The Power Of Reinvested Dividends - Use Your Dividends To Buy More Shares And Ignore Market Fluctuations

Like many of those born during the Great Depression, my wife’s aunt Joan, who passed away last year at age 78, was financially disciplined. She saved 10% of her income and never used a credit card. “If I can’t pay cash, I can’t afford it,” she always said.

Like many of those born during the Great Depression, my wife’s aunt Joan, who passed away last year at age 78, was financially disciplined. She saved 10% of her income and never used a credit card. “If I can’t pay cash, I can’t afford it,” she always said.

In 1954, when she was just 17, Joan began working at what was then known as The Bell Telephone Company. The young secretary immediately began investing as much of her paycheque as was allowed in the employee share purchase plan. During a 40-odd year career at the company, Joan regularly added to her Bell stake, getting a few shares when the price was high and a few more when it was low. Joan made no effort to time the market, didn’t study charts or read analyst reports and never bothered with an advisor.

Joan held only BCE shares, having preferred to ignore my advice that a diversified portfolio of dividend-paying holdings including banks, insurers, telecoms, utilities, industrials and resource stocks would help reduce industry-specific risk.

By the time she retired Joan had 10,000 BCE shares and could have spent her nest egg on a lavish retirement, but she preferred to live modestly from her pension alone. As a result, Joan’s heirs inherited a substantial estate and learned valuable lessons: start investing early, gradually accumulate shares in a blue-chip company, don’t fret over market fluctuations, hold for the long term, and perhaps most importantly, reinvest the dividends.

With the exception of Warren Buffett’s Berkshire Hathaway, which has never paid a dividend, investors are generally better served by large, well-established dividend-paying companies. Of course, past results are no guarantee of future results, but if you accumulate gradually and reinvest the dividends, you’ll tilt the odds in your favour.

The key element in successful long-term growth is reinvesting the dividends in more shares, which you can do yourself or preferably through a company’s dividend reinvestment plan (DRIP). Dividend reinvestment plans are an incentive offered by companies to persuade buy-and-hold shareholders to keep buying and holding, and some companies even allow plan subscribers to use the dividend to buy more shares at a discount to the market price. If the company has a habit of increasing its dividend, DRIPs can be a huge contributor to long-term growth.

The power of reinvested dividends is illustrated at longrundata.dom, developed by brothers Harvey and Dennis Malovich. The free site lets users input stock symbols and a start date, then instantly calculates annualized return and what the current value of $1,000 would be if it had been invested at the beginning of the period.

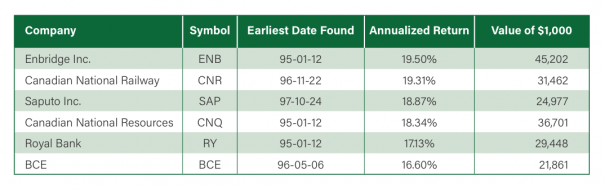

I used longrundata.com to find the long-term total returns for each of the 60 companies in the TSX 60 Composite Index. the top six, based on percentage annualized return, are illustrated in the following table.

Enbridge Inc.

Enbridge was first incorporated as Interprovincial Pipe Line Co. in 1949. The company’s first pipeline, opened in late 1950, carried Alberta crude oil to Regina, Saskatchewan and Superior, Wisconsin. The line was extended to Sarnia, Ontario in 1954; Buffalo and Chicago in the 1960s, and Montreal in 1976. In 1996, the company, then known as IPL Energy Inc., acquired Consumers Gas, the country’s biggest natural gas distributor. In 1998, IPL energy changed its name to Enbridge, combining the terms “energy” and “bridge.” Along with its natural gas distribution services, Enbridge has interests in wind, solar and geothermal power.

Enbridge’s website says its shareholders have enjoyed an average annual return of 13.5% since its founding, but longrundata.com shows the last 20 years have been much more lucrative, with an average gain of nearly 20%. Except for a nine-year period between 1986 and 1995, the company has increased its dividend almost every year. Despite a dismal 2015—in which falling earnings dragged down its share price to December lows near $40 from April highs near $65—Enbridge’s board raised its dividend by 14%, to $2.12 from $1.86, to yield about 4%.

“We expect that our highly transparent growth outlook will translate into 14-15% dividend growth between 2015 and 2019,” the company says on its site. Enbridge’s target dividend payout is between 40% to 50% of earnings, “providing a healthy balance between returning income to shareholders and retaining income for reinvestment in new growth opportunities.”

Figures from Morningstar show Enbridge’s payout ratio fluctuating from between 34.8% of earnings to more than 150%, reflecting the consistent dividend increases as measured against variable profits.

Canadian National Railways

Canadian National is a giant Class 1 North American railway, with about 20,000 miles of lines throughout Canada and the United States. With a market capitalization of $61.8B, CN is one of the largest companies in Canada, and is about 2.4 times larger than its rival, Canadian Pacific.

Over the past year, CN shares have outperformed CP and its big U.S. competitors, Union Pacific, Norfolk Southern and CSX. CN shares periodically dip below $75, which typically represent a solid buying opportunity, although long-term investors will be more interested in the dividend.

CN’s site shows annual dividends steadily increasing to $1.50 in 2016 from a split-adjusted 6.75 cents in 1996—a phenomenal record that puts daily, weekly and even annual share-price fluctuations in perspective. At a share price of about $78, CN’s dividend yields less than 2%, but it’s the steady dividend increases that are behind CN shareholders’ long-term gains.

CN typically pays out between 20% and 30% of its earnings as dividends, figures from Morningstar show.

Saputo Inc.

Montreal-based Saputo makes and sells cheese, milk, cream and other dairy products, with most of its growth coming through acquisitions of businesses around the world. There are plenty of acquisitions yet to make in Asia and developing countries, and Saputo has the capital to make them, so the growth should continue—although acquisitions do carry more risk than internally generated growth.

The company’s shares have been a superb investment over the past 20 years, thanks to steadily rising earnings and dividends. The company pays out about one-third of its earnings as dividends. Although it looks like a solid long-term investment, the current annual dividend of 54 cents yields just 1.34%, which probably makes it unsuitable for income-seekers.

Canadian Natural Resources

Oil and gas producer CNQ, as investors call Canadian Natural, has been another long-term gem. CNQ did not even begin paying a dividend until 2001. Since then, however, dividend increases have been as regular as clockwork.

Like many other oil producers, CNQ had a horrible 2015, losing $637-million or 57 cents per share. CNQ lost half its value, falling from levels near $50 in mid-2014 to the $25 range at the end of last year. Despite the slump, the company still increased its dividend to 92 cents, yielding about 2.4%. The latest dividend increase pushed its payout ratio to an obviously unsustainable 232.6%, up dramatically from the safe 25% to 30% range of the last few years. Eventually, earnings must increase or the dividend will have to be cut.

Royal Bank Of Canada

The Royal Bank, founded in Halifax, Nova Scotia in 1864, is not just Canada’s largest bank; it’s Canada’s largest company, both by revenue and market capitalization. The bank has more than 1000 branches in Canada, more than 400 in the southwest U.S. and 127 in the Caribbean. The bank also has an investment and corporate banking unit, RBC Capital Markets and RBC Dominion Securities, an investment brokerage.

Royal Bank’s shares are up nearly 70% over the past ten years, second only to Toronto-Dominion’s huge 90% gain over the same period, and both Royal and TD are well ahead of all other Canadian banks.

Royal’s board has generally decided to increase its dividend, although the annual payout was frozen at $2 between October 2007 to April 2011. For the last two years, the dividend has been rising by two cents per quarter.

BCE Inc.

BCE owns Bell Canada, which carries phone and DSL services for eastern Canada and the northern territories. Bell’s Bell Mobility unit is one of Canada’s largest cellphone signal carriers, while Bell TV provides television services. BCE also owns Bell Media, with assets in television (CTV), the Montreal Canadiens and Toronto’s Maple Leaf Sports and Entertainment, which owns several sports franchises.

BCE has steadily increased its dividend, although the increase has not been consistent. Annual common-share dividends were held at $1.20 between 2000 and 2004, and were suspended through most of 2008.

A long-term price chart for BCE’s common shares shows the stock climbing smoothly and steadily since 2009, vastly outperforming the S&P/TSX index with only brief and relatively small interruptions. The current dividend of $2.73 yields 4.5%, making it well suited for income seekers.

The six stocks mentioned here are merely the top performers among a list of solid investments. Using longrundata.com, I was able to find 18 other TSX 60 companies that have achieved annualized returns of more than 10%, which essentially means a $1,000 made 20 years ago would be worth $6,727. The key is to buy and hold, and reinvest the dividends.

Richard Morrison, CIM, is a former editor and investment columnist at the Financial Post. richarddmorrison@yahoo.ca