The CMS Model ETF Portfolio: Getting A Helping Hand From Our Neighbours To The South

The model ETF portfolio has not been around for a very long time but the portfolio has already faced a good test after being put through the wringer in the latest bout of macroeconomic concerns. All investors had to sit through the roller coaster ride of plummeting oil, a falling Canadian dollar and political tensions between Russia and essentially the rest of the world. This is not to mention a hobbled European economy and economic outlook in Canada that seems to get dimmer as the days go by. To add to the turmoil, industries and assets that were shining stars since 2008 such as utilities are now being put under the microscope with a growing likelihood of interest rate increases in the US. Fortunately, all roller coaster rides come to a smooth stop where the patrons get to exit the vehicle, look back at the challenge they just conquered and enjoy the spoils of their personal victory.

The model ETF portfolio has not been around for a very long time but the portfolio has already faced a good test after being put through the wringer in the latest bout of macroeconomic concerns. All investors had to sit through the roller coaster ride of plummeting oil, a falling Canadian dollar and political tensions between Russia and essentially the rest of the world. This is not to mention a hobbled European economy and economic outlook in Canada that seems to get dimmer as the days go by. To add to the turmoil, industries and assets that were shining stars since 2008 such as utilities are now being put under the microscope with a growing likelihood of interest rate increases in the US. Fortunately, all roller coaster rides come to a smooth stop where the patrons get to exit the vehicle, look back at the challenge they just conquered and enjoy the spoils of their personal victory.

Back when Peter Hodson and I started the ETF portfolio, we wanted to provide a tool that was simple, easy to implement and easy to tailor to your specific and unique situation. Also, in true MoneySaver fashion, we wanted to ensure that the costs were low and the dividends were plentiful! What we ended up with was a 12 ETF portfolio, diversified across asset class, geography and market-capitalization with low turnover. We wanted to balance out the complexity that can be within a portfolio while offering some unique but simple ‘tilts’ that we felt could benefit an investor. This is where the US dollar exposure and more concentrated allocations toward energy and US small-caps came into play. While the USD exposure and small-caps worked out well, the energy sector moved against the portfolio, as we are sure most Canadian investors know. Even though some things did not work out (all things never work out how you want them to) the portfolio still fared well since inception and we would chalk most of the success up to the simple concept of diversification.

It is hard if not impossible to know where any market is going to go at any specific time, which is why the portfolio has aimed to own various markets and asset classes. Some will go down but others will go up. We, and many statistical studies, find that simply owning a bit of everything works much better than trying to time markets and jump between asset classes and industries. Bonds are a great example. Everyone, including ourselves, thought bonds were going to have a tough year but to the contrary, they actually performed well. It seemed like a no brainer that fixed income was the losing trade of the year but as usual, the markets like to make fools of us all. This is precisely why, even though we are not overly excited about bond returns, we still insisted on owning some degree of fixed income in the portfolio. You just don’t know WHEN an asset class is going to do well, and by the time it starts to perform, you have likely missed out on a lot of the gains. This is why we feel that diversification is key and not just across asset classes and geographies but across industries and currencies.

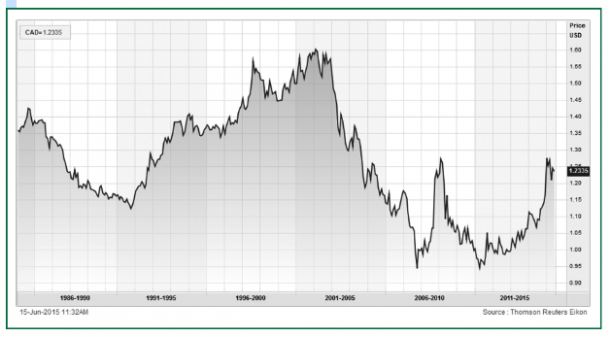

The currency benefit was a large factor in the performance of the portfolio. We are quite happy with the way it has played out but are happy to admit currency movements are next to impossible to predict. This, again, is why we simply prefer a bit of exposure to other currencies so the benefit can be experienced, if any. Obviously, this trade can move against the portfolio and we would not be surprised if readers see the portfolio slowly rebalance some of those US gains back into Canadian dollar denominated funds while maintaining some exposure to USD. If we look at a long-term chart of the CAD/USD since 1986 in Figure 1, many readers would be less inclined to jump to the conclusion that the Canadian dollar is too far below historical averages. Further, with what looks like diverging interest rate policies (US seeming ready to raise rates within a year, Canada recently lowering them) the Canadian dollar could weaken further yet.

While you would see a more active portfolio in our 5i Research Balanced Equity portfolio (up 89.8% since inception of March 18, 2013 as of the end of May) and the Income Portfolio (up 9.3% since inception of April 1, 2014 as of the end of May), we do have some more active exposures through the overweight to Energy and US Small-Cap stocks in the CMS portfolio. We think the key here is that you can still remain diversified and hold stability while trying to earn a bit extra in returns by simple portfolio tilting. We are not carrying out some left field strategy where we own an inverse ETF or make a big bet on a single company, we are simply allocating a few more dollars to a specific industry we like (that pays dividends) and an asset class that has historically shown outsized returns relative to broader markets. This is all to say that you can still seek above average returns without holding some sort of complex or complex looking portfolio while keeping in mind that diversification is still paramount. If too many eggs are put into one basket, the whole portfolio and potentially your retirement prospects can be hurt.

We are happy the portfolio has performed well so far and we are even happier that we did it with very little trading, as continuous trading leads to the often-overlooked transaction costs and tax drag on a portfolio. Every year won’t be a positive year but sticking to the fundamentals of diversification, low cost investing, dividends and having a little fun while you are at it can go a long way to helping investors finish that bumpy roller coaster ride toward retirement. For interested readers, feel free to check out 5i Research (www.5iresearch.ca) for more information on our model portfolios or the free blog where we talk about anything and everything investment related and don’t forget to check out the CMS Portfolio on page 29.

Ryan Modesto, BBA, is a Managing Partner at 5i Research Inc. in Kitchener, Ontario. He can be reached at ryanmodesto@5iresearch.ca