Settling The TFSA And RRSP Debate Once And For All

To many cheers and jeers, Canada’s worst kept budget secret was confirmed in April: the annual TFSA contribution limit has been increased to $10,000. There is a small caveat with this change and that is the issue of the inflation adjustment being dropped, so the $10,000 amount is fixed now. This announcement has been an interesting one to follow as it is one of the first times one can remember that some citizens are unhappy with what is effectively a tax cut. Much concern has been voiced over lost tax revenue come 2080 but policies and economies change over a 65-year period and this type of issue is likely clutching at straws. Is the limit increase of benefit to the wealthy only? Maybe, but this is likely also a bit of a straw-man argument. Even if one group benefits more from this change, everyone still has access to it and receives a similar benefit. Regardless, we are not discussing the politics behind such a policy but rather trying to end the debate between TFSAs and RRSPs, once and for all.

To many cheers and jeers, Canada’s worst kept budget secret was confirmed in April: the annual TFSA contribution limit has been increased to $10,000. There is a small caveat with this change and that is the issue of the inflation adjustment being dropped, so the $10,000 amount is fixed now. This announcement has been an interesting one to follow as it is one of the first times one can remember that some citizens are unhappy with what is effectively a tax cut. Much concern has been voiced over lost tax revenue come 2080 but policies and economies change over a 65-year period and this type of issue is likely clutching at straws. Is the limit increase of benefit to the wealthy only? Maybe, but this is likely also a bit of a straw-man argument. Even if one group benefits more from this change, everyone still has access to it and receives a similar benefit. Regardless, we are not discussing the politics behind such a policy but rather trying to end the debate between TFSAs and RRSPs, once and for all.

After first distinguishing between the two accounts, we are going to take a quantitative look at the two accounts. Then, since most things in finance are not cut-and-dried, we will try to look at the more granular and qualitative factors that may influence the RRSP and TFSA decision. A TFSA (Tax-Free Savings Account) is what is known as a tax-exempt account. These types of accounts allow your investment to grow tax-free. The only catch is that the money being used to fund a TFSA has already been taxed as income. So you are using after-tax dollars and get no type of credit or rebate when funding this account but you do get to enjoy the tax-free growth. Once an investment is in a TFSA, it will grow as follows: (1+r)^n. This says that the gains grow and compound indefinitely (remember you have already paid income tax on the initial amounts). An RRSP is a tax-deferred account. This means that you invest ‘before income tax’ dollars into the RRSP, allow them to grow tax-free but then are taxed at your prevailing income tax rate as you withdraw from the account. So the taxation on your income and the gains are being pushed back to a later period but you still pay income tax on those funds once withdrawn. In a TFSA, you pay initial income tax but those funds within the TFSA (and even when withdrawn) are not taxed. Amounts in an RRSP grow following this formula: (1+r)^n (1-Tn).

The Simple Rule:

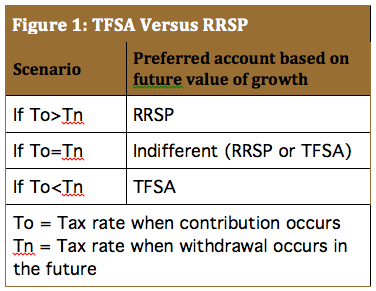

What follows is the simple rule, taken right from the CFA textbooks, to follow when determining which account is optimal to fund. It is one that is not often mentioned:

If your tax rate is greater when funding the account than it will be when withdrawing, the RRSP is best to use as the compounded future value is higher. If your tax rate when contributing is the same as the tax rate upon withdrawal, then you are indifferent to the accounts. If your tax rate is less when funding the account than when withdrawing, you would prefer the tax-free account. Figure 1 puts this into a more formulaic view. To think of this intuitively, if we look at the two equations provided earlier (1+r^n and 1+r^n*1-Tn) and focus on equivalent tax rates today and in the future, the end result can easily be seen. With the same growth in the accounts, the end amount is the same at the same tax rates. Feel free to plug some numbers in to test it out. Just be sure you are applying before and after tax dollars appropriately! With this understanding, it is intuitive then that you would simply want to realize taxes, whenever your tax rate is the lowest. RRSPs allow the realization in the future, TFSAs allow tax to be realized immediately. So why is it so hard to find this rule? This is likely because the situation can get complicated and does involve some uncertainty, mainly, determining what your tax rate in the future will be.

Your Future Tax Rate:

This is where layers of complexity are added. In order to make an optimal tax efficiency decision, you have to know what your tax picture will look like in the future. I feel like many years ago, it was more clear that in retirement, individuals make less money. But now with the proliferation of investing, people working later in life, a Boomer generation with some pretty solid pensions and high asset values with the help of housing prices, I would tend to think that this future tax scenario has become a bit less clear for many. This future determination of tax rates gets easier as time passes and things become more clear, but certainly at a young age when an individual starts on their financial journey, the decision is very difficult to make with any real accuracy.

Theory Versus Reality:

This point is likely a little nuanced, especially if we are taking a long-term (over ten years) view on saving but it is worth mentioning. The growth formula used for an RRSP actually assumes that you are using before-tax dollars immediately when investing. In a lot of cases, this is not reality for many. A lot of savers have already paid income tax on funds being deposited into an RRSP. It is not until tax return season that the ‘before-tax’ amount is given back to the individual in the form of a credit. This creates two inefficiencies. The first is that you are missing out on a year’s worth of potential investing. While the comparable TFSA contribution has had potential to grow since the beginning of the year, an individual has to wait to invest the extra amount until after the tax return has been filed. Realistically, in a down market this would benefit the investor so it is probably fair to assume this issue cancels itself out over the long-term. The second inefficiency is the assumption that the saver has the resolve to diligently reinvest that tax credit into the RRSP year in and year out. Often life gets in the way and these types of credits are spent elsewhere.

Flexibility And Simplicity:

This is the big qualitative differentiator in my view. RRSPs can be a bit confusing with various rules and guidelines to follow along with tracking them and claiming contributions appropriately for tax season. TFSA accounts are a bit easier to use as you are just taxed on your income and essentially free to do with that money what you will. You can withdraw without penalties and are not required to convert them to a RRIF and withdraw at a certain age. This withdrawal flexibility is huge in my mind, especially for someone who is younger and may have more, large, or unexpected expenses. Yes, the contribution limits can be a bit confusing and are not well communicated by authorities but this is the same as with RRSPs. I don’t think many people would be able to argue for an RRSP over a TFSA when it comes to enhanced simplicity and greater flexibility.

So there you have it. If someone asks whether to invest in a TFSA or RRSP, we can now respond with confidence that the answer depends on your tax rate in the future—then we can just hope they don’t ask us any more questions on the subject! Now that the TFSA has become a serious player in the retirement account conversation with the recent limit increase, I tend to favour the TFSA over an RRSP with the exception for the individual who can confidently say or determine that they will be in a lower tax bracket in the future than they are today. With all of the rules and inefficiencies in an RRSP mentioned above, I think they offer too many opportunities for savers to have missteps and offer too much temptation to spend tax credits opposed to ferreting it away in your RRSP.

Flexibility is the other major factor where TFSAs get a big nod from me personally. Having the freedom to withdraw from these accounts in a pinch is a big advantage. Keeping in mind that everyone’s situation is different, I think that it is pretty safe to say that younger savers easily benefit from a TFSA more. Younger generations face some very large potential expenditures (housing, children, post-grad education, etc.) and being locked down by withdrawal rules can be a pain. Not to mention that determining your future tax rate is very difficult at a young age and TFSA funds can always be transferred into an RRSP later in life. As individuals get older and have more clarity on the future while also are more likely to be in their prime earning years, the optimal decision is easier to determine through the earlier mentioned formulas. It can become a complex topic with many ‘ifs’ that need to be taken into consideration but there are two truths we can glean from this conversation:

- The important part is that you are utilizing at least one of these accounts. If you are using either a TFSA or RRSP, you are already ahead of the pack.

- While different people will use an increased TFSA limit in different ways, the recent change is probably a net benefit to all savers and investors.

Ryan Modesto, BBA, is a Managing Partner at 5i Research Inc. in Kitchener, Ontario. He can be reached at ryanmodesto@5iresearch.ca