The OAS Pension Recovery Tax: What To Do If The Clawback Ainít For You

If you really want to light a fire in belly of most middle class retirees, I strongly suggest turning the conversation to how their OAS pensions are reduced if their taxable incomes top about $72,809 for the 2015 tax year. More specifically, they will lose $0.15 for every dollar in taxable income they receive above that point until, if they make enough, their entire OAS pension of $6,839.40 (the current maximum pension as of September 30, 2015) is a thing of the past. I plan to use this and a subsequent article or two to explain how the clawback (officially known as the “Old Age Security Pension Recovery Tax”) works, and some steps you can take to minimize the impact. Today’s offering will set the stage and explain why dividends may not be as good as advertised when the clawback comes calling.

Situations Where The Clawback Most Often Occurs

A) Following the Death of a Spouse: Although some couples may successfully fight off the clawback during most of their retirement, things might change when the first spouse has passed into the great beyond so that RRIFs, pensions and investment portfolios previously taxed on separate two returns are reported solely in the survivor’s hands. The result: the survivor loses twice. Not only is she (or he) stuck paying more tax per dollar of income (since anything that would have previously taxed at in lower tax bracket in the deceased’s hands is now stacked on top of her own income), but this bump in her taxable income may also mean an unwelcome visit to the clawback zone. Adding insult to injury, she also loses the deceased’s own OAS pension and at least part of his CPP pension as well. Thus, she has less total income but pays tax on it at a higher rate.

B)Testamentary Trust Beneficiaries in 2016 and Onward: When the changes to how testamentary trusts are taxed kick in, in 2016, I expect to see more widows and widowers journeying into the scary land of clawback. Until now, trusts created through things like wills or life insurance trusts could be reported on the trust’s own separate tax return, which was a huge benefit, since the trust’s income was taxed largely using the same marginal rates people used. These trusts would then report and pay tax on the inherited income and then write the senior a cheque that was now tax-free in her hands. In many ways, it allowed income-splitting from beyond the grave; although income could no longer be reported in the deceased spouse’s hands, it could at least be taxed in a trust he may have left behind for the survivor in his will and be taxed in a similar way.

The new tax laws will now tax income inside such trusts, except for a qualifying disability trust (“QDT”) at the highest tax bracket. As a result, although it may still be a really good idea to keep the trust going for other reasons, it will generally make more tax sense to declare the trust’s income on the senior’s own return, even if it means clawback time. Although there has been a two-year transition period, any testamentary trusts other than a QDT will now no longer be the tax shelters some of us have previously grown to know and love.

C) RRIF Millionaires and Hoarders: Quite simply, some seniors are the victims of their own success and frugality. Although I love deferring taxes as much as the next guy (and perhaps a little more), it’s important to realize that with RRSPs, there is a day of reckoning that comes in the year you turn 71. It usually means converting your RRSP to a RRIF by year-end and then withdrawing at least a set minimum percentage of your RRIF’s value each subsequent year, whether or not you need or want to. Although the reductions in the minimum amounts RRIF’ers must withdraw each year is a welcome change, it may still not be enough to keep some seniors out of clawbackville. While I’m still an RRSP believer, I also think that it may make sense to keep the size of your RRSP under control by making strategic early withdrawals in some cases or deciding not to contribute in some cases even if it means a higher tax bill now. Sometimes, a little pain now really is better than a lot of pain later.

Taxation Of OAS Pensions

Finally, I also want to put the impact of the clawback into perspective. Although no one likes to give up $6,600 in free money, it’s not like you were going to get to keep it all anyway. As the OAS is taxable, most people in the clawback zone would have paid back over 30% of it in taxes.

Secondly, some clients look at paying clawback as the cost of doing business; while they may not love it, they look at it as a price of their own financial success and as money they really don’t need anyway. Moreover, they might correctly see that in some cases combatting the clawback isn’t worth the effort. For example, although the rest of the article will focus on how dividends are often bad news for retirees trying to avoid the clawback, these same people might also be reluctant to modify their investments to produce other types of investment returns, especially if that means unnecessarily courting more investment risk or triggering a big capital gain in order to rebalance their porfolios.

All Types Of IncomeAre Not Treated Equally

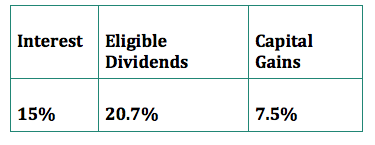

Many financial advisors utter the phrase “eligible Canadian dividends” as if it is holy writ. At times, I am one of them but mine is not a blind faith. Although eligible dividends can be manna from heaven for investors in the right tax bracket, they start to lose their lustre if you’re bumping up against the clawback threshold. This is because each dollar of dividends you receive actually shows up at $1.38 on your tax return. Although you later get a significant tax credit against this income, the added hit this “gross up” (i.e. taxing each $1.00 as $1.38) causes to your OAS pension might make other forms of income a little more attractive, particularly for capital gains. Only $0.50 of each $1.00 of capital gain you earn is included as income. Put another way, each $1.00 of capital gains earned only reduces your OAS pension by 7.5%, compared to 15% of each interest dollar and. . . gulp . . . 20.7% of each eligible dividend after factoring in the gross up.

What does that mean in the grand scheme of things? To get a clearer picture, I suggest adding the impact of the OAS clawback to the income taxes you pay on the different types of income in your tax bracket. In other words, treat the reduction to your OAS pension as another tax and add it to the tax bill on that type of income.

Converting theory to numbers, here is how to crunch the figures. Let’s assume that Colleen lives in British Columbia and earns $77, 000 per year, but has the choice of how to receive an additional $5,000 as interest, eligible dividends and capital gains.

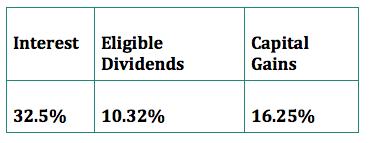

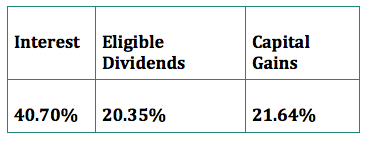

In this situation, Colleen’s marginal tax rates on the different types of income ignoring clawback issues is as follows:

On the other hand, Colleen will trigger clawback on this extra $5,000 of income, which needs to be calculated as well. Here are the basic clawback rates on each of these three types of income without factoring in the tax you’d have to pay on the clawed-back money if you’d been able to keep it.

OAS Clawback Rate on Different Types of Income

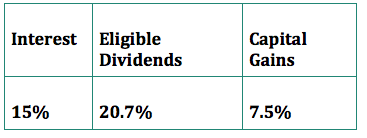

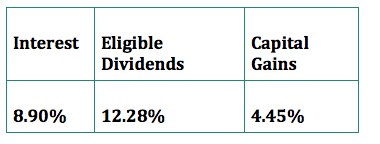

The next step is to adjust the figures just provided to account for the portion of the money that would have been clawed back that would have been paid in taxes away. To do this, I first investigate and discover that Colleen is in the 32.5% tax bracket when receiving this extra money. I multiply the $0.15 per dollar clawback in pensions by (1- 0.325) in order show that she would have only been able to keep 67.5% (100% of the pension amount minus the 32.5% she would have lost in tax) of the clawed-back pension because of taxes if clawback hadn’t occurred. Here are the real effects of the clawback to the different types of income after accounting for the clawback.

Tax-Adjusted Clawback Rate on Different Types of Income

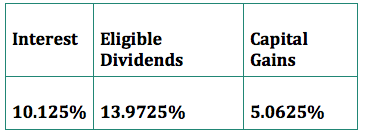

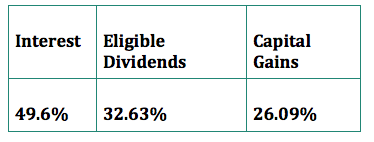

The next step is to add the totals from the previous chart to the totals from the marginal rate chart on the different types of income to see the combined tax bill, including the OAS clawback that Colleen would pay on the different types of income in her situation.

Combined Income Tax and Clawback Tax for Colleen

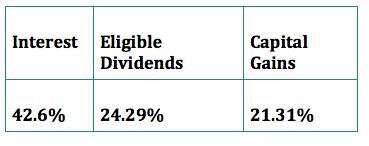

What if Colleen’s income was $105,000 before including the extra $5,000 of income? In that case, she would be taxed on the different types of income as follows:

Marginal Rates for Colleen at $105,000 in Taxable Income

OAS Clawback Rate on Different Types of Income

The OAS clawback rates remain the same before tax.

On the other hand, Colleen would have been able to keep less of her OAS pension anyway since she’s in a higher tax bracket. Accordingly, the rates must be calculated as 1- 0.407 (i.e. she would have only kept 59.3% of the amount of her OAS pension clawed back anyway because of taxes).

Tax-Adjusted Clawback Rate on Different Types of Income at $105,000 in Taxable Income

Combined Income Tax and Clawback Tax for Colleen

Interesting Implications

When I look at the various numbers above, I see the following:

If Colleen was earning $105,000 before receiving her last $5,000, she is actually paying more tax per dollar than she would have paid if she was in the highest tax bracket, reserved for income-earners making more than $150,000 in B.C. in 2015. This is because Colleen would have already lost her OAS pension when her taxable income reached about $116,000. Accordingly, we wouldn’t need to calculate the impact of the clawback for that scenario, as it would no longer apply. As a result, if Colleen had a spouse already in B.C.’s highest tax bracket, he would actually pay less tax after including the clawback. This suggests that in some cases, it might actually make sense to income-split in order to attribute more income to the higher income spouse.

Eligible dividends aren’t the ideal way of receiving investment earnings for seniors facing clawback. Even though they look at first blush to be a better deal than capital gains (10.32% tax rate on dividends vs. 16.25% taxes on capital gains using Colleen’s example at $77,000) the impact of the clawback makes capital gains a slightly better deal when the dust settles (21.31% vs. 24.29%). In a province like Ontario, where eligible dividends aren’t taxed as favourably as in B.C., the differences should be even more significant, though I will leave it to someone else to crunch the numbers. In fact, if you’re earning more than $88,000 in Ontario at the time I write this, you’re paying essentially the same tax rate on dividends as you’re paying on capital gains in the first place without factoring in the OAS clawback!

Although I carefully selected Colleen’s income and the amount of extra money she could receive so she would be taxed in one tax bracket throughout, that’s probably not going to be the case for most of us. Since 1.38% of every dollar of dividend is taxed and only 50% of every capital gain, it is quite likely that many people would end up paying taxes in a higher tax bracket if they received dividends rather than capital gains, ignoring the clawback implications. In other words, using the first example, Colleen’s taxable income would have increased by $2,500 if she took her $5,000 as capital gains and $6,900 if she took it as eligible dividends. Using Colleen’s example, this would provide her with a total taxable income of $83,900 if she took the $5,000 as dividends and $79,500 as capital gains. If she had to pay tax on some of the $4,400 difference in taxable income between dividends and capital gains at a higher tax bracket than the rest, this would mean that the tax advantage of capital gains is even better in such situations.

The potential benefit of investments that provide a tax-free return of capital or deferred capital gains might be even higher than you suspect. Although some investment options that allow you to do this (such as corporate class mutual funds) do carry management fees, it is important to understand the true savings they can provide when deciding whether they are the investment for you despite the management-expense ratio blues. My goal today isn’t to answer this question but merely let you know of your options, especially if you already own and like mutual funds.

Conclusion

Certainly, there are more than a few more significant problems in life than the OAS clawback (such as the plight of Canada’s NHL teams, for one). In addition, sometimes the steps necessary to eliminate the clawback simply aren’t worth the complexity, expense or risk, particularly since the OAS pension may only be a small part of some senior’s retirement plan and since it is taxed anyway. All the same, there is no point in paying extra taxes or unnecessarily giving up government benefits. Hopefully, this article can help you decide all of this for yourself and perhaps even save you a few dollars along the way if you do decide to take action.

Colin S. Ritchie, LL.B., CFP, CLU and FMA is a Vancouver-based fee-for-service lawyer and financial planner who does not sell investment or insurance, just advice. To find out more, visit his website at www.colinsritchie.com