Avoid The Herd With These Contrarian Investments

Contrarian investing is the easiest investment strategy in hindsight, but the hardest one to execute in foresight. After all, you and I are hardwired – through a centre in our brains known as the limbic system – to run with the crowd. Evolution has driven herding characteristics deep into our survival mechanisms. Following the crowd isn’t such a bad thing when it comes to survival of a species. Herds of animals increase survival odds against carnivores by running together. People avoid fatal mistakes by running out of a burning building with the crowd – rather than into it just to be contrarian. I’ve covered this many times in my past blogs at www.valuetrend.ca - and my book Sideways. Herding can even help us profit by buying into a good stock trend. At ValueTrend, we hold up-trending stocks like Google, with little regret in following that herd.

Contrarian investing is the easiest investment strategy in hindsight, but the hardest one to execute in foresight. After all, you and I are hardwired – through a centre in our brains known as the limbic system – to run with the crowd. Evolution has driven herding characteristics deep into our survival mechanisms. Following the crowd isn’t such a bad thing when it comes to survival of a species. Herds of animals increase survival odds against carnivores by running together. People avoid fatal mistakes by running out of a burning building with the crowd – rather than into it just to be contrarian. I’ve covered this many times in my past blogs at www.valuetrend.ca - and my book Sideways. Herding can even help us profit by buying into a good stock trend. At ValueTrend, we hold up-trending stocks like Google, with little regret in following that herd.

However, there are points where we should avoid buying into overzealous herd behavior. Contrarian investing should be about identifying points of irrationally high levels of optimism or pessimism, not of healthy trending behavior. Recent examples of losses driven by irrational herd mentality include the tech bubble of the late 1990’s and the oil & real estate bubble of 10 years ago. I’ve argued that the stock market might currently be in a mini-bubble right now and that Canadian real estate might be in a fully-fledged bubble as well. Statistics Canada reported in September that the ratio of Canadian household debt to disposable income has reached 167.6 per cent — the highest it’s ever been – and the majority of that debt is mortgage debt. Canadians’ household debt is bigger than the country’s economy! To me, this is a statistic that suggests irrational speculation and demand characteristics for real estate – which may pose a problem for Canada’s real estate prices in the future.

Contrarian investing can also offer us the opportunity to purchase stocks and sectors that the crowd has dismissed. Easier said than done. It’s hard fighting our evolutionarily hardwired herding behavior and step boldly into an out of favor stock or sector. That’s where having a few technical analysis tools can help calm your herding instincts, and take a logical look at the situation. A recent example of this strategy for ValueTrend was the short termed sell-off on tech stocks in early November. We bought a couple of tech stocks that were still on trend – one of which was Amazon (AMZN-US), but had fallen aggressively after the Trump election. Some of our momentum and sentiment studies suggested that, despite crowd paranoia, we should buy into the weakness. It’s been a good decision so far. Same with our decision to buy into the Japanese market via the iShares Currency-hedged Japan ETF (CJP-T) back in the summer. Contrarian indicators we follow noted an oversold condition with a favorable chart breakout – helped by a falling Yen.

Bonds Are Potentially Setting Up As A Contrarian Buy

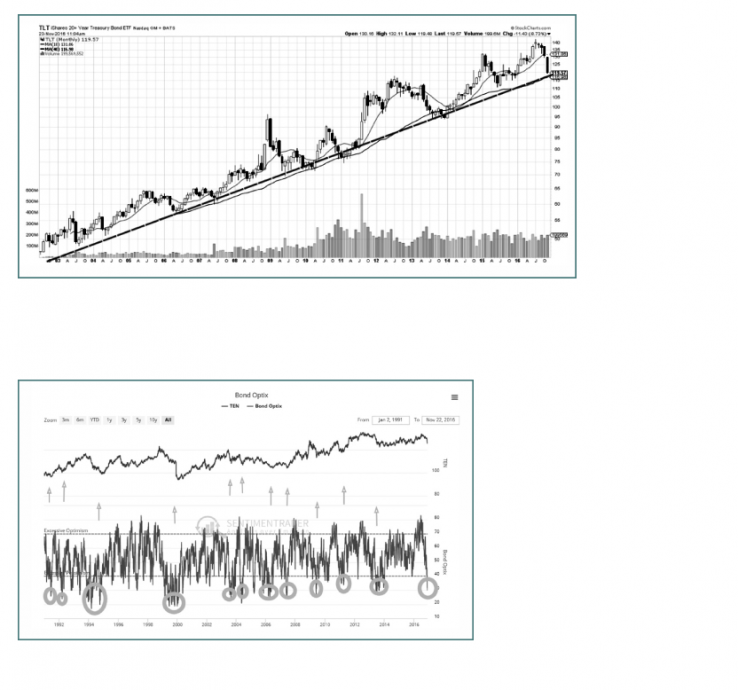

Take a look at the iShares 20 year US Bond ETF chart below (TLT-US). Note the strong uptrend, the current test of that trend, and the support by the 200 day Moving Average (MA) (red line). If the TLT can hold this line, and bounce off it, that would be technically bullish.

Now let’s look at a sentiment composite indicator for bonds (the results of which are identical for the 20 year bond). This is a compilation of sentiment indicators put out by our friends at www.sentimentrader.com. The indicator incorporates smart/dumb money flow, sentiment studies, put/call ratio, and commitment of trader’s data. Note that when sentiment gets well below the horizontal green line, it typically suggests a rally is overdue. Some are bigger than others, but you do seem to get some bump-up on the trade – even if it’s a short one. This seems to indicate the upcoming rate increases in treasuries are baked- into the price of US Treasuries. Could this negative sentiment be setting up a contrarian play for a bounce? I don’t own the long bond right now, but it’s worth watching to see if it starts to move back onto trend.

Crude Oil Has Been Out Of Favor Since 2014

While West Texas Intermediate (WTI) recently bounced off its January 2016 lows of near $30, oil is still well below the $100+/barrel prices seen just a few years ago. Crude oil is not in its favorable seasonal period until February. Despite the recent OPEC-meeting and subsequent price spike, the weekly chart suggests it’s not likely to rally much more in the near-term. However, over the next year or so I maintain that WTI will begin to move into the $60-$62 zone. Oil looks to be putting in a technical formation known as a “Head & Shoulders Bottom”. A breakout from that bottom formation should be aided as seasonal influences later in the winter kick in. For now, I am not in the trade, but do plan on entering in the coming few months.

Copper

Base metals like copper have been out of favor since 2011. However, there may be some hope for the metal. The materials sector can be strong from this time of the year until early January. Aided by the Trump victory, the sector is off to a good start. Copper typically doesn’t start its seasonal period until the New Year. But it has begun an early move on the Trump trade. A similar sentiment study as in my bond commentary above suggested that copper sentiment was overly bearish by investors back in the summer. Remember, from a contrarian’s stance – that’s a good thing!

Being a contrarian investor is hard. Humans have been around for about six million years, so you are fighting a pretty well developed instinct when you want to go opposite the herd. You will feel comfortable and secure if you go with the crowd, and you will feel self-doubt when thinking independently. It is tough to be a contrarian – but technical analysis tools such as sentiment studies, trend analysis, and overbought/oversold indicators can offer quantitative measurements that might help you make these counter-intuitive, but profitable decisions. Happy trading!

Keith Richards, Portfolio Manager, can be contacted at krichards@valuetrend.ca.

ValueTrend Wins 2017 Canadian Business Excellence Award

Barrie-based ValueTrend Wealth Management, of Worldsource Securities, was one of only 19 private businesses across Canada to receive a Canadian Business Excellence Award. Presented by Excellence Canada and PwC Canada, the national award is administered annually.

Keith Richards may hold positions in the securities mentioned. Worldsource Securities Inc., sponsoring investment dealer of Keith Richards and member of the Canadian Investor Protection Fund and of the Investment Industry Regulatory Organization of Canada. The information provided is general in nature and does not represent investment advice. It is subject to change without notice and is based on the perspectives and opinions of the writer only and not necessarily those of Worldsource Securities Inc. It may also contain projections or other “forward-looking statements.” There is significant risk that forward-looking statements will not prove to be accurate and actual results, performance, or achievements could differ materially from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements and you will not unduly rely on such forward-looking statements. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please consult an appropriate professional regarding your particular circumstances.