BTSX – 2015/2016 Annual Update

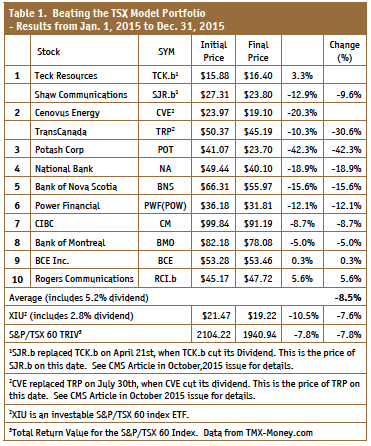

I know some of you are thinking 2015 was an awful year for the Canadian stock market and that you are glad it is over, but we need to put it in the proper perspective. You will see in Table 1 that the XIU ETF that I use as my baseline had a total return of -7.7%. This obviously did not move in the direction we want but it is not too big of a setback if you consider that this negative return follows six years of positive returns since 2008. This market pullback has actually created some good buying opportunities, which I will highlight later, that we haven’t seen in the past few years.

I know some of you are thinking 2015 was an awful year for the Canadian stock market and that you are glad it is over, but we need to put it in the proper perspective. You will see in Table 1 that the XIU ETF that I use as my baseline had a total return of -7.7%. This obviously did not move in the direction we want but it is not too big of a setback if you consider that this negative return follows six years of positive returns since 2008. This market pullback has actually created some good buying opportunities, which I will highlight later, that we haven’t seen in the past few years.

For new CMS readers, please note that I use David Stanley’s BTSX process to pick the stocks each Dec 31st for the following year, with a few modifications.

Here are my guidelines/modifications:

If you are not comfortable with a particular stock on the list, don’t buy it. I don’t want to be losing sleep over owning a particular stock. That is just not healthy for anyone. An example would be if I believe a stock that appears on the list is in a dying industry or just has too many problems that leave me uncomfortable.

want to be losing sleep over owning a particular stock. That is just not healthy for anyone. An example would be if I believe a stock that appears on the list is in a dying industry or just has too many problems that leave me uncomfortable.

I always remove Husky Energy (HSE) from the list since its dividend payment history is erratic. The company pays out more when they make more and pays out less when they make less. This is really not the steady blue chip business that we are looking to invest in.

When POW (Power Corp of Canada) appears on the list, I replace it with PWF (Power Financial Corporation). POW is the holding company for PWF. I prefer PWF as it has a higher dividend. Given that the performance of these two stocks track each other closely, it doesn’t appear to matter which one you own.

When POW (Power Corp of Canada) appears on the list, I replace it with PWF (Power Financial Corporation). POW is the holding company for PWF. I prefer PWF as it has a higher dividend. Given that the performance of these two stocks track each other closely, it doesn’t appear to matter which one you own.

If a company cuts or reduces its dividend, then I sell the stock immediately. I have owned too many repeat dividend cutters. Dividend cuts in the BTSX portfolio don’t happen often but unfortunately it did happen this year with TCK.b and CVE. I detailed how I dealt with this situation in an October 2015 CMS article. The dividend cuts complicated the process this year but were worth the trouble to sell the two stocks after the cut. By year end Teck Resources was down 67% after I sold it and Cenovus was down a much smaller 8%.

owned too many repeat dividend cutters. Dividend cuts in the BTSX portfolio don’t happen often but unfortunately it did happen this year with TCK.b and CVE. I detailed how I dealt with this situation in an October 2015 CMS article. The dividend cuts complicated the process this year but were worth the trouble to sell the two stocks after the cut. By year end Teck Resources was down 67% after I sold it and Cenovus was down a much smaller 8%.

January to December 2015 Results

As you can see from Table 1, the return for the BTSX portfolio was -8.5%. This was -0.9% less than the XIU (iShares S&P/TSX index ETF) of -7.6%. I have also included the S&P/TSX 60 TRIV (Total Return Index Value) for comparison.

2015 was one of the years when investors would be more pleased with the less negative result of the XIUs in their portfolio than the BTSX results, although there was really not that great of a difference. I have always suggested using the XIU ETF as a starting point for new investors or experienced investors who don’t have time to invest in individual stocks. I still own the XIUs that I purchased when starting my portfolio. In years when XIU outperforms the BTSX, I am always happy to still own them.

2015 was one of the years when investors would be more pleased with the less negative result of the XIUs in their portfolio than the BTSX results, although there was really not that great of a difference. I have always suggested using the XIU ETF as a starting point for new investors or experienced investors who don’t have time to invest in individual stocks. I still own the XIUs that I purchased when starting my portfolio. In years when XIU outperforms the BTSX, I am always happy to still own them.

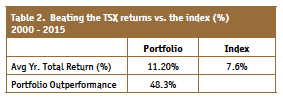

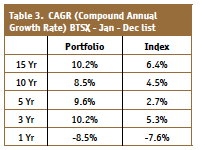

Table 2 shows the average results over the last 15 years. The BTSX portfolio that I have been using is outperforming the index by over 48%. The goal is to have a long-term average return that is greater than the index. We should not expect to beat the index every year.

In Table 3, the CAGR (compound annual growth rate) is shown, rather than the simple average numbers I usually work with. The CAGR number will allow a comparison to mutual fund returns or any other investment returns that indicate their CAGR number. As you can see, the BTSX portfolio currently is outperforming the index in all time frames except for the current year.

2016 BTSX Portfolio

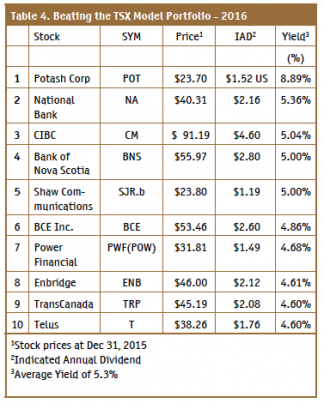

Table 4 lists the stock picks for 2016. These stocks are purchased Jan 1 and held until the end of the year, unless they cut their dividend.

You can use this list as you choose. You may wish to purchase all the stocks or  perhaps use this list as a suggestion of high yielding stocks from the S&P/TSX 60 to review further. Some readers may want to follow the usual BTSX formula which would include HSE and other dividend-reducing stocks which would bump a couple of stocks off the bottom of the list. The choice is up to you.

perhaps use this list as a suggestion of high yielding stocks from the S&P/TSX 60 to review further. Some readers may want to follow the usual BTSX formula which would include HSE and other dividend-reducing stocks which would bump a couple of stocks off the bottom of the list. The choice is up to you.

The average yield of this year’s list is a high 5.3%. Even if the high POT dividend is removed, the average is still 4.9%. This is a particularly high dividend yield when compared to the BTSX list of other years. This high number is an indication that there is a bit of a stock sale currently underway. One good example from the list is CM. Its stock price is down 8.7% from last year but they have announced four increases to their dividend since January 1, 2015, totalling 11.3%. Put another way, the investor is getting 11.3% more income from CM and paying 8.7% less for the stock. CM is a much better deal than it was on January 1, 2015!

ENB is a new addition to the list due to its 24% price decline and a 12% dividend increase in December 2015. Again a much better buy than a year ago. Of course there is always the risk of further price declines but no one knows what the future holds. All you can say for sure is that the stock is on sale!

The 5.3% dividend yield of this year’s list is another one of the exciting things about this strategy. If you are able to live off 4% or less of your portfolio, as is often recommended by financial experts, then you can fund your retirement income from the dividends received without having to sell any capital. This makes portfolio income management quite simple.

Dogs Of The Dow Portfolio

Dogs Of The Dow Portfolio

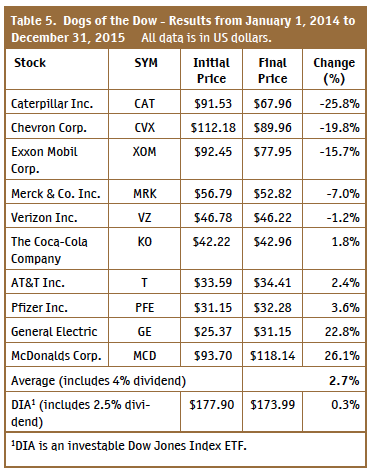

I also invest in Dogs of the Dow, so I have decided to provide this list of stocks as well. This provides me with a US portfolio of high-dividend-paying blue chip stocks. As you can see from Table 5, for 2015 we had a return of 2.7% and thus beat the index by 2.4%. This return is in US dollars and thus does not take into account the additional gain in the portfolio due to the weakening Canadian dollar. Table 6 shows the average results from the last 11 years with an outperformance factor of 14.3%. This result is lower than the BTSX result, but still in our favour.

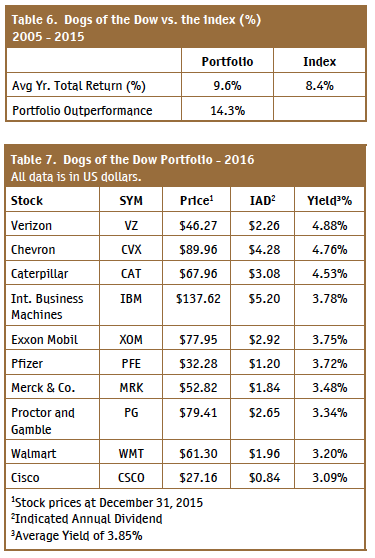

Table 7 lists the stock picks for 2016 with the new additions of IBM, PG, WMT and CSCO.

I will be purchasing all of the new stocks in the 2016 lists for BTSX and Dogs of the Dow, and hoping for the best, as usual. Due to the dividend increases, one of the benefits of owning these dividend stocks is that the total income from the portfolio is growing at or above inflation each year. The total income gets an extra boost in January when the lower yielding stocks that move out of the top ten are sold and then replaced with higher yielding stocks.

Fortunately with this system, all that is left to do for the next twelve months is to watch for any dividend changes. Hopefully there will be many more increases than decreases!

Ross Grant is the e-book Author of Destination: Early Financial Independence, available on Amazon and Kobo for $5.99. Free e-reader software is available for PCs, MACs, etc. to view the books.

Please email Ross if you need the links. You can reach him at RossGrantEFI@gmail.com