on the impact of short-term rates so real returns may not reach that 1.0% level for some time. As shown above, the current real returns for ten year Canadian and US government bonds are 0.60% and 0.84% respectively. To reach the 2.0% real return level would require rates to increase 1.40% and 1.16% respectively. That would lead to nominal ten year rates of 3.20% and 3.70% respectively compared to the 1.80% and 2.54% levels as 12/23. A similar calculation would put the thirty years maturities at 3.70% and 4.20% compared to 2.39% and 3.11% as of 12/23. I don’t think those levels would negatively impact stock markets.

Assuming the Fed keeps a lid on short-term rates it indicates a steepening yield curve for the two and ten year maturities. The yield curve for the two to thirty year maturities has flattened slightly. The key going forward is that a total flattening of the yield curve doesn’t likely occur in the next twelve to twenty-four months. That is good news as a flat yield curve has historically been the death knell for the economy and stock markets (think ’00 and ’04).

Stock Markets:

Both the TSX and S&P 500 have increased 15.2% and 17.9% since September 30th 2015. However, I think it more useful to look ahead especially as President-Elect Trump moves into the White House January 20th, 2017. The TSX and S&P 500 have increased 5.6% and 8.5% respectively from November 4th. To what extent have markets already discounted one view (Ed Yardeni of Yardeni Research Inc.) that “It would be wrong to dismiss the possibility that President Trump will succeed beyond the wildest dreams of anyone with the exception of Kellyanne Conway”? One key driver would be that if Congress passes legislation reducing the current effective corporate tax rate of 27.5% to 15.0% it would add a one-time boost to US corporate earnings. Ed Yardeni suggests it could be as much as about $13.00 per share in each of ’17 and ’18. JP Morgan has also suggested a one-time boost but has not yet quantified what those figures would be. If in fact the tax reduction happens, it would add further support to stock markets as estimated forward price/earnings multiples would be reduced from what many think are currently excessive levels. The obvious caveat to that scenario is that once President Trump assumes office, Murphy’s Law will show up in a number of places during his term in office. David Rosenberg of Gluskin Sheff Inc. (in his 12/28 Notes) thinks that law will be present in spades. The rally to date “is a faith-based rally and before anything gets legislated we will see the dampening effects of this sharp run-up in the dollar and mortgage rates”. In either case, neither one of us would not rule out one or more corrections from time to time.

Summary:

As previously stated either in CMS or on BNN TV, I thought that the ’08 – ’09 experience was so severe that it would take much longer than normal for the US economy to fully recover. In my view, it also severely damaged the American psyche not only because of job and in some cases stock market losses, but in particular the decline in the value of Americans’ homes. Today the picture has improved dramatically. Based on the latest US Fed data, the total value of Household real estate has recovered to its ’06– ’07 levels. Homeowners’ equity has more than doubled and mortgage debt as a percent of the value of Household real estate has plunged from about 64% to about 43%. The foregoing plus the improved outlook for jobs and disposable income should support a further increase in consumer confidence. As for the stock market, part of its recent gains reflected an already improving economy and corporate profits. Without ignoring David Rosenberg’s warnings, I remain optimistic and would use bouts of weakness as buying opportunities.

Peter Brieger, HBA, CFA,Chairman & Managing Director, GlobeInvest Capital Management Inc, 20 Queen Street West, Suite 3308, Toronto, Ontario M5H 3R3 (800) 387-0784 pbrieger@globe-invest.com