Be Prepared Big Change Is Coming

After years of investor advocacy, securities regulators and the investment industry have finally recognized the need to provide Canadians with more clear and objective information about their investments. As a result, the new Client Relationship Model phase 2 (“CRM2”) rules are being phased in that will provide information that should help investors better understand their investments, and extract more out of their relationship with their salesperson. It 's very important that investors know what to do with this wealth of new information. Don’t leave these reports in an unopened envelope.

After years of investor advocacy, securities regulators and the investment industry have finally recognized the need to provide Canadians with more clear and objective information about their investments. As a result, the new Client Relationship Model phase 2 (“CRM2”) rules are being phased in that will provide information that should help investors better understand their investments, and extract more out of their relationship with their salesperson. It 's very important that investors know what to do with this wealth of new information. Don’t leave these reports in an unopened envelope.

On July 15, 2016, the requirement for registered dealers and registered advisers to deliver reports on charges to clients and on investment performance will come into force. However, firms that report for the calendar year 2016 will not be required to include comparative data from 2015 in their investment performance reports. They will be able to base their first investment performance reports on 2016 information alone. Dealers will have until December 2016 to program for the new statement disclosure requirements including position cost information and market values using prescribed methodology. When the new rules are fully implemented, investors will receive a statement that shows how well their investments have performed (pre-tax) for the previous year, and the previous three, five and ten years. A few dealers can provide this information now, but under CRM2, all investment dealers will be required to do so.

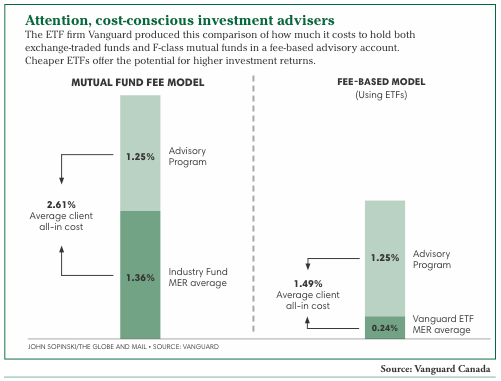

Compare the performance of your account to that of an appropriate benchmark and/or the target rate of return in your financial plan. If there's a big gap, ask why. It could be that the fees paid are too high or the portfolio investments are poor choices or both. For instance, low-cost ETFs might be more suitable and tax-efficient to meet your financial goals than actively managed mutual funds.

The other new required report will disclose fees and other charges. This report will itemize the cost of everything from embedded trailer commissions, to redemption fees, point-of-sale commissions, switching fees and RRSP administration fees, and will provide an aggregate dollar figure for the 12-month period. However, the costs of managing the mutual fund and associated trading commissions are not included. If you feel you've been overcharged, don't be shy—ask for a rebate.

Make sure you understand each and every entry. These costs are not new; investors have been paying all along for the ongoing services they should receive from their dealer and dealer representative. But in most cases, this will be the first time these costs will be listed separately on investors’ account statements for increased visibility. No doubt some investors will be shocked. Value in terms of advisory services provided is important, so try to enumerate the services you received versus what you paid. Could you have done this on your own? Would a robo-advisor or discount broker be more suitable?

When investors receive these statements, they should discuss them with their salesperson. It’s not too early to be asking dealer representatives about the charges and the services that they provide. Ask about any cost that you don't understand. Compare the monies paid to the amount of your gain. If you feel you've been given some useful advice that say, saves you taxes, try to assign a value to that advice. As a rough measure of level of effort, use a $150/hr. rate—e.g. $1500 in fees means 10 hours—did you receive that much attention? Of course not every benefit can be quantified but at least take such advice into account as a value obtained from your salesperson/broker.

A rep’s greatest potential value is in working in concert with clients, creating a financial plan, generating an Investment Policy Statement, helping them understand how the securities they are sold fit into their portfolio, and helping clients make informed, objective investment decisions. Ask: did I receive these services and analyses? If not, what am I paying for? If you have lost money you feel is due to unsuitable investments, churning or undue leveraging, you can file a complaint for restitution.

A basic rule of investing is that lower costs feed higher returns. If you’re the sort of investor who is best served by receiving advice, the most practical way to follow this rule is to squeeze the costs of the securities you are sold as low as possible. Visit getsmarteraboutmoney.ca to see the impact of fees on long-term retirement savings. Your eyes will be opened. Regarding the securities recommended, ask if cheaper alternatives are available, paying due regard to risks.

The more investors understand their account statistics, advisory relationship, personal financial goals and risk tolerance/loss capacity, the better equipped they will be to make decisions that are appropriate for their individual circumstances. The more prepared investors are to engage with their salespersons about these issues, the more helpful professional advisors can be in helping them stay on track to cost-effectively meet their financial goals.

Research shows that there exists a conflict of interest between the salesperson and the client due to sales incentives like commissions. Do you feel on balance, given the fees and value obtained, that you've received a fair shake? That is one key question to be answered by reviewing these new disclosures.

Investors should meet with their salespersons at least annually and following any major life event, such as marriage, birth of a child, job promotion or receipt of an inheritance to review their portfolio and goals. Be sure to review your Know Your Client Form to ensure it is congruent with your current situation.

Always remember—It's Your Money.

Ken Kivenko, PEng, President , Kenmar Associates, Etobicoke, ON (416) 244-5803, kenkiv@sympatico.ca, www.canadianfundwatch.com