Low Cost Investing In Foreign Equities: Beyond Vanguard ETFs

The recent collapse in the value of the Canadian dollar provides a useful lesson in the potential value of currency diversification in a portfolio. As of October 1, 2015, sitting in U.S. cash delivered a year-to-date return of about 14% due strictly to changes in the exchange rate. That’s a good tonic for portfolios ailing due to poor Canadian stock performance: the benchmark S&P/TSX Composite Index was down 9% during the same period.

The recent collapse in the value of the Canadian dollar provides a useful lesson in the potential value of currency diversification in a portfolio. As of October 1, 2015, sitting in U.S. cash delivered a year-to-date return of about 14% due strictly to changes in the exchange rate. That’s a good tonic for portfolios ailing due to poor Canadian stock performance: the benchmark S&P/TSX Composite Index was down 9% during the same period.

Canadians can add currency diversification to their portfolios by buying un-hedged TSX-listed ETFs that invest in foreign assets. Due to greater choice and lower costs, investing in U.S.-listed ETFs could be a better way to accomplish this.

Readers may be aware of only two ETF players in the United States, Vanguard and Blackrock, aka iShares, as they are among the few American fund firms with Canadian operations and both have significant public profiles. Of the two, Vanguard is the choice of many DIY investors due to its reputation as the firm charging the lowest fees. However, another American fund company actually owns this title.

Charles Schwab (www.schwab.com) offers a comprehensive line up of low cost ETFs that span three asset classes, U.S. equities, international equities and bonds, and two methodologies, Market-Cap Index and Fundamental Index.

Schwab actively competes with Vanguard in the low cost market-cap index ETF space. The firm’s website even compares the operating expenses of its ETFs to those of similar funds from Vanguard. The Schwab funds invariably have the lowest expenses, albeit by extremely small margins of between 0.01 and 0.03%.

Low cost is only one factor to consider when selecting an ETF. How do Schwab’s ETFs measure up to Vanguard’s funds in other areas? Let’s compare equivalent ETFs from the two firms for the three most common foreign content mandates: U.S. stocks, stocks from developed markets outside the U.S., and emerging market stocks?

In the U.S. large cap blend fund category, Schwab offers the Schwab U.S. Broad Market ETF (SCHB-NYSE). This well-diversified fund tracks the Dow Jones U.S. Broad Stock Market Index which consists of the largest 2,500 publicly traded U.S. companies with readily available pricing information. The fund was launched in November 2009.

The Vanguard Total Stock Market ETF (VTI-NYSE) which is a member of the same fund category is more diversified than SCHB. Its current benchmark index is the CRSP US Total Market Index which has nearly 4,000 constituents and represents nearly 100% of the U.S. investable equity market. It began life in May 2001 and has tracked two other similar benchmark indices at different times in the past.

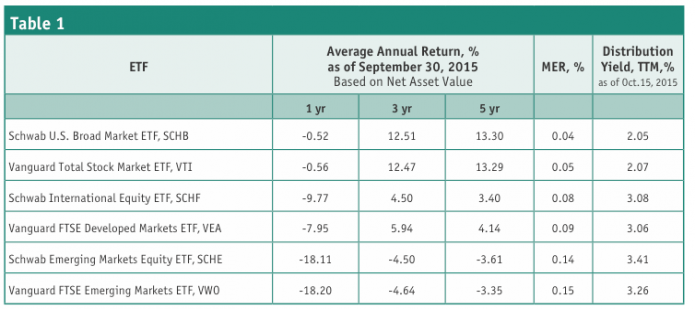

As you can see from Table 1, the returns of the two funds are almost identical. The extra diversification inherent in VTI does not appear to impact performance over any time period. The MERs are rock bottom, 0.04% for SCHB, 0.05% for VTI. Vanguard offers a Canadian-listed version of VTI, VUN-T, which charges an MER of 0.16%.

Either ETF would provide all the US stock market exposure that most Canadian investors need.

Schwab’s offering in the foreign large blend category is the Schwab International Equity ETF (SCHF-NYSE). This ETF is based on the FTSE Developed ex US Index which consists of over 1,400 stocks of large and mid-capitalization companies in 24 developed market countries outside the United States. Japan and United Kingdom stocks account for about 43% of the holdings and Canadian stocks are currently 7%.

The Vanguard FTSE Developed Markets ETF (VEA) is a member of the same category. It tracks the FTSE Developed ex North America Index, which is very similar to the FTSE Developed ex US Index that SCHF tracks, but there are no stocks from Canada.

SCHF is well-suited to American investors seeking foreign large blend exposure. However, VEA is the better choice for Canadians as it does not hold our own domestic stocks. Furthermore, VEA has consistently provided better returns.

In the diversified emerging markets category, the two funds to compare are the Schwab Emerging Markets Equity ETF (SCHE) which debuted in January 2010, and the Vanguard FTSE Emerging Markets ETF (VWO) which was launched in March 2005.

Both funds seek to track the performance of the same FTSE Emerging Index of over 900 large- and mid-cap securities from 21 emerging market countries. The top five countries represented in the index are China, Taiwan, India, South Africa and Brazil.

Given that the MERs for SCHE and VWO are almost identical and the two ETFs track the same index, it is not surprising that the returns are very similar over all time periods. The Schwab fund may invest up to 10% of its net assets in securities not included in its benchmark index which along with tracking error, likely accounts for the slight differences in returns.

The Schwab Emerging Markets Equity ETF and Vanguard FTSE Emerging Markets ETF are both good choices for emerging market exposure in Canadian investors’ portfolios.

In all three fund categories, the distribution yields for the analogous ETFs are comparable, as shown in Table 1.

The Vanguard and Schwab lineups include similar ETFs in six other categories of U.S. equities covering growth, value, company size and equity income mandates. Both companies have a U.S. real estate ETF and funds covering several U.S. bond categories.

Currency diversification by purchase of foreign asset ETFs trading on U.S. stock exchanges is another way to manage risk in your portfolio. Vanguard and Schwab ETFs offer low cost options to do so. As always, before buying, do your own research to ensure you make the best investments for your personal circumstances.

Gail Bebee is the author of "No Hype–The Straight Goods on Investing Your Money." Visit www.gailbebee.com

Disclosure: The author owns shares of SCHB and VTI.